Silver Tiger Metals – 2024 Milestones, Resource Update and PFS For El Tigre Open Pit – 2025 Focus Shifting Exploration Deeper, Building Towards Underground Mining PEA

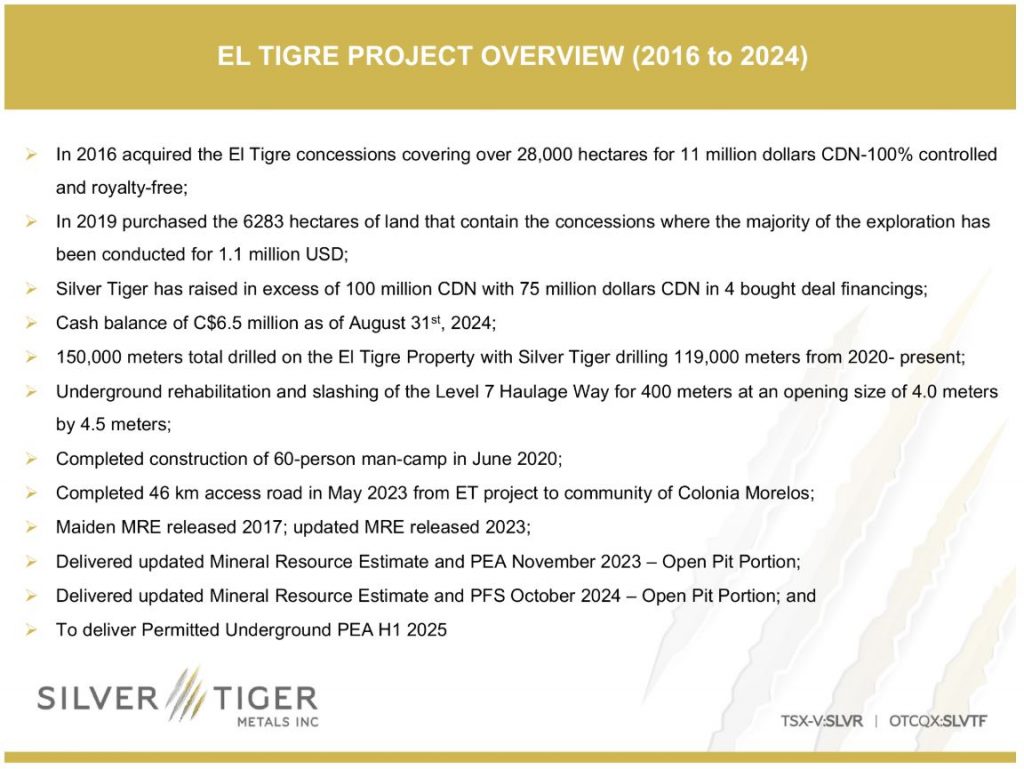

Glenn Jessome, President and CEO of Silver Tiger Metals (TSX.V:SLVR – OTCQX:SLVTF), joins me to recap the key milestones from 2024, and to look ahead to all the work initiatives and company and sector catalysts on tap for 2025, at the El Tigre Silver-Gold Project in Mexico.

We start off with a brief review the key takeaways from the updated Resource Estimate and Pre-Feasibility Study (PFS) on the open-pit that were released to the market in 2024 as key company milestones. There has been a lot of drilling done to move categories from inferred into indicated, as well as metallurgical testing, preliminary engineering work, permitting, and social licensing.

Then we shift gears into the deeper drilling, from underground, that commenced at the end of last year and will be continuing into the first half of this year; testing the high-grade silver veins, sulphide zones, and shale areas, continuing to mass up underground resources. The strategy is then compile that data with other ongoing derisking work into the Preliminary Economic Assessment (PEA) out on the underground mining second phase out in the first half of 2025. There is going to be a steady stream of newsflow emanating from the Company over the next few months with regards to both exploration and development.

We also expand the conversation to touch upon the political change in administrations in Mexico in October and what it means for the mining sector. As underground and open-pit permits start getting granted in Mexico in the first half of 2025, Glenn points out that this permitting visibility will be a very meaningful catalyst for Mexican mining projects across the board to get rerated significantly higher. Glenn is also getting financial term-sheets in place to hit the ground running, once they receive their permit, and they can get the open-pit mine constructed and producing roughly 18 months after getting the green light to move ahead.

2025 Upcoming Mining Conference Attendance:

-

Silver Tiger will be attending the Vancouver Metals Investor Forum (MIF) on January 17 and 18, 2025. Silver Tiger’s CEO, Glenn Jessome, will be a panellist on the Main Stage on Saturday January 18 at 10:20 am;

-

Silver Tiger will be attending the Vancouver Resource Investment Conference (VRIC) on January 19 and 20, 2025 in Vancouver. Silver Tiger’s CEO, Glenn Jessome, will be a panellist on the Main Stage ‘2025 Silver Forecast’ on Monday, January 20th at 3:30pm. Our booth number will be 428;

-

Silver Tiger will be attending the BMO Global Metals, Mining, and Critical Metals Conference from February 23 to February 26, 2025 in Hollywood Florida;

-

Silver Tiger will be attending the PDAC in Toronto from March 2 to March 5, 2025. Our booth number will be 3206; and

-

Silver Tiger will also be attending the Swiss Mining Institute (SMI) in Zurich March 18 and March 19, 2025.

If you have any follow up questions for Glenn about Silver Tiger, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Silver Metals at the time of this recording.

.

Click here to follow the latest news from Silver Tiger Metals

.

.

Investors Capitulate On Gold Mining Stocks

Robert Sinn – Goldfinger Capital – Jan 06, 2025

“Meanwhile, gold mining investor sentiment continues to plumb the lows. Just in the last few days I’ve noticed a consensus forming that mining stocks are uninvestible. Even long time mining stock investors have recently expressed to me that they have given up on the sector.”

“With the turning of the calendar year, I have rarely witnessed sentiment on the gold sector as negative as it is today.”

>> A selection of comments and messages I have received in recent days:

“So dead, so dead”

“…until the SPY breaks and go into bear market & gold beats out the 60/40 portfolio, these mining stock will drown a slow death.”

“I don’t think the sector will ever recover.”

“You have to have something wrong with your brain to own a mining stock.”

While I can certainly sympathize with investor frustration, I think it’s important to highlight some realities.

The gold mining sector is not intended to be invested in as a sector. As Rick Rule likes to say “Don’t own the sector, cherry pick the sector. I repeat, don’t own the sector, cherry pick the sector.”

“By owning and holding the GDX or GDXJ over long periods of time you are choosing to own beta. Mediocre beta at best…”

https://robertsinn.substack.com/p/investors-capitulate-on-gold-mining

Picking mining stocks….. is like picking and knowing RARE COINS…… requires a lot of experience… 🙂

Hi Jerry, it’s also like picking the right person to spend the rest of your life with, and if you go through a divorce, you must change your thinking, so you don’t get fooled the second or third or fourth time around. When the little head is talking the big head must listen because you never want to let the little head control the big head. LOL! DT 🤣👍

Hello DT…………….. I have been married to the same woman for 54 yrs……. 🙂

Hi Jerry, you got me beat I have only been married to the same woman for 45 years. I never wanted to go through a divorce my parents got divorced when I was in my early teens, and it wasn’t a pleasant experience. Lesson learned! DT😉

Investing in general US stocks may be like getting married, but in the very cyclical commodities space, and even more volatile related resource stocks, one does NOT want to get married to them.

It is more like dating for upcoming catalysts, and the reassessing if it was a fling, a 3-6 month situationship, or a 1 year+ relationship. Resource stocks are very rarely buy and hold “forever and ever amen.”

People that have camped out in stocks for many years or decades in almost any commodity sector generally have not done as well as those that were selective and had a number of stocks where they traded in for the momentum, catalysts, or macro trends during the good times, and got out of the way of the carnage during the bad times.

+45

Just Some Brief Fundamental And Technical Thoughts On Silver Tiger Metals

Excelsior Prosperity w/ Shad Marquitz (01/06/2025)

https://excelsiorprosperity.substack.com/p/just-some-brief-fundamental-and-technical