Sean Brodrick – Taking Advantage Of The Volatility In Early 2025 In A.I., Semiconductors, Tech, Utilities, Uranium, Gold, And Silver Stocks

Sean Brodrick, Editor of Wealth Megatrends and contributing analyst to Weiss Ratings Daily, joins us to review some of the macro news moving the markets, and how he’s positioning into the volatility we’ve seen over the last 2 weeks in AI stocks, utilities, uranium stocks, gold, silver, and precious metals stocks. There are sectors he is limiting exposure to while there are plenty of opportunities and sectors he believes will do well in 2025 in light of the Trump administration economic strategy with tariff and global trade policies.

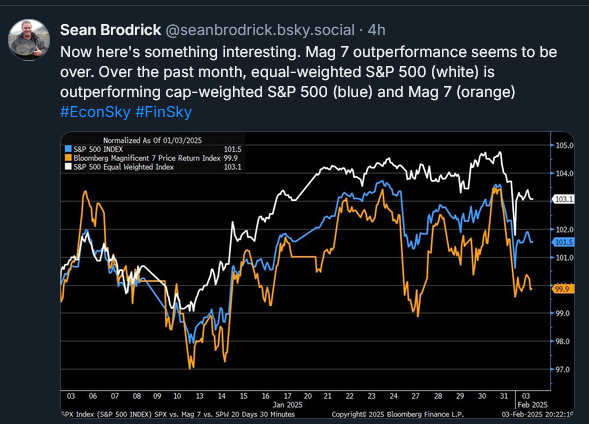

We start off discussing how the DeepSeek AI platform news was a bit overhyped, and affected certain sectors in AI, semiconductors and chips, electric utilities, and the uranium stocks disproportionately. Sean feels many of those moves earlier last week were way overdone in a market overreaction, and notes why he is still bullish on businesses that could see enhancements through AI automation, and notes that we are still going to need a lot of electricity, and both natural gas and nuclear energy on a global basis. Sean also noted that other segments of the market spread out into wider breadth despite the selloff in concentrated sectors, and that the equal-weighted index is outperform the more skewed weighted indexes lately.

Wrapping up we note the future breakout in gold and silver prices, and that we are seeing more volume and pricing outperformance in a number of the PM stocks. We discuss the potential for Q4 earnings numbers that will be released in a couple of weeks to be a potential catalyst to get more momentum going forward and more analyst coverage of the sector. Sean also notes that he is starting to move down the risk curve in the precious metals equities and position in more junior companies, and is more bullish on the prospects for silver stocks over the gold stocks.

.

Click here to follow along with Sean’s work at Weiss Ratings Daily and Wealth Megatrends

.

Click here to learn more about Resource Trader

.

.

When I was in grade 6 in Saskatoon, the teacher said Bolivia had a lot of tin.

Hi Terry, the biggest tin porphyry deposits in The World are found in Bolivia. Iska-Iska has all the characteristics of the 4 other big tin deposits found there. Eloro Resources tin deposit is in oxide form and that makes it easier to separate from the other metals. They also have a cornucopia of Silver, Zinc, and Lead and a float of only 82 million shares. Tom Larsen their CEO owns about 22% of the shares outstanding and Crescat Capital has another 16%, half of the shares are held in strong hands leaving only a small float to be traded, that is important for investors. DT

Sixty-five years after the teacher told us about all that tin in Bolivia, they are finally going to dig it up. Trader Ferg has been talking about tin in Tasmania but maybe now Eloro and Bolivia will be more valuable.

Collective Mining Expands the High-Grade Ramp Zone by Intersecting 51.95 Metres at 8.38 g/t AuEq Including 18.05 Metres at 16.32 g/t AuEq

4 Feb 2025

https://www.collectivemining.com/investors/news-releases/index.php?content_id=286

The (CNL) Collective Mining chart has been a thing of beauty for the last 6+ months…. because they keep putting out banger after banger of high-grade wide-intercept drill holes.

BTW – Gold futures recently hit an all-time high of $2,888.80 in overseas trading. (cosmic)

As I write this gold futures are at $2,884.

That’s not a bad price for producers of the yellow metal or companies that have solid economics on a gold project at much lower metals price assumptions.

We are starting to see a larger swatch of gold stocks start to demonstrate the leverage we’ve been waiting for in this sector. Bring it!

Now gold futures are up to $2,893….

Could we see trading in the $2,900s today in the North American trading session, or is this going to get the typical early morning smack down?

This is getting really interesting…

Gold looking good…(IMO)………. Like I have been saying for a long time… 🙂 or

was that J The Long…. LOL…… 🙂

$36 TRILLION in Debt …. and Bonds rolling over in the next 4-5 yrs…. humm

That BIG CUP AND HANDLE broke , and now a totally new ball game….

As always……expect corrections….

For now they’re still called consolidations and buying opportunities. 😜

Hi Ex, this news release on Calibre Mining should get your juices flowing, the old standard of sell the news is now buy the news, the pendulum has corrected. LOL! DT 🤣🤣🤣

Yes indeed DT. Great news from Calibre (as per usual)….

Hey Ex. Definitely good to see it finally working its way to some of the stocks. Fortunately for me the laggards are the ones I sold so still time to get back in when the bottom feeders finally join in when gold gets over 3K.

Still a big fan of copper. 😉

Be great if you found a few more guests with nice charts to contribute. Matthews skills there are certainly missed. Last one I remember was Tesla. He nailed the pop despite not being into it himself.

Hi Wolfster – Yes, good to see more juniors finally starting to join in with the moves up in the PM sector.

I’m still a big fan of copper as well… but ever since going up and tagging a new all-time high last year up to $5.199, it has rolled over and there hasn’t been a big push in most base metals for the last 7-8 months. With less of a push towards EVs and a somewhat diminished push towards AI data centers in light of the DeepSeek news out the end of last month, there just hasn’t been a big push into copper (yet).

It appears to be Precious Metals’ time to shine first, and then maybe later this year or next year we’ll see the industrial metals come back into favor once again.

As for guests with charts or technical outlooks, we have TG Watkins, Joel Elconin, and Dave Erfle on regularly discussing technical levels to watch in a number of stocks and sectors. We just did 2 different video calls with Steve Penny and TG Watkins that were posted in the last month that had plenty of charts on various sectors and stocks, for those interested in technical analysis. We’ll be having Christopher Aaron back on later this week with technical thoughts. Jordan Roy-Byrne and Rick Bensignor will be on the weekend show with their fundamental and technical outlooks… So we have plenty of guests on the show that provide TA and technical outlooks as it is, but we are always looking for more. I ran into Chris Vermeulen in Vancouver, and we start getting him back on the show again too.

TG Watkins – Technical Analysis: Semiconductors, Utilities, Nuclear, Uranium, & Crypto Mining Stocks

Steve Penny – The SilverChartist Charts Of Gold, Silver, GDX, SILJ, Uranium, URNM, And The US Dollar

KE Report – January 14th

Is he from the south, Tommy Gabe or Timmy George or just Turd Gunderson?

I actually don’t know what the T.G. stands for “Trading Genius”? 😉

He lives in Washington though…not the south…

Back in Guangzhou, China for couple months after leaving here two years ago. Many new buildings, roads, the place seems cleaner and more organised. Lots of people on the streets, packed restaurants and malls, smiling faces everywhere. A friend says DeepSeek is just the first of several technological advances that will come out of China.

Eloro Resources opens up major tin zone at The ISKA ISKA deposit in Bolivia. DT

https://www.youtube.com/watch?v=A3cKuaBxVtQ