Blackrock Silver – Recapping The Key Initiatives From 2024 Leading Into Growth Catalysts For 2025

Andrew Pollard, President and CEO of Blackrock Silver (TSX.V:BRC – OTCQX:BKRRF), joins me to outline the key Company initiatives from 2024, that will lead into next year’s growth catalysts on the 100% controlled Tonopah West Project, in Nevada.

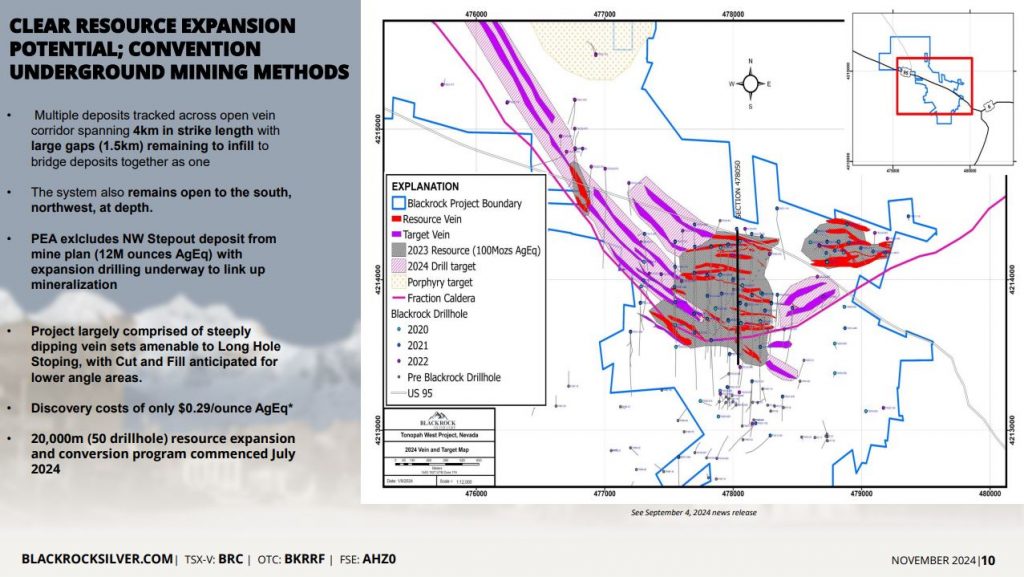

We start off reviewing the key metrics released on September 4th in the Preliminary Economic Assessment (PEA) on the Tonopah West Project. In that initial PEA at the base case gold price of $1,900 per ounce and silver price of $23 per ounce, the Project commands an after-tax net present value (“NPV”) discounted at 5% of $326-million on a low initial capex of $178-million (including $22-million contingency) with a payback of 2.3 years and an after-tax internal rate of return (“IRR”) of 39.2%, and an All-in Sustaining Costs (“AISC”) of $11.96 per silver equivalent ounce basis. Expanding upon the Project economics sensitivities to higher metals prices, Andrew points out that even at a gold price of $2,280 per ounce and a silver price of $27.60 per ounce (base case +20%), the economic profile of the Project escalates to an after-tax NPV5% of $495-million and an after-tax IRR of 54.0%.

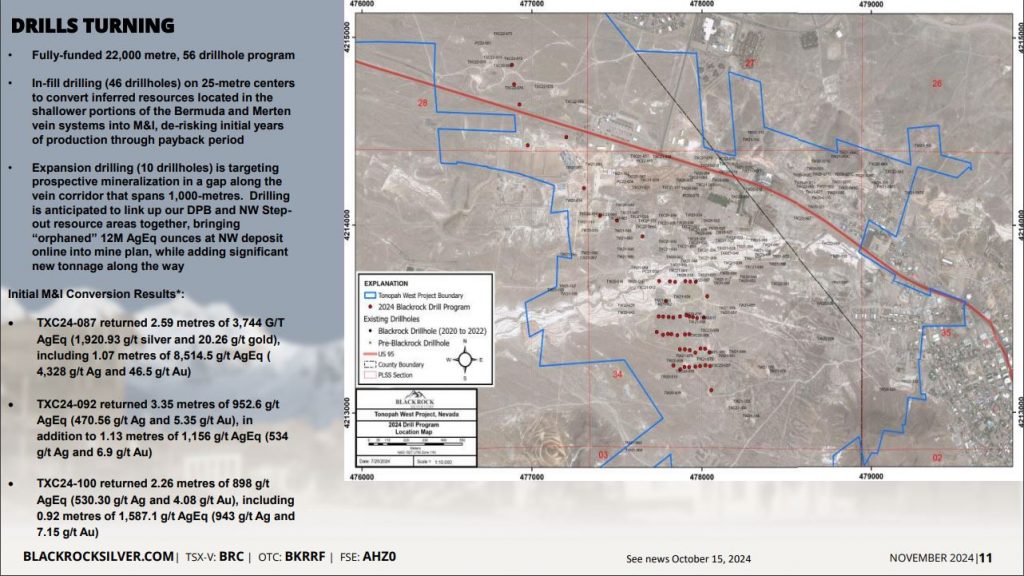

Next the discussion shifted to the expanded 22,000 meter Measured and Indicated (M&I) conversion and expansion drill program the company conducted in 2024. Some of the first assays released have shown even higher grade intercepts than the average resource grade. This means that as more M&I drill results come back in, and tighten up the spacing between holes, the average grade profile will likely be rising. In addition, there are some drill results that are going to be expanding mineralization along strike and at depth. Andrew speaks to how the additional drilling is just further validating the continuity of how the deposit hangs together, and this will be enhancing future resource estimates and economics on the Project. There are still a large number of holes waiting on assays from the lab to release to the market in the first quarter of 2025.*

If you have any follow up questions for Andrew regarding Blackrock Silver, then please email them into me at Shad@kereport.com.

- In full disclosure, Shad is shareholder of Blackrock Silver at the time of this recording.

.

Click here to visit the Blackrock Silver website to read over the recent news we discussed.

.

.

Paul Huet, was also just put in as the new boss and CEO of Americas Gold and Silver (USA.TO) (USAS), at the request of large shareholder Eric Sprott. I did incredibly well with Karora Resources with Paul at the helm, and told him so in person at Beaver Creek, up until they were acquired this last year by Westgold Resources. I also jumped into Klondex back in the day, when Paul was getting it turned around a few months before they were acquired by Hecla.

I’m very curious to see what Paul and team will do with new initiatives at Americas Gold and Silver moving forward, and added to my position there accordingly when that news broke.

The two best times to buy stocks are after a crash and during tax loss season. DT 🤣

+2

NFG has started to stair step, it has a lot of stairs to climb. LOL! I consider this stock to be an investment not a speculation. DT 👍

Oh, By The Way I own NFG, my first tranche was bought for $2.30. I wanted to be in this stock for a long time, but I was waiting for an entry point. As always DYODD, “Due Your OWN Due Diligence.” DT

LAST>>>>>>>>>FREAKY FRIDAY OF THE YEAR……………………..

It may have been the last Freaky Friday, but not the least freaky…. 🙂

William Hayden, a founder of Ivanhoe mines with a storied past and someone who is also associated with Robert Friedland has joined the board of New Found Gold. Management is very important in investing and NFG is acquiring the best. I mentioned Paul Huet as well the other day. Take note the stars are lining up. DT

https://www.marketscreener.com/insider/WILLIAM-HAYDEN-A0GA65/