Magna Mining – TSX Venture Top 50 Recognition, Anticipated Acquisition Closing On Multiple Polymetallic Mines And Development Projects In Sudbury, And The 2025 Work Strategy

Jason Jessup, CEO and Director of Magna Mining (TSX.V: NICU) (OTCQB: MGMNF), joins me to unpack a number of key Company milestones that were recently achieved and on tap in the near-term, as well as the work strategy developing for the balance of 2025, at the McCready West mine and multiple other prior-producing polymetallic mines and development projects located in Sudbury, Canada.

We started off reflecting on the announcement February 19th that Magna Mining has been included in the 2025 TSX Venture 50 list. The TSX Venture 50™ is a ranking of the top fifty performing companies on the TSX Venture Exchange over the prior year. Jason remarks that this stems from the results of the solid work their team had executed on growing their asset base and value creation over the course of the last year.

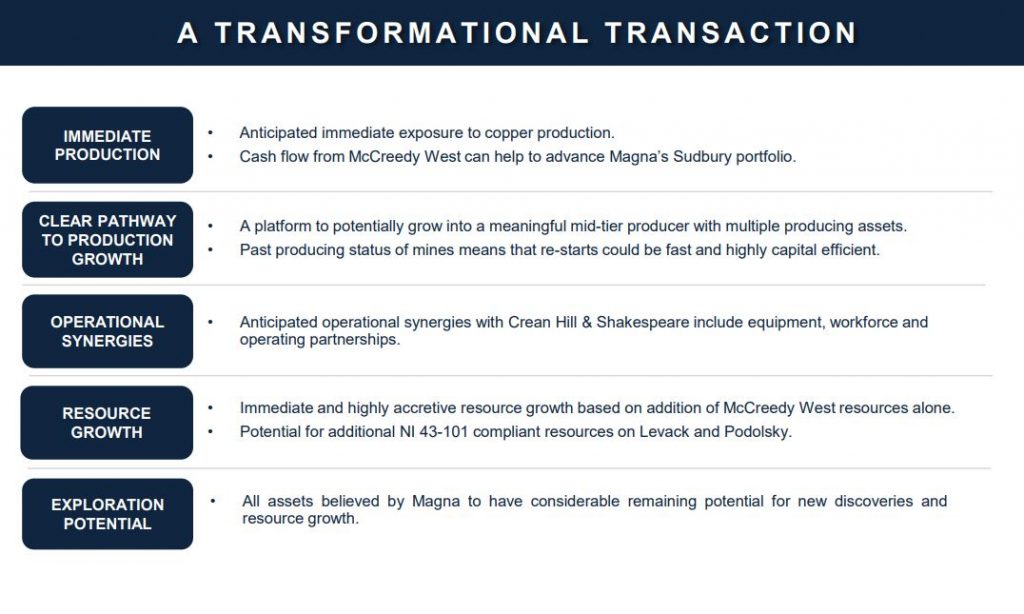

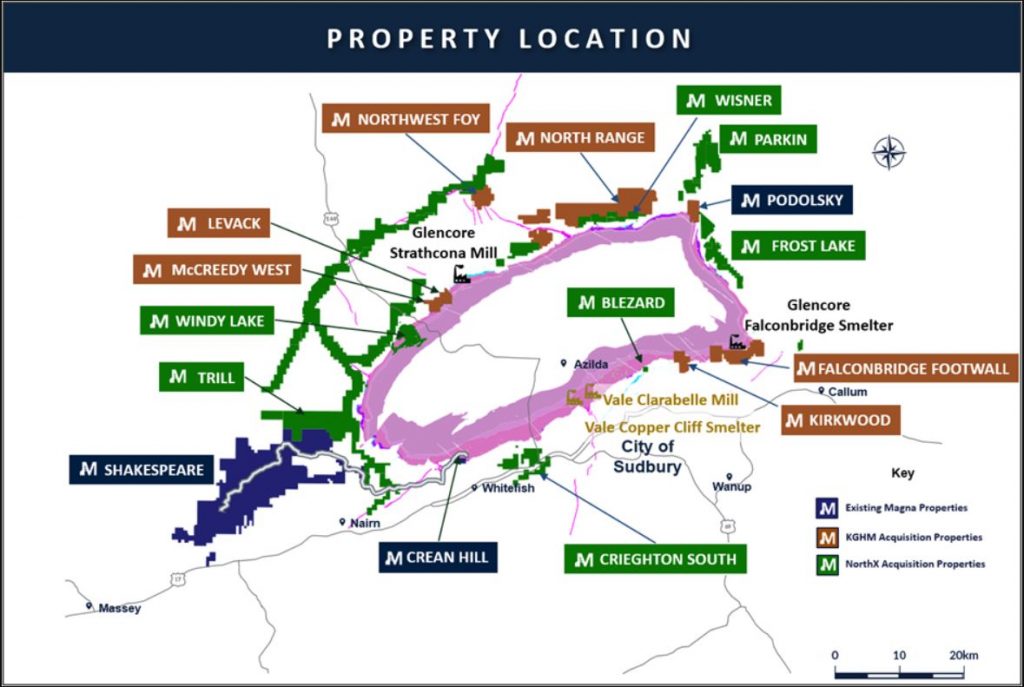

This leads us into a discussion on their transformative move into copper and nickel production that commences in March, once the KGHM International Ltd. acquisition transaction closes at the end of this month on a portfolio of base metals assets located in the Sudbury Basin. These assets include: the producing McCreedy West copper mine, the past-producing Levack mine, the past-producing Podolsky mine, and past-producing Kirkwood mine, as well as the Falconbridge Footwall (81.41%), Northwest Foy (81.41%), North Range and Rand exploration assets. Jason outlines how he and multiple members of the Magna Mining team had worked at and operate the McCreedy West, Levack, and Podolsky Mines in the past when they were with FNX Mining, so that they are very familiar with these assets. While the current flagship will be the McCreedy West Mine, he also lays out the development pathway for bringing back into production the Levack Mine in 2026, and the Podolsky Mine and Crean Hill by late 2027 or early 2028.

Next we review that the payment from the bulk sample that was mined at Crean Hill and processed at Vale’s facilities last year is slated to come in about a month out, which will bring in more capital to the company. Additionally, we reviewed the financial health of Magna Mining now that they have upsized the Debenture Offering from C$15 up to C$22 million of Convertible Debentures. Concurrent with the Debenture Offering, the Company previously announced a “best efforts” private placement offering of up to 6,451,612 common shares of the Company at a price of C$1.55 per Common Share for aggregate gross proceeds of up to C$10 million, it will take the financing up to C$32 million raised in the Offering, and is expected to close on or about February 27, 2025.

Wrapping up we discussed how these funds would be used for both ongoing development and a healthy exploration program at the McCreedy West copper mine, and around the past-producing Levack mine to keep optimizing future mining operations and resource expansion. Jason also gives us a boots-on-the-ground take on the sentiment and reception from all their meetings at the BMO Conference in Hollywood, Florida. There will be a lot of newsflow on tap over the next few weeks and months from Magna Mining.

If you have questions for Jason regarding Magna Mining, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Magna Mining at the time of this recording.

.

Click here to follow along with the news at Magna Mining

.

.

Yeah DT, I saw many of the cryptos really got hit the last few trading sessions.

Bitcoin has pulled back a lot since it hit its high earlier this year up near $110,000 and now it has fallen back down to under $85,000 over the last month. Other cryptocurrencies are down even more.

Magna Mining Included in 2025 TSX Venture 50™ List of Top Performing Companies

February 19, 2025

Here’s the whole list of the companies on this TSX.V Top50 (some other companies are on the list):

West Red Lake Gold (TSXV: WRLG) (OTCQB: WRLGF) Intersects 114.26 g/t Au over 10.6m, 77.90 g/t Au over 3m and 24.48 g/t Au over 8.5m at South Austin – Madsen Mine

February 26, 2025

THREAT TO NATIONAL SECURITY FROM IMPORTS OF COPPER – UNITED STATES EXECUTIVE ORDER

February 25, 2025

Where Does The US Get Its Copper?

By Lewis Jackson and Amy Lv – Reuters – February 25, 2025

“U.S. President Donald Trump on Tuesday ordered a probe into possible tariffs on copper imports to rebuild U.S. production of a metal critical to electric vehicles, military hardware, semiconductors and a wide range of consumer goods.”

“A White House official said the investigation would look at imports of raw mined copper, copper concentrates, copper alloy, scrap copper and derivative products made from the metal. A result is expected quickly.”

“The United States produces domestically just over half the refined copper it consumes each year. More than two-thirds of that is mined in Arizona, where the development of a massive new mine has been stalled for more than a decade. The remaining refined copper, just shy of 1 million metric tons annually, is imported.”

https://www.reuters.com/markets/commodities/where-does-us-get-its-copper-2025-02-26/

Rout wipes 800 billion from Crypto Market as Bitcoin slump Deepens! DT

https://archive.is/jWGuZ