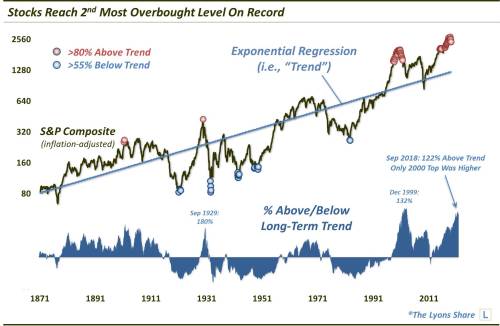

The 2nd Most Overbought Historical Level For The S&P

Dana Lyons, Fund Manager in Chicago joins me to share some of his recent research on the US markets. See the chart below that outlines just how stretched the market has gotten from its mean. While this is not a good short term indicator it does validate the overall idea that the markets should have a big correction coming.

Click here to visit Dana’s free blog.

Also click here for his subscriber site where he is running a holiday special.

Here’s a good listen of Dr. Malmgren on Macro Voices: https://www.macrovoices.com/

Pippa Malmgren, a former advisor of Bush II has some far out ideas on Trump and the next election. Do yourself a favor and listen to her thoughts. Guarantee you few have ever thought of the outcome as she see’s it!

NYC…………Mayor’s Wife ripping off the City…in Mental Health..?

Why do they never have the same last name…….

https://www.zerohedge.com/news/2019-03-01/new-york-stonewalls-over-850m-mental-health-program-run-mayors-wife

Spearheaded by Mayor Bill de Blasio’s wife, Chirlane McCray,

Spearheaded by Mayor Bill de Blasio’s wife, Chirlane McCray, ThriveNYC encompasses “a variety of initiatives,” according to Politico – making it difficult to pinpoint exactly how the city is spending taxpayer dollars on the program. Thrive is meant to help low-income minorities without access to mental health care deal with issues such as substance abuse, depression and suicide.

What’s worse, ThriveNYC has been evasive when asked by Politico for a line-item budget in October, asking twice for extensions. When Politico was finally able to obtain two budget breakdowns – one from the city’s Independent Budget Office, and another from City Hall – there were significant discrepancies in how money was spent under the initiative.

Female corruption running wild, ….NYC and Chicago are neck and neck in the battle to see who can cheat the most………..jmo

GReat chart…….

Superb macro listen. Thanks Cory. Interesting graph shows that the last low (blue dot) corresponded with the height of interest rates about 1981-82. When those rates began sinking, bonds and stocks took off………for at least 18 years. Then the healthy correction was stopped by Greenspan and the second correction in ’07 was stopped by Bernanke. Today, all risk is multiplied and many are simply holding their breath, waiting for the inevitable. Hope I’m still here to see it!