Metallic Minerals – 2024 Exploration Strategy At Both The Keno Silver Project And The La Plata Copper-Precious Metals Project

Scott Petsel, President of Metallic Minerals (TSX.V:MMG – OTCQB:MMNGF), joins us to review the 2024 exploration strategy at both the Keno Silver Project in the Yukon and the La Plata Copper Project in Colorado.

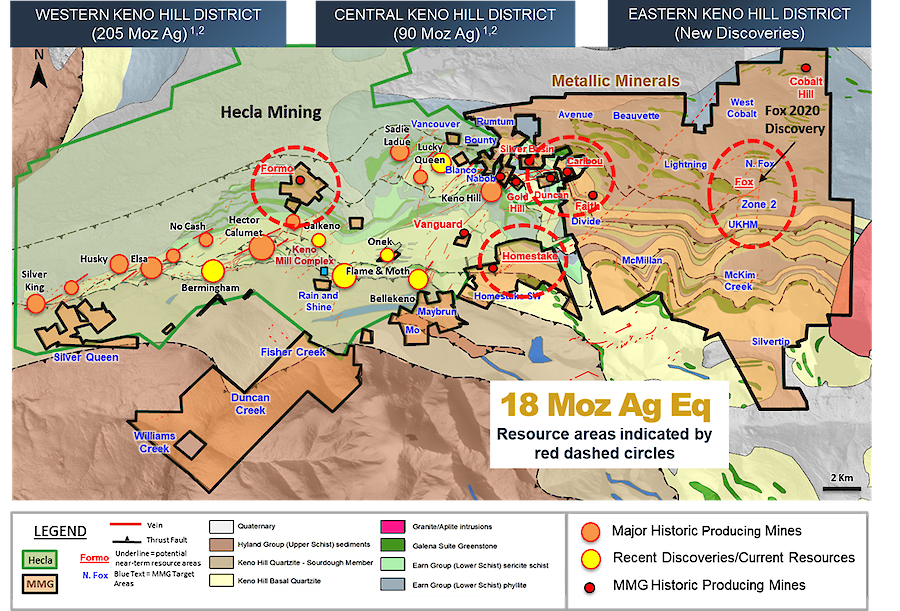

We lead off discussing the 2,000 meters of drilling planned to begin in the next few weeks at the Keno Silver project, building upon the inaugural NI-43-101 mineral resource estimate, announced February 26th. This was a key milestone for this Project which defined 18.16 million ounces of silver equivalent (inferred), over 4 deposits (Formo, Fox, Caribou and Homestake). Preparations are underway to begin step-out drilling near the Formo target, which is the largest of the four deposits contributing to the initial resources announced earlier this year, and located inside the neighboring Hecla Mining’s Keno Hill land package. There will also be drill testing at a few new targets like McMillan and Rumtum.

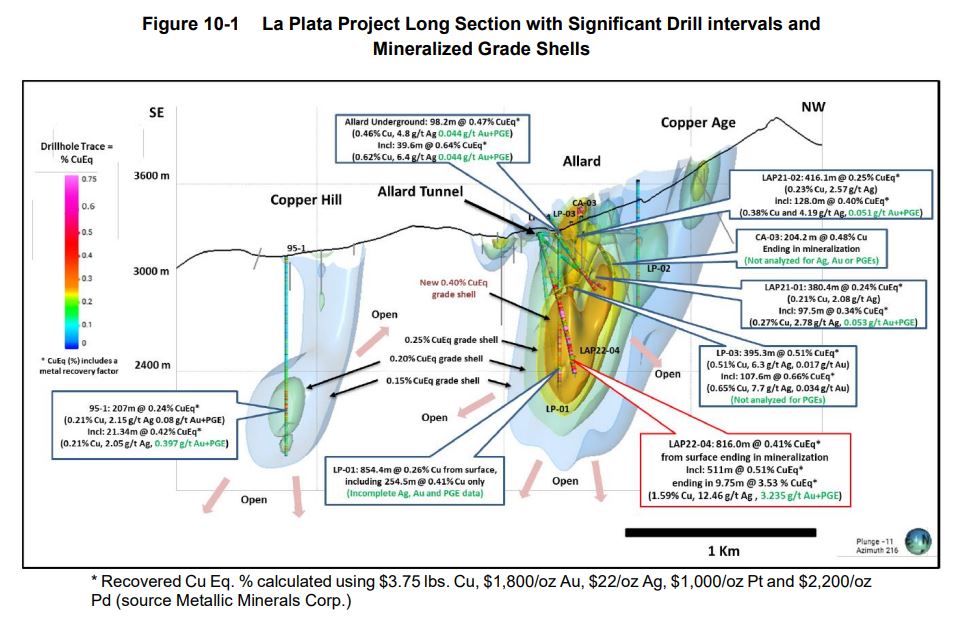

Then we pivoted over to the developing exploration strategy, ongoing groundwork, and targeting for this year at the La Plata Copper-Silver Project, following up on last year’s 4 drill holes over 4,530 meters, that was funded by a May 2023, 9.5% strategic equity investment by Newmont Corporation. Scott outlines that those 4500 meters drilled last year have not yet been added into the existing 1.21-billion-pound copper and 17.6-million-ounce silver inferred mineral resource. Importantly, they will also add in more a grade and resources from gold, platinum, and palladium for the first time; which have not previously been included.

Scott outlined that the 4 holes drilled by the exploration team in 2023 did follow up on the area near the high-grade intercept hole # LAP22-04, and that three of four holes intercepted continuous porphyry style Cu-Ag-Au-PGE mineralization over 500 m in width at 0.3% Cu including significant intervals exceeding 0.5% to 0.7% CuEq with associated Ag, Au and PGEs. Drill hole LAP23-05 intersected 909 m of continuous mineralization from surface grading 0.26% CuEq over the entire hole length, with a 550 m wide higher-grade zone. We discuss the variability in the grade and intensity of the mineralization in all drill holes, based on the density of veining and concentration of associated sulphides that carry the copper, silver, gold, platinum, and palladium. The deposit remains open to expansion at depth and along trend. Defining the geometry of these higher-grade porphyry units and alteration zones is an important focus of follow up drilling at the Allard resource area and potentially testing a few new targets in 2024.

If you have any follow up questions for Scott on Metallic Minerals, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Metallic Minerals.

.

Click here for a summary of the recent news out of Metallic Minerals.

.

Check out Jay Taylor and Chin interview….

Hi Jerry, do you have a link? DT

DT…………. You should subscribe to Jay…… he will email you …..

I will see if, I can retrieve it…..

DT………….. see below…………

I posted the Substack……..info……….. and they deleted it………..sorry DT….

I appreciate the effort, thanks Jerry. DT

The Surrender Announcement for those who listened…so it was Party ti

Jay Taylor from J Taylor’s Gold Energy & Tech Stocks

From:

taylorjay@substack.com

The headline here was stolen from Michael Oliver of http://www.OliverMSA.Com who pointed out that Powell was clearly sending a signal yesterday before Congress that rate cuts are on the way. He said, “Elevated inflation is not the only risk we face; reducing policy restraint too late or too little could unduly weaken economic activity and employment” (our emphasis). He also said the Fed had made “considerable progress” on their anti-inflation policy before finally admitting what most economists had recognized for several months: that the labor market has “cooled considerably.”

Then came the 0.1% decline in the CPI which when combined with Powell’s remarks triggered a huge move out of the few stocks that have been rocketing the S&P and NASDAQ in a perpetual rise in the indexes. Once again, wealthy Americans celebrated the anticipation of untold financial gains at the expense of America’s middle class.

Hi Jerry, Lately I have been sensing a real uneasy feeling about this market. I am talking about commodities but keeping one eye on Nvidia, a collapse of this one stock is enough to bring Humpty Dumpty to a prostate position where his arms are flailing, and he is on his back trying to right himself. I think The Fed is seeing this as well and they think they need to loosen the purse strings before it is too late, but alas it is already too late, they see life through the rear-view mirror.

When you allow anything to tip too far in one direction you can expect blowback of the same magnitude. The credit and speculation market allowed by The Fed going back to The Greenspan years has been fueled by excesses never before seen in the modern World, and now The Fed is trapped. They can hope that their bag of marbles will slow down the impending crash but that is only wishful thinking. The economy has been run by children playing with funny money for years, no matter which way they turn there is no way out of this dilemma except through disaster. DT

The smart money has been exiting Nvidia for about one month, most of the dumb money is still engaged thinking this stock is on a plateau that can just keep going higher. The Fed will have to intervene directly into the stock market and buy up the tech stocks to keep them from rolling over, but that too has a life because it involves oodles and oodles of printed money that is no longer backed by Saudi Oil. The Petrodollar is dead. The rest of The World does not need to hold American dollars to buy oil. All of that money held in foreign Central Banks will start flooding back to The US causing inflation. Like our opposition leader in Canada likes to point out if you have ten apples and ten dollars that is one buck an apple but if you have 20 dollars and ten apples that is two bucks an apple. Why do they always use the apple sellers as an example to point out inflation. LOL! DT

Hello DT………….

Thanks for the follow up and outline of FREAKY FED ……..

AND……………… It is FREAKY FRIDAY AGAIN……….. 🙂

I see Taylor Substack info….was released….

In a recent CapitalCosm podcast, Patrick Karim claims there are about 5 PM stocks worth investing in and most people should just buy the metal instead of hoping to get rich with an explorer.

Well, that is one opinion to have. Another opinion to have is that there are many more PM stocks worth investing in that will outperform the metals, and there are plenty of them that are not explorers (although there are a number of quality advanced explorers), but rather developers, producers, and even royalty companies.

This is a dangerous game and if the conventional markets blow up your beaten down resource stocks will crater, and many will go bankrupt. The risk is huge nobody knows anything, there are no gurus, you shouldn’t play this game unless you are prepared to lose what you have and to make sure that you have enough other investments that you can afford to play this game and lose. How many times has it been mentioned that 95% of investors lose money on the stock market. Those are terrible odds but that is reality. I think everyone should own the physical metal before they consider gambling in the casino. DT

Hi DT…. I agree 100% with You . Everyone should hold physical G&S… I have done pretty good on my holding’s of both….. I think i should take a closer look at Plat. what say You. Most investing in stocks , is gambleing…. imo.

Hello Irish………….

Platinum…. I think platinum has done a turn around , since over taking palladium

I have been holding it a very long time…

Hi Irish, the time to buy Platinum is before the war in Ukraine is over this according to Rick Rule. The Russians are selling all their supplies to finance the war and when it ends, he expects the price to shoot much higher. Why? because platinum principally comes from two countries South Africa which is a basket case and Russia and when the Ukraine war is over, they won’t be selling anymore at these prices, that should make you a handsome profit. DT

Great comment DT…………. thanks

Not to cross plug other sites but anyone who uses and understands how ceo site works if I’m seeing people responding to a users comments but I’m never seeing that users comments would it mean that user has blocked me????…. Would be stunned that I’ve been able to offend or annoy someone on there. Lol

Wolfster, you have been blocked but it might be by someone who is familiar with this site or some other site that you are posting on, remember some posters have multiple aliases and travel to other sites like Korelin. DT

Wolf:

Blocked: my experience on the Emo board on ceo.ca was there seemed to be a group of trolls (lack of a better term) that blocked some of the regulars that were providing facts in response to some of the trolls false info or false spin. This got stronger after some shorters got caught in a squeeze. So the bottomline is that there are those on ceo.ca that have negative agendas that use blocking to prevent opposition posters from being direct participants in the conversations.

Lovely…….. I think I will scratch off ceo.ca

I scratched it probably 10 or more years ago.

I’ve been on Ceo.ca since 2016, and find it to be one of the most valuable resources for investing in the resource sector that is out there, and utilize it daily for a multitude of reasons. To each their own…

Yeah, Wolfster, it sounds llke that user blocked you from seeing their posts. I’ve had some users do that simply because I posted about a company they didn’t like or posted an interview from a sector pundit they didn’t like. People are so fickel. Haha!!

It’s only happened a few times, but I’ll notice it when I see people responding to a user and I can’t see their responses. If you click on their name and can’t see any posts, but only responses to them, then they may have you blocked. Once in a while I’ve private messaged people there asking if said something that offended, and several said they must have done it by accident and didn’t mean to block me, or just hit that button by accident on their device when reading my profile to follow my posts.

I’ve almost accidentally done it myself where I’m scrolling through someone’s profile, and then the popup comes up that says are you sure you want to block (and I’ll exit it). So, I do think sometimes it’s just accidental. There are some people though that just don’t want certain people seeing their posts (normally it is to bash a company they know somebody likes).

I make it a policy not to block anyone but have accidentally blocked several. I don’t hang out at one site that much but have found out months later I blocked someone. Since I was the only one blocking and not posting that often, I don’t think anyone noticed.

BDC …I missed that 2.20 ish low in /NG this morning…Was distracted…glta

will try a retrace

Opportunities In Growth-Oriented Silver Producers – Part 3

Excelsior Prosperity w/ Shad Marquitz – 07/12/2024

https://excelsiorprosperity.substack.com/p/opportunities-in-growth-oriented-5cb

Nvidia fell $7.50 today and that wiped out $180 billion, or should I say 180 billion American pesos. Can you believe Nvidia, talk about a huge Casino that can smash the World’s economy. Even during the stock market crash of 1929 only $10 billion disappeared. Nvidia can lose that in a heartbeat. Nobody Cares! I Care! LOL! DT