Forum Energy Metals – Qavvik Drill Assays Return 296 Metres of Uranium Mineralization With Intercepts Up To 8.2% U3O8

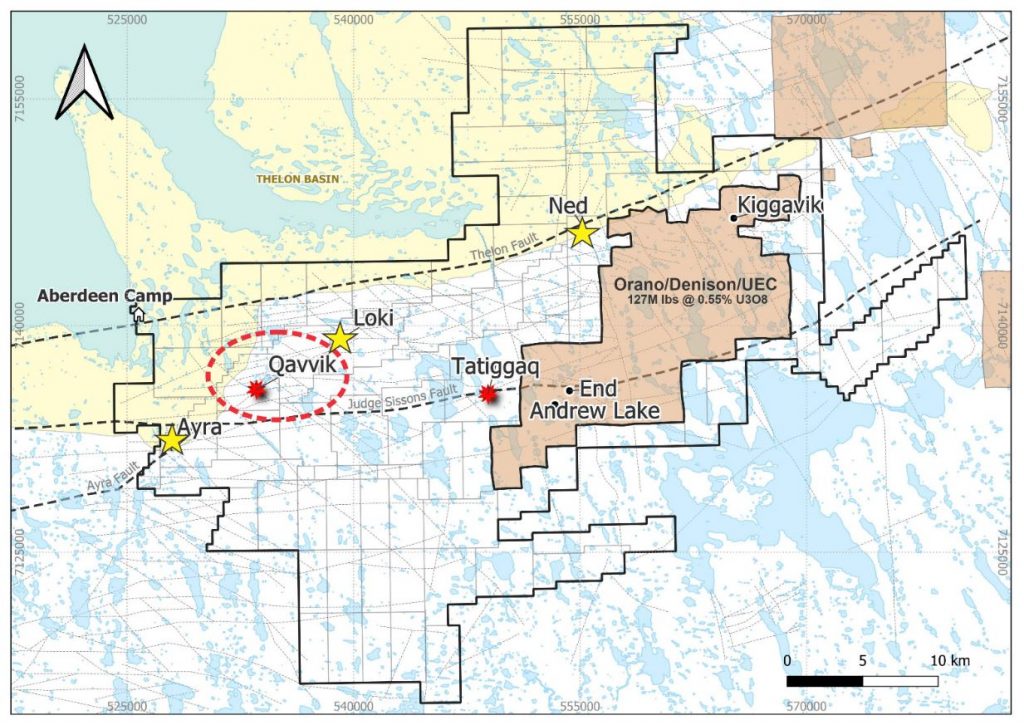

Dr. Rebecca Hunter, VP of Exploration at Forum Energy Metals (TSX.V:FMC – OTCQB:FDCFF), joins me to unpack the key takeaways from next batch of 2 drill holes released from the 2024 exploration program to the market on January 21st. These holes expand the mineralization at the Qavvik anomaly; Forum’s second basement-hosted deposit, located within their 100% owned Aberdeen Project in Nunavut, Canada.

These 2 holes compliment the more than 2 dozen historic holes that were drilled by Cameco into the Qavvik deposit, and had the highest grade results to date. This successful exploration program intersected a 296-metre-wide zone of uranium mineralization with grades up to 8.2% U3O8 in a newly identified lens and resulted in more than 20 assays with grades greater than 1% U3O8. Mineralization is open to the northeast and southwest, and the shallow depths along with the thick overall uranium intercepts demonstrate the open pit potential of this deposit.

These 2 Qavvik drill holes expanded that basement-hosted deposit, much like the previously released 19 holes drilled into the Tatiggaq area also expanded that basement-hosted deposit. Rebecca outlined how the 2 prior year’s drill results will likely be combined with relogging of historic drill holes completed by Cameco, to work towards the delineation of a Maiden Resource Estimate at Tatiggaq and Qavvik deposits in the future. This mineralization in the basement-hosted rock is similar in nature to the nearby 133 million pound Kiggavik uranium project held by Orano/Denison/UEC, located about five kilometers to the west of the Tatiggaq deposit.

Wrapping up we look ahead to the upcoming drill hole assays still to release from last year’s exploration program from highly prospective regional targets. There are still holes to release from the Ned, Ayra, and Loki targets, with the goal of testing and exploring for the higher-grade unconformity style of deposits; similar to what is found in the Athabasca Basin.

If you have any follow up questions for Rebecca or the team at Forum Energy Metals, then please email them into me at Shad@kereport.com.

.

Click here to follow along with the most recent news from Forum Energy Metals

.

.

If you are talking about Forum Energy Metals you are sadly mistaken, this stock has been anything but volatile for over 10 years. Maybe you should get off the toilet seat and have a look around. LOL! DT

Just looked at the last month not interested in 10 years ago

Hi guys. Interesting thread with regards to the volatility in Forum’s price chart.

I’d submit that almost all junior stocks are by nature very volatile, and one could consider FMC volatile in how it pops or drops in relation to the 50-day exponential moving average. It does whipsaw back and forth regularly, but that is not unique to FMC.

>> I won’t go back 10 years, but likewise won’t just look at the last month. Here’s a 5 year chart.

What is interesting is that they’ve learned so much more about both their flagship Aberdeen Project in the Thelon Basin and their multiple projects in the Athabasca Basin, with far more drilling data, since their high in 2021 at $0.55, but now they are trading down 88% to $.065.

However, that was the big uranium run from 2020 into 2021 that sent many uranium exploration stocks up multiple-fold. It has been a more difficult market for the uranium explorers since that heydey in the U308 stocks, but I’m optimistic for how things are setting up for 2025 in the U-stocks.

I’m surprised that Forum (FMC) is still around. I bought some about 25 years ago, for a jr. exploration company they have been around for a very long time. They were uranium explorers even back then and haven’t re-invented themselves. Their endurance is pretty remarkable, most companies would have gone bankrupt a long time ago. DT

Gold just touched $4000 CDN an ounce. DT👀

Hi Jerry,

I’m still here and nothing has changed. But I have some great news I think if no one is buying the miners at these lows today you will regret it in 7/8 weeks. Silver is going to take off starting next week and won’t look back.

I’m expecting this move in miners to be very aggressive. This is the move many have been waiting for years.

We are in wave 5 of a larger cycle wave. The start of it. Within that wave we are in wave 1 literally getting started to take off starting next week. Wave 1 should take 7/8 weeks.

All the best to everyone and pray for the Canadians who many will lose there homes. 26% drop in housing in regions like Durham Peterborough Niagara.

I read one of Peter Schiff s books in 2009 predicting this exact thing would happen including in Canada. Canada withheld printed to the moon dropped rates much more aggressive but delayed. Now we pay.

As an example of 26% drop from the peak prices in Durham and Peterborough that’s about $330,000 loss from the peak. What’s even worse is Peter‘s book predicted that these types of life-changing events that happen once every 25 to 30 years usually have a complete drop of 45 to 55%.

Yikes!

Best glen

Hello Glen…………………. thanks for the comment……..

Appreciate you coming back to bring us up to date……and the forecast….

Glen, in Canada we are in “The Greater Depression”, bigger than the 1930’s. This time The US will follow our lead. It will be a “Deflationary” bust lead by Real Estate. We never went through the housing correction The US experienced in 2008, prices here just kept climbing, the higher they go the more they correct, and we are faced with Trump’s tariffs in a country that is leaderless and has been this way for ten years. DT

I agree 100% going to get really bad

Good to hear from you Glen. I honestly am one of the ones who capitulated on holding silver miners for now. Look to get back in when some signs of volume return to the jrs.

As for the real estate market. None of those cracks are showing up in Toronto. I’m at the point where I’m turning away work from clients kids and friends kids who are now home owners as well.

As for it being the “greater depression” let’s have a big recession first not just a mild one.

The people with money that can afford to buy real estate in Toronto for their children or pay for expensive home renovations are not going to feel the downturn the way the non-existent middle class has. Go to a homeless tent encampment there are more than 1400 in Ontario alone and ask them about how life feels, or better yet, ask many of the tradespeople that build the homes you are working with if they aren’t in the market could they afford a home in Toronto now. Once the tariffs come in the house prices will drop drastically and the carpetbaggers will move in. Alliston On. (where you live) will be devastated. Really Wolfser, you need to look beyond yourself. DT

Look beyond myself. Lol…..I’m looking at those around me. Not sure what middle class you hang out with but the one I hang out with is fine. The younger ones have their kids in all the sports running around from arena to arena or field depending on the sport. The rest are out enjoying themselves at the pub etc…..there’s always been homeless the fact they now set up tent encampments makes them more noticeable. ….and yeah Alliston is down big cuz Honda is going bankrupt….. but it all won’t matter when we become the 51 state cuz as Trump says they don’t need anything from us. Cuz they have tons of nickel mines and are loaded with heavy oil the type their refiners are built for. 🤣🤣🤣

Wolfster, look at the disastrous policies this Liberal Gov’t has brought on over the last ten years. Crime is up, inflation is rampant, corruption everywhere, free street drugs, tradesmen who build homes can’t afford the homes they build, yet our Liberal leaders can’t see that they have destroyed The Canadian dream. Why is that? Well, they care about two things actually their pay cheques and their pensions. Never do they stop to think about the constituents lives their disastrous policies have cost. This is what happens when people don’t think beyond themselves and base the existence of others by what happens to them. Pretty shallow and stupid thinking wouldn’t you agree. DT

Money of Mine did a gold focused show today and will do a uranium show soon. If you want an Aussie perspevtive these guys are pretty good

Volatile, goes up and down like a toilet aeat.