Sean Brodrick – Taking Advantage Of The Volatility In Early 2025 In A.I., Semiconductors, Tech, Utilities, Uranium, Gold, And Silver Stocks

Sean Brodrick, Editor of Wealth Megatrends and contributing analyst to Weiss Ratings Daily, joins us to review some of the macro news moving the markets, and how he’s positioning into the volatility we’ve seen over the last 2 weeks in AI stocks, utilities, uranium stocks, gold, silver, and precious metals stocks. There are sectors he is limiting exposure to while there are plenty of opportunities and sectors he believes will do well in 2025 in light of the Trump administration economic strategy with tariff and global trade policies.

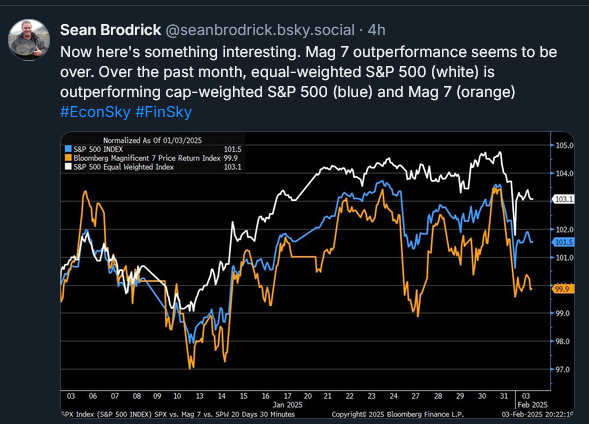

We start off discussing how the DeepSeek AI platform news was a bit overhyped, and affected certain sectors in AI, semiconductors and chips, electric utilities, and the uranium stocks disproportionately. Sean feels many of those moves earlier last week were way overdone in a market overreaction, and notes why he is still bullish on businesses that could see enhancements through AI automation, and notes that we are still going to need a lot of electricity, and both natural gas and nuclear energy on a global basis. Sean also noted that other segments of the market spread out into wider breadth despite the selloff in concentrated sectors, and that the equal-weighted index is outperform the more skewed weighted indexes lately.

Wrapping up we note the future breakout in gold and silver prices, and that we are seeing more volume and pricing outperformance in a number of the PM stocks. We discuss the potential for Q4 earnings numbers that will be released in a couple of weeks to be a potential catalyst to get more momentum going forward and more analyst coverage of the sector. Sean also notes that he is starting to move down the risk curve in the precious metals equities and position in more junior companies, and is more bullish on the prospects for silver stocks over the gold stocks.

.

Click here to follow along with Sean’s work at Weiss Ratings Daily and Wealth Megatrends

.

Click here to learn more about Resource Trader

.

.

When I was in grade 6 in Saskatoon, the teacher said Bolivia had a lot of tin.

Hi Terry, the biggest tin porphyry deposits in The World are found in Bolivia. Iska-Iska has all the characteristics of the 4 other big tin deposits found there. Eloro Resources tin deposit is in oxide form and that makes it easier to separate from the other metals. They also have a cornucopia of Silver, Zinc, and Lead and a float of only 82 million shares. Tom Larsen their CEO owns about 22% of the shares outstanding and Crescat Capital has another 16%, half of the shares are held in strong hands leaving only a small float to be traded, that is important for investors. DT

Sixty-five years after the teacher told us about all that tin in Bolivia, they are finally going to dig it up. Trader Ferg has been talking about tin in Tasmania but maybe now Eloro and Bolivia will be more valuable.

Collective Mining Expands the High-Grade Ramp Zone by Intersecting 51.95 Metres at 8.38 g/t AuEq Including 18.05 Metres at 16.32 g/t AuEq

4 Feb 2025

https://www.collectivemining.com/investors/news-releases/index.php?content_id=286

BTW – Gold futures recently hit an all-time high of $2,888.80 in overseas trading. (cosmic)

As I write this gold futures are at $2,884.

That’s not a bad price for producers of the yellow metal or companies that have solid economics on a gold project at much lower metals price assumptions.

We are starting to see a larger swatch of gold stocks start to demonstrate the leverage we’ve been waiting for in this sector. Bring it!

Eloro Resources opens up major tin zone at The ISKA ISKA deposit in Bolivia. DT

https://www.youtube.com/watch?v=A3cKuaBxVtQ