Thor Explorations – Q3 Financials and Operations Update At The Segilola Mine, Exploration At The Douta Project Building Towards PFS

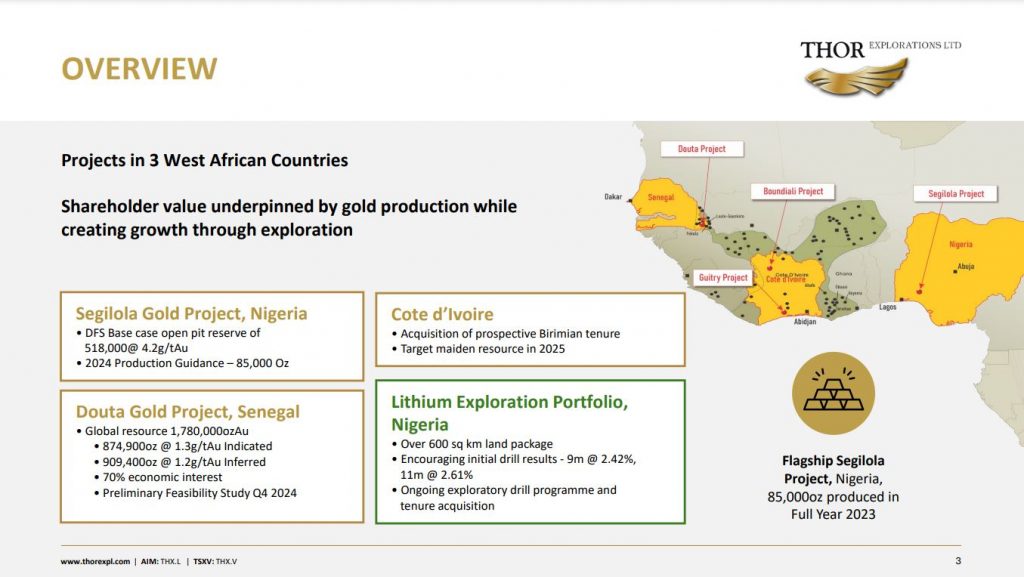

Segun Lawson, President and CEO of Thor Explorations (TSX.V: THX) (AIM: THX) (OTC: THXPF), joins me to review the Q3 financials and operations from the Segilola Mine, as well as exploration activities around both Segilola in Nigeria, and further drill results from the ongoing 2024 exploration program at the Douta Gold Project, Senegal. We also discuss the recent acquisition of the Guitry Gold Project in Cote D’Ivoire.

Segun outlined that the gold poured at the Segilola Mine during Q3 totalled 20,110oz, but mining rates were lower than Q2 2024 due to the previously reported fly-rock incident. Improved controlled blasting practices are now in place to avoid a recurrence. Mill feed grade was 3.22 grammes per tonne (“g/t”) gold with recovery at 88.5%. The lower recovery was due to a delayed change in mill liner during the period. The stockpile balance increased by 13% to 1,329,007t of ore at an average grade of 0.94g/t as this was mined during shortfalls resulting from events that occurred during the Quarter.

Q3 2024 Financial Highlights

-

18,167 ounces (“oz”) of gold sold with an average gold price of US$2,328 per oz.

-

Cash operating cost of US$585 per oz sold and all-in sustaining cost (“AISC”) of US$766 per oz sold.

-

Revenue of US$40.2 million (Q3 2023: US$36.6 million).

-

EBITDA of US$27.4 million (Q3 2023: US$10.5 million).

-

Net profit of US$17.5 million (Q3 2023: US$0.9 million).

-

Senior debt facility reduced to US$3.9 million as at September 30, 2024. This debt is scheduled to be fully repaid by the end of Q4 2024

-

Transitioned from a net debt position of US$2.7 million as at June 30, 2024 to a net cash position of US$2.7 million as at September 30, 2024.

We reviewed that the priority of the Company’s exploration strategy at Segilola is extending the mine life through delineation of potential additional underground resources, as well as additional geochemical sampling continued at near mine open pit targets. An initial 12-hole drilling program continued during the period with initial positive drill results received from the first two holes of 3.0 m grading 11.24g/t Au from 294m and 1.5m grading 3.22g/t Au from 269m.

Transitioning over to the Douta Project, the RC drilling program was focussed on increasing the percentage of oxide resources at the Makosa East Prospect, which runs parallel to the main Makosa mineralised trend and is additional to the current mineral resource. Additional infill drilling was completed at the Makosa North, Mansa and Maka prospects. Remaining Pre-Feasibility Study (“PFS”) and Mineral Resource Estimate update workstreams are being completed, with a target completion in Q4 2024.

Wrapping up we discussed the signing of a binding agreement with Endeavour Mining Corporation to acquire a 100% interest in the Guitry Gold Project for US$100,000 in cash and a 2% Net Smelter Royalty. This is an advanced exploration project with 11,000 meters drilled showing it is prospective for expansion of mineralized zones, and this project will be getting some exploration work focus in 2025.

If you have any questions for Segun regarding Thor Explorations, then please email them into me at Shad@kereport.com , and we’ll get those submitted to management or discussed in future interviews.

*In full disclosure, Shad is a shareholder of Thor Explorations at the time of this interview.

.

Click here to read over the recent news out of the Company.

.

.

Troilus (TLG) progresses project financing with two additional LOI’s for up to another US$500 million from Scandanavian Export Agencies. In one week, they have received LOI’S from three sources all European of $1 billion US. That should get investor’s attention! DT

https://money.tmx.com/quote/TLG/news/8856450538351589/Troilus_Progresses_Project_Financing_with_Two_Additional_LOIs_for_up_to_Another_US500_Million_from_Scandanavian_Ex