Cosa Resources – Summer Exploration Program Updates On 3 Key Uranium Targets In The Athabasca Basin

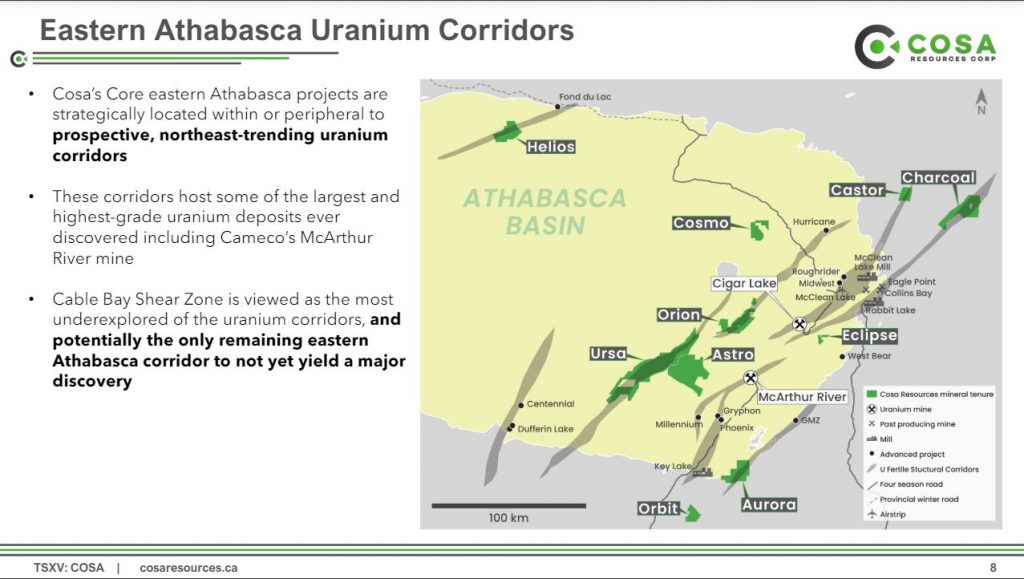

Keith Bodnarchuk, President and CEO of Cosa Resources Corp. (TSX-V: COSA) (OTCQB: COSAF), joins me to review the 3 key targets for this summer work program at this Canadian uranium exploration company operating in the Athabasca Basin region of northern Saskatchewan. The portfolio comprises roughly 209,000 ha across multiple projects in, all of which are underexplored, and the majority reside within or adjacent to established uranium corridors.

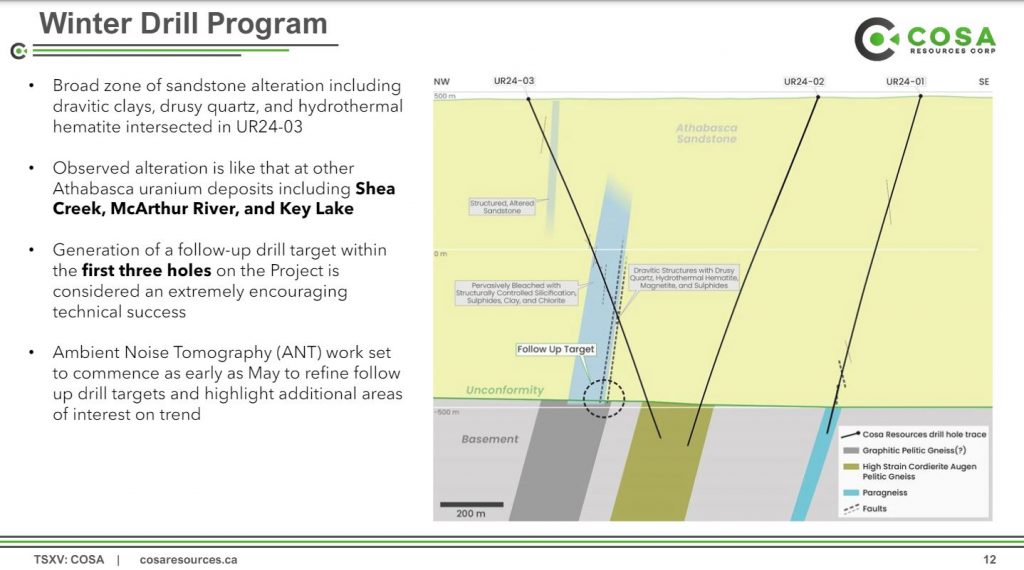

We start of discussing the 2024 drilling will kick off in August at their Ursa Project, following up on Drill hole UR24 -03 from the winter drill program, that intersected structure, alteration, and minor sulphide mineralization several hundred meters above the unconformity. The Ursa Project captures over 60-kilometres of strike length of the Cable Bay Shear Zone, a regional structural corridor with known mineralization and limited historical drilling. It potentially represents the last remaining eastern Athabasca corridor to not yet yield a major discovery. Modern geophysics completed by Cosa in 2023 identified multiple high-priority target areas characterized by conductive basement stratigraphy beneath or adjacent to broad zones of inferred sandstone alteration – a setting that is typical of most eastern Athabasca uranium deposits.

Keith then outlined Cosa’s award-winning management team, which has a long track record of success in Saskatchewan. In 2022, members of the Cosa team were awarded the AME Colin Spence Award for their previous involvement in discovering IsoEnergy’s Hurricane deposit. Prior to Hurricane, Cosa personnel led teams or had integral roles in the discovery of Denison Mines’ Gryphon deposit and 92 Energy’s Gemini Zone, and held key roles in the founding of both NexGen and IsoEnergy.

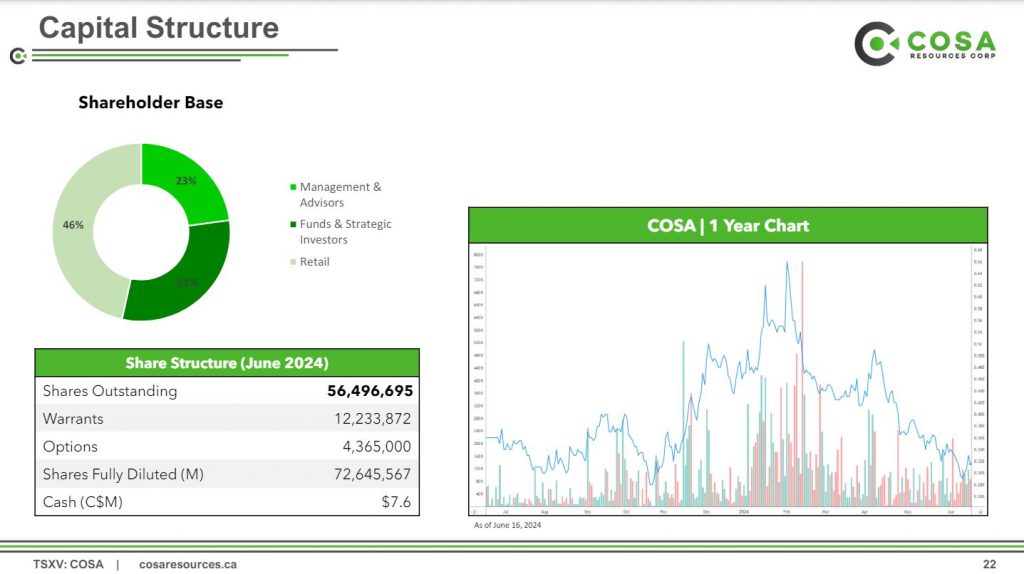

Next we pivoted over to both the Aurora and Orion Projects where the Company will be flying Airborne VTEM gravity at Aurora, and conducting ANT surveying at Orion, to further refine km-scale sandstone conductivity anomalies. Both projects are expected to be drill ready for H1 2025. We wrapped up with the share structure, key strategic investors, and the financial strength of the company to complete this year’s exploration and have access to capital in the future.

If you have any questions for Keith regarding Cosa Resources, then please email them in to me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Cosa Resources at the time of this recording.

.

Click here to follow the most recent news from Cosa Resources

.

Daily Pattern is alternating day of some up and some down with any stock reaching 100% gain being worked backward. Positive or negative news treated the same. Failure to put out drill results on a regular basis will be a walk back. Funding treated negatively. Explorers vulnerable to being undervalued with managed money and brokerage firms facilitating naked shorting for personal gain. Regulators not engaged or pressured to perform. Market intervention is dominant and data reporting false. Problem growing signaling failure of Western Commodity markets but wealth transferred to managed money of all forms. Reset appears unavoidable. Uncertain what form of government will surface.

Along the above lines, Hercules Silver put out a

drilling update today …but has not received drill results for this years drill to date. It was met with an orchestrated 20% negative hit. I bought, but as I said above, “the rule” is to hit the news no matter what the news is. That is classic AI intervention that affects price direction “without fact and basis”. I continue to be concerned about the illegality upon which markets operate without Regulator Control or Political intervention. Without representation under the Constitution, We are a country without law. Without law, the citizens are without security and protection and are at the mercy of the preemptive government. In other words, the transfer of wealth continues.

Willie Mays died at 93 yoa.

When I heard the news I picked up Bill James’ Historical Baseball Abstract’ and read the entry on Willy Mays. Brilliant stuff. Among many interesting angles it points out that one of baseballs’ unwritten codes is that no player can win more than three mvp awards. Suppresses interest in other great players it is supposed.

Between them Mays and Mantle had seven seasons each when they were clearly the best player and other seasons when they were at least the equal of the mvp winners.

The Milwaukee Braves chief scout wanted them to sign the teenaged Mays but they passed. They would have had Mays, Aaron, Mathews and Spahn at the same time.

R.I.P. Say Hey Willie.

Great post. I grew up during the era of Mays, Mantle, Aaron , Mathews and Spahn and so many others. I collected baseball cards and followed the game. The magic stayed in my head and the loss of each and every one of these “giants” of the game (and Yankees, Braves, Red Sox or Indians, etc) is always a personal loss.

I was a little league outfielder then and practiced his catching style where he held his glove on his waist and magically snagged fly balls.

The volume in these markets is really anemic. I know I got into a discussion with Ex about this, but he saw things differently. Today The U.S. markets are closed but if you look up the price history on a lot of these stocks the buyers have dried up. Wolfster today mentioned GASX, and it has terrific volume but most of these juniors I would trade as many stocks in one day as they sell in one day. The market for juniors is abysmal and nobody seems to mention this and if you look up a lot of developers and producers the volume is way down in comparison to where it should and where it would be with the price of commodities improving. It’s always a factor of a number of variables but no one wants to mention that the Moms and Pops are broke. DT

DT; silver is at $29.56. We have 7 trading days to the end of the month. That means we need to average price gains of $2.92/trading day to hit $50.00 by the end of the month—do you think we can do it?

richard, (Doc) I didn’t make that prediction, but Chen Lin has been very successful as a trader, the mantle is his to win or lose. DT

My opinion was that it would be no earlier than July if (that’s IF) he got his squeeze which he didn’t.

Either way, silver is behaving superbly as it bullishly continues to avoid everyone’s downside targets.

https://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=11&dy=0&id=p82487492495&a=1663367326

Stop complaining or go trade elsewhere

Grumble, I’ve got a better idea, why don’t you disappear, you are the one who adds nothing but your stupid complaints. LOL! DT

Hi DT. Sorry for the delayed response but I’m traveling. I actually agree with you on the anemic volume, as a general observation in the resource sector overall. There is still muted buying or selling overall for gold, silver, copper, uranium, etc….

We were discussing copper stocks that day, and I was simply pointing out that the volumes did increase in the copper juniors from March into May as copper was making it’s run, in stocks like Faraday, Surge, Regulus, etc…. and that many of them spiked up 80%-150% as an observation. They’ve all rolled over since mid-May though as copper retreated, just like gold and silver topping and consolidating over the last month. Now the volumes came back down, but there was a more speculative fervor going on for a few months.

Maybe “Sell in May and go away” thinking is in play as we enter the summer doldrums.

One thing I do know is that if the conventional markets crash between now and the autumn, there are no buyers (no buyers means very little for the uninformed) for 90% of many of the stocks I have been following. Look out below if we should have a serious sell-off, whether in our market or the conventional market, one will spill into the other. DT

Name calling is not a valid argument. It is unproductive, rude, not factually based, misdirected, distasteful, weak, and pretty much obsolete in the world of a discussion. Just saying…

Whatever you say, you’re the prosecutor! This is however not your court. LOL! Hear Ye, Hear Ye, court is in session. DT

… but it seems to be a playground for you…

Dan, Grumble follows me around constantly and is constantly making critical remarks based on nothing, he never posts anything of meaning period. If he would disappear this wouldn’t happen, he attacks first, and I defend. What is your response to that, you seem to be interested lets here it. DT

Like I said, playground tactics, you two should have a private discussion to keep this crap off the board.

Dan, how can we possibly have a private discussion on a public forum. That is crap! DT

It’s your problem that spills over to the board, I’m sure someone from KER can arrange an after school scrap for you two.

Dan, your response is totally silly, something is wrong with your reasoning, you refuse to see the problem and so you keep crapping on. I think you like attacking others because that is what I am seeing now. Dan should exchange his e-mail with Grumble I’m sure they would have a lot in common. DT

If both individuals agree to exchange emails, to have a private chat, then I can help facilitate this off the board. For now let’s hope cooler heads will prevail and folks can get back to discussing the markets instead of each other.

I’m traveling this week and will be ignoring the computer a great bit of the time to enjoy the great outdoors and unplug for a much needed rest, but can address any emails to this effect upon my return.

Ex:

You and Cory both need to enjoy some time away as you both produce a tremendous amount of information through interviews and discussions. Thanks for all you do and enjoy the “true beauty” of the World.

Much appreciated Lakedweller2. It’s good to get away from the glowing screen and unplug and recharge.

FREAKY FRIDAY AGAIN………………..

OOTB:

Freaky Friday spreading like the plague …..

Dollar power is muting many movers.

Hi Jerry, if you haven’t watched this latest video with Bob M I strongly urge you to give it a view, especially the last half where he starts talking about the subsurface mineral rights in Ukraine being sold to Blackrock, The Hedge Fund. DT

Hello DT……………….

Just got back, saw you note………. Will do…..thanks………

Also, saw the note in the ORPHAN SECTION….

Word out like , I said yesterday… Hilly is going to run … Biden is OUT….

Heard that one on one of my Anon sites… 🙂

Blackstone………owns the ground in Ukraine… what a hoot….. going to loot the entire nation for the

hedge fund owners…. EVERYONE SHOULD LISTEN TO THE TAPE…..

SHEEPLE ALERT….. 🙂

Today is the last day to sell stocks in Canada to avoid paying the new level of capital gains tax of 66% from 50%… not good for energy stocks but next week could be wild.

GLD ran into fork resistance yesterday and today’s reaction has taken it to support provided by a different fork. If that support breaks it will quickly test its May 3rd low and probably take it out.

https://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=1&mn=5&dy=0&id=p62127672775&a=1701870844

Silver perfectly erased yesterday’s move which allowed SILJ to fill yesterday’s gap.

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=D&yr=0&mn=11&dy=0&id=p04762002088&a=1703420817

Very interesting spike down and recovery today for the TSX-V…

https://stockcharts.com/h-sc/ui?s=%24CDNX&p=D&yr=1&mn=5&dy=0&id=p63956609194&a=1219911686

SLV filled yesterday’s big gap.

https://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=11&dy=0&id=p15537402240&a=1663367326

Off Subject update: New all-time low for last 20 years . Only 4 of about 70 in green. 4 in green are neither located in US or Canada. Same algos run against the account everyday and same algos for 3.5 years. 70 stocks have rotated at least 65% and makes no difference.