The most important sentence to come out of the latest Fed meeting

Some interesting comments here regarding the statement from the Fed yesterday. While the Fed did continue the $10 billion taper they also reinforced that there would be no raising of interest rates for a “considerable time” after the full windup of QE.

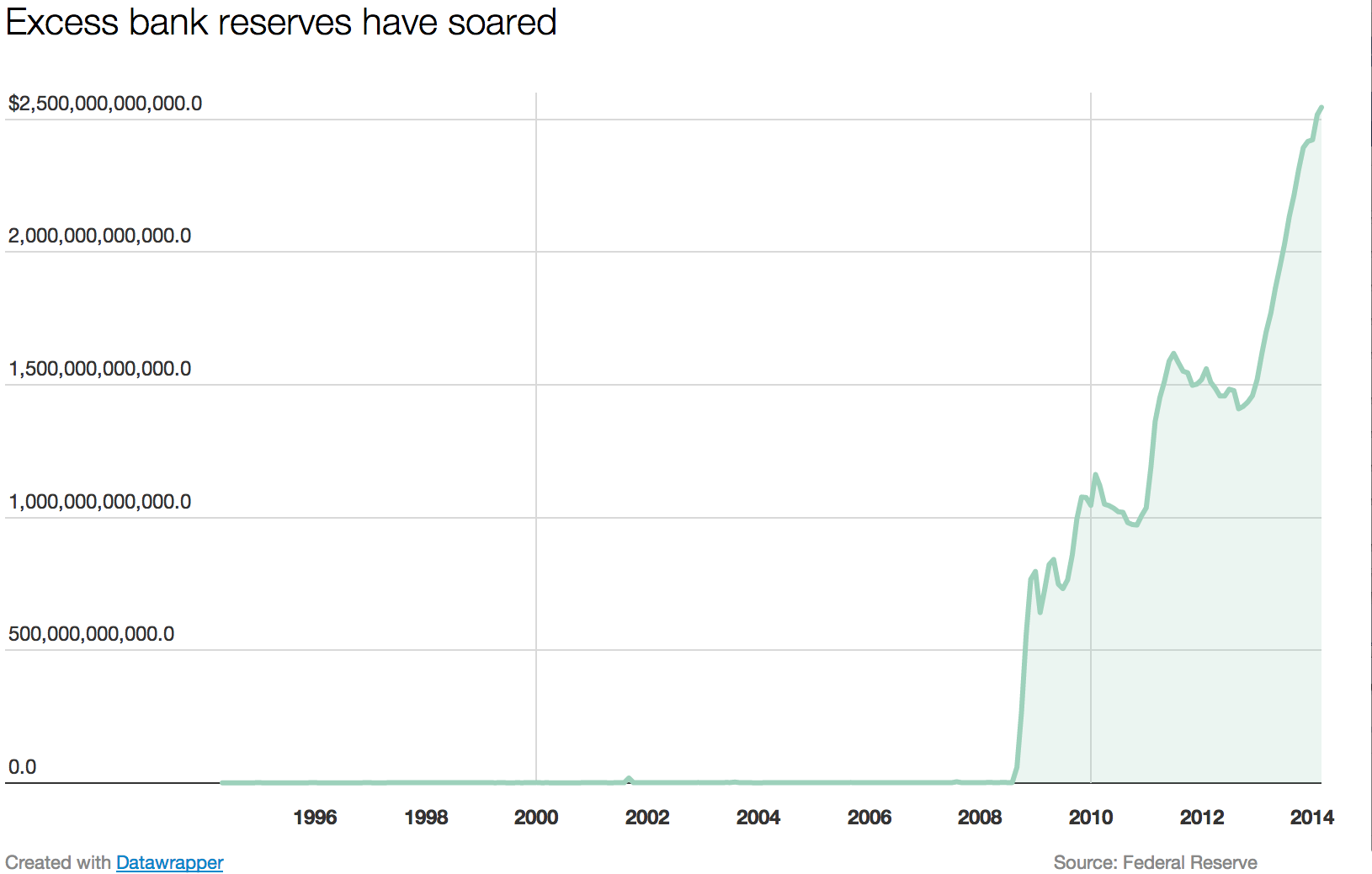

Check out this chart that is presented in the post. I think it says a lot about where the money is being held up in the “free market” system.

That money is starting to trickle out. Banks are sending out un-solicited credit card applications again, something they hadn’t been doing for years. I hadn’t gotten one since early 2010, and I have a perfect credit file at all three bureaus. Since early May, I’ve gotten no less than 10, all “You’re pre-approved!”. Three of the few credit cards I do have – none with a balance – have had the credit line increased without my even asking. This is all the result of the recent changes that curtailed the “prop trading” banks were doing and where they were making nearly risk-free returns. They’ve HAD to turn somewhere to replace that revenue stream, and one of those “somewhere”s appears to be consumer credit, and risks be damned. This is from whence will come the monetary “velocity” that inflation needs, as banks lend these excess reserves to anyone with a pulse in the hopes of making something – anything – on it. Obviously, this is going to be one of the contributors to the next Even Greater Crash, once the wildfire caused by the inflation finally burns out. With gold probably at or near $5,000 an ounce. Or higher.

I never thought of credits card pre approved mailing to be a sign of more lending but I think you might be on to something MAD.

I pointed this out over 4 weeks ago………………

check out the article from McAlvany……….

No need to worry about inflation for some time. The remuneration rate is a credit control device that acts on both the money stock as well as in the loan-funds credit market. I.e., the FOMC won’t have to adjust the rate as frequently or by as much

Also, liquid assets of non-farm non-financial corporate businesses have been increasing at unbelievable levels, with little or no hiring and real investing until now.

http://www.ritholtz.com/blog/wp-content/uploads/2012/03/cd2.png

For lack of real economic growth, it looks like the formula of the jour are stocks buybacks, thus partly contributing to the Stock market bubble in my opinion.

Some would argue that the cash on the sidelines that are at a nominal record level should be compared as a percentage of total business assets: http://www.ritholtz.com/blog/wp-content/uploads/2012/03/cd4.png

The problem with this argument, imo, is that it is does not take into account the over inflated value of total assets. In other words liquid assets or corporate cash reserves are compared to an asset bubble. Looks like this economy is a virtual economy with no real growth or value creation anyways, and ready to implode any time now.