Electric Royalties – 41 Royalties And 30 Projects For Option, And The Recent Acquisition Of A Cash-flowing Copper Royalty

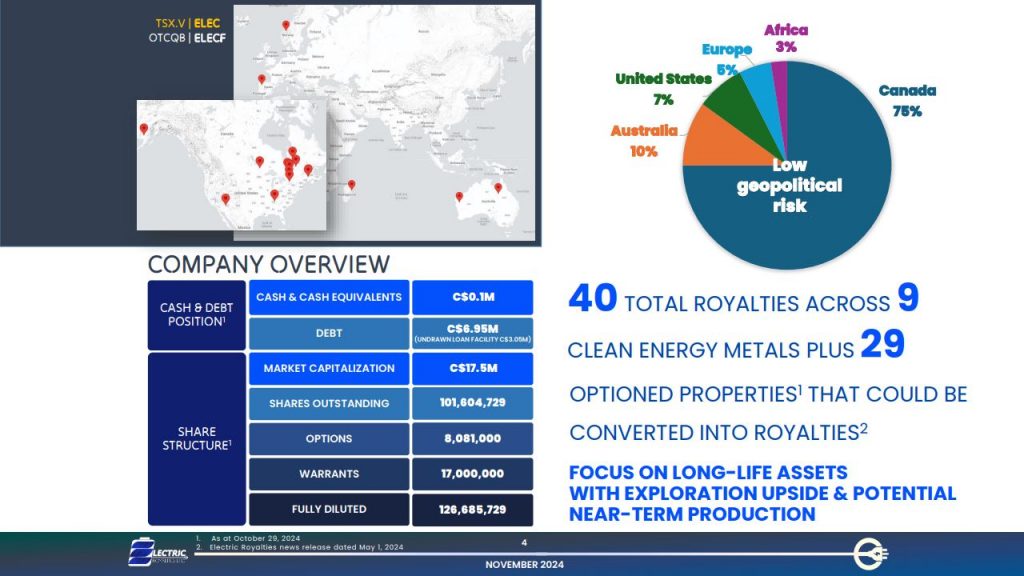

Brendan Yurik, CEO of Electric Royalties (TSX.V: ELEC) (OTCQB: ELECF) joins me for a reintroduction to the Company’s position as a diversified royalty company with a growing portfolio of 41 royalties in lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper across the world. The Company also has 30+ other mineral projects to option off to other companies, and it is looking to next year to be cash-flow positive from a combination of royalty payments and option anniversary payments.

We start by having Brendan review the corporate strategy of focusing on acquiring royalties on advanced-stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to the buildout of infrastructure and technology needed for the clean energy transition.

Next we review the recent acquisition, dated November 22, 2024, of the 0.75% Gross Revenue Royalty (GRR) on the mining claims, mining leases and mineral tenures comprising the producing Punitaqui copper mine in Chile operated by subsidiaries of Battery Mineral Resources Corp. (TSXV: BMR) (OTCQB: BTRMF). This marks their first cash-flowing copper royalty in their portfolio of 9 metals.

We also look ahead to next year with Brendan sharing which other royalties in the portfolio could be either moving back into production or moving towards initial production. We also touch up on the royalty partner projects that have seen significant resource growth or development, as well as those demonstrating exploration upside from recent newsflow and updates from their respective operators.

If you have any follow up questions for Brendan regarding Electric Royalties, then please email them into me at Shad@kereport.com and we’ll get those answered by management or addressed in future interviews.

.

Click here to follow the latest news from Electric Royalties

.

.

Hey Glen to be honest I’m more focused on the base metals these days as I like the potential there and the plays that im overweight in. I will say I’ve been expecting gold to pullback to the $2400-2450 range as it consolidates after the last move up. I’m impressed at how well it’s held up as it consolidates after that last leg up. I do see +$3000 in the cards towards late spring/summer but may be sooner the way it’s held on to the gains

Hey wolf,

Hope you’re making some coin! Base metals has done well in some areas. It’s not my cup of tea simply because I stick more to what I know. I’ve always been less is best, however guys like you and ex are able to invest in multiple things which works the brain more.

I agree with your outlook of $3000 plus gold second quarter or after next year. Again I think gold and silver have a c wave down but I don’t think it gets to that target you mentioned however anything is possible.

All the best

Might have worded it bad Glen. On the initial break through $2800 I expected a pullback to the $2400-2450 range. The resilience it’s shown has impressed me and makes it less likely with each passing day

Good thoughts on gold price action Glenfidish and Wolfster. Yes, pricing has been much more resilient all year long compared to what many were expecting.

Yes, but – the Donald isn’t a big ESG fan and even though Elon is all over the place don’t be surprised if subsidies for EVs go poof, and for once I agree with the Orange one on something, and regular Auto makers are walking from their full EV plans and moving to hybrids. So, my guess is that the great future of EVs will be delayed so this may be an idea who’s time is yet to come.

When the market gets flushed down the drain I will re-look at it but for now sadly things are not looking great for this market.

I don’t disagree Mike but hybrids still need the critical metals too and power infrastructure upgrades are needed everywhere. There’s a reason all the tech companies are securing their power sources before building their centres and the demand for power is way ahead of supply and only getting worse.

Bingo Wolfster. Anyway one slices it (hybrids or EVs), eBuses, eBikes, battery powered mining equipment, charging stations, more solar or wind, crypto mining, or AI data centers…. we’re going to need more Copper and Nickel and Tin and Silver.

As far as the big tech companies securing their power needs, they’ve almost unanimously gone towards nuclear power, so there will be a continued bid for Uranium supply from North America and friendly nations.

Resource investors don’t have to spend much time looking into these evolving megatrends to see where the cheese is moving…

Europe has placed restrictions on EV’s from China, so The Chinese are producing hybrids to get around those restrictions. Northvolt the big Swedish battery manufacturer went bust because governments poured money into them to appease the green agenda, they created without understanding what the real market needs. Consumers decide with their pocketbooks, Governments print money. One side must live within their means and that is the side that calls the shots in the marketplace. DT

I also should have added the disconnect between physical price and stocks in PMs was frustrating me. Making more elsewhere but waiting for a sign that the disconnect is over.

Update!

Further to my last post about a week ago that ex responded to regarding my technical views for gold also silver, there is a change in tone.

Regarding my three weeks uptrend it’s still in play but I must say that this current bounce in the metals and more specifically the miners is smelling like a classic b wave! Take that how you will.

I don’t mean to throw more gasoline at an already beat up, forgotten, destroyed, punched, deserted, abandoned miners investor group and crowd. By the way me included as any other what I have endured but still here standing! So here is what I have for you fine folks and I hope some of you like Matthew, doc, ex, Charles, wolf and others chime in….

Miners are telling me one final pull back here which will take 4/5 weeks and hate to be that bad news. But this c wave pull back if it even happens I’m leaning on 75% it willl. Then I would say 100% that it will be the final pull back and miners will be finally off to the races specifically the explorers and small cap is what I’m talking about. I’m talking about the ker and what we invest in…

100% do not be discouraged, the miners have either already bottled or they bottom in 4:5 weeks and they will cut the low making it a lowers low but by once’s nothing huge don’t buckle. And this scenario may not even play out however what I’m looking at tells me two miners show me it will.

If we get that lower low I’m 4/5 weeks like some doc and others have suggested load it it will be the final low before we go to 60/79 silver $3200/$3400 gold the move will be epic.

Glen