Stillwater Critical Minerals – Reviewing The Final Tranche Of 2023 Drill Results From Stillwater West And The Polymetallic Value Proposition

Michael Rowley, President and CEO of Stillwater Critical Minerals (TSX.V: PGE – OTCQB: PGEZF), joins me to review the final tranche of drill results from resource expansion drilling completed at the Company’s flagship Stillwater West Ni-PGE-Cu-Co + Au project in Montana in 2023. We dig into what these results mean for the continuity and polymetallic prospectivity of the updated geological model that is coming into focus, as well as the value drivers moving forward on their 4 other non-core properties.

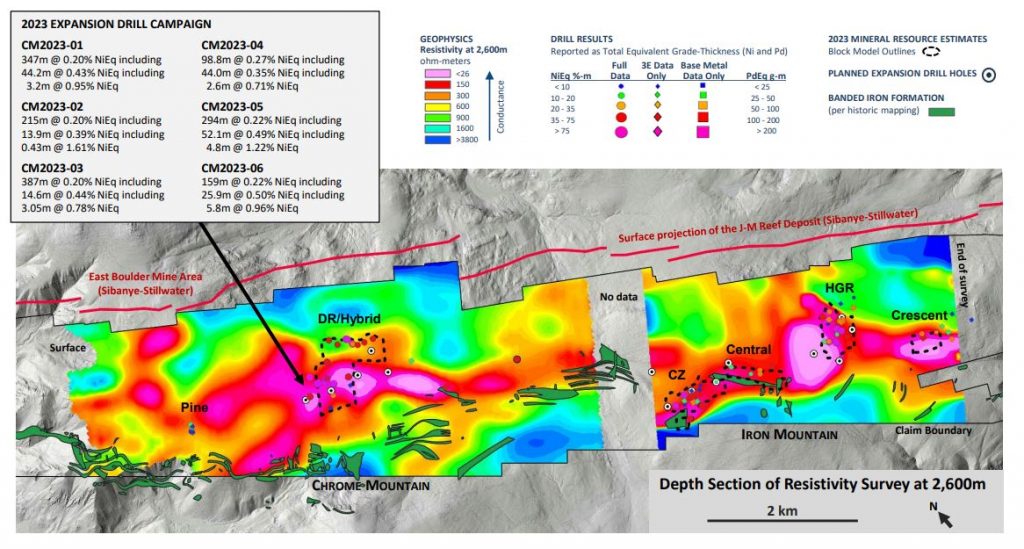

With regards to the Stillwater West Project, in 2023 a total of 6 holes totaling 2,310 meters were completed within and outside of the current resource area, west and south of the current DR-Hybrid deposit, as part of a planned multi-phase program. The focus was on expanding recent high-grade discoveries at Chrome Mountain at the west end of the nine-kilometer-long resource area. Holes CM2023-01, -02 and -03, reported here, targeted and successfully intercepted magmatic nickel and copper sulphide mineralization with significant platinum group element (“PGE”) in several styles of mineralization, furthering known parallels with the Bushveld Igneous Complex, in particular the Northern Limb, or Platreef.

We get into the parallels between the Stillwater Igneous Complex and the Bushveld Igneous Complex and South Africa’s Platreef district, which hosts very large Ni-Cu-PGE mines that are now in operation by Ivanhoe Mines and Anglo American. We also discuss some of the new understanding of a second mineralized event on the property producing what have been labeled as the “N series” of sulphide-rich mineralized structures parallel to high-grade nickel sulphide mineralization first discovered by the Company in prior drill holes CM2021-05 and CM2020-04. We also discussed the deep roots under Chrome Mountain as a potential feeder system warranting further follow up drilling in 2024.

Mike also highlighted that the Company has other value drivers being overlooked by the market place at their other 4 non-core properties: The Drayton-Black Lake Gold Project where Heritage Mining (CSE: HML), is under an earn-in agreement, by which they can earn a 90% interest in the project by completing work commitments and making payments of cash and shares to the Company. There has also been some additional exploration work at the Company’s 100%-owned Kluane PGE-Ni-Cu project in Yukon, Canada, funded in part by a Yukon Mineral Exploration Program grant. We also mention the potential for further value drivers at both the Duke Island Project in Alaska and their long-standing Yankee Dundee Project in British Columbia.

If you have any questions for Mike regarding Stillwater Critical Minerals, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Stillwater Critical Minerals at the time of this recording.

.

Click here to follow along with the latest news from Stillwater Critical Minerals

.

Still holding Stillwater.

Me too. The longer-term value arbitrage between their insitu metals value in the ground versus their market cap is simply mind-boggling.

Me Three! DT

I’m long Emerita for the same reason.

I’ve held on to some PGE for the long haul too.

Still holding… still underwater… still adding

(I guess I just can’t stand still)

🙂

Nvidia lost $200 billion U.S. today. Can somebody tell me that I can’t see the forest for the trees. I had my eyesight checked today and it checks out. In one month from the top on June 18th 2024, Nvidia has lost $563 billion, and nobody here can see other than me that these kinds of numbers can crash the system. This is WACKO Land. I hope you guys have some phyz. I hope when the system dumps that you have some cash on hand to buy at Bargain Harolds. LOL! DT🤣