Sean Brodrick, Editor of Wealth Megatrends and contributing analyst to Weiss Ratings Daily, joins us to review some of the macro news moving the markets, and how he’s positioning into the volatility we’ve seen over the last 2 weeks in AI stocks, utilities, uranium stocks, gold, silver, and precious metals stocks. There are sectors he is limiting exposure to while there are plenty of opportunities and sectors he believes will do well in 2025 in light of the Trump administration economic strategy with tariff and global trade policies.

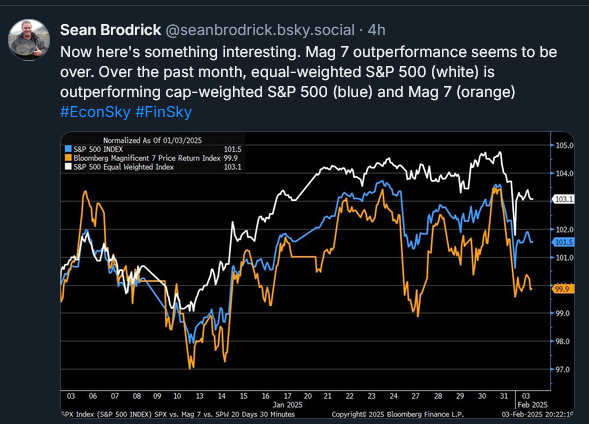

We start off discussing how the DeepSeek AI platform news was a bit overhyped, and affected certain sectors in AI, semiconductors and chips, electric utilities, and the uranium stocks disproportionately. Sean feels many of those moves earlier last week were way overdone in a market overreaction, and notes why he is still bullish on businesses that could see enhancements through AI automation, and notes that we are still going to need a lot of electricity, and both natural gas and nuclear energy on a global basis. Sean also noted that other segments of the market spread out into wider breadth despite the selloff in concentrated sectors, and that the equal-weighted index is outperform the more skewed weighted indexes lately.

Wrapping up we note the future breakout in gold and silver prices, and that we are seeing more volume and pricing outperformance in a number of the PM stocks. We discuss the potential for Q4 earnings numbers that will be released in a couple of weeks to be a potential catalyst to get more momentum going forward and more analyst coverage of the sector. Sean also notes that he is starting to move down the risk curve in the precious metals equities and position in more junior companies, and is more bullish on the prospects for silver stocks over the gold stocks.

.

Click here to follow along with Sean’s work at Weiss Ratings Daily and Wealth Megatrends

.

Click here to learn more about Resource Trader

.

.