David Awram, Sr. Executive Vice President, Co-Founder, and Director of Sandstorm Gold (TSX: SSL) (NYSE: SAND), joins me for a review the key takeaways from Q1 2024 financials and operations. We also got into many of the key royalty partner projects feeding into the larger growth profile over the next 5 years for this mid-tier precious metals royalty company. Sandstorm Gold is diversified across 250 royalties, 40 producing assets, exploration optionality, different jurisdictions, and has a leading cost profile from producing royalty partners.

This is wide-ranging discussion that gets into the value proposition and key attributes of Sandstorm Gold within it’s peer group of royalty companies. We spend some time unpacking some of the key projects they hold royalties on that are partnered with senior mining companies as operators, that are well capitalized to have more exploration and development upside than the market is anticipating. Some of the projects Dave outlined were the Houndé Project operated by Endeavour Mining, the Bonikro Project operated by Allied Gold, the Barry Project operated by Bonterra Resources (that is being combined with Osisko Mining’s Windfall Project), and Caserones operated by Lundin Mining.

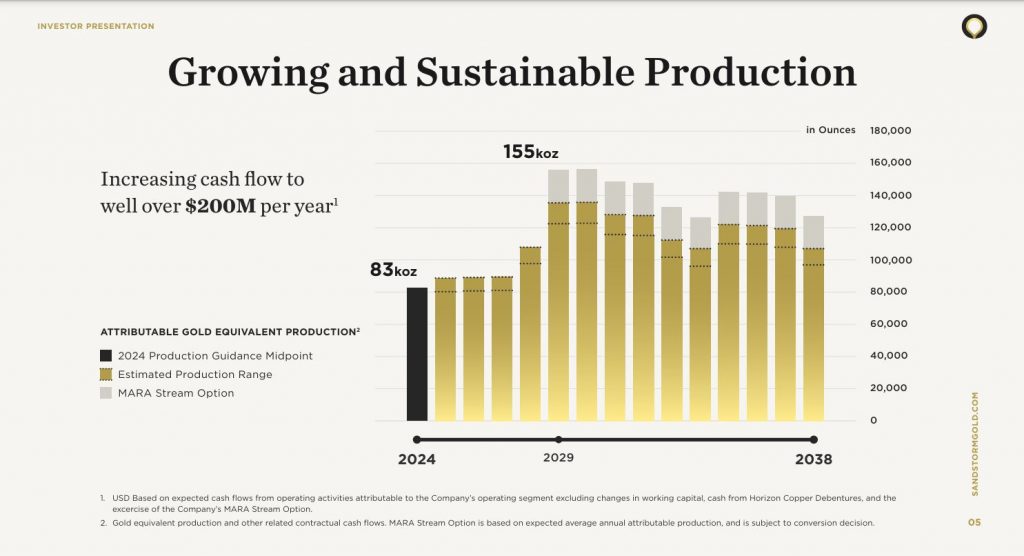

Next we got into some of the large development projects that are moving down the development pipeline and into production, as big contributors to future gold equivalent ounces and revenues. We reviewed how Equinox’s Greenstone Mine has just had first gold pour, as the 4th largest gold mine in Canada and a big win for Sandstorm and the Canadian mining sector at large. Next Dave highlighted a recent site visit to Ivanhoe Mining’s Platreef Project in South Africa, and how construction is well underway to bring this mine into commercial production by next year. We then reviewed the cornerstone Hod Maden royalty asset in Turkey, and how the terms on this asset and conversion into a gold stream have changed over time, including the sale of the 30% interest in the project to Horizon Copper Corp. Lastly we wrap up with a look ahead to the Mara gold stream operated by Glencore, as an example of how a royalty purchase can change hands and become incredibly value-accretive.

If you have any questions for Dave regarding Sandstorm Gold, then please email me at Shad@kereport.com and we’ll get them addressed, or covered in a future interview.

- In full disclosure, Shad is a shareholder of Sandstorm Gold at the time of this recording.

.

Click here to follow along with the news from Sandstorm Gold.

.