Important Bond Market Comments

The comments below are courtesy of our friend Dana Lyons. We have been talking about the bond markets a lot and he points out how important some of the moves were yesterday.

Click here to visit Dana’s free blog.

…Here’s the post…

Major developments are underway across the fixed income market.

In reality, most days in the financial markets are pretty forgettable. They all seem important at the time, but in the grand scheme of things, they are mostly unremarkable. Some days, however, are more noteworthy. Like yesterday, for example. Events emanating (maybe) in Italy sent shockwaves throughout all matters of markets, from foreign and domestic equities to currencies to fixed income. It is the action in that last category that prompted this post.

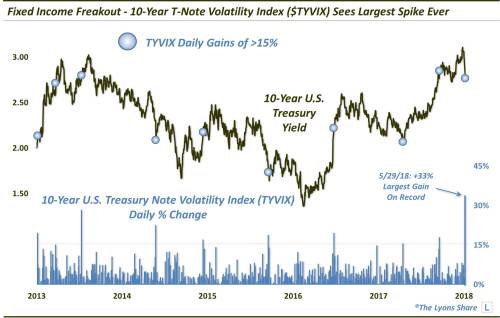

A few developments took place yesterday in the bond market that we deemed noteworthy enough to include as our “Charts Of The Day” on Twitter. One had to to do with the level of volatility in the bond market while the other highlighted a potentially important interest rate level being tested currently. Taken together – along with a wide swathe of additional fixed income charts and data points – they help paint a picture of the current state of the bond market, as well as the future prospects. Here are the 2 charts.

The first one highlights Tuesday’s action in the 10-Year U.S. Treasury Note Volatility Index, or TYVIX. As with the VIX (the S&P 500 Volatility Index), the TYVIX measures the expected volatility in the 10-Year Note over the subsequent month. What was special about Tuesday’s session is that, amid the monster rally in bonds, the TYVIX recorded its largest 1-day spike (+33%) in its, albeit brief, history.

Does this mean that volatility is on the rise in the bond market? It remains to be seen whether this is a 1-day wonder or part of a developing trend. As we mention in a Premium Post at The Lyons Share, however, action following similar spikes in the past has been quite interesting – and perhaps quite instructive in determining one’s bond positioning, at least in the near-term.

The 2nd Chart looks at an important level currently being tested by the 30-Year U.S. Treasury Yield (TYX). Specifically, the TYX is testing the topside of the post-2011 Down trendline that served as the upper boundary of the “ultra-low rate” environment following the financial crisis.

After breaking above the trendline in February, the TYX successfully tested the top of the broken trendline in April, leading to a solid bounce to new, though temporary, multi-year highs in the TYX. Will it bounce again? That also remains to be seen, but we do consider it a pretty key level in determining the direction of interest rates.

What do we make of the above charts and their potential impact on future prospects in the bond market? Is the secular bond bull over and interest rates headed higher for years to come? Or are the bond shorts in for an epic squeeze in a return to an extraordinarily low-rate environment?

In that Premium Post on The Lyons Share, we run the table on the complete technical picture of the bond market – from key levels and technical markers to watch in the 10-Year and 30-Year Yields, to the implications of the TYVIX volatility spike, to the current (and interesting) technical read on other various segments of the market, like corporates, munis and mortgage bonds.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

Folks need to listen to the second half of Greg Hunter’s Market wrap:

https://www.youtube.com/watch?v=AgVsaAuZwGA

wherein he talks about collapse of DeuscheBank and its effects on interest rates/ bonds.

My personal belief is the Draghi and Merkel will support European Banks as long as possible, because their collapse would also end the EU.