Silver Tiger Metals – Key Takeaways From El Tigre Open Pit PFS, Looking Ahead To Underground Mining PEA

Glenn Jessome, President and CEO of Silver Tiger Metals (TSX.V:SLVR – OTCQX:SLVTF), joins us to review the key takeaways from the Pre-Feasibility Study (PFS) on the open-pit mine at the El Tigre Silver-Gold Project in Mexico; with plans to have the Preliminary Economic Assessment (PEA) out on the underground mining second phase out in the first half of 2025. We also expand the conversation to touch upon the political change in administrations in Mexico in October and what it means for the mining sector. We also discuss the silver market and what it means for the silver equities.

We start off by recapping the key metrics and investor takeaways from the PFS on the open-pit portion of the El Tigre Project, which is more gold dominant. Highlights of the PFS are as follows:

-

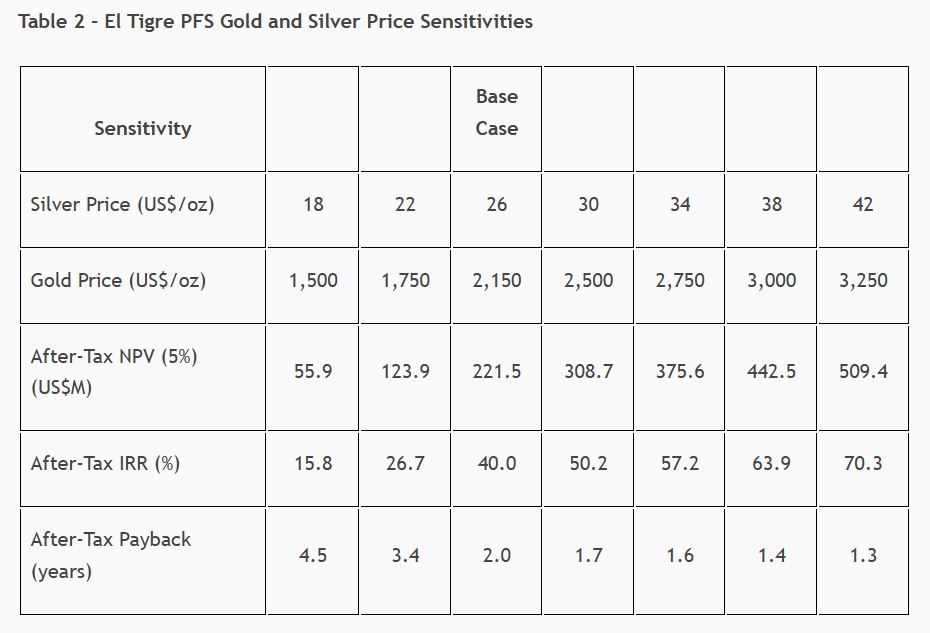

After-Tax net present value (“NPV”) (using a discount rate of 5%) of US$222 million with an After-Tax IRR of 40.0% and Payback Period of 2.0 years (Base Case);

-

10-year mine life recovering a total of 43 million payable silver equivalent ounces (“AgEq”) or 510 thousand payable gold equivalent ounces (“AuEq”), consisting of 9 million silver ounces and 408 thousand gold ounces;

-

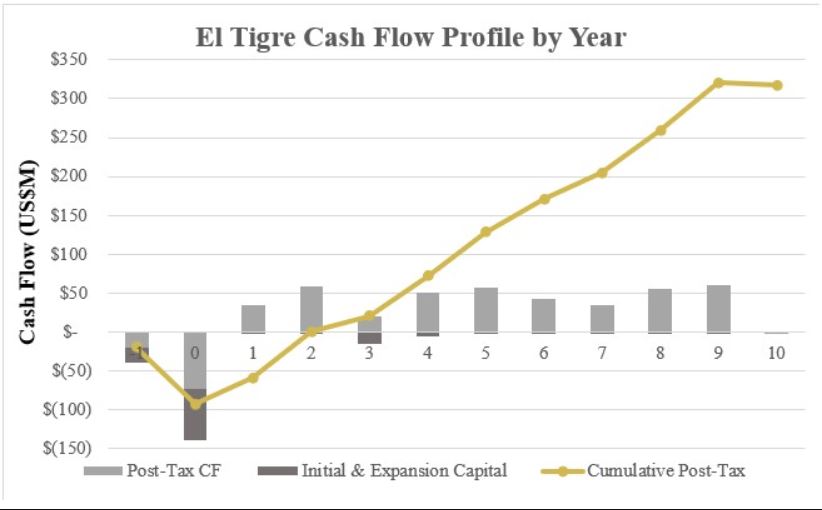

Total Project undiscounted after-tax cash flow of US$318 million;

-

Initial capital costs of $86.8 million, which includes $9.3 million of contingency costs, over an expected 18-month build, expansion capital of $20.1 million in year 3 and sustaining capital costs of $6.2 million over the life of mine (“LOM”);

-

Average LOM operating cash costs of $973/oz AuEq, and all in sustaining costs (“AISC”) of $1,214/oz AuEq or Average LOM operating cash costs of $12/oz AgEq, and all in sustaining costs (“AISC”) of $14/oz AgEq;

There has been a lot of drilling done to move categories from inferred into indicated, as well as metallurgical testing, preliminary engineering work, permitting, and social licensing. The exploration focus is now shifting over to, once again, drilling down into the deeper underground targets with the high-grade silver veins and high-grade shale that is going to be feeding into the PEA for the underground silver-dominant long-mine-life portion of the deposit in the first half of next year. There is going to be a steady stream of newsflow emanating from the Company over the next few months.

Next we pivoted over to the complete sea-change in sentiment that the silver stocks in Mexico have seen from depressed valuations over the last couple of years, to the recent upswing in prices, with more reratings likely to still come once the mining permits start being issued again in H1 of 2025. Glenn shares the key takeaways he heard from the new President, Claudia Sheinbaum’s, public address; which reiterated that foreign capital investment was safe within their country. He also reminds listeners that it will be a process to get new cabinet positions filled and for staffing up the new administration, but that he expects the permits will start getting granted next year, and this could be a very meaningful catalyst for Mexican mining projects to get rerated significantly higher once the first one is announced.

If you have any follow up questions for Glenn about Silver Tiger, then please email us at Fleck@kereport.com or Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Silver Tiger Metals at the time of this recording.

.

Click here to follow the latest news from Silver Tiger Metals

.

.