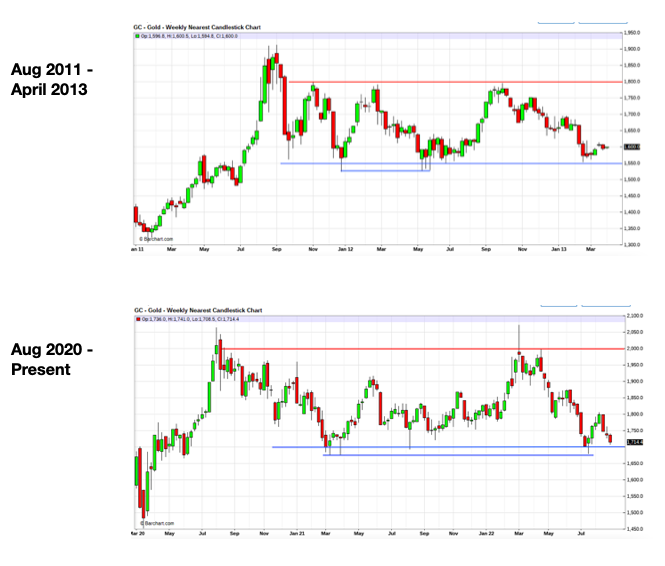

Craig Hemke – Have The Last 2 Years Technical Trends In Gold Just Been A 2011-2013 Redux?

Craig Hemke, Editor of TF Metals Report, joins us to review the gold chart from 2011-2013 compared to the chart from 2020-2022 and notes the potential bearish implications and risks. In addition to the caution warranted if the bearish scenario was to play out again, Craig makes the point that there are some key differences in the data and macro backdrop compared to that time period, and also outlines the potential bullish scenario that could still unfold.

This leads the conversation into a wide-ranging discussion touching upon COT positioning, silver backwardation in prices, the question of who exactly will buy the US debt moving forward if it is not the Fed as the buyer of last result, treasury yields versus real inflation-adjusted interest rates, the recent US Dollar strength, and Fed jawboning versus actual policy moves. We look forward to the jobs data tomorrow, and more importantly next month for data that could change the prevailing market trends and expectations.

Click here to visit Craig’s site – TF Metals Report.

As discussed in both the interview with Craig and Brien Lundin today, the reason the US Dollar is so strong is that the Euro and Yen have been so weak in comparison, as their nations are in even more economic trouble than the US.

This gives the perception of a “strong” dollar, but really the dollar is being eroded by 8.5% inflation at present and is losing purchasing power ever day, week, month, and year.

This is important though, as so many HFT algos are keyed off taking a specific type of action in the event of a strong US Dollar, and most notably the commodities are hit hardest by this headwind.

Summer Is Ending… Our Experts Are Forecasting a Big Fall

Stansberry Research – Aug 26, 2022

“We’ve been having fun with our guests this summer and compiled some interview clips from our Summer Series. Our guests have touched on hot topics such as recession, bitcoin, precious metals, Treasury bonds, and more.”

Oil’s Selloff on China Covid Could Send a Barrel Below $85

Barani Krishnan – Investing.com – Sep 01, 2022

“It’s not looking good for oil bulls and it could get worse before it gets better. New lockdowns in China triggered by COVID scares extended the selloff in oil for a third straight day, increasing the likelihood of U.S. crude being pushed below $85 a barrel the first time since late January.”

“From a technical perspective, a break below $85 could make WTI test the monthly Middle Bollinger Band of $82,” said Sunil Kumar Dixit, chief technical strategist at SKCharting.com. “If that snaps, it could go all the way down for a test of $77.98 in the short term, before any fresh rebound takes it toward the $97-$99 resistance zone.”

The Energy Sector Has Been Ignored For Too Long: Martin Pelletier

The Jay Martin Show – Sept 1st, 2022

“Co-Founder of TriVest Wealth Martin Pelletier gives his view on the emerging energy crisis and why he thinks the energy sector has been underinvested in for the better part of a decade. Martin also gives his take on the housing market, Canadian politics, inflation, and more.”

00:00 Introduction

00:58 Canadian Politics

04:07 Wealth Disparity

12:04 Energy Sector

17:52 Gold

20:02 US Dollar

22:22 Strength of US Economy

25:49 Rebuilding Canada’s Reputation

29:57 Mobility of Labor

37:02 Commodity Volatility

40:38 Housing Market

Maybe buying the major miners like Barrick and Newmont both down 40 percent last 6 months but both paying over 5 percent while you wait. Majors and royalties should leed way back first, then the small juniors will take off when gold gets back to bull market rising, majors are safe play then you can sell after they get the move up as gold starts move and buy juniors with profit. Many juniors will need to add more money to support exploration or proving out reserves and more stock dilution in short term and many could fail or just crash.

Look at Jordan best 10 bagger rio 2, it crashed 90 percent, amount other high risk lotto ticket companies. Go with majors and royalties and wait out those penny stock juniors.

Paul,

You may be right.

Tax loss selling season could make junior bargains even better. I worry if I wait too long for that 20 percent downside that they will just double and double again.

Trends: https://tinyurl.com/4ypebbv9

Non-Farm Payrolls 08:30 Friday

PM Box Expansion Targets:

GDX 22.44, GDXJ 27.05

HUI 167.40, XAU 89.29

Pop, Turn, or Drop?

NatGas Bottoming

PM Pop or Turn

Likely NatGas Turn

Nope.

The dollar’s run is overdone and has been throwing off bearish divergences for several months.

https://stockcharts.com/h-sc/ui?s=%24USD&p=W&yr=6&mn=11&dy=0&id=p22114005130&a=653766793

Dollar negative at the moment. See if it can stay that way until tomorrow’s close..

Looks like a double top and bull trap for CRB:Gold:

https://stockcharts.com/h-sc/ui?s=%24CRB%3A%24GOLD&p=W&yr=6&mn=0&dy=0&id=p89735438769&a=934280158

HL closed at fork support…

https://stockcharts.com/h-sc/ui?s=HL&p=D&yr=0&mn=11&dy=0&id=p21155172311&a=1174402329

And another fork support…

https://stockcharts.com/h-sc/ui?s=HL&p=D&yr=1&mn=3&dy=11&id=p78238602638&a=1163581562

SLV textbook technical action…

https://stockcharts.com/h-sc/ui?s=SLV&p=W&yr=5&mn=0&dy=0&id=p22052062012&a=1230908007

Notice that after backtesting support-turned-resistance 4 weeks ago SLV is now backtesting the fork support that held in July. Most are fixated on price so all they see is a new low instead of the retest of angled support which is very often much more important and can take many forms including/especially moving averages. Get to know your guardian angles.

SILJ bottomed versus GDX and GDXJ way back in May and continues to hold up impressively which is a good sign for the whole sector.

https://stockcharts.com/h-sc/ui?s=SILJ%3AGDX&p=W&yr=3&mn=0&dy=0&id=p28212431892&a=1239656750

SILJ:GDXJ is at its highest level since November.

https://stockcharts.com/h-sc/ui?s=SILJ%3AGDXJ&p=W&yr=5&mn=0&dy=0&id=p82423563183&a=714035035

TSX-V still looks just fine vs gold…

https://stockcharts.com/h-sc/ui?s=%24CDNX%3A%24GOLD&p=W&yr=6&mn=9&dy=0&id=p95538128932&a=1111516519

This would be a good looking double bottom for Silver:Gold if it holds…

https://stockcharts.com/h-sc/ui?s=%24SILVER%3A%24GOLD&p=W&yr=5&mn=0&dy=0&id=p71376942451&a=1144482232

This crash in silver vs CRB has been the most impressive one in about 40 years and it’s probably due in part to the fact that Silver:CRB beat its 1980 blow-off by 17% two years ago.

https://stockcharts.com/h-sc/ui?s=%24SILVER%3A%24CRB&p=M&yr=25&mn=11&dy=0&id=p72611152396&a=1189668128&r=1662102254875&cmd=print

FREAKY FRIDAY……………again……..THUG THURSDAY is over…..

Chris Temple who used to be a regular contributor on The Ker Report, has a good article out on Algernon Pharmaceuticals. I have been buying AGN-SYL-CSE for the last 10 days, they have had some exciting news out recently. It is refreshing to buy something that is not resource related especially these days. Anyway, without further ado, here it is…………….. DT

https://www.streetwisereports.com/article/2022/09/01/expert-rates-pharma-co-an-immediate-buy.html

Bought back Aston Bay today as they finally hit some copper after many years of searching. Could mean something if follow-up drills hit again. If you want to keep an eye on it, watch for news, Check Eric Coffin’s site or the ceo.ca site. Might want to interview them here if things develop more. Just a thought.

EU: Controlled Demolition

Raúl Ilargi Meijer – TAE – August 24, 2022

“As I read through the multitude of daily news articles about Russia, Ukraine, NATO and EU, it’s getting ever harder to escape the idea that there is a controlled demolition of the continent happening. And that neither its “leaders”, and certainly not its people, have any say in this. All we get from those “leaders” are NATO or World Economic Forum talking points. The only independent voice is Victor Orban. Who is either silenced in western media or painted as fully insane.”

“And no, it wasn’t just Russia/Ukraine, way before that Europe had already screwed up its economies beyond recognition -if you cared to look under the hood. But why make it worse? I get a very strong feeling that those EU “leaders” have alienated themselves far too much from the people they purport to serve, and they’ll regret it.”

“The entire energy and food crisis is being sold as “inevitable”, but it is nothing of the kind. They are the result of choices being made in Brussels, Berlin, Amsterdam etc., about which nobody has asked your opinion…”

https://www.theautomaticearth.com/2022/08/eu-controlled-demolition/