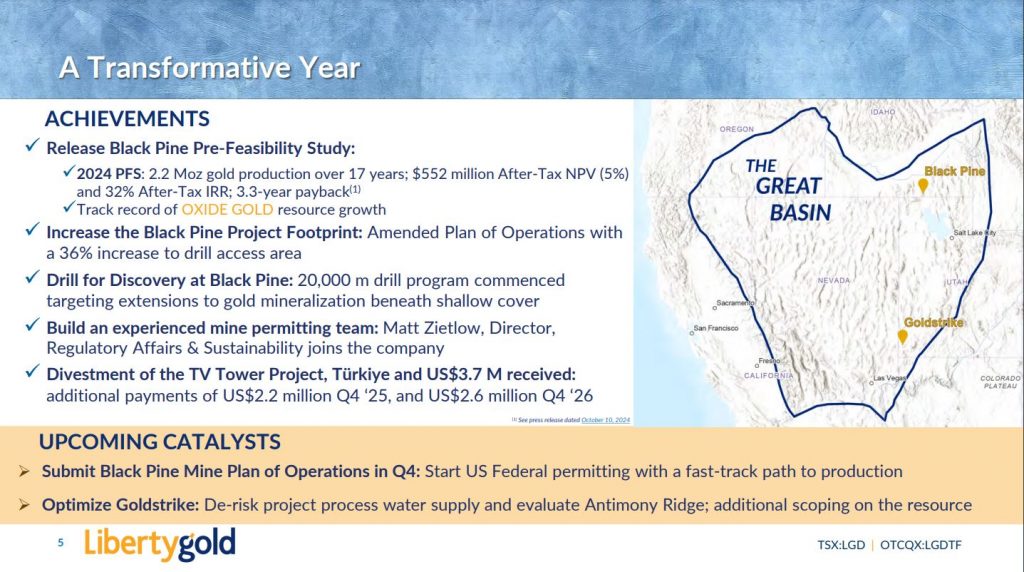

Liberty Gold – Key Value Drivers At The Black Pine And Goldstrike Gold Projects In The Great Basin

Jon Gilligan, President and COO of Liberty Gold (TSX:LGD; OTCQX:LGDTF), joins me for a comprehensive update of the exploration, development, and future value drivers at both the Black Pine and Goldstrike oxide gold, open-pit, heap leach Projects in the Great Basin.

We start off reviewing the key metrics from the Pre-Feasibility Study announced on October 10, 2024:

- Open pit, run-of-mine (no crushing) heap leach operation with a one-year construction period and initial capital expenditure of $327 million

- Average annual production of 183 thousand ounces of gold in years 1 to 5 with Life-of-Mine average annual production of 135 thousand ounces of gold

- All-In Sustaining Cost for years 1 to 5 of $1,205 per ounce of gold and LOM AISC of $1,380 per ounce of gold

- $552 million After-Tax Net Present Value (5%) with a 32% After-Tax Internal Rate of Return and a 3.3 year payback at a base case gold price of $2,000 per ounce

- $1.296 billion After-Tax Net Present Value (5%) with a 62% After-Tax Internal Rate of Return and a 1.5 year payback at spot gold prices of $2,600 per ounce

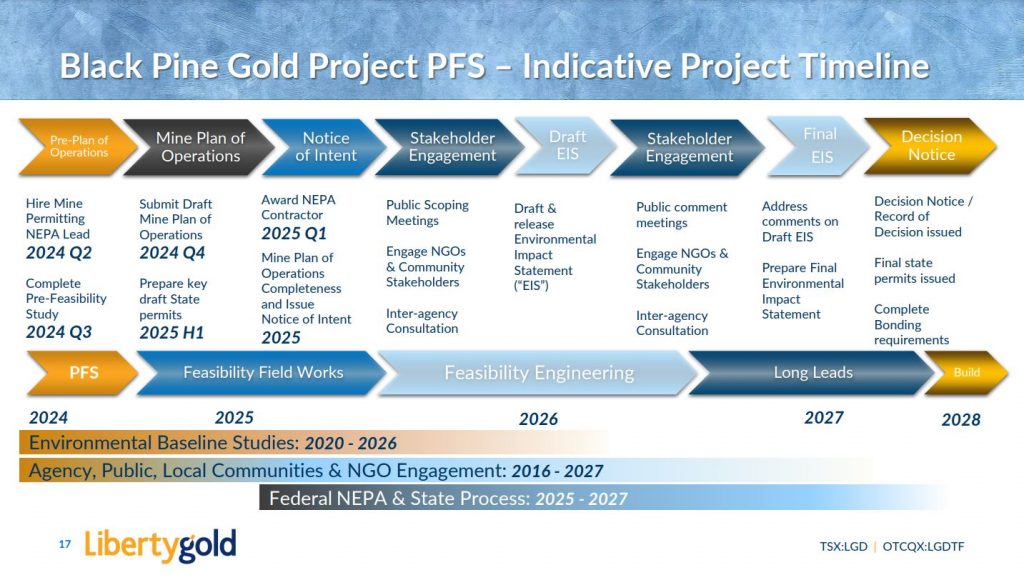

Additionally there is still a lot of room for exploration expansion at Black Pine, where the ongoing 20,000 ounce exploration program is exploring 7 key target areas for expanding near-surface mineralization and looking for more potential satellite pits. Jon also provides a detailed roadmap of the timeline of permitting milestones and derisking initiatives in front of the Company over the next 2.5-3 years through targeted construction and first gold pour.

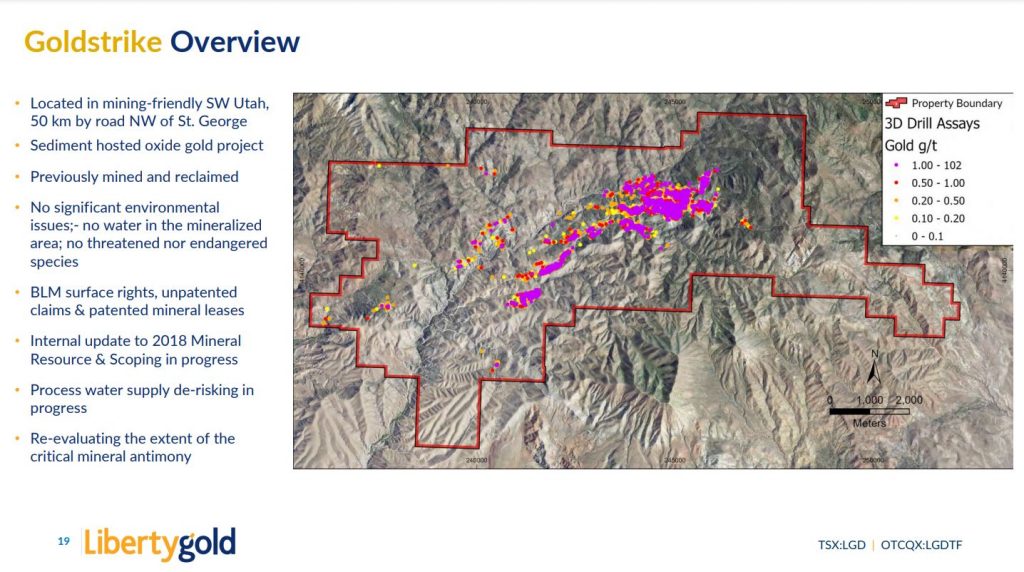

Next we got an overview of the Goldstrike Project in southwestern Utah, key derisking work on water rights, optimization studies, and the growing importance of antimony mineralization value as a co-credit to the gold in this Project.

We wrap up reviewing the financial health of the company, after the news announced October 7th of the sale of the non-core TV Tower copper gold project, located in Biga Province, northwest Türkiye, where the Company has received US$3.7 million representing the Company’s share of the payment due upon closing; with the remainder of the gross proceeds will be paid in two stages as follows:

- US$2.2 million on October 4, 2025.

- US$2.6 million on October 4, 2026.

This gives Liberty Gold a solid treasury of near $11million at present, and plenty of capital to advance the ongoing exploration and derisking work programs at both Black Pine and Goldstrike moving into 2025.

If you have any questions for Jon regarding Liberty Gold, the please email me at Shad@kereport.com.

.

Click here to follow the latest news from Liberty Gold

.

.

The leader of The Progressive Conservative Party in Canada who is way ahead in the poles yesterday stated that he will not allow The Bank of Canada to produce a CBDC (Central Bank Digital Currency). He believes in small government so the citizens can keep more of the money their hard work earns. DT 👌🤣

Interesting…………….

FREAKY FRIDAY AGAIN………………..LIBERTY…………. AND GOLD………………