Dolly Varden Silver – Milestones Achieved In 2024 – Key Catalysts And Growth Initiatives For 2025

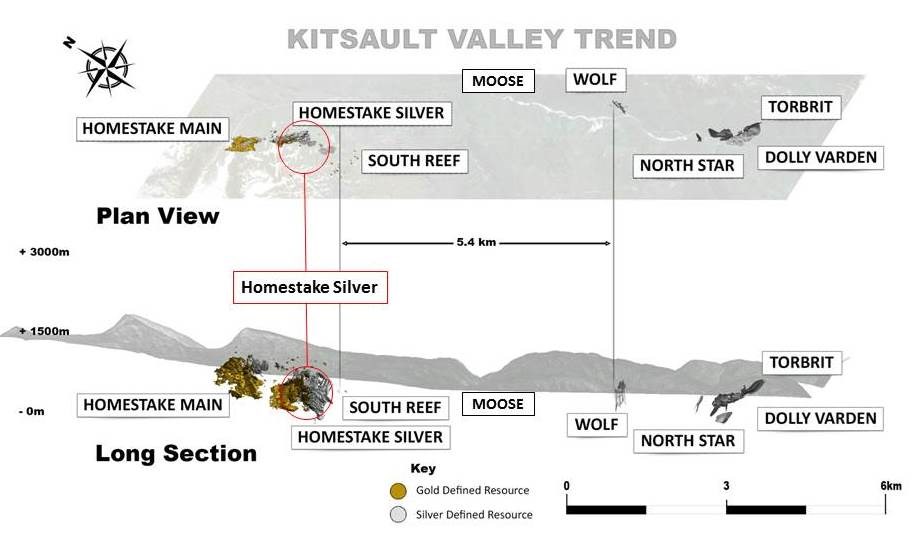

Shawn Khunkhun, President and CEO of Dolly Varden Silver (TSX.V:DV – OTCQX:DOLLF), joins me to review the key milestones achieved in 2024, and looks ahead to the catalysts and growth to come in 2025 at the Kitsault Valley Project; located in the Golden Triangle of British Columbia.

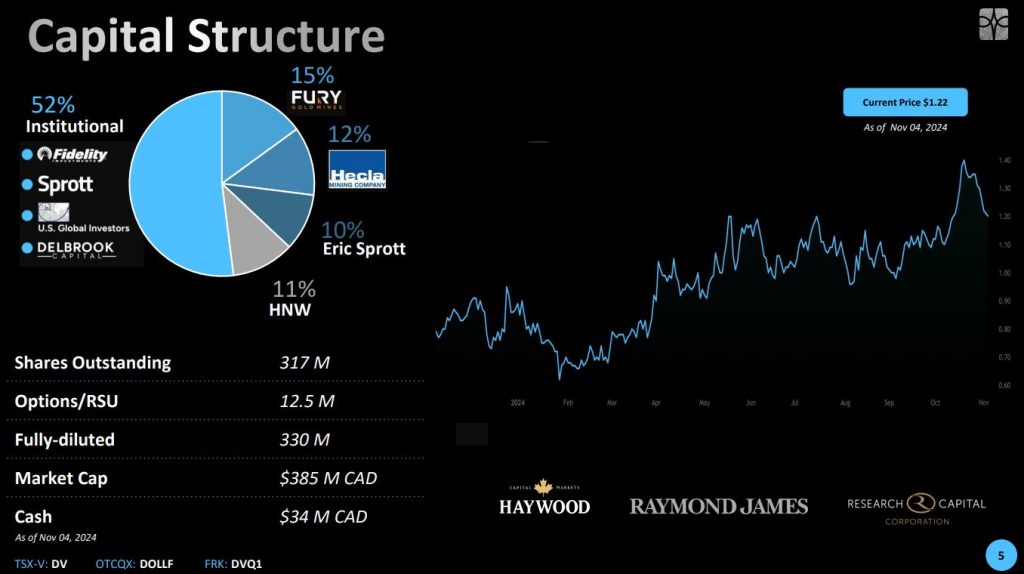

We kick things off with a comprehensive synopsis of the many of the key news releases this year, starting with the consolidation of the Big Bulk copper-gold porphyry deposit, acquiring the remaining portion of the project from Libero Copper, and then a number of the key drill results returned from the Homestake Silver, Wolf, Moose, and Chance areas of the Kitsault Valley Project. Shawn also outlined the success the company had in raising capital, growing the exposure to key strategic shareholders like Eric Sprott and Hecla Mining, and the strong balance sheet and capital on hand the company has moving into 2025.

Next we point to the better structural geological understanding their exploration team has of the periodicity of high-grade silver mineralization in the southern part of the project; where every 1,400 meters from Torbrit to Wolf to Moose to Chance, there are recurring deposits. This geological model, combined with ground truthing, and modern geochemical and geophysical surveys, has helped the team vector in on future targets across the property and make substantial step-outs from known mineralization. Shawn also highlights the potential at depth where the mineralization is continuing to grow with deeper cost-effective directional drilling.

In addition to the silver resources, there is quite a bit of gold that has been delineated in the northern Homestake Main and Homestake Silver areas of the Project, and these wide envelopes of gold mineralization contribute handsomely to the growing silver equivalent resources in place. Shawn lays out why he remains constructive on the silver pricing environment, the leverage that Dolly Varden has to a rising silver price, and a gold:silver ratio that is likely to show silver catch up to the price of gold.

If you have any follow up questions for Shawn about Dolly Varden Silver, then please email me at Shad@kereport.com and then we’ll get those questions addressed by management, or covered in future interviews.

- In full disclosure, Shad is a shareholder of Dolly Varden Silver at the time of this recording.

.

Click here to visit the Dolly Varden Silver website and read over the recent news.

.

.

Like the company but get turned off by exaggerations and discrepancies in the promotion material. The stock is not down 40% from the high (more at 35%) and VP of exploration said a few weeks ago their step-outs were 80-100 m, not 100-200 like CEO states. Just please stick to the facts as I get weary when the truth starts to slide. Perhaps I’m nit-picking a bit here but things like this can become a slippery slope and erodes trust and confidence in my mind. Still holding.

They have done stepouts over the last 2 years that were well over 100 meters, some were 150+ meters and almost 200 meters, so that was not an exaggeration or marketing. I don’t know the exact stepout meters of the hole at Wolf where they are waiting on the assay for, (as it hasn’t been released yet), but Shawn said around 100 meters (80-100 meters would in fact be around 100 meters)… but that is just on that 1 hole and in no way reflective of every step-out hole they drilled the last few years.

As for the Dolly Varden shareprice, it hit its peak in October at $1.46 (which I celebrated with Shawn live in person at a resource investing convention in Fort Lauderdale) and it fell all the way back down to $0.86 last week, which was a drop of 41%. So, again, his comment that their stock had dropped around 40% was spot on.

We had recorded the interview earlier in the week when the stock was still down 38%, after having just been down over 40%, and so that was the vantage point from which Shawn was talking about the stock (having been down 41%-38% over the days leading up to the interview). Yes, now after a bump right before Christmas it is up to only being down 35% as you point out, but I think publicly calling Shawn out for exaggerating the data is way off base and required more research on your part.

Your comments do seem a bit nit-picky as you stated, because the main point is the same regardless – they are stepping out big on many targets over and over and hitting paydirt, and their stock price is down big from the peak in October representing a great opportunity to acquire the exact same company with even more great drill results known now and more solid data at a better entry price. Those were the main points Shawn was highlighting.

I’ve talked to literally hundreds of CEOs and Shawn has some of the most integrity of anybody I’ve talked to….so I don’t feel like he’s going down the slippery slope of over-promotion and I’ve known him for several years. To each their own.

Here is Dolly Varden (DV) chart – demonstrating the 41% drop in shareprice over the last 2 months from from later October peak of $1.46 down to $0.86 last week in late December.

https://cdn-ceo-ca.s3.amazonaws.com/1jmr69f-Dolly%20Varden%20-%202-year%20daily%20chart.JPG

It’s all tax loss selling! DT

Hi DT. Yes, agreed that much of it was tax loss selling. Additionally, Silver pulled back down from over $35 in late October to under $30 last week. Gold correct down from over $2800 to the low $2600s, as well, so the whole PM sector took it in the shorts and corrected. Much of this 40% pullback in DV was just par for the course with many PM stocks down 20%-50% over the last 2 months.

If people liked these stocks in October, then they should really like the opportunity to accumulate more here where prices are at in late December. Time to position for the seasonal Q1 Run!

Hello, that’s a screaming buy if silver gets over $30.50… just sayin’… buy when others are freaked out!

+1 Dan. Absolutely!

The time to buy and accumulate in a bull market (and we are and clearly have been in a bull market in PMs) is when there are sharp corrective moves within the larger bull trend. Silver was in the low to mid $20’s just a year+ back, and now it is around $30 and many investors are crying in their beers because it pulled back from $35. Still, both Gold and Silver had a fantastic year overall and remained in the next leg of the larger bull market, ever sense putting in their intermediate bottoms in the fall of 2022 where gold got down to $1618 and silver got down to $17.40. Pullbacks like we’ve seen the last couple months here in late 2024 should be exploited through accumulation of the quality stocks.

I did MAJOR buying in SCZ at the recent bottom as the line from Sep. ’23 until now has held so far so I don’t have a lot of dry powder to speak of because I got taken to the cleaners a couple times trying to trade Nat Gas ETFs, haha! Dolly will be my choice for non-producer buyout candidate.

BTW, my sell target on SCZ could be about $0.60 +/- at the top of the rising channel.

Nice work Dan. Yeah, I was adding a bit more Santacruz to my position in November, but should have waited a bit longer as it pulled back even more. Still I feel really good about the SCZ trajectory for 2025 and really enjoyed the update interview with Arturo we hosted here at the KER back in November:

Santacruz Silver Mining – Q3 Financials, 6 Mines, 3 Mills, & Ore Feed Sourcing In Mexico & Bolivia

As for Dolly Varden as a takeover candidate, I’m thinking that once they put out all their drill results from this year’s program in early 2025, and then update their resource estimate accordingly, then it could be that Hecla moves on them even at that point. If not, it would likely be after they work up a PEA on the Kitsault Valley Project overall with all the silver and gold resources. I also think that Big Bulk project located smack in the middle of Hecla’s project next door makes sense for Hecla to have in house.

I was looking at some picks by well-known analysts in the industry and honestly, they are all over the map. None of them picked Dolly Varden although I believe it must be a top contender. DT

I know of 3 newsletter writers that have Dolly Varden as one of their top picks, but will not name them as that info is behind their paywalls.

The have also recieved some analyst coverage (and you can see some of the key institutional stakeholders in the capital structure slide up above). I agree that it would be nice to see even more of it, and I believe in 2025 they’ll become a force in the Canadian silver and gold space that is too big to ignore.

I talked recently with the owner and content team behind Streetwise Reports and they shared with me that Dolly Varden is one of the top stocks they have had coverage on this year, and that over 6000 analysts and institutional clients have read those articles, with many times more retail, based on their analytics. There is likely far more institutional coverage to clients and analyst coverage in confidentiality than we are aware of.

Like Shawn said in the interview, when Fury Gold reduced down some of their shares to fund their own exploration work, those shares went into the hands of strong institutional investors.

I believe 2025 will be a stock pickers year. Usual suspects like TSLA, GOOG will continue higher (Elon on his way to become the first trillionaire) Looks like Boeing put a bottom. Silver stocks look attractive, I purchased EXK and planning on adding more when it dips. Keep an eye on Chinese equities.. 2025 is going to be the year of BABA, JD.

Agree on Chinese equities, we are doing well there.

https://www.tradingview.com/x/bO8R261p/

NatGas : Gartley Bear Pattern

Turn or Continuation?

Who said they aren’t interested in B.C… Joe Mazumdar? Too many mountains, too much snow

Merry Christmas and Happy Holidays to all the KE Report listeners and contributors!

Wishing everyone prosperity in their trading and in life as we round out 2024 and head into 2025!

– Shad