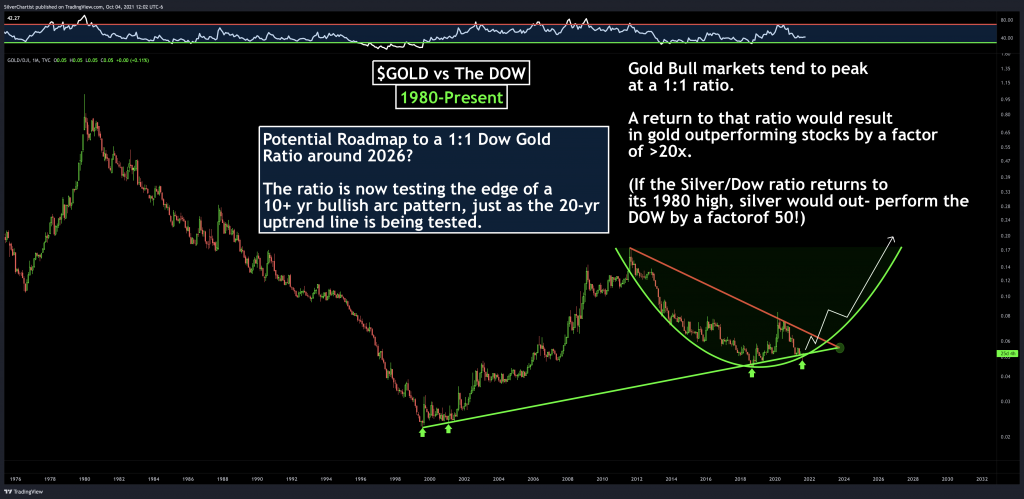

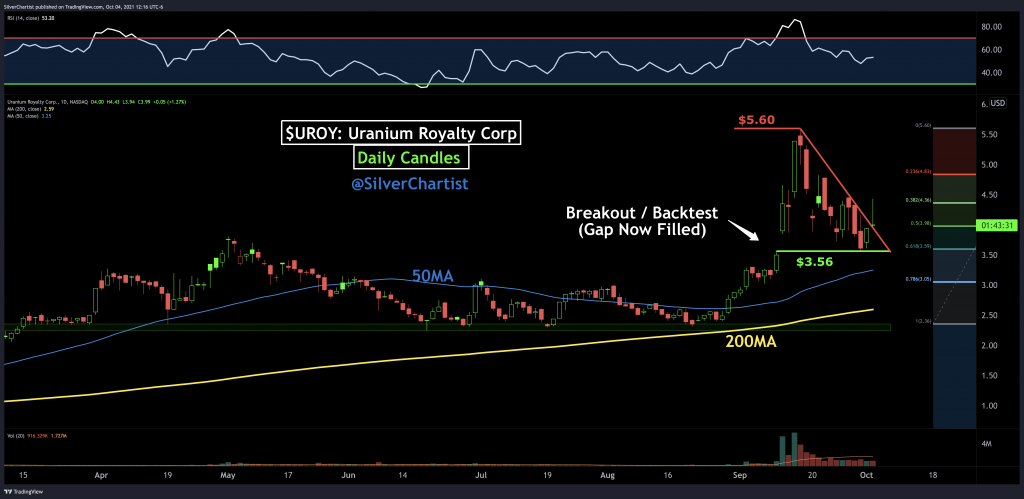

Using Charts to Predict Future Moves – Gold:Dow Ratio, Key Levels in Silver, and Uranium Miners

Steve Penny, Publisher of the SilverChartist Report joins us to share a handful of charts (all posed below so you can follow along) focused on gold, silver and Uranium equities. We combine both short term daily charts with weekly and longer term charts to outline key levels to watch in each sector.

Click here to learn more about the SilverChartist Report.

I also share Steve’s view that what we’ve seen in the Uranium stocks has been quite bullish, and that after gapping higher on high volume for the breakout, that many of them are now pulling back down to test that area as support, and should be a good potential place that I’ll personally be accumulating more heavily to beef back up my U stock positions.

Also as outlined in the discussions on Uranium from the weekend show with both Rick Rule and Joe Mazumdar, it was nice to hear Steve reaffirm that the clear next driver in this sector will be the longer-term off-take contracts getting set up between the utility companies and uranium miners. Ever Upward!

Expect $30 silver price, then $50 soon after, by 2022 – Steve Penny (@SilverChartist)

Kitco News – Oct 1, 2021

“Once silver breaches $30, there would be minimal resistance keeping it back from hitting $50, said Steve Penny, publisher of The Silver Chartist report.”

“Penney told David Lin, anchor for Kitco News, that $50 or even $30 an ounce for silver is unlikely to happen by the end of the year.”

0:00 – Gold & silver relationship

2:00 – Gold/silver ratio

5:40 – Mainstream adoption

7:10 – Silver price manipulation

9:05 – Price performance

11:48 – 1980 silver price peak

12:45 – Catalysts for $50 silver

13:50 – Metals and monetary policy

15:25 – Silver’s monetary role

17:00 – Siler price forecast

I said that over 18 months ago….. silver needs to go over $30, before it even gets interesting….

I wont get interested until it hits $50……….if it ever does.

The issue tho will be so many sellers at that point.

If Silver does eventually get back up to test overhead resistance at $30 in 2022, and then rapidly ascends to $50 in a few months, then that would get pretty interesting for those investors holding the silver mining stocks. Many would go up multi-fold from current levels, so, it depends on what one considers “interesting” but those kinds of gains are of interest to me.

That is a fact EX, which is why some people only look at jr miners and not the phyzz.

which very well could be wise as phyzz really doesnt look like it will ever be used as currency again.

Yes agreed b. The miners, with millions of ounces of Silver in the vault of the Earth, give an investor much more leverage to upside moves in the price of the metals, but of course, have more associated counter-party risk.

Still, if people are bullish on Silver getting back up to $30, or breaking through to $50, then they are nuts if they don’t own some silver mining stocks to participate in a move that will be many multiples of that percentage move higher.

+30 OOTB. Yes indeed!

If America enters a war with China over Taiwan just think about how they will be jeopardizing American business interests China. Then there are the microchip plants in Taiwan that will be lost and the chips that go into many products that are produced in North America and Asia. The Tech Giants will suffer internet outages by Asian cyber warfare. They may have the power to shut down The American government. The hazards of which I have listed are a few but they are huge. War will bring about an international depression from political and economic dislocation.

Russia (Heartland) is always ‘their’ ultimate target.

My /GC day chart…With 2 potential targets…initiated positions in miners due to the leg f down 9/29 w bullish reversal candle , bullish sash with RSI technical reading and .70% retracement…A bit too much pullback for an actual AB=CD…So target 1 is more likely…

Pardon me , for putting this here , i like how WB got the Statue of Liberty in this old painting …. and Biden fiddled.

https://www.zerohedge.com/news/2021-10-05/posterity-gives-every-man-his-true-value

enlarge it.

5 Reasons to Be Bullish on Platinum & 3 Ways to Play It

by Sean Brodrick – October 5, 2021

https://wealth-wave.com/wealth-wave/5-reasons-bullish-platinum-3-ways-play/

Beyond just buying physical Platinum or buying the related ETFs, there are still a number of mining companies that give investors exposure to Platinum, Palladium, Rhodium and other platinum group elements.

Just like all resource mining companies, they have more risk than the underlying commodity, but conversely, they also can present far better returns to investors on a breakout in that commodity. We saw that in spades from the middle of 2020 and into the first quarter of 2021 in the Palladium miners (which are essentially the same list posted below), when many stocks went up 300%-600% in less than a year.

It was clear during that time period that many investors were not positioned in these companies, just like they weren’t in the Lithium stocks or Uranium stocks that were running hard for that same time period, because most of the comments were about the sluggish PMs.

Nobody is suggesting to “go all-in” on any of these niche sectors, as mentioned in the editorial today with Steve Penny, but likewise to have zero exposure to them missed and excellent opportunity to be diversified and harvest gains during a time period of time where most PM stocks were under pressure. If people believe Platinum has further to run to the upside, then just like any commodity that is going to go on a run, there is more leverage in the miners.

Platinum & Palladium stocks Symbol

Aberdeen International Inc. AAB.TO

Anglo American Platinum Limited AGPPF

Artemis Resources Limited ARV.AX

Benton Resources Inc BEX.V

Bitterroot Resources Ltd BTT.V

Canada Nickel Company CNC.V

Canadian Palladium Resources BULL.CN

Clean Air Metals AIR.V

Eagle Plains Resources EPL.V

Eastern Platinum Ltd ELR.TO

Forum Energy Metals FMC.V

Generation Mining Limited GENM.CN

Grid Metals Corp GRDM.V

Group Ten Metals Inc. PGE.V

Impala Platinum Holdings Limited IMPUY

Ivanhoe Mines Ltd. IVN.TO

Jangada Mines PLC JAN.L

Jubilee Metals Group PLC JLP.L

Legend Mining LEG.AX

Major Precious Metals SIZE.CN

New Age Metals Inc. NAM.V

Nickel Creek Platinum Corp. NCP.TO

Noble Metal Group Incorporated NMG-H.V

Noble Mineral Exploration NOB.V

Norilsk Nickel NILSY

Noront Resources Ltd. NOT.V

Northam Platinum Limited NMPNF

Palladium One Mining Inc. PDM.V

Pan African Resources PLC PAF.L

Panoramic Resources Limited PAN.AX

Platina Resources Limited PGM.AX

Platinum Group Metals Ltd. PLG

PolyMet Mining Corp. PLM

Sibanye Gold Limited SBGL

St George Mining Limited SGQ.AX

Sylvania Platinum Limited SLP.L

Talon Metals Corp. TLO.TO

Tharisa plc THS.L

Transition Metals Corp. XTM.V

Val Ore Metals VO.V

Western Areas Limited WSA.AX

Zijin Mining Group Company ZIJMF

When I hear people say there really aren’t many ways to play the Platinum and Palladium sector, it just perplexes me, because there are plenty of companies with exposure to the PGMs, to find a few of them to get exposure to the sector in one’s resource portfolio.

Most resource investors just simply have not done their homework in other commodity sectors like PGM/NIckel stocks (often PGMs and Nickel appear together in the same deposit), Copper, Lithium, Uranium, etc.. and make sweeping flippant statements that there really aren’t many mining stocks to take advantage of these trends. That is simply not true.

Personally, I had 6 PGM stocks (out of the list of 40+ companies above) from early 2020 to early 2021 and they trounced the returns of many other mining stocks during that time period. You gotta be in it to win it, when a commodity starts making that move upwards, like Palladium and Nickel did during that time period.

If people expect that Platinum may start outperforming Gold to the upside, then will they pick up any positions in the PGM stocks to at least have some small exposure to the sector, or will they just watch again from the sidelines?

Just noticing that Great Bear is moving. That is an unusual event during this suppressed market as they have repeatedly put out good releases since the beginning. They had a release earlier this week, but nothing happened.

Today I am up +9% and that bears watching. Also Emerita is usually hit down right after open, but today it has been a very slow beat. I am keeping an eye on this whole thing as the metals are mixed and thee gold smack down is wishy washy…the lull before the storm or the sun after the Titanic sunk.

I’m got a new Emerita position started, and will be adding to it if EMO continues to correct.

I guess Emerita could correct, but there was one day in the last several months it hit $1.72 or there abouts, and then not too long ago it went either sub dollar or there abouts. I feel it us kinda of tired of being kicked around. It is not like they are looking for stuff. They are already finding more of what they have a lot of. But, welcome back as it is your thrn to put on the morning coffee…

Yeah, it seems to have consolidated back some of the gains and it feels good to be back in, and yes, I guess it’s my turn to put on the morning coffee now. Haha!

bears and bares…the bears bare watching…

Here’s some FWIW info that if you are interested you should do some research: but I added a few more Copper Lake Resources with spare change today after looking at there recent SEDI activity. There seems to be a lot of share ownership and warrant buying among insiders…but, I am just saying …and not knowing if something to it.

there = their

About One Mil volume…who knows

Fantasia’s missed payment “provides a clear sign that despite piecemeal bailouts of select Evergrande assets, property market stresses remain elevated.” He added that “the rot is unlikely to stop here.”

Down is good for gold?

Yes. The same goes for this one:

Nasdaq Composite Index vs GLD

https://stockcharts.com/h-sc/ui?s=%24COMPQ%3AGLD&p=W&yr=5&mn=11&dy=0&id=p33898570866&a=1029504727

Seems a trend in the works…thanks

Yes, a very important trend change IS coming.

https://stockcharts.com/h-sc/ui?s=SPY%3AGLD&p=D&yr=1&mn=7&dy=0&id=p32346044914&a=1038064995

matthew, is usas priced for bankruptcy? thank u

Not quite but it does reflect trouble, past and present.

Read the most recent MD&A, at least pages 10 thru 15:

https://www.americas-gold.com/site/assets/files/5686/2021q2mda.pdf

At a market cap of $101 million, it can get significantly cheaper if the metals don’t improve materially. It could also underperform its peers even if the sector turns up convincingly as the market waits for the terms of the next financing. Management is probably waiting/hoping for the metals to take off before announcing the inevitable next round of dilution.

So, in my estimation, opportunity cost is the main risk for new buyers here IF this is the low.

Tired longs who want out have a dilemma since it has been so beat up yet could still fall significantly further. They might do well to consider selling a significant portion (30 to 50 percent?) right now to buy one or more quality peers which are also beat up. This way, they could avoid the very unpleasant possibility of watching everything take off while USAS continues to languish. It would be no fun at all to be faced with exchanging stagnant or cheaper USAS shares for shares in peers that have already moved up significantly.

I do not watch the company like I used to so take my words as food for thought, if that.

It just might respond to higher metals prices much more bullishly than I expect.

There’s a fork support at about 65 cents. It will be interesting to see what it does when/if it gets there…

https://stockcharts.com/h-sc/ui?s=USAS&p=W&yr=4&mn=2&dy=0&id=p04678397849&a=969292295

Daniela Cambone / Rick Rule … 5th october 2021

https://www.youtube.com/watch?v=DPuH-OjilW0

There wasn’t a lot of strength today but the action was still bullish. SILJ made a new 52 week low before reversing and painting a nice bull hammer candlestick as it rose 3.4% off its low.

https://stockcharts.com/h-sc/ui?s=SILJ&p=D&yr=0&mn=7&dy=0&id=p09744008381&a=997764155

I like this SILJ vs Silver chart, especially today’s action…

https://stockcharts.com/h-sc/ui?s=SILJ%3A%24SILVER&p=D&yr=1&mn=7&dy=0&id=p16581291437&a=705143650

Bull hammer for SILJ vs GDX…

https://stockcharts.com/h-sc/ui?s=SILJ%3AGDX&p=D&yr=1&mn=3&dy=0&id=p56691301267&a=1014251382

SILJ:GDX tested its 2 year MA for the first time this year and still managed to close above speed line support.

https://stockcharts.com/h-sc/ui?s=SILJ%3AGDX&p=D&yr=1&mn=1&dy=0&id=p59464106576&a=1005949937

Uh oh…

45 degree walk down in metals starting before 8PM cst…algo controlled and persistent due to intermingled buying pf paper. Very different. But same impact.

Rebound at 4 AM cst

Always nice to get a technical update from Steve Penny @SilverChartist.

We’re thrilled that he invests time with us here at the KE Report, and I personally believe he has one of the best free newsletters out there in the PM & Uranium space.