Guanajuato Silver – Highlights From Q1 Financials And A Comprehensive Review Of All 4 Silver – Gold Mines

James Anderson, CEO of Guanajuato Silver (TSX.V:GSVR – OTCQX:GSVRF), joins me to provide a review of the key metrics from their Q1 financials and a comprehensive operational and exploration update from their 4 producing silver-gold mines and 3 processing facilities in central Mexico.

The Company produces silver and gold concentrates from the El Cubo Mine Complex, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. In addition, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango.

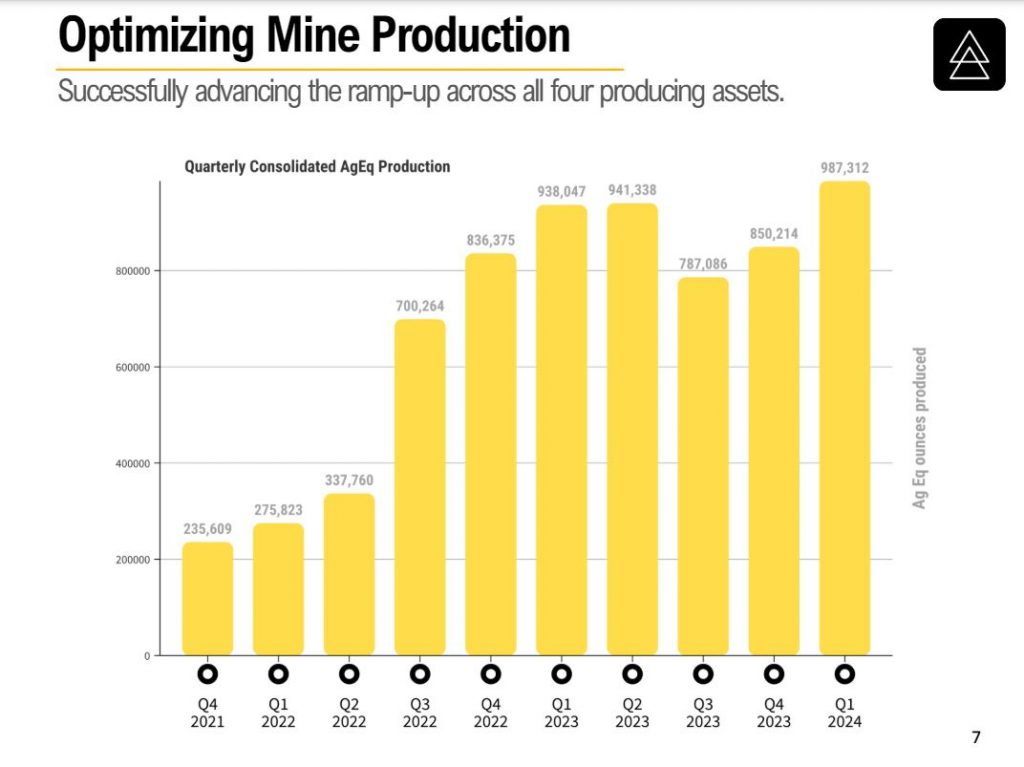

Q1 2024 Highlights

- Record metals production during the quarter of 987,312 AgEq (silver equivalent) was up 16% over the previous quarter; AgEq ounces derived from 428,279 ounces of silver; 5,384 ounces of gold; 879,242 pounds of lead; and 922,297 pounds of zinc.

- Tonnes milled increased 20% over the previous quarter; a total of 165,079 tonnes were processed among GSilver’s three production facilities.

- Both all-in sustaining cost (“AISC”) of $20.19 per AgEq ounce, and cash costs of $16.55 per AgEq ounce were 6% lower than the previous quarter

- Record revenue of $17.8M was 7% higher than the previous quarter; net loss decreased by 3% in Q1 to $7.3M compared to $7.6M in Q4, 2024.

- Realized average metal prices for the quarter of $23.37 per silver ounce, and $2,068 per gold ounce sold.

James highlighted the consistent quarter over quarter growth in the Company since beginning operations in 2021, discussed how they calculate their AISC more inclusively than many companies, and the different initiatives the company has at each mine to keep bringing costs down in the quarters to come. We also discuss the capex investment into new flash flotation cells, ore sorting equipment, and a new filter press to continue to optimize their mining operations and improve efficiencies and costs.

Next we review the augmenting of material at the El Cubo mill from 3rd party sources, as well as surface stockpiles from their El Horcon mine, with the potential of looking at starting to develop their Pinguico Project to ship more mineralized material to El Cubo down the road. We wrap up with the exploration upside still present across their properties and a quick review of the key strategic shareholders.

If you have any follow up questions for James or want more information on any of the assets please email me at Shad@kereport.com and we’ll get those addressed by management or in future interviews.

* In full disclosure, Shad has a position in Guanajuato Silver at the time of this recording.

.

.