Sierra Madre Gold And Silver – Ramping Up Towards Commercial Production By Year-End At The La Guitarra Mine

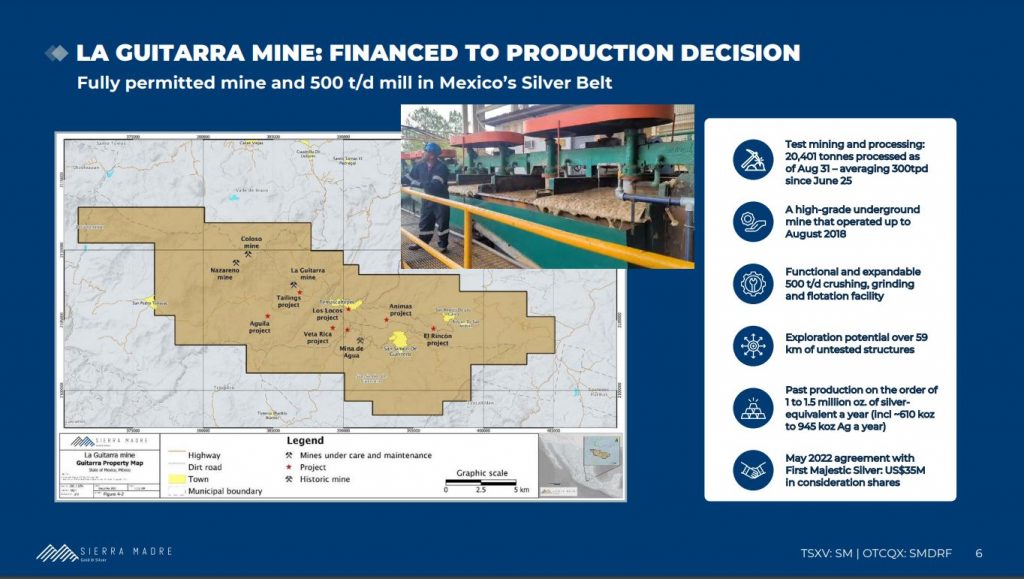

Alex Langer, President and CEO of Sierra Madre Gold And Silver (TSXV: SM) (OTCQX: SMDRF), joins us for an introduction to this brand new precious metals producer, currently ramping up towards commercial production by year-end, at the La Guitarra Mine, in Mexico. The La Guitarra Mine complex is a permitted, past-producing underground mine, which includes a 500 t/d processing facility that operated until mid-2018; which was purchased from First Majestic Silver (TSX: AG) (NYSE: AG) in 2023, and just went into test mining on June 25th of this year.

The Company announced on September 24th, that it has generated in excess of $2.4 million in revenues since the commencement of the test mining and milling phase at the Guitarra mine complex. Daily throughput rates of economically interesting silver and gold mineralization have averaged 350 tonnes per day (TPD) over the past 30 days. Alex shares with us that the plan is to incrementally move it up to 400 TPD next month, and then up to 500 TPD by year-end, where commercial production can be declared. He also shares the pathway forward to growth where after a full year of 500 TPD production slated for 2025, that there process to grow the mill throughput to 650 TPD in 2026, and then all the way up to 1,000+ TPD by the end of 2027.

Next we got into the larger growth vision of the company, as it will turn it’s it focus to exploring this district scale land package the end of next year, funded through organically generated revenues. The property hosts 8 different past-producing mines, with the first 2 priorities being to explore around the El Rincon and Mina de Agua mines. Additionally, there is a non-compliant 17 million ounce historic resource at the Nazareno Mine, and also solid underground infrastructure at the nearby Coloso Mine, that First Majestic had put quite a bit of sunk cost into already that will be an area of future expansion.

We wrap up discussing the benefits of having First Majestic as a key 44.9% stakeholder, where they have provided data, employees, and a small loan to the Company at favorable terms. Management and insiders hold a heavier 24.8% stake in the company, with no outstanding warrants, and with several key members of the management team that have worked at and operated the La Guitarra mine in the past.

If you have any questions for Alex regarding Sierra Madre Gold and Silver, then please email us at either Shad@kereport.com or Fleck@kereport.com.

- In full disclosure, Shad is a shareholder of Sierra Madre Gold & Silver at the time of this recording.

.

Click here to follow along with the latest news from Sierra Madre Gold & Silver

.

Click here to see the latest Corporate Presentation for Sierra Madre Gold & Silver

.

.

Nope! … lol

FREAKY FRIDAY AGAIN………………

Jerry, even when you say that in a roaring voice (capital letters) it fails to get noticed by the half-witted sheeple or as Mencken would say the “anthropoid rabble.” DT 😉

You are one of them.

Grumble, you are a total IMBECILE and Numbskull! The problem is that you don’t know what either of those two words mean, as usual I am wasting my time on homo boobus. DT 😉🤣😜

GOOD ONE >>>>>>DT…………………… 🙂

Silver looks like it is getting ready to take out $33. DT

… and poof! It’s an industrial metal going up on strong jobs data, I hope this is more than short covering but I’m impressed by this move too.

Silver

Canada’s Ivey PMIs are both over 50 and increasing, possibly from the strength in the US since they are 80ish % of our exports.

Silver needs to hold above $32 for awhile…. (I think the number is $32.50)

Silver is going up , no doubt about that……

Who ever thought the GSR, would be 80 to 100… for this long….

DOLLAR TO SILVER RATIO…………….. 1 to $1550…, you can see the number at usdebt clock…. 🙂

THE ELITES in charge of the GOVT…… want you broke…… real simple…. 🙂

SGN, Scorpio has a stealth rally going on IMO… I don’t own any but that may change soon.

Holy crap… this is the big M&A news of this week for the silver stocks:

____________________________________________________________________________

(CDE) Coeur Announces Acquisition of (SILV) SilverCrest to Create Leading Global Silver Company

October, 04, 2024

Hi Ex, that is interesting, I wonder if Silvercrest anticipated such a move. I don’t follow either, but it looks like it could have gone either way. DT

Hi DT – I’ve got big positions in both Silvercrest and Coeur Mining, but aside from my biases as shareholders in both companies, I think this is significant transaction for the Silver producers in general.

It shows Coeur comfortable expanding their presence in Mexico, at a time when many investors are still tenuous about the country for silver stocks. It also takes off the board one of the best single-asset silver producers around in Silvercrest, with high-grade, high-margins. With both Gatos Silver and Silvercrest being scooped up lately, that really on leaves Mag Silver and Aya Gold and Silver as the last high-grade high-margin single asset producers left.

I’m likely going to write up a piece over on my Substack channel about this, as it’s really got my wheels turning… Stay tuned….

CDE -10%, SILV +10%. Looking forward to your in depth analysis of this deal, the structure of it…etc

Mexico may not be a problem until there is an indication there is a problem. Not every country puts party before country. The new President may be more business oriented than anticipated.

https://www.tradingview.com/x/wxGKcGRe/

DOLLAR: Bearish Continuation Expander?