Emerita Resources – More Multi-Element Drill Assays Returned From El Cura, Building Towards A Resource Update Next Month At The IBW Project

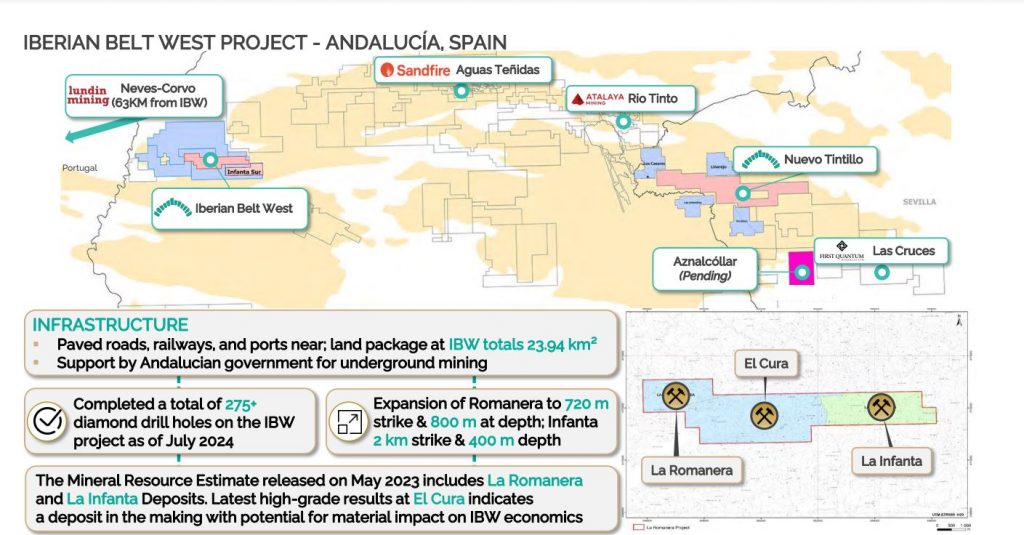

David Gower, CEO and Chairman of Emerita Resources (TSX.V: EMO) (OTCQB: EMOTF), joins me to provide an update on the recent multi-element drill results returned at El Cura, along with continued metallurgical testing and other derisking work being conducted which will feed into a resource update next month and upcoming Pre-Feasibility Study later in the year to advance the polymetallic Iberian West Project (IBW), located in southern Spain.

We start by discussing the exploration and development potential at El Cura, and what is being learned through the additional drill results just released to the market today on February 13th. Highlights include:

- Drillhole EC037 intersected 9.3m grading 1.1% copper, 0.7% lead, 2.1% zinc, 1.2 g/t gold and 34.8 g/t silver, including 2.5m grading 1.7% copper, 0.9% lead, 3.8% zinc, 2.0 g/t gold and 47.3g/t silver;

- Drillhole EC036 intersected 5.2m grading 2.1% copper, 1.3% lead, 2.8% zinc, 1.6 g/t gold and 65.5 g/t silver;

- Drillhole EC034 intersected 1.1m grading 2.2% copper, 2.0% lead, 6.7% zinc, 3.5 g/t gold and 148.2 g/t silver.

David walks us through how El Cura is located into between La Infanta and La Romanera, but more closely resembles La Romanera, returning higher gold values along with the base metals. Each of these 3 deposit areas plays into the larger development strategy where the earlier stage mining at La Infanta can now drift through El Cura on the way to the development of La Romanera, bringing in El Cura as a future economic driver much earlier in the mining sequence. We discuss all the derisking work going on in the background building toward the PFS later this year, as well as an update on the environmental permits anticipated to come in over the next couple months.

We wrap up noting the ongoing exploration work at the earlier-stage Nuevo Tintillo Project, and got an update on where things are in the courts, with the sentencing portion of the legal proceedings kicking off in early March, furthering the clarity on whether Emerita Resources will be awarded the high-grade polymetallic Aznalcóllar Project later this year, as the only other qualified bidder at the time.

If you have any follow up questions for David regarding Emerita Resources, then email those in to me at Shad@kereport.com.

.

Click here to follow the latest news from Emerita Resources

.

.

https://www.tradingview.com/x/ZzkQcVtZ/

EMOTF : Optimum Buy Zone

Thanks for the Emerita chart BDC. Yes, if that gap gets filled, it would be a good accumulation spot.

Nice update on EMO….. with the trial date coming soon can’t see it filling that gap.

Ex – Great Silver pop today, Valentines Day !!

P.S. I meant to mention this during the recording: Hadn’t been up M Street Georgetown all the way (Key Bridge) for a couple years. Did so last Sunday.

Sea Change!

There were many vacant storefronts before. Sunday I counted only 4-5, all the way back to 30th Street, and at least two of these under construction. More importantly, many of the new ones are very top shelf home furnishing stores with high quality etched signs etc.

Power people shop at these places, and they may be moving back in! BDC

https://www.tradingview.com/x/IST8IGvB/

DOLLAR : Bearish Gartley Targets

(Turn When Reached)