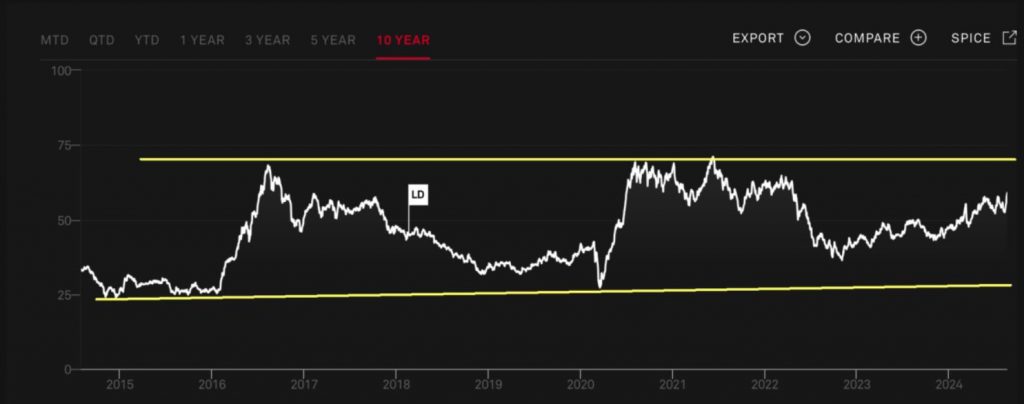

Jordan Roy-Byrne – Gold Close To Breaking Out To New Highs In Inflation-adjusted Terms, And Both GDX and GDXJ Close to Breaking Out Above Lateral Price Resistance

Jordan Roy-Byrne, CMT, MFTA, and Editor of The Daily Gold, joins us to review the significance of gold getting close to breaking out to new highs in inflation-adjusted terms, and both GDX and GDXJ are close to breaking out above multi-year lateral pricing resistance.

He is watching these indicators closely to confirm a legitimate breakout in the gold sector, and of course still monitoring for it to break out versus US equities in real terms. We also review gold versus the WTIC oil price, as a good gauge on commodities, inflation, and as a major cost factor in the margins of producers. We also touch on the small to medium cap stocks in the TSX Venture Gold Sub Index (CDNX), and how this could portend to even the junior gold stocks getting close to really breaking out in a significant move.

.

Click here to visit Jordan’s site – The Daily Gold

.

https://www.tradingview.com/x/R3vuDKbq/

Dr. COPPER for the General Markets.

Prophet SILVER for the PMs.

Some clarification of my comments concerning my personal account performance discussed on the Dave Erfle thread:

The significant data point from the review of the last 42 days of trading in my Junior Explorer account was this (Which should concern all of you that trade the markets);

Main Issue: No matter whether the account traded in an alternating pattern “while the markets were open” , AFTER the markets closed at 4:00PM EST, my account was taken down 22% between Market Close and Open the next day over the 42 day trading period. In summary, almost ONE QUARTER of my account value disappeared after the Markets closed for the general retail investors … with no evidence of how it was done other than the repetitive “errors in reflecting accurate closing prices consistent with the New York close.”.

You never responded last time when I asked so I will ask it again ……did you check to see if they used the closing bid price for calculating account value. That is what td does in my accounts and yes it’s confusing

You don’t understand him he loves to GRIPE and WHINE; in fact, he lives to gripe, and he will let nothing get in his way of achieving just that! Visit an old age home and you will see what I mean. LOL! DT 😉

Wolf:

Sorry for not responding. I probably did not look back at the thread as hardly anyone responds to anything anymore and I have “discovered YouTube” and listen most of the day to podcast including those by Cory and Shad.

In answer to your question: Schwab does use closing costs but often gets them wrong (I think intentional). At the 4:00PM EST close they may use a close consistent with OTC markets. Let’s say using the 4 PM OTC closing values gives you an account value of $10,000. I usually don’t check the aftermarket close but have been known to check account value at 4AM. What has been happening repetitively is that before market opens the next day and after EOD processing, the account rather than totaling $10,000, it may total $9,800.

I print out every day’s 4PM close ….So I compare the individual closing values at 4pm the previous day and the premarket individual values before open on the current day and find out which individual values differ. Then compare the ones that have different values from the previous day close in my “Customer Account” against the closing value shown in the premarket Schwab “Research Page and their Trading Page”. If they do not match the Customer Page …. Then I go to the OTC market page to see what it matches. If the OTC Markets and the Schwab Research and Trading page all match but the Customer Account page is different then I go to IbKR and yahoo finance to verify that the ONLY place the closing price has changed is in my Customer Account. Then I complain to Schaub and have gotten every excuse in the World for not correcting it including “the closing value in Customer Accounts achieves its intended purpose”.

Now maybe everyone thinks I am a little picky, but these overnight closing price deviations from what all other sources reflect, have reduced my account by over $25,000 with no acceptable explanation over a recent 42 trading day period.

Nvidia came out with news last night after the market close on the most recent fiscal quarter and it surpassed expectations on the top and bottom lines. Today the stock dropped -6.32%, or -$7.94, or it lost $194.5 billion in market cap. Can we say, “SELL THE NEWS”! This sort of volatility is making investors nervous when you see good news and the stock gets sold off. This is telling you something but are you listening? Is this the smart money getting out or have they already left? DT 😉

I think they left….. when they did the “split”…… 🙂

Three separate law firms have joined into the fray! One is trouble enough but three! LOL! DT

https://www.tradingview.com/x/H21bSkBd/

NVIDIA post market 38.2% pull back.

This may be most of the move.