AbraSilver Resource – New Discoveries At Occulto East and Sombra Expand Gold And Silver Mineralization At The Diablillos Project

John Miniotis, President and CEO and David O’Connor, Chief Geologist of AbraSilver Resource Corp (TSX.V:ABRA – OTCQX:ABBRF), join me to review the next batch of drill assays returned from 2 new regional targets from the ongoing 20,000 meter Phase 4 diamond drill campaign on their wholly-owned Diablillos property in Salta Province, Argentina. We also get an update on the financial health of the company with $58.5 million having been successfully raised to fund future work programs including the Phase 5 drill program, a resource update, permitting, and upcoming Definitive Feasibility Study next year taking things to a construction decision.

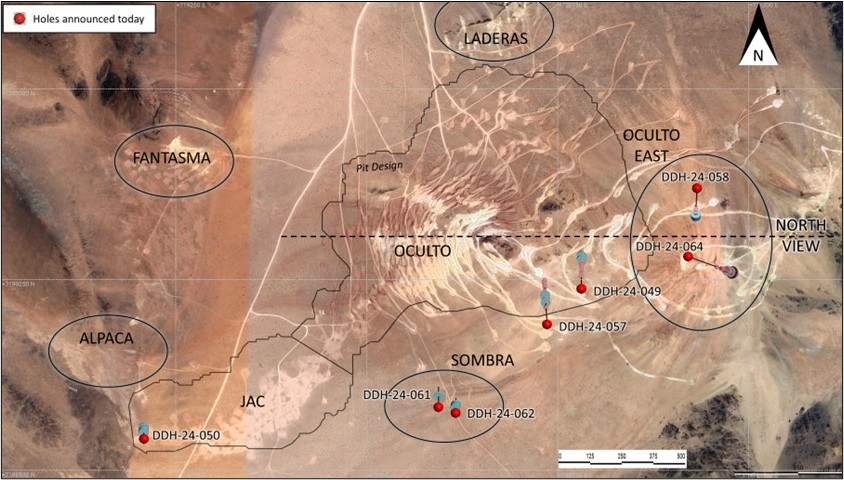

John and Dave outline the key takeaways from high-grade gold and silver assay results from initial drilling at the new Oculto East target, previously referred to as Cerro Bayo, represents the prospective eastern extension of the Oculto deposit.

- Hole DDH 24-058, located approximately 600 metres east of the current limit of the existing Oculto deposit, intersected 24.5 m at 107 g/t Ag, starting at a downhole depth of 201.5 metres (“m”). This included a high-grade interval of 3.0 m at 465 g/t Ag, indicating localized zones of higher-grade silver mineralization.

- Hole DDH 24-064, located 300 m south of hole 24-058, returned 22.0 m grading 2.78 g/t Au starting from a downhole depth of 307 m, including a higher-grade section of 9.0m grading 5.35 g/t Au in oxides.

We also discuss results from the Sombra Target in Hole DDH 24-062, which encountered 23.0 m at 55 g/t Ag starting at a shallow down-hole depth of only 40.0 meters. Dave outlines the thesis that the corridor between Sombra and Oculto East could be a parallel trend to the Oculto Main and JAC deposit. They are awaiting 2 more holes from Phase 4 in this area, and then will be drilling 15 more holes into this zone in the coming Phase 5 drill program.

We also reviewed that there would be more drilling to come in Cerro Viejo and Cerro Blanco targets to the East that both intersected broad zones of gold, silver, and copper porphyry-style mineralization, with epithermal mineralization closer to surface.

Additionally, the upcoming resource estimate update in mid-2025 will feed into the Definitive Feasibility Study (DFS), which will be managed by a team of experienced engineers and consultants, supported by the Company’s technical team. The Company will undergo a competitive tendering process to select qualified Engineering, Procurement, Construction and Management firms, with the award anticipated by no later than April 2025. Regular progress updates will be provided by the Company as the DFS advances forward for release in 2026, with results expected to further showcase the Company’s potential to become a key low-cost silver-gold producer.

If you have any follow up questions for John or Dave regarding at AbraSilver, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of AbraSilver at the time of this recording.

.

Click here to visit the AbraSilver website and read over the most recent news releases.

.

.

Hi Shad- is Sandstorm an example one of the mismanaged gold stocks you have referred to in the past? Stock price used to be 14 but now 6 with twice as many shares! Is it a buyout candidate? It can’t seem to get going. Yes I consider myself a bagholder.

Thanks

Calibre Reports 2024 Financial Results; 2025 Set to be a Transformational Year as the Multi-Million Ounce Valentine Gold Mine, Canada Advances to First Gold During Q2, 2025

02/19/2025

“Calibre delivered a record Q4 consolidated gold production of 76,269 ounces, and full year 2024 production of 242,487 ounces, surpassing the revised 2024 annual production guidance. As of February 15, 2025, the year is off to a strong start with consolidated production trending 15% higher than budget and cash increased to $161 million, a 23% increase over December 31, 2024.”

“2025 is set to be a transformative year for Calibre, with the Valentine Gold Mine on track for first gold during the second quarter…”

Stocks like Kraken Robotics (V-PNG) are the future and the now and it is just starting to happen in a big way, anything in the line of AI robotic systems. Just like nuclear energy and the build out AI systems are taking over. I should know I have been a Sci Fi fan since “The Day The Earth Stood Still”. LOL! Kraken Robotics tops the TSXV 50 2025 list. Klaatu!

Anyone know why Impact Silver stock is down over last month 14 percent and silver and gold are going higher ????

Only speculation on my part but I think the costs of the recent acquisition getting running optimally is turning out to be more expensive than originally thought. Also if I remember correctly it was more zinc based than silver. I sold out of it and Kootenay and put that money to better use. The laggards are still lagging big time. I keep a casual eye on them but there’s too many better plays right now.

Ipt is largely 90% silver, one of the few pure silver plays with leverage to higher silver prices that doesn’t have a significant zinc component. That’s the good part.

Obviously a great number of million share selloff days recently have pinned the stock price to the ground. Why? One can only guess. I think IPT moves only when silver breaks above $35…or if they post a profitable quarter in the meantime.

I have been acquiring at these levels.

Sandstorm (SAND) (SSL) Investor Presentation (February 2025)

“Sandstorm’s President & CEO, Nolan Watson, discusses 2025 guidance, key development assets, and what will set Sandstorm apart from the royalty industry in the coming years.”

https://youtu.be/X1CTlSBRGVc