Silver Tiger Metals – High-Grade Silver Over Broad Intercepts Returned In First Assays From This Year’s Underground Drilling Into The Sulphide Zone

Glenn Jessome, President and CEO of Silver Tiger Metals (TSX.V:SLVR – OTCQX:SLVTF), joins me to review the first assay results from the drilling campaign being conducted from underground drill pads targeting the high-grade silver veins, and the Sulfide and Shale Zones on its 100% owned, silver-gold El Tigre Project in Mexico.

Highlights from the drilling program include the following:

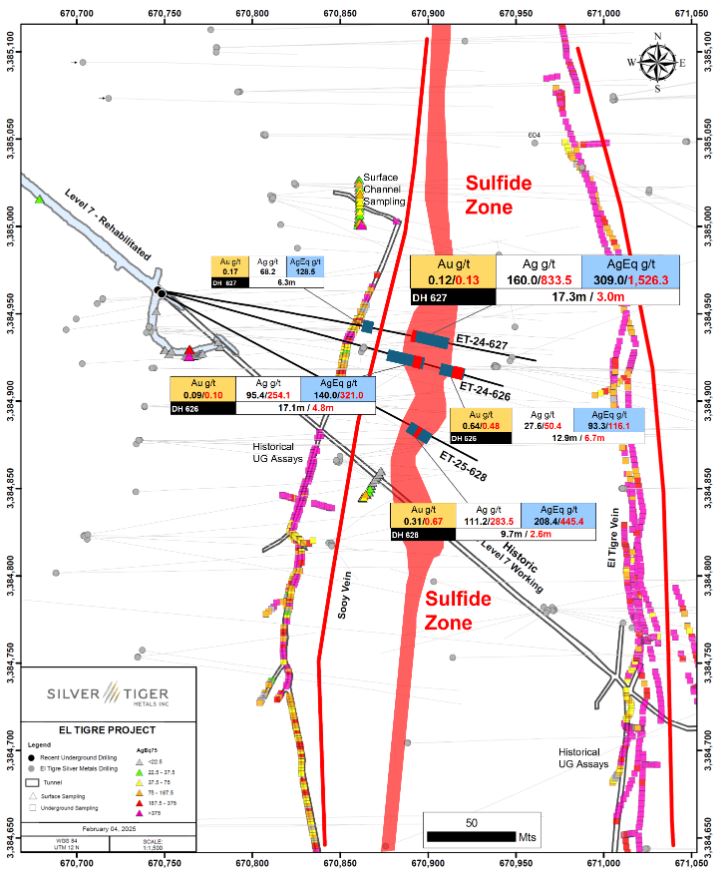

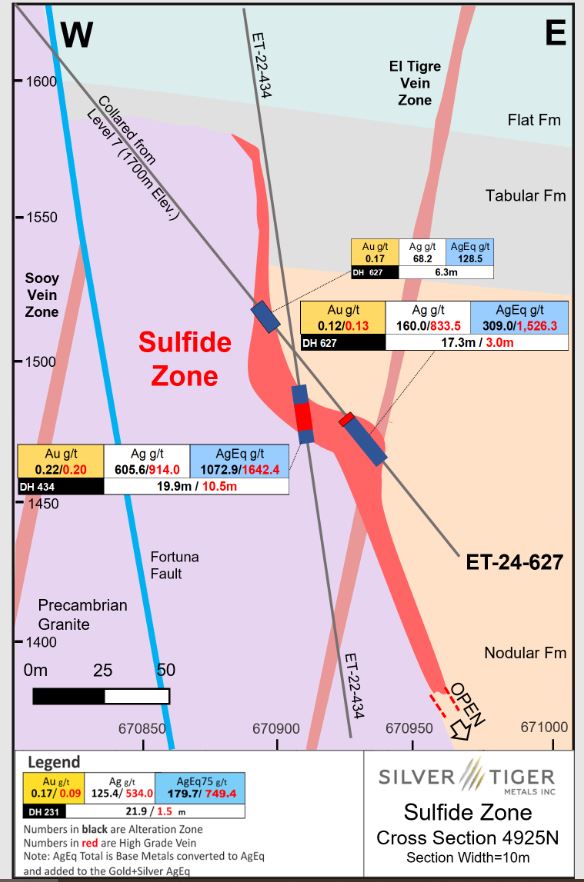

- Hole ET-24-627: 3.0 meters grading 1,526.3 g/t total silver equivalent from 297.5 meters to 300.5 meters, consisting of 833.5 g/t silver, 0.13 g/t gold, 0.87% copper, 6.22% lead and 13.24% zinc within 17.3 meters grading 309.0 g/t total silver equivalent from 297.5 meters to 314.8 meters consisting of 160.0 g/t silver, 0.12 g/t gold, 0.18% copper, 1.34% lead and 2.68% zinc in the Sulfide Zone.

- Hole ET-23-626:8 meters grading 321.0 g/t total silver equivalent from 253.5 meters to 258.3 meters, consisting of 254.1 g/t silver, 0.10 g/t gold, 0.33% copper, 0.33% lead and 0.61% zinc within 17.1 meters grading 140.0 g/t total silver equivalent from 242.0 meters to 259.1 meters consisting of 95.4 g/t silver, 0.09 g/t gold, 0.13% copper, 0.29% lead and 0.54% zinc in the Sulfide Zone.

This underground drilling work will continue with 1 drill rig, and all the prior data and other derisking work that the company is busy with in the background will be building toward a Preliminary Economic Study on the underground mining phase, set to release later in Q2. We discussed that banks and institutional analysts are now taking notice of these underground drill results, with Desjardins, Ventum Capital Markets, and SCP Research, all issuing updates and upgrades to their share price targets following this recent news.

Additionally, we also circled back to the ongoing permitting developments and more mining permits just issued by the new political administration in Mexico. Now that permits have started getting granted in Mexico, he feels it is just a matter of time before the first open-pit permits start getting issued in the first half of 2025. Glenn points out that this permitting visibility will be a very meaningful catalyst for the company and many Mexican mining projects across the board to get rerated significantly higher.

If you have any follow up questions for Glenn about Silver Tiger, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Silver Metals at the time of this recording, and may choose to buy or sell shares at any time.

.

Click here to follow the latest news from Silver Tiger Metals

.

.

Ventum Capital Markets, Phil Ker

Silver Tiger Metals – Target Price: $0.70

“Underground drilling targeting the Sulphide Zone has delivered exceptional results, with intersections just 40 metres from existing infrastructure (Exhibit 1). Silver Tiger maintains its focus on expanding the underground resources at El Tigre, as they continue to add value and optionality to a future mining scenario.”

SCP Research, Brandon Gaspar

Silver Tiger Metals – Target Price: $1.60

“Big picture, while last year’s focus was on advancing El Tigre’s open pit to PFS outlining a 10- year 4-5Moz pa AgEq heap leach operation with US$222m NPV5%, 40% IRR and a 2-year payback, this year is all about securing a permit amendment for advancing development of the OP and progressing the UG to an initial 1H25 PEA to sweeten the pit’s economics.”

Desjardins, Allison Carson

Target Price: $0.80

“The underground drill campaign has been designed to target three main zones—the Sulphide zone, the Shale zone and the high-grade epithermal vein system that dips steeply to the west. Drilling has been completed within 40m of the pre-existing haulage way, which adds to the economics of the project. The company intends to release its underground PEA in 2Q25.”

https://mcusercontent.com/61c130f409095eca3cdf12e97/files/2baaa876-8e58-979b-68fe-293f0b5321f9/2025_02_11.pdf