Sierra Madre Gold And Silver – Industrial Production Achieved in December At The La Guitarra Mine, With Commercial Production Slated For Q1

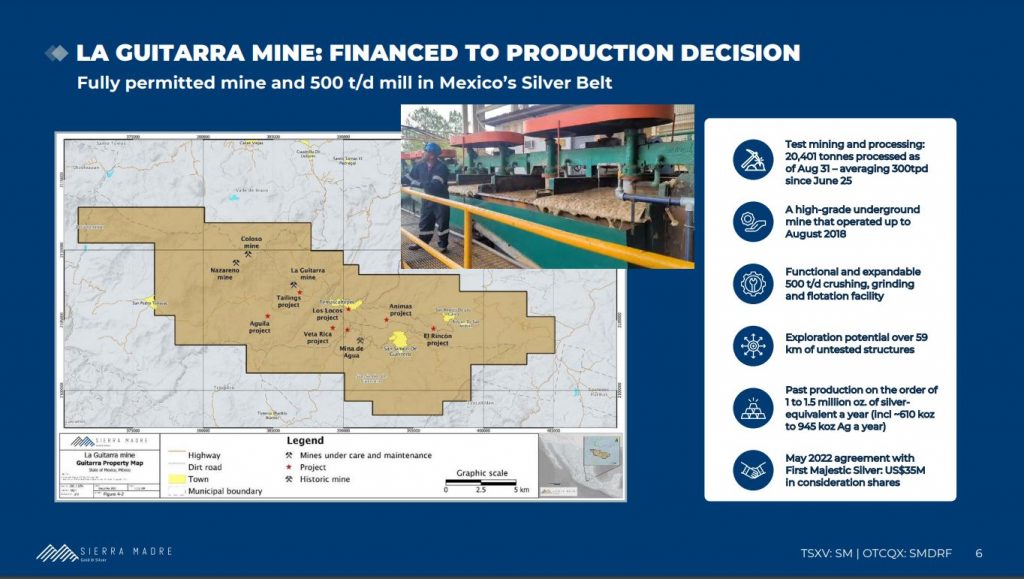

Alex Langer, President and CEO of Sierra Madre Gold And Silver (TSXV: SM) (OTCQX: SMDRF), joins me to review the news out December 10th announcing industrial production at the La Guitarra Mine and processing plant, in Mexico; with commercial production slated for Q1 of 2025. The La Guitarra Mine complex is a permitted, past-producing underground mine, which includes a 500 t/d processing facility that operated until mid-2018; which was purchased from First Majestic Silver (TSX: AG) (NYSE: AG) in 2023, and just went into test mining on June 25th of this year.

The plant has been operating at 86% of the milling circuit nameplate capacity, or 516 wet metric tonnes per day, for the last two months, exceeding the engineering standard of 80% for 30 days necessary to declare industrial commercial production. Alex shares the milling throughput has been just over 500 tpd in mid to late December, so the announcement of commercial production should be imminent.

Production statistics for the last two months:

- October: 13,208 wet tonnes of economically interesting vein material processed, producing 296.84 dry tonnes of concentrate, containing 21,186 ounces of silver and 295.3 ounces of gold.

- November: 13,064 wet tonnes processed, producing 317.7 dry tonnes of concentrate, containing 22,917 ounces of silver and 363.3 ounces of gold.

Alex then lays out the envisioned plan is to run the mill at 500 tpd most of next year, at the slated commercial production throughput. However, he then also shares the pathway forward where a modest amount of equipment can be purchased and installed to grow the mill throughput to 650 TPD in 2026, and then all the way up to 1,000+ TPD by the end of 2027. In addition to the potential of growth through production, we also discuss the leverage that a silver and gold producer like Sierra Madre will have to the potential of rising metals prices in 2025 and 2026.

Next we shift over into the larger growth vision of the company, as it will turn it’s it focus to exploring this district scale land package the end of next year, funded through organically generated revenues. The property hosts 8 different past-producing mines, with the first 2 priorities being to explore around the El Rincon and Mina de Agua mines. Additionally, there is a non-compliant 17 million ounce historic resource at the Nazareno Mine, and also solid underground infrastructure at the nearby high-grade Coloso Mine, that First Majestic had put quite a bit of sunk cost into already. Moving the Coloso Mine back into production will be another area of future expansion, which could see supplementary production complimenting that out of La Guitarra as soon as April of 2025.

If you have any questions for Alex regarding Sierra Madre Gold and Silver, then please email us at either Shad@kereport.com or Fleck@kereport.com.

- In full disclosure, Shad is a shareholder of Sierra Madre Gold & Silver at the time of this recording.

.

Click here to follow along with the latest news from Sierra Madre Gold & Silver

.

.

Silver’s Perfect Storm: 200M oz Deficit, M&A Wave & 2025 Price Targets | Peter Krauth

The Deep Dive – Dec 12, 2024

“In this insightful interview, Peter Krauth, editor of the Silver Stock Investor newsletter, discusses the current state and future outlook of the silver market. He explains how silver is experiencing its fourth consecutive year of deficit, with demand exceeding supply by 20%. Krauth draws parallels between silver and uranium markets, noting how both experienced supply constraints and price appreciation. He predicts silver could reach $35 in Q1 2025 and potentially touch $40 later in the year. Krauth also discusses recent major M&A activity in the silver sector, including First Majestic/Gatos Silver and Coeur/SilverCrest deals, suggesting more consolidation is likely. For investors interested in silver exposure, he recommends thorough research and considering a mix of established producers and quality junior miners based on individual risk tolerance.”

https://youtu.be/vSm4HlP5FZI