TG Watkins – Weak Breadth Continues; Is This A Defensive Markets Or Is It Turning To A Growth Market?

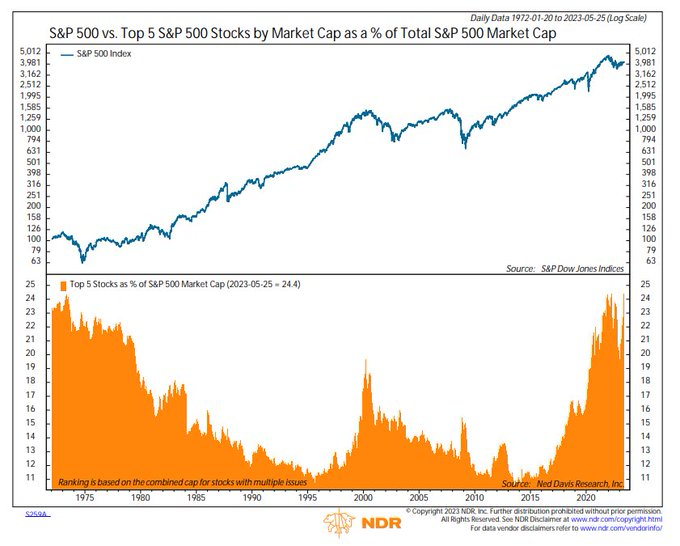

TG Watkins, Director of Stocks at Simpler Trading and Editor of The Profit Pilot website joins me to discuss the action in the US markets combined with the continued very weak breadth. TG shares a chart below that goes back 50 years showing the S&P balanced with breadth (the lower charts shows the top 5 stocks as a % of the S&P 500 market cap).

The most important question is if money will rotate and create a more broad based move higher. This also ties into comments on if this is defensive or growth market.

Click here to visit TG’s website – Profit Pilot.

GDXJ is slightly cheaper versus SPY today than it was at the 2015 low:

https://stockcharts.com/h-sc/ui?s=GDXJ%3ASPY&p=M&yr=13&mn=9&dy=0&id=t9901591687c&a=1106801720&r=1685501245155&cmd=print

If Friday’s low doesn’t hold silver could find itself at 21 quickly.

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=D&yr=1&mn=6&dy=0&id=p60951868108&a=1415040180

It’s been a month since SILJ made a new low vs GDX:

https://stockcharts.com/h-sc/ui?s=SILJ%3AGDX&p=W&yr=3&mn=11&dy=0&id=p24593099701&a=1408282914

Gold backtested its broken 6 month uptrend line today as well as its double top neckline. Obviously it would be bullish if it were to close well above it tomorrow but if it is instead heading down to the 1910 level we should watch the gold miners for a positive divergence. If they don’t deliver it might be a sign that gold is heading well below 1900 even if it initially seems to find support there.

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=D&yr=1&mn=0&dy=0&id=p37219353317&a=1417974144

US Home Prices Show Annual Decline For First Time Since 2012

Tuesday May 30, 2023

https://www.zerohedge.com/personal-finance/us-home-prices-show-annual-decline-first-time-2012

The dollar is at a confluence of resistance:

https://stockcharts.com/h-sc/ui?s=%24USD&p=D&yr=1&mn=3&dy=0&id=p72879354209&a=1294481280