Outback Goldfields – More information on the start of exploration at Ballarat West and 2 ongoing programs around the Fosterville Gold Mine

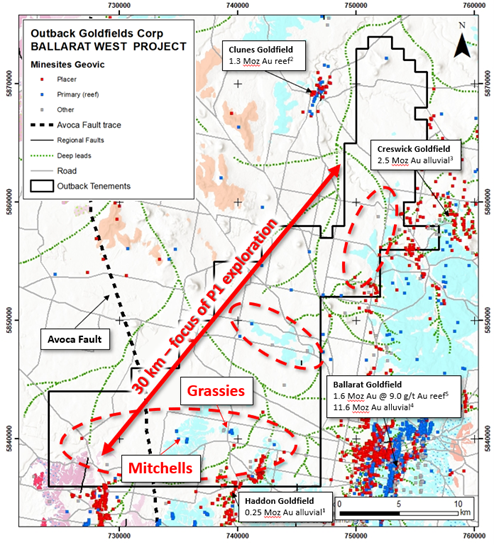

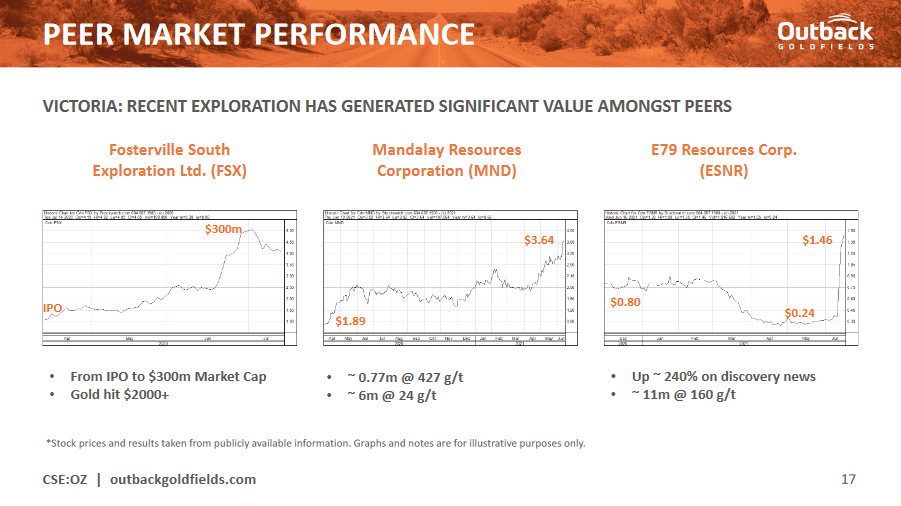

Chris Donaldson, President and CEO of Outback Goldfields (CSE:OZ) joins me to recap the news from Monday, June 22, outlining the start of exploration at the Ballarat West Project, in Victoria Australia. This is the third program that the Company is running at its projects around the Fosterville Gold Mine. The other Projects currently being explored are the Yeungroon and Glenfine Projects. We wrap up the call with a comment on the general Victoria area and two recent drill results that pushed neighboring companies higher.

If you have any follow up questions for Chris please email us at either Fleck@kereport.com or Shad@kereport.com.

Click here for a summary of the recent news out of Outback Goldfields.

Hey Glenster, I thought if you were to ask a gold bull when is the best time to buy the metals… they would always say: “yesterday.”

With regards to Kirkland Lakes’s Fosterville Mine – Yes, it is absolutely world class Tier 1, so many of the companies exploring near it (Fosterville South, Mandalay Resources, E79 Resources, and Outback Goldfields) are creating quite the area play in Victoria Australia.

We also had Fosterville South onto the show a few weeks back and here is that interview if anyone missed it.

______________________________________________________________________

Fosterville South Exploration – An Overview Of The Land Package Around the Fosterville Gold Mine And Exploration Plans

Korelin Economics Report – June 10, 2021

“Bryan Slusarchuk, CEO of Fosterville South Exploration (TSX.V:FSX – OTC:FSXLF) joins us to provide a comprehensive update on the Company’s strategy on its 4,000 km² land package consisting of multiple properties around in Victoria Australia around the Fosterville Gold Mine. We focus on the ongoing exploration strategy at three main projects being drilled currently, including the Lauriston Project, Golden Mountain Project, and Moormbool Property.”

Is there a recession out there? We working hard up here lol…. Please take a second and post a thought. We don’t care if it’s right or wrong or debate we care that you care..

Glen 🙁

Hi Glenfidish. Sorry it’s been a busy day.

As for the Seasonality factor in Gold this chart from equity clock does a good job of highlighting the general trends. Of course, each year is different, and on outside years like last year in 2020 or in 2016 Gold rallied during the summer, but in general about 16 of the last 20 years, Gold was slow in June/July and then rallies into the Fall quarter. I wouldn’t be surprised to see something like that play out this year.

http://equityclock.com/pictures/MinisizedGoldFuturesYGSeasonalChart_E5CF/image.png

Here’s another interesting Seasonality chart that shows Gold futures relative to the S&P 500.

June is another low point on this chart as well, but then the yellow metal gains on the general equities in the late summer to early Fall. That also seems like a potential for the balance of 2021.

http://charts.equityclock.com/seasonal_charts/futures/FUTURE_GC1_RelativeToSPX.PNG

Historically (history doesn’t always repeat), often the lows in gold are the beginning of January, February, and the end of June. It appears we are in an extended time of ups and downs in this market with consolidation over a number of months—I wouldn’t be surprised if we have the BBs narrowing on a monthly basis until we’re set up for another run. Patience is the key and those that purchase on the dips will be rewarded when the next large run comes. The next run may be the one we’ve been all been waiting for over the past few years.

While we wait for the Mother of All Runs, I am heading out to St Augustine Fl in search of Fountain of Youth in case ther are any further delays.

Safe travels David and good luck searching for the Fountain of Youth.

It is good to get away on a trip and get out in nature for a bit. I had a friend in town visiting the end of last week and we got out to hike on some trails in the mountains, went to a few beaches, and got some fresh air and it was exhilarating. It was on Thu/Fri last week when the metals were crashing, it was great not to be in front of the glowing screen all day for that. I popped on the smart phone and executed about a dozen trades when we’d stop at a new location, and then go back to nature and fresh air… it does the body, mind, and soul well.

Ever Upward!

David

Please enjoy your time I just got back from a three day trip to northern Ontario! Nothing like feeling free and burning 🔥

Fosterville mine if I’m not mistaken is world class so if there drilling around those parameters it’s intriguing..

This could be a really good time to put some chips down! If I told ya that historically the best time to buy gold monthly in this order would be March, June and October would you believe me?

If I told ya that the best month historically to buy silver would be jume would you believe me?

And if I told you the best time to buy silver and gold quarterly and historically would be in Q2 would you believe me?

This all dating back to 1975

Just some thoughts… I believe bob m also mentions historically summer is best to buy in his 80 plus years of age give or take..not sure how old he is 🙂

Glenn