Barton Gold – Multiple Exploration And Development Updates At The Tunkillia And Tarcoola Projects

Alex Scanlon, Managing Director and CEO of Barton Gold (ASX: BGD) (OTCQB: BGDFF), joins us to review multiple exploration and development news releases over the last few months, along with updates to the resource estimates at both the Tunkillia and Tarcoola Projects in South Australia.

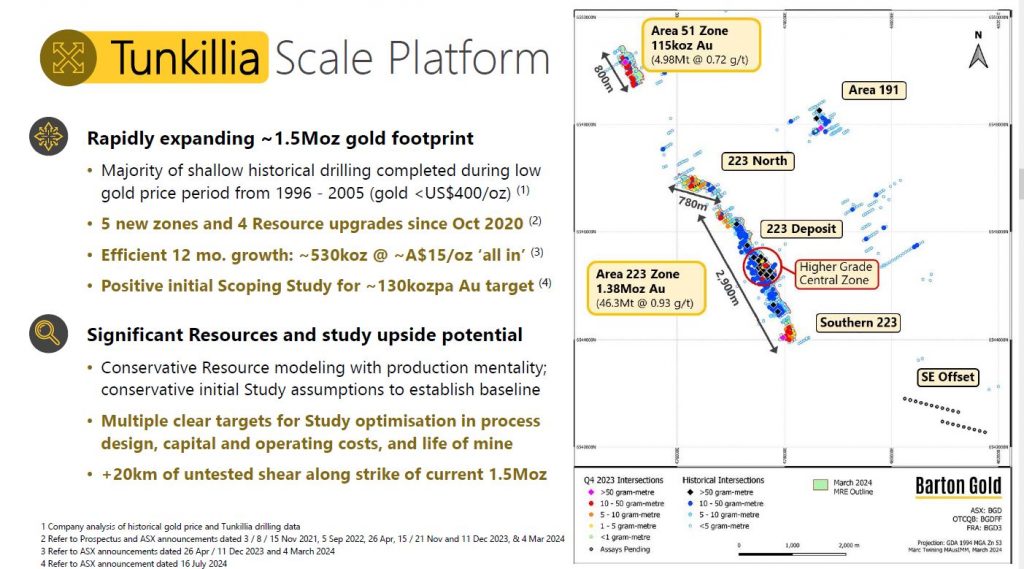

We start off reviewing the updated Tunkillia Gold Project JORC Resources that have grown earlier this year to 1.5Moz Au, and that the company has just released a Scoping Study to wrap some preliminary life-of-mine metrics and economics around the Project.

Key Highlights from the Tunkillia Scoping Study:

- Initial 6.4 year life-of-mine (LOM) and total ~8 year project life (including construction), with a total of 30.7Mt processed materials grading an avg 0.93 g/t gold (Au) and 2.52 g/t silver (Ag)

- Initial LoM estimates include:

- total payable metal of ~833koz Au and ~1,993koz Ag

- avg annual production of ~130koz Au and ~311koz Ag

- avg operating cashflow of ~A$1,626 / oz Au (net of by-product Ag credits), and

- avg All-in Sustaining Cost (AISC) ~A$1,917 / oz Au (net of by-product Ag credits), would currently rank Tunkillia #17 of 47 Australian gold operations reporting AISC / oz Au produced.

- Higher-grade ‘Starter’ pit during first ~18 months of mining and processing:

- 4.9Mt mill feed averaging 1.26 g/t Au and 3.32 g/t Ag

- total production of ~181koz Au and ~420koz Ag, and

- avg operating cashflow of ~A$2,265 / oz Au (~A$396m total) (net of Ag credits).

- ~A$374m initial capital cost (incl. ~A$70m EPC), before owner costs, pre-strip and contingencies

- Initial Net Present Value (NPV)7.5% ~A$512m, 40% IRR and 1.9 year payback (unlevered, pre-tax)

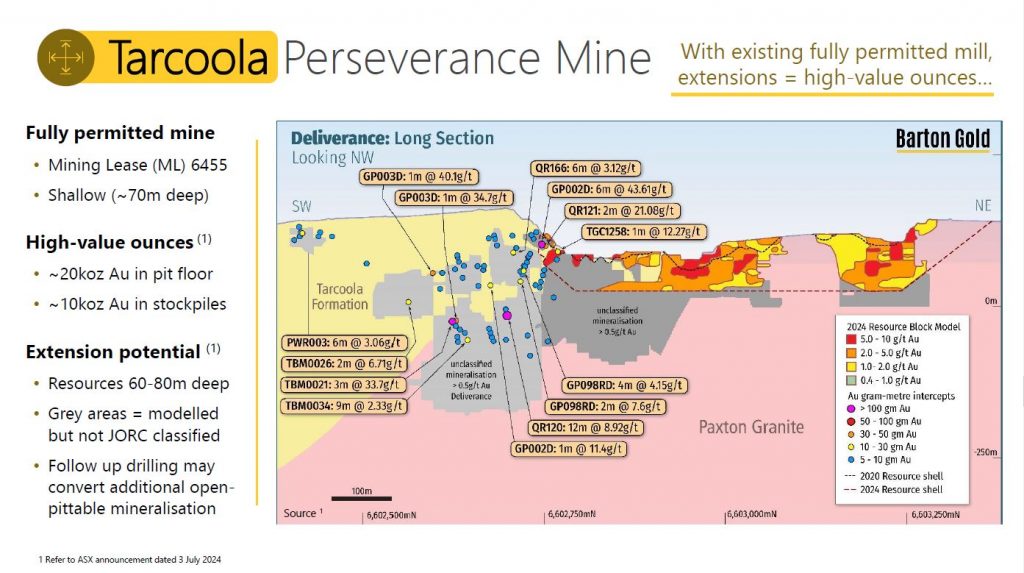

Next we transitioned over to the Tarcoola Project, and the resource updates there where the the JORC (2012) Mineral Resources were increased to ~20,00oz @ ~2 g/t Au at the Perseverance Mine area. These resources within 60 – 80 meters of open pit floor, with potential depth / strike extensions. There is ongoing drilling at Tarcoola to keep expanding the resources, with more drill news to come to market over the next few months.

Alex points out that Tarcoola gives the company optionality in that it is a higher-grade open pit that could be trucked up to their 100% owned Central Gawler Mill to bring in revenues and augment the development funds needed down at Tunkillia. The Central Gawler Mill has now been reported to have a replacement cost of $100Millon (about double their current market cap), and was just cleaned out and optimized, resulting in gold being recovered and sold for $4.25Million.

- If you have any questions for Alex about Barton Gold, then please email us at Fleck@kereport.com or Shad@kereport.com.

.

Click here to see the latest news from Barton Gold

.