GoGold Resources – Comprehensive Overview Of Their Silver And Gold Production And Development Assets In Mexico

Brad Langille, President & CEO, of GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF), joins me for a comprehensive overview of this Canadian-based silver and gold producer focused on operating, developing, exploring high quality projects in Mexico. We delve into their producing Parral Tailings mine, in the state of Chihuahua, but then focus most of the discussion on their flagship Los Ricos South and Los Ricos North development and exploration projects in the state of Jalisco.

We kick off the conversation with an operations update from their Parral Tailings mine, where production in 2024 was 1.5 million silver equivalent (AgEq) ounces. We discuss why this number may grow in 2025 with the commissioning of a new zinc circuit in January of 2025, which improves the precious metals and base metals recoveries at the processing center; while recycling and conserving the cyanide for the leach cycle, as a key cost input. Brad points out just how important the cleanup of these historic tailings, through their ongoing production, has been to the local community over the last decade; and how significant these initiatives are in a broader sense within Mexico from a social license standpoint.

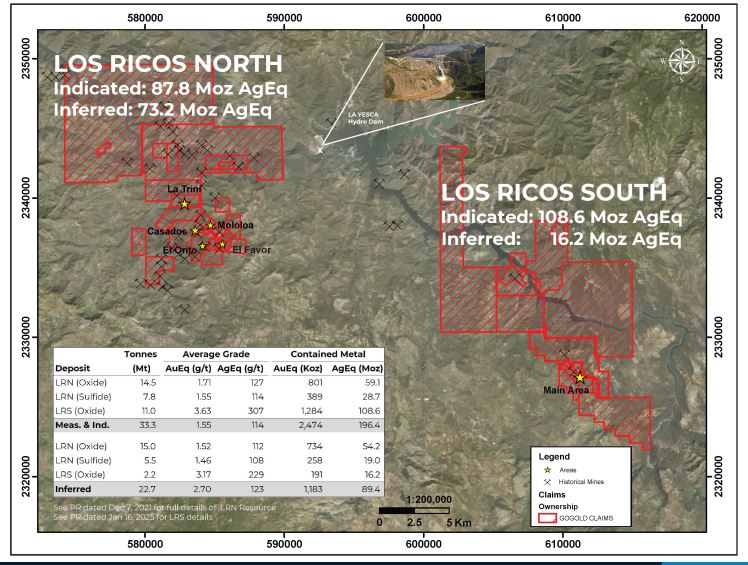

Next we review the delineated mineral resources and project economics for their flagship Los Ricos South and Los Ricos North Projects.

- Los Ricos South – 108.6 million ounces AgEq Indicated + 16.2 million ounces AgEq Inferred

- Los Ricos North – 87.8 million ounces AgEq Indicated + 73.2 million ounces AgEq Inferred

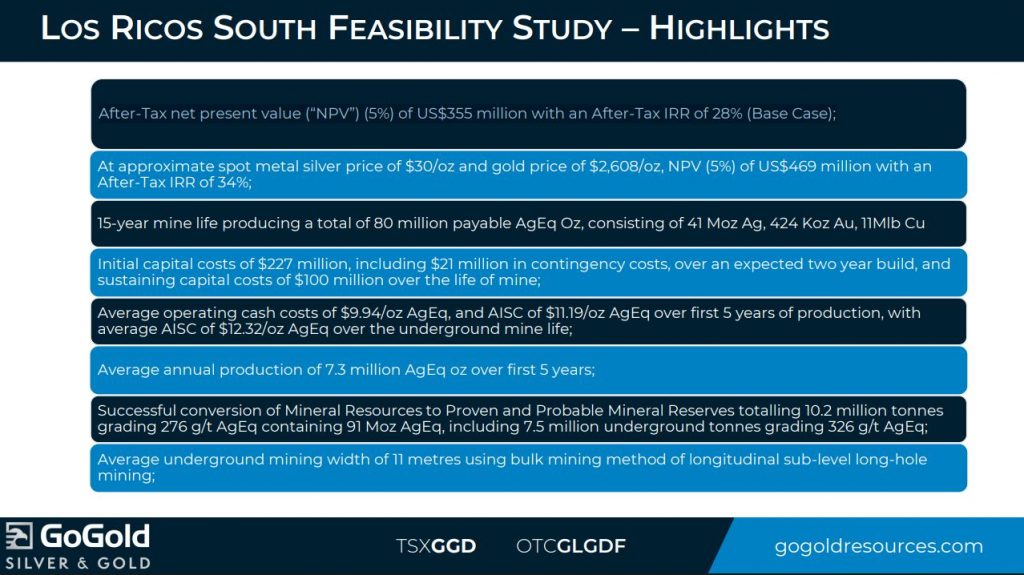

Los Ricos South is shovel-ready, has a Definitive Feasibility Study in place, and is just waiting on the permit to begin construction. There is a 24-month build, and then 6 months of ramp-up production estimated to get to full commercial production. The Feasibility Study (using a base case silver price of US$26.80/oz, gold price of US$2,330/oz and copper price of

US$4.00/lb) outlined an after-tax net present value (“NPV”) (5%) of US$355 million with an After-Tax IRR of 28%. Using a metals price assumption of silver at $30/oz and gold at $2,608/oz, NPV (5%) of US$469 million with an After-Tax IRR of 34%. Brad shares in the interview how much more that grows using today’s spot prices at $32 Silver and $3,300 gold, and clearly this is an economic project to build.

Additionally, there is some compelling exploration the team has been doing outside of the existing resources, based on historical data that has been analyzed and some recent scout holes that have hit the anticipated geological structure, which demonstrate the potential to delineate another large mineralized area that has never been mined. Brad highlights how significant that would be, once the sunk costs and infrastructure was already in place, to then outline essentially a whole other body of mineralization to mine beyond the existing resources.

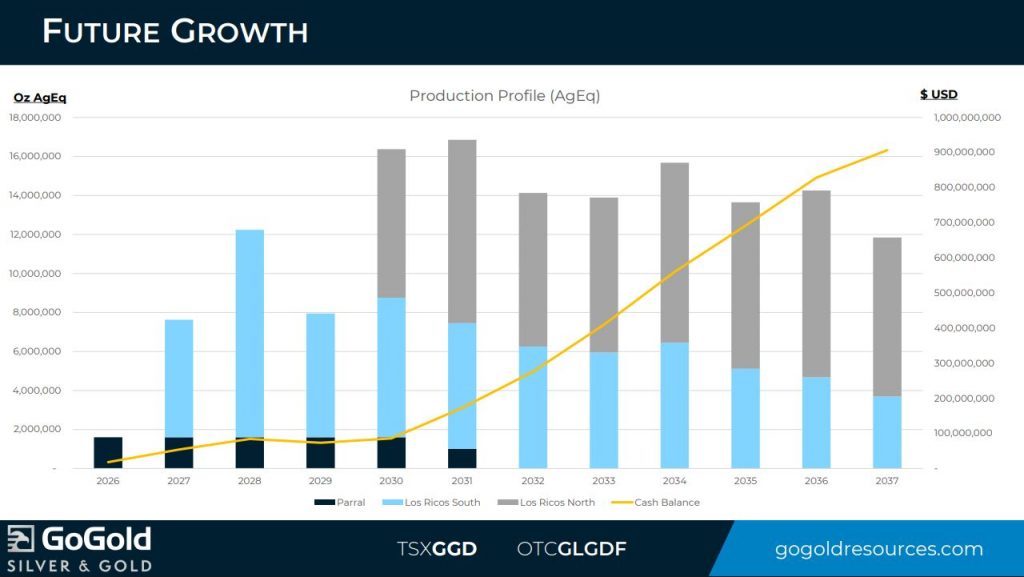

Next we talk about the schedule of production growth over the next 5 years, as Parral and Los Ricos South is eventually augmented by more production from Los Rico North. Brad outlines a solid trajectory for the Company for the next handful of years, highlights their strong financial position, and key institutional and insider ownership of the stock.

If you have any follow up questions for Brad on GoGold Resources, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of GoGold Resources at the time of this recording and may choose to buy or sell shares in the market at any time.

Click here to follow the latest news from GoGold Resources

.

.

Shad, it seems obvious that the bull market in gold and silver has a long, long way to go, but what do you think about crude oil and oil stocks? If we go into a depression they could drop but if we go to war with Iran then oil could soar. Maybe one day we can trade each of our NEM shares for 3 or 4 shares of XOM…

Yeah, I’m looking at oil stocks with keen interest lately as they have been pounded down over the last month. I could see the case for lower oil in the $50’s, and if that plays out then that is where I’ll step into some of the energy companies. If we see a big dip in natural gas then there are a few of the “gassers’ that I’d like to scoop up on pullbacks as I’m bullish nat gas for a price target in the $4-$5 range by this winter. I also want US oil companies with a nice nat gas kicker (20-40% of production out of nat gas).

The generalist investors haven’t arrived at our segment of the market in a meaningful way. The days when gold is skyrocketing the precious metal stocks get a boost on days where gold trades down a fraction the share prices decline. This too will change. DT

They are CLUELESS………….

I went to the local coin shop today… you talk about CLUELESS….

I had to explain why gold is going higher….. like duh….

I know exactly what you mean, I talked to a neighbor today and her husband was hospitalized because he had a blood clot in his leg. I mentioned the covid shot and she said that didn’t matter because that was three years ago. DT

Gold to $3,350 – GDXJ Breaks Out – Charts Of Leading Gold Producers

Excelsior Prosperity w/ Shad Marquitz 04-16-2025

https://excelsiorprosperity.substack.com/p/gold-to-3350-gdxj-breaks-out-charts