Emerita Resources – More Metallurgical Testing Shows Enhanced Gold Recoveries At La Romanera, Exploration Update At El Cura, and Development Update At The IBW Project

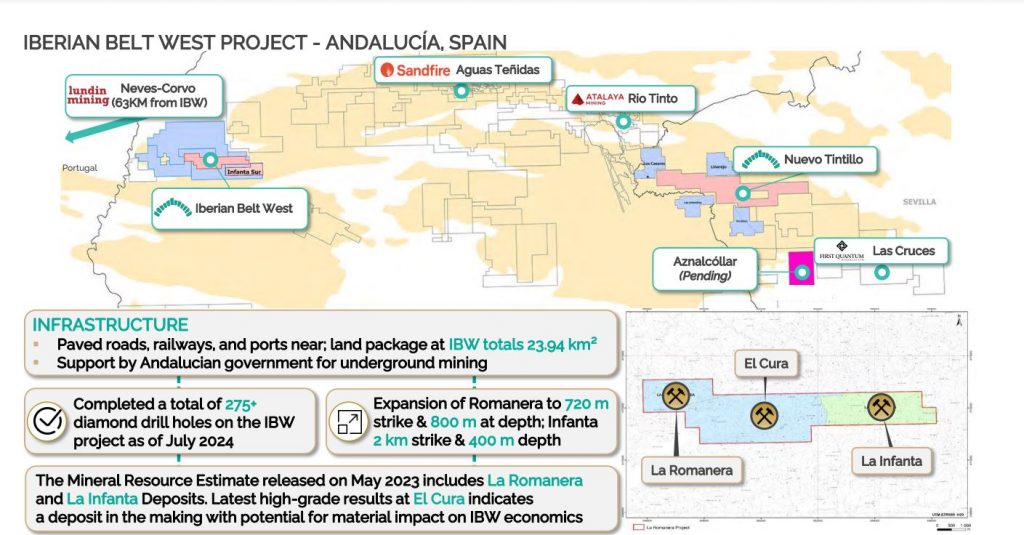

David Gower, CEO and Chairman of Emerita Resources (TSX.V: EMO) (OTCQB: EMOTF), joins me to provide an update on the continued metallurgical testing beyond even the Phase 2, showing enhanced gold recoveries at La Romanera, along with an exploration and development update at El Cura and other derisking work being conducted to advance the polymetallic Iberian West Project (IBW), located in southern Spain.

We start by discussing the ongoing metallurgical work completed in the Phase 2 testing at the IBW Project, mostly at the Zinc-Copper-Lead-Silver-Gold La Infanta and Romanera deposits. David shares how their approach has optimizing metal recoveries at both areas using separate copper, lead, and zinc concentrates; but also a new 2 phase system really improves the gold recoveries, which would impact future payables in production scenario at La Romanera which has a higher gold credit. The company is also still exploring the viability of a 4th arsenopyrite concentrate circuit at Romanera to capture even higher gold values and payable arsenic credit that would report to this concentrate, but the previously mentioned 2-phase process doesn’t require this.

Next we pivoted over to the exploration and development potential at El Cura , which was not part of the Phase 1 or Phase 2 metallurgical study, but is going through it’s own testing at present. There has also been a continued focus on exploration drilling and expanding the mineralized area so that this 3rd deposit it can be included in the coming updated resource estimate due out in late Q1. David walks us through how each of these 3 deposit areas plays into the larger development strategy where the earlier stage mining at La Infanta can now drift through El Cura on the way to the development of La Romanera, bringing in El Cura as a future economic driver much earlier in the mining sequence now. This will be highlighted in a PFS due out later in 2025.

We wrap up noting the ongoing exploration work at the earlier-stage Nuevo Tintillo Project, and got an update on where things are in the courts, with 3 months until the sentencing portion of the legal proceedings in their initiative to be awarded the high-grade polymetallic Aznalcóllar Project/

If you have any follow up questions for David regarding Emerita Resources, then email those in to me at Shad@kereport.com.

.

Click here to follow the latest news from Emerita Resources

.

.

Appreciate it Ex…..shows how undervalued Emerita was without taking Aznacoller into account when it was trading at .40-.60….. now it’s getting closer to fair value without it. Still room for 6x with it tho

Hi there Wolfster. Yeah, I’m very curious to see what kind of multiplier that Emerita could get if the Aznalcollar case is awarded to it later this year. Right now IBW is underpinning the valuation.

It was a really strong day in the resource stocks today to kick off 2025, particularly in gold, silver, and uranium stocks.

GDX up 4.22%

GDXJ up 4.87%

SIL up 4.25%

SILJ up 5.94%

URNM up 7.14%

URNJ up 12.16%

My diversified portfolio was up 6.5%.

Boom!!

For having a diversified portfolio that was an EXcellent day for you. My big winner was NFG up 8.49% but my portfolio is not nearly as diversified. NFG is my biggest holding. (for now) DT

Thanks DT. Yeah, it really was a fantastic way to break out of the gates for the first trading day of 2025.

I think what really carried the day were the moves in the silver and uranium stocks. They can have a lot of torque on bullish sentiment days, and definitely did so today; with many up double digits or high single digits.

Ticker – Silver Producers – Daily change (%)

GSVR.V Guanajuato Silver Company Ltd. +14.71%

ASM Avino Silver & Gold Mines Ltd. +9.81%

EXK Endeavour Silver Corp. +9.29%

SCZ.V Santacruz Silver Mining Ltd. +9.09%

CDE Coeur Mining, Inc. +8.39%

AG First Majestic Silver Corp. +8.38%

GATO Gatos Silver, Inc. +8.30%

GGD.TO GoGold Resources Inc. +8.11%

SILV SilverCrest Metals Inc. +7.80%

AGX.V Silver X Mining Corp. +7.69%

APM.V Andean Precious Metals Corp. +7.14%

HL Hecla Mining Company +7.13%

FSM Fortuna Mining Corp. +6.76%

MAG MAG Silver Corp. +5.88%

PAAS Pan American Silver Corp. +5.69%

SVM Silvercorp Metals Inc. +5.00%

AYA.TO Aya Gold & Silver Inc. +4.56%

FRES.L Fresnillo plc +4.51%

USAS Americas Gold and Silver Corporation +3.75%

HOC.L Hochschild Mining plc +3.50%

SSRM SSR Mining Inc. +3.16%

IPT.V Impact Silver Corp. +2.38%

SM.V Sierra Madre Gold and Silver Ltd. +2.13%

Ticker – Silver Explorers & Developers – Daily Change (%)

SWLF.V Silver Wolf Exploration Ltd. +25.00%

CMB.V CMC Metals Ltd. +25.00%

VIPR.V Silver Viper Minerals Corp. +25.00%

DEF.V Defiance Silver Corp. +16.22%

SAND.CN Silver Sands Resources Corp. +14.29%

ZFR.V Zephyr Minerals Ltd. +14.29%

AAG.V Aftermath Silver Ltd. +14.12%

PRIZ.CN Prismo Metals Inc. +13.64%

BRC.V Blackrock Silver Corp. +13.51%

CCM.TO Canagold Resources Ltd. +12.73%

AHNR Athena Gold Corporation +11.71%

MTH.AX Mithril Silver and Gold Limited +11.54%

DSV.TO Discovery Silver Corp. +11.27%

SLV.CN Silver Dollar Resources Inc. +11.11%

CDPR.CN Cerro de Pasco Resources Inc. +10.34%

NUAG.TO New Pacific Metals Corp. +10.00%

GRSL.V GR Silver Mining Ltd. +9.09%

TUF.V Honey Badger Silver Inc. +9.09%

KTN.V Kootenay Silver Inc. +8.70%

SSV.V Southern Silver Exploration Corp. +8.11%

SVE.V Silver One Resources Inc. +8.11%

SSVR.V Summa Silver Corp. +7.69%

REX.V Orex Minerals Inc. +7.14%

MMG.V Metallic Minerals Corp. +7.14%

ABRA.V AbraSilver Resource Corp. +6.84%

OCG.V Outcrop Silver & Gold Corporation +6.76%

BNKR.V Bunker Hill Mining Corp. +6.45%

KUYA.CN Kuya Silver Corporation +5.88%

ARD.AX Argent Minerals Limited +5.88%

EXN.TO Excellon Resources Inc. +5.56%

EQTY.V Equity Metals Corporation +5.56%

BIG.V Hercules Metals Corp. +5.45%

SVRS.V Silver Storm Mining Ltd. +5.26%

MSV.TO Minco Silver Corporation +5.26%

RSLV.V Reyna Silver Corp. +5.00%

IVR.AX Investigator Resources Limited +4.76%

APGO.V Apollo Silver Corp. +4.55%

SLVR.V Silver Tiger Metals Inc. +4.44%

SMI.AX Santana Minerals Limited +4.35%

DV.V Dolly Varden Silver Corporation +4.17%

SVB.TO Silver Bull Resources, Inc. +4.00%

TAU.V Thesis Gold Inc. +3.51%

BML.AX Boab Metals Limited +3.23%

SVL.AX Silver Mines Limited +2.56%

ELO.TO Eloro Resources Ltd. +2.30%

Is This A Buy The Dip Moment In The Junior $Silver Stocks?

Excelsior Prosperity w/ Shad Marquitz (12/28/2024)

Dolly Varden $DV $DOLLF.US, Blackrock Silver $BRC $BKRRF.US, AbraSilver $ABRA $ABBRF.US, Silver Tiger $SLVR $SLVTF.US, Santacruz Silver $SCZ $SCZMF.US, Avino Silver & Gold $ASM $ASM.US Sierra Madre Gold & Silver $SM $SMDRF.US, and Guanajuato Silver $GSVR $GSVRF.US

https://excelsiorprosperity.substack.com/p/is-this-a-buy-the-dip-moment-in-the

Nice day but don’t get too “amped” up. The dollar is strong but gold and metal stocks are now looking to stay in their trading ranges. The odds are that we’re going to see weeks and months of treading water. However, it’ll be a great time to add at these low bumps down to add to the stocks you own—of course it’s different for the day and semi-day traders. We’ll see continuing strengthening of the dollar and what is encouraging is that gold is holding its’ own—-we may see a trend of a gradual move down for the metals over the next week to months. But not to worry since the bull market is still intact and we’re still in consolidation mode.

Thanks for the reality check Doc. Yeah, best not to get too amped or vamped on any one up or down day in the markets, and if the dollar stays strong as you outlined, then it will be a headwind to the PMs.

Still, there have been so many days lately where we took it in the shorts, and the sector sentiment has been so sour in November and December, that it just felt good to kick off the new year with a solid green day in the space and a tiny amount of celebrating. 🙂

Now, with regards to the Uranium stocks, they are less tethered to a relationship with the US dollar, or really any other asset class, and are marching to the beat of their own drums based on the unique sector fundamentals.

There were 2 big news stories out moving the U-stocks in a positive direction today – the Cameco JV news and the utility company Constellation news.

Constellation Inks $1 Billion Deal To Supply US Government With Nuclear Power

Laila Kearney and Timothy Gardner – Thu, January 2, 2025

“Constellation Energy has been awarded a record $1 billion in contracts to supply nuclear power to the U.S. government over the next decade, the company said on Thursday.”

“Constellation, the country’s largest operator of nuclear power plants, will deliver electricity to more than 13 federal agencies as part of the agreements with the U.S. General Services Administration.”

“The deal is the biggest energy purchase in the history of the GSA, which constructs and manages federal buildings, and is among the first major climate-focused energy agreement by the U.S. government to include electricity generated from existing nuclear reactors.”

https://finance.yahoo.com/news/constellation-secures-1-billion-contracts-154447132.html

Production Suspension at JV Inkai

BusinessWire – January 2nd, 2025

“Cameco (TSX: CCO; NYSE: CCJ) was informed by our partner, National Atomic Company Kazatomprom JSC (Kazatomprom), and Joint Venture Inkai LLP (JV Inkai), that as of January 1, 2025, JV Inkai has suspended production activity.”

“On December 31, 2024, JV Inkai formally notified us that it had not received an extension of the timeline to submit its updated Project for Uranium Deposit Development documentation (Project Documentation), an extension that was expected prior to 2024 year-end. We were informed by Kazatomprom that the extension was not received as expected due to the delayed submission of the necessary documentation to the Ministry of Energy. As majority owner and controlling partner of the joint venture, on December 30, 2024, Kazatomprom directed JV Inkai to plan for a halt of operations as of January 1, 2025, to avoid potential violation of Kazakhstan legislation.”

“We are disappointed and surprised by this unexpected suspension and we will be seeking further clarification on how this transpired, as well as the potential 2025 and 2026 production and financial impacts (including on future dividends), and what Cameco can do to help Kazatomprom and JV Inkai restart mining operations.”

“Kazatomprom holds a 60% interest in JV Inkai, while Cameco owns a 40% share.”

Ticker – Uranium Stocks – Daily Change (%)

AAZ.V Azincourt Energy Corp. +50.00%

FIND.V Baselode Energy Corp. +23.53%

BEA.V Belmont Resources Inc. +20.00%

UUSA.CN Kraken Energy Corp. +16.67%

AL.V ALX Resources Corp. +16.67%

DNN Denison Mines Corp. +15.56%

GLO.TO Global Atomic Corporation +15.38%

UEC Uranium Energy Corp. +13.90%

BMN.AX Bannerman Energy Ltd +13.10%

SASK.V Atha Energy Corp. +12.50%

URNJ Sprott Junior Uranium Miners ETF +12.16%

AGE.AX Alligator Energy Limited +11.43%

LEU Centrus Energy Corp. +11.17%

NXE.TO NexGen Energy Ltd. +11.08%

UUUU Energy Fuels Inc. +10.72%

EU.V enCore Energy Corp. +10.31%

URG Ur-Energy Inc. +9.57%

DYL.AX Deep Yellow Limited +9.44%

FMC.V Forum Energy Metals Corp. +8.33%

FUU.V F3 Uranium Corp. +8.33%

1164.HK CGN MINING +7.93%

LTBR Lightbridge Corporation +7.82%

UROY Uranium Royalty Corp. +7.76%

MGA.TO Mega Uranium Ltd. +7.58%

PEN.AX Peninsula Energy Limited +7.41%

BOE.AX Boss Energy Limited +7.26%

URNM Sprott Uranium Miners ETF +7.14%

SYH.V Skyharbour Resources Ltd. +6.76%

LAM.TO Laramide Resources Ltd. +6.25%

WUC.CN Western Uranium & Vanadium Corp. +6.12%

FSY.TO Forsys Metals Corp. +6.06%

AEC.V Anfield Energy Inc. +5.88%

URA Global X Uranium ETF +4.97%

PTU.V Purepoint Uranium Group Inc. +4.55%

CVV.V CanAlaska Uranium Ltd. +4.41%

U-UN.TO Sprott Physical Uranium Trust Fund +3.94%

NLR VanEck Uranium and Nuclear ETF +3.90%

GCL.L Geiger Counter Limited +3.87%

AEE.AX Aura Energy Limited +3.85%

COSA.V Cosa Resources Corp. +3.70%

ISO.V IsoEnergy Ltd. +1.97%

YCA.L Yellow Cake plc +1.94%

CCJ Cameco Corporation +1.50%

#GotUraniumStocks?

Uranium Demand Is Going Nuclear

Excelsior Prosperity w/ Shad Marquitz 12-13-2024

https://excelsiorprosperity.substack.com/p/uranium-demand-is-going-nuclear

Kick-Off To 2025! Gold Miners & Uranium Soar As Tesla Tanks

Gold mining bulls are hoping that the first trading session of 2025 is a positive omen for the year ahead.

Robert Sinn – Goldfinger Capital – Jan 02, 2025

https://robertsinn.substack.com/p/kick-off-to-2025-gold-miners-and

FREAKY FRIDAY AGAIN……………….

The first Freaky Friday of the year… many more to come… 🙂

I’ve seen a lot of comments on other boards here regarding Emerita Resources (EMO), and figured it was a good time to get David on for an update. There ya go boys!