EMX Royalty Corp – Multiplicative Optionality Across 170 Precious Metals And Critical Minerals Royalties

Dave Cole, President and CEO of EMX Royalty Corp (TSX.V: EMX) (NSYE: EMX), joins me for a comprehensive update on their distinguishing value proposition in the royalty space, a number of copper, gold, and critical minerals partner project updates, a number revenue-generating pre-production royalties, a review of Q1 financials, and the balance between further paying down debt in tandem with buying back Company shares.

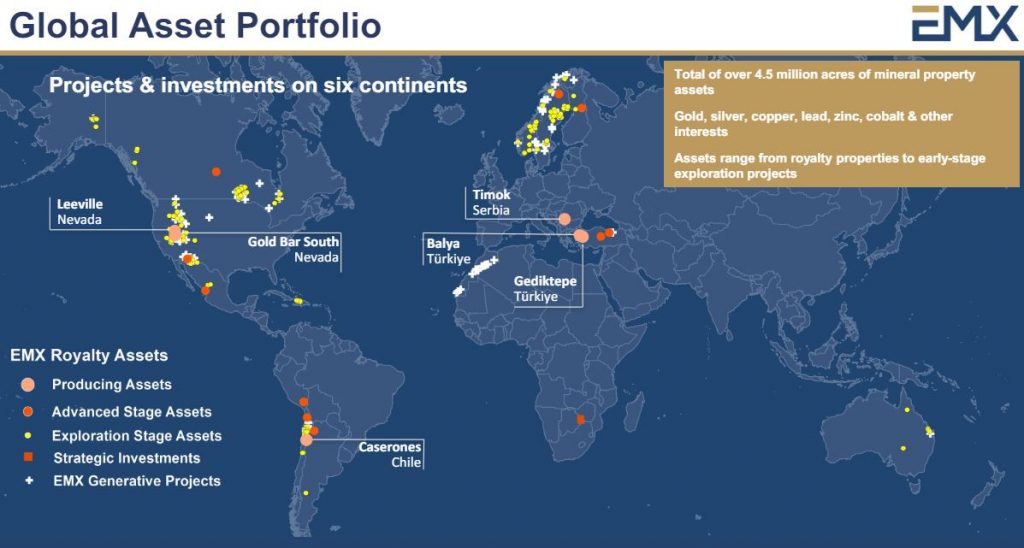

We start off discussing the multi-prong approach of generating revenues from existing properties optioned off to other operators, and then creating royalties, in addition to buying royalties in the market when the right value accretive dynamics are in place. At present EMX Royalty has 6 producing royalties and around 50 other royalties bringing in revenues from defined pre-production payments, option payments, and gate payments.

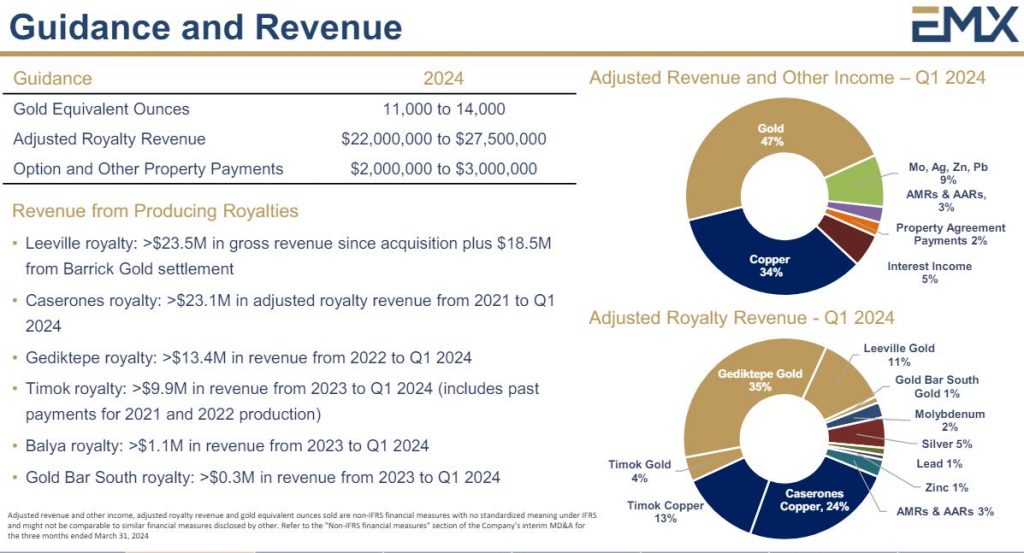

Next we discussed the substantial copper exposure and incoming cashflows that EMX has coming in from both the Caserones Project in Chile operated by Lundin Mining, and the Timok Project in Serbia operated by Zijin Mining, and as cornerstone generational assets. With regards to the producing gold royalties, Dave first outlines how the Gediktepe Mine in Turkey is throwing off great revenues from gold, but then will be transitioning to a polymetallic deposit in the years to come. Then he also outlines the stable gold production and long-life asset in the Leeville Mine in Nevada, operated by Nevada Gold Mines (the JV between Barrick Gold and Newmont Mining).

This leads into a broader discussion about how important it is to have quality operating partners on the royalty projects; leading us into a few more partner updates with South32’s $2.16Billion at the polymetallic Peake deposit on the Hermosa Taylor Project in Arizona, and the development-stage copper-iron-gold Viscaria project in Sweden, operated by Copperstone Resources.

We then shift over to reviewing the 44 other pre-production royalties that are still generating revenues via lease-option payments, stage-gate payments to advance properties, advanced minimum royalty payments, and that come in by way of cash and often times shares in partner companies. We do a brief review of Q1 financials and strength of the company, as well as have Dave break down the balance between paying down debt with buying back company shares, since the company is still trading below it’s net asset value.

Wrapping up we discuss the synergistic relationship between EMX Royalty and Franco-Nevada (FNV) where not only are they the new lender of choice for their recently announced $35 Million Loan, that clears out the prior Sprott loan, but Franco-Nevada has an investment stake in EMX, has syndicated royalty purchase agreements together in the past, and there is an ongoing joint venture partnership to acquire earlier-stage gold and copper royalties sourced by EMX.

If you have any questions for Dave regarding EMX Royalty Corp, then please email them into me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of EMX Royalty at the time of this recording.

.

Click here to follow along with Company news from EMX Royalty Corp

.

Correct. EMX doesn’t have any uranium exposure in their royalty portfolio, but they do have plenty of exposure to copper, gold, silver, zinc, nickel, PGMs, molybdenum, cobalt, tin, and lithium.

For exposure to uranium royalties, there is Uranium Royalty Corp. (UROY)

Just curious, not a problem

Yeah it is interesting that with exposure to so many commodities on their mineral licenses that none are on prospective uranium claims. Still they got a nice mix of precious and base metals.

FREAKY FRIDAY AGAIN…………..

Thursday was Freaky with Joe Blow dribbling show……. Elder abuse…. CNN should be real happy, what a bunch of MORONS…

Now the rest of The World and at home can see how obvious it is that Howdy Doody was kept in power by the ventriloquists who manipulated his body parts for their agenda and needs.

Dave Cole has a lot of enthusiasm. Looking at his royalty portfolio, don’t notice any uranium exposure, so wonder if he is interested in it.