West Red Lake Gold – The Capital Stack Has Been Set Up And Restart Activities Are Underway To Put The Madsen Mine Back Into Production

Gwen Preston, VP of Communication at West Red Lake Gold Mines (TSX.V:WRLG – OTCQB:WRLGF), joins me to review the recent capital raise via equity and the ongoing deal for structuring a debt facility, in tandem with all the initiatives on the ground and underground, to support the restart of gold production next year at the Madsen Mine, in the Red Lake district of Ontario, Canada.

On October 24th, the Company announced that it has closed its previously announced public offering of 41,666,800 units of the Company at a price of C$0.69 per Unit, for aggregate gross proceeds to the Company of C$28,750,092. This in combination with news released on October 17th, announcing the US$35 million (approximately C$48 million) loan facility with Nebari Natural Resources Credit Fund II, LP bearing interest of SOFR (Secured Overnight Financing Rate) plus 8% with a term of 42 months, gives them the capital stacked needed to put the Madsen Mine back into production in mid-2025. Gwen takes some time to unpack the company thinking on different possible options, and they elected to go with the balance of equity dilution versus debt that they did, when the bullish gold pricing environment backdrop that we have seen all year long.

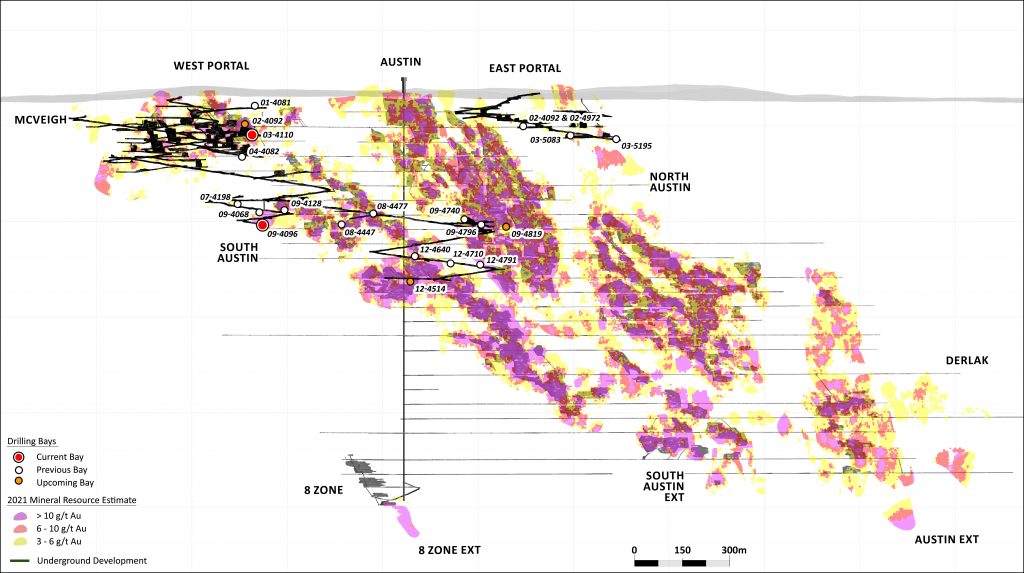

Next we got into all the mine restart activities well underway, encapsulated in a news release from October 31st, getting into the tailings dam lift, the definition drilling, and the ramp up from one to three development crews operating underground at Madsen throughout 2024. Miners are creating access for definition drilling while keeping the 2 underground drills turning, as well as working on completing the Connection Drift, and creating access to multiple areas in advance of mining, as well as starting the test mining program. All of this is building towards the release of a Pre-Feasibility Study in about a month’s time, and Gwen sheds light on why this PFS will be more expansive and have more known metrics than most PFS documents we see in the industry working off cost and method assumptions versus the prior and current data that this coming economic study will incorporate.

If you have any follow up questions for the team over at West Red Lake Gold please email me at Shad@kereport.com.

- In full disclosure, Shad is shareholder of West Red Lake Gold Mines at the time of this recording.

.

Click here to visit the West Red Lake Gold website and read over the recent news we discussed.

.

.

This one has probably seen its low.

https://schrts.co/hMKQpWRx

I do not own it.