Omai Gold Mines – Exploration And Development Update On Both The Wenot and Gilt Creek Projects In Guyana

Elaine Ellingham, President and CEO of Omai Gold Mines (TSX.V: OMG) (OTC: OMGGF), joins me for an update on all the exploration and derisking work going on at both the Wenot and Gilt Creek Projects across this mineralized gold trend in Guyana, South America.

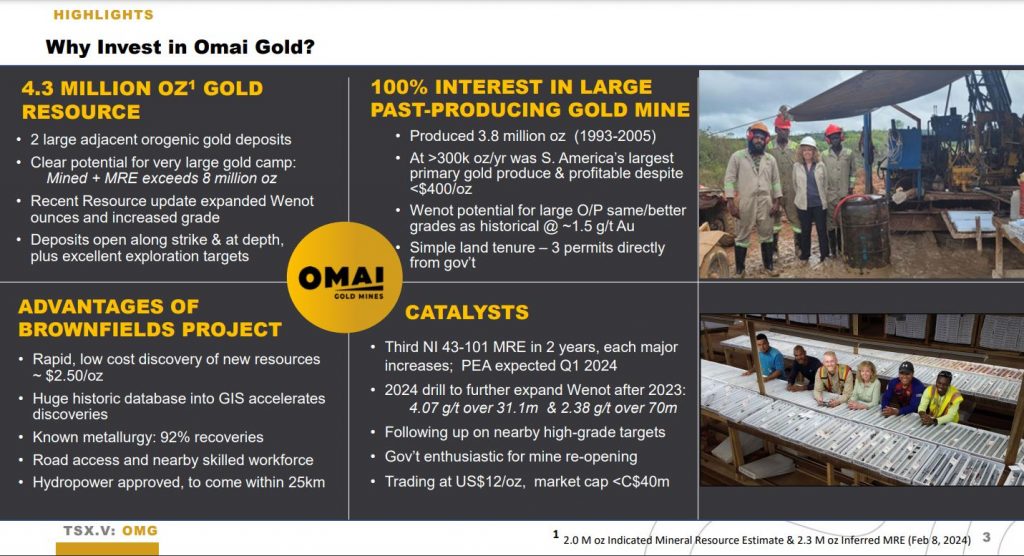

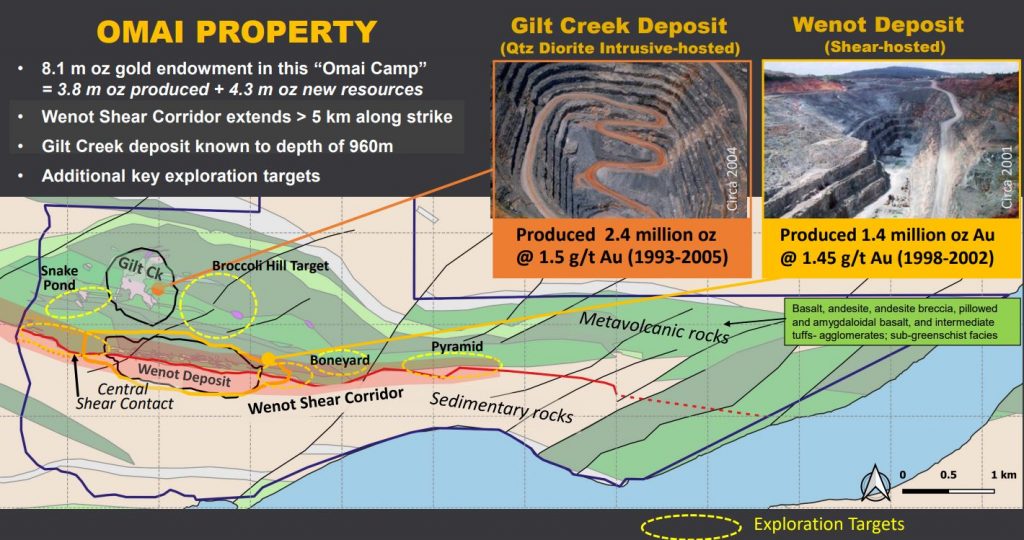

We start off discussing the large resource in place between the 2 Projects, at over 4.3 million ounces of gold, across this brownfields and past-producing mine site. We review the PEA again on the open pit Wenot Project, which does not yet incorporate the Gilt Creek underground project economics at this point, and only includes about 45% of the mineral inventory. Elaine outlines the potential to keep exploring for mineralization at depth, beneath the pit shell, as well as along strike, and there is a current 10,000 meter drill program underway that kicked off in July. With the completion of their recent financing, Omai has $11 million in the treasury, and they are well positioned both their 2024 and 2025 exploration and development programs. They are considering adding a drill at one point to test a few more targets at the Gilt Creek project and keep expanding resources there.

Next we talk about the infrastructure and social advantages of this brownfield site in Guyana, the support of locals and the government to move this mine back into production. We touch upon the ongoing permitting, metallurgical work, and other derisking work the company is doing in the background to further improve the project economics. There should be a steady stream of exploration newsflow for the balance of this year.

If you have any questions for Elaine regarding Omai Gold Mines, then please email me at Shad@kereport.com.

.

Click here to see the latest news from Omai Gold Mines.

.

Omai Gold mines is a compelling story with 4.3 million ounces of gold and $11 million in the treasury, but I don’t like the number of shares, management has let this get way out of hand. You look at the price of 15.5 cents CDN and you think nice, but you know they must do a share consolidation at 10 for 1. That is what turns me off. I will wait till they do a reverse split before thinking of taking a position. With shares outstanding at 516.6 million, warrants at 27.9 million, options 39.2 million for a total of 583.2 million shares, that is a lot of investor dilution. When the split happens a lot of small investors get driven off never to return and the price falls further because most don’t do any Due Diligence.

There is always the dream of a takeover but that too will mean that for most, they will still be underwater. A lot of managers are lousy at handling finances, finances are so important because so many things can go wrong and do with these juniors. If you can’t control the share count when times are bad you will never be good at it when financing becomes easy.

I will also add that $11 million these days doesn’t last long unless the money is handled very carefully with an eye to looking out for the investor. DT

Are they way out over their skis?

More shares than I like but I have taken profits on my .02 to .05 shares but maybe it will work out for the rest.

Thanks for the detailed update. This sounds like a good one and well managed.