Amex Exploration – Introduction To The Mineral Resources, Preliminary Economics, And Ongoing Exploration At The Perron Gold Project In Quebec

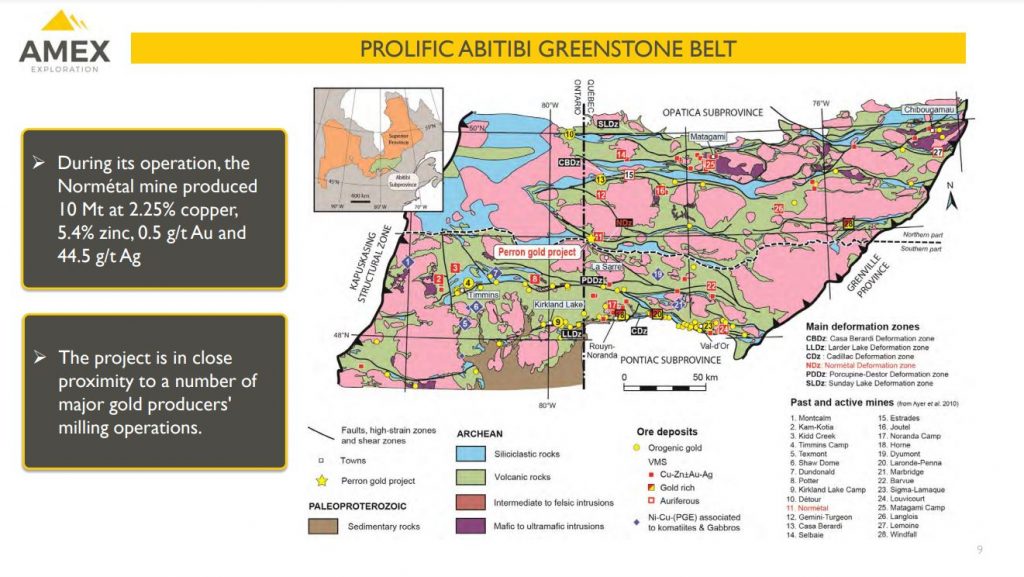

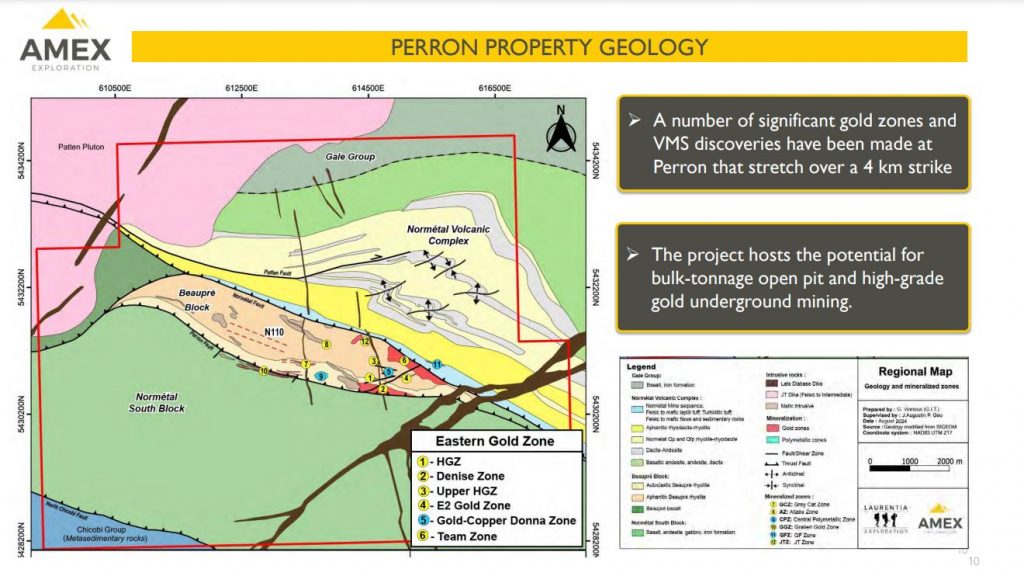

Victor Cantore, President and CEO of Amex Exploration Inc. (TSXV: AMX) (OTCQX: AMXEF), joins me for an introduction into the Company, and the growing resources and recently announced preliminary economics around their 100% owned high-grade Perron Gold Project located in Quebec, Canada; consisting of 117 contiguous claims covering 4,518 hectares.

We start off getting a sense of the years of historical work completed on this project, and how the over 500,000 meters of drilling that led to a Maiden Resource Estimate of 0pen pit and underground stope constrained 594,100 of measured and indicated ounces at 4.28 g/t Au and 1,049,650 of inferred ounces at 3.80 g/t Au. This initial resource at 1.6 million ounces of gold in all categories is just a snapshot in time, and doesn’t include the 28,000 of additional meters the team has drilled since the June cutoff, and Victor explains that there other areas of mineralization not previously included in the resource since it required tighter drill spacing density. The main point emphasized was that this was plenty of resource to illustrate the point that this has the potential to be an economic mine, as highlighted in the PEA announced on November 13th, 2024.

Perron Preliminary Economic Assessment Highlights:

[The following assumes a gold price of US$2,000/ounce (“oz”) and a C$/US$ exchange rate of 1.35:1.]

- 1,750 tonnes per day (“tpd”) production rate with a Life-Of-Mine (“LOM”) of 10 years;

- Average diluted grades for gold (“Au”) at 5.26 grams per tonne (“gpt”);

- Years 1 to 5: average diluted grade at 6.49 gpt Au.

- Average annual production of 101,000 oz Au, or 1,014,000 million oz Au over LOM;

- Years 1 to 5: average annual production of 124,000 oz Au (620,000 oz Au).

- LOM All-in sustaining cash costs (“AISC”) of US$807/oz Au;

- Years 1 to 5: AISC of US$739/oz Au.

- Initial Capital Expenditure (“Capex”) of $229 million;

- LOM Sustaining Capex of $230 million;

- Pre-tax IRR of 59.5% and After-tax IRR of 40.2%;

- Pre-tax NPV of $948 million and After-tax NPV of $525 million;

- Cumulative Pre-tax Undiscounted Net Free Cash Flow of $1,333 million and Cumulative After-tax Undiscounted Net Free Cash Flow of $767 million; and

- Pre-tax payback period of 1.5 years and After-tax payback period of 1.8.

Victor outlined how these economics are far surpassed to the upside when factoring in the metals sensitivities of todays spot gold pricing backdrop. We also got into the exploration focus of the company that will be drilling 24/7 through year-end and all through 2025, with plenty of drill assays to be releasing to the marketplace consistently as the resources continue to grow.

We wrap up getting the background of key management team and board members of Amex Exploration, the synergistic relationship with a key strategic shareholder, Eldorado Gold Corp, and we discuss the financial health of the company with about $20 million in the treasury in both hard dollars and flow through funds, to enable the work programs are funded into next year.

If you have any questions for Victor regarding Amex Exploration, then please email me @ Shad@kereport.com and we’ll get those addressed or covered in future interviews.

- In full disclosure, Shad is a shareholder of Amex Exploration at the time of this recording.

.

Click here to follow the latest news from Amex Exploration

.

.