Avino Silver and Gold Mines – A Review Of Q3 Financials, And The Development Pipeline For Organic Growth With Both The La Preciosa And Tailings Projects

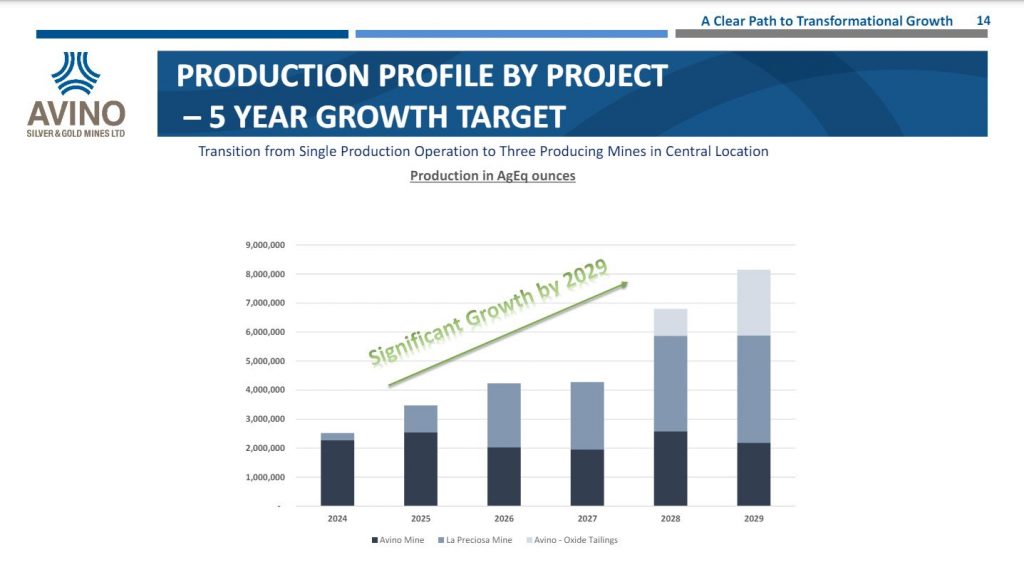

Nathan Harte, CFO of Avino Silver and Gold Mines (TSX:ASM – NYSE:ASM), joins us from the floor of the New Orleans Investment Conference to recap the key takeaways from the Q3 2024 financials and operations. Then we take a deeper dive into the Company’s 5-year production growth plan, to become a Mexican intermediate silver producer, with the development of both the La Preciosa Project and the Tailings Project.

Third Quarter 2024 Financial Highlights

- Revenues of $14.6 million, an increase of 19% from Q3 2023

- Gross profit / mine operating income of $5.7 million

- Mine operating cash flow before taxes of $6.7 million

- Net income of $1.2 million, or $0.01 per share

- Adjusted earnings of $5.0 million, or $0.04 per share

- Earnings before interest, taxes, depreciation and amortization (“EBITDA”)3 of $3.8 million

- Cash costs per silver equivalent payable ounce sold of $14.94, down 12% from Q3 2023

- All in sustaining cash costs per silver equivalent payable ounce sold of $22.06, down 3% from Q3 2023

Nathan outlines the consistent silver, gold, and copper production coming from the Avino Mine, where the Company realized strong revenues driven by higher metal prices and a 13% increase in production at the mine. said Nathan Harte, Chief Financial Officer. He highlighted improvements once again in all key financial metrics compared to Q3 2023, with cash flow generation and improving operating margins bolstering their cash and working capital positions.

For the balance of the discussion we shifted over to the ongoing development work at the La Preciosa Project, and once the final explosives permit is received, then work on the underground decline will commence and mining will get underway with first production expected in 2025. Then the Oxide Tailings Project is in cue for a few years out with low ~$10 All-In Sustaining Cost, it will contribute to the 5-year production growth plan.

If you have any follow up questions for Nathan or would like further information on any of the topics we discussed please email them to me us at Fleck@kereport.com or Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Avino Silver & Gold at the time of this recording.

.

Click here to follow along with the latest news from Avino Silver and Gold

.

.

This was pointed out recently by Egon von Greyerz, “The total Gobal Gold Reserves held by Cental Banks (37.000 tonnes) are valued at $3.1 trillion at a market price for gold of $2700 US. Microsoft has a bigger valuation than the gold backing of the global financial system.”

I will go him one better Nvidia has a bigger valuation than Microsoft at $3.31 Trillion. The market cap of those two companies is more than double the gold backing of the global financial system. That is absurd, we are living in a hyperinflated tech stock market bubble that most can’t see, and which will implode. If Roger Babson was alive today, he would be gesticulating wildly about this stock market. DT 😉