Jordan Roy-Byrne – MIF Presentation Takeaways – The Biggest Gold Breakout In 50 Years Is Here

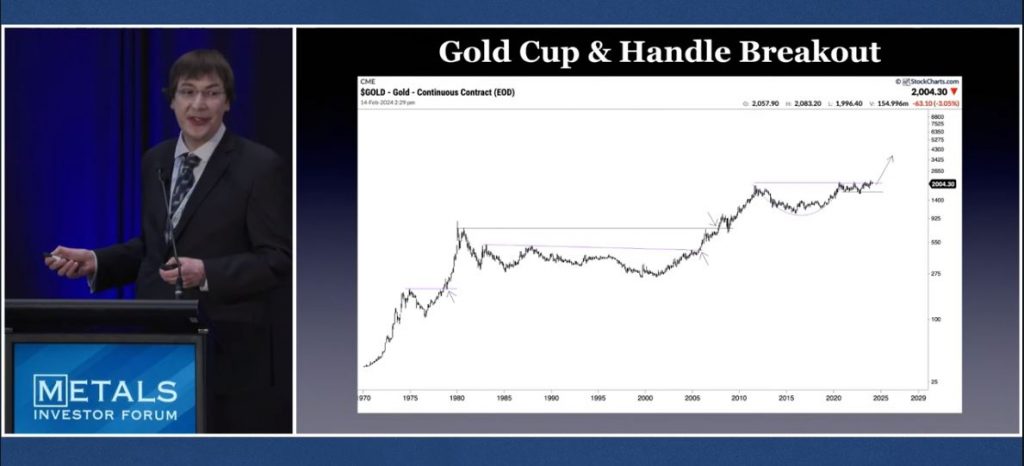

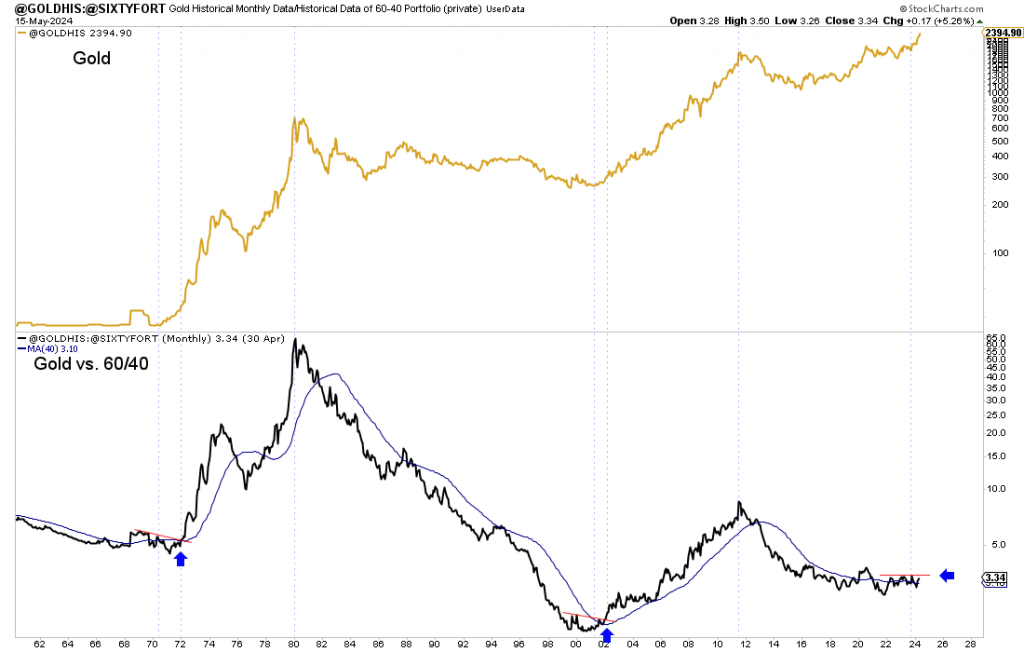

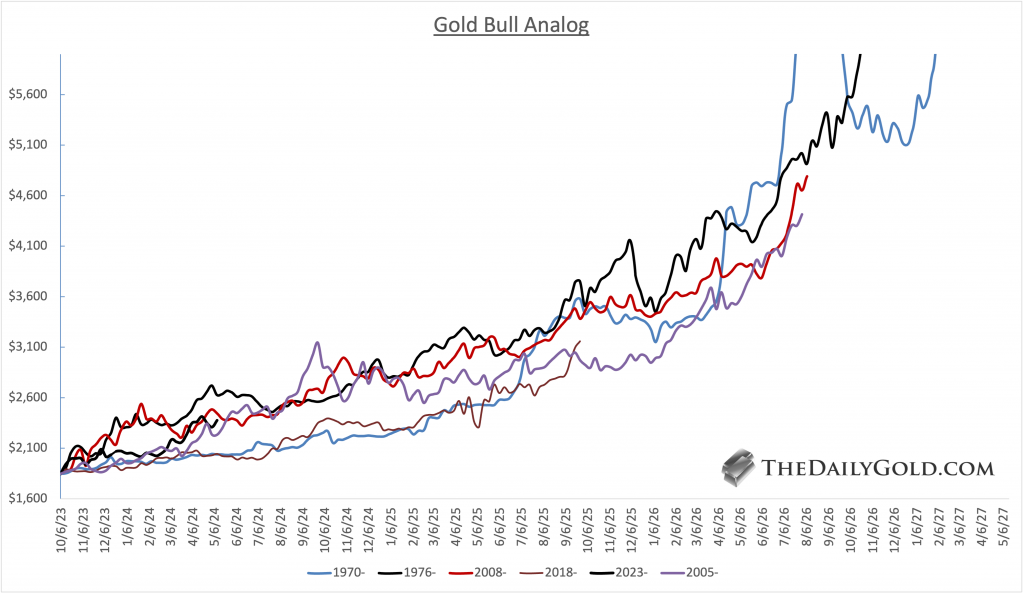

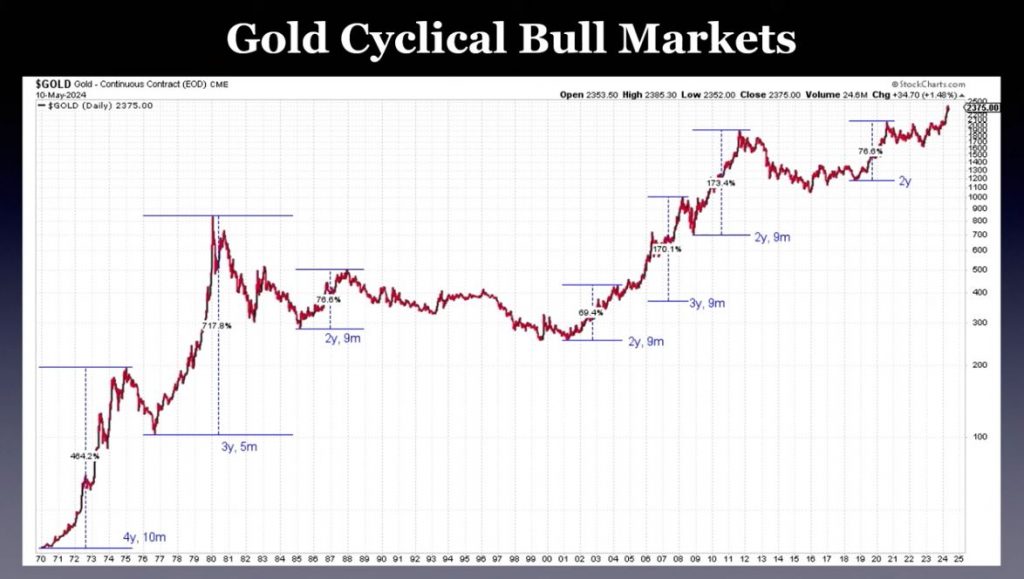

Jordan Roy-Byrne, CMT, MFTA and Editor of The Daily Gold, joins us to discuss the key takeaways from his presentation last weekend at the Metals Investor Forum titled “The Biggest Gold Breakout In 50 Years…Is Here.” We start off reviewing the recent breakout higher in gold from the 13 year larger cup & handle pattern, and then look to the upcoming breakout confirmation on the 45-year basing on the inflation adjusted gold price chart as some critical longer-term technical factors. Then we look towards the next confirming factor that we will be truly in a new secular bull market, which would be the breakout in gold versus the traditional 60/40 retirement portfolio (60% equities / 40% bonds), which is also close to breaking out. We have Jordan outline the nuances between cyclical and secular moves, and some higher price targets he sees in gold should we see gold really make a secular run, as general equities enter a secular bear market.

In the latter part of the discussion, we shift things over to the precious metals mining stocks, and why he still favors being positioned in the growth-oriented producers, or developers with access to capital to build a large project of scale in the next 1-2 years. Conversely, Jordan points out why he is still avoiding the smaller deposits, earlier stage explorers, and orphaned developers, that will not have the same kind of leverage to rising gold prices in the next leg of this bull market.

.

Click here to visit Jordan’s site – The Daily Gold.

.

Yes indeed. Copper hit a new all-time intraday high earlier today up close to $5.13, before pulling back down to close at $4.92 on the day.

Yes, and this time the juniors seem to be responding. Many are rocketing higher.

Great day for Defiance Silver. DNCVF up 44%

Absolutely — A yuge move in Defiance Silver.

Since Defiance was up again bigly today, I sold my shares as I was up in the position about 250%.

If it pulls back in the days to come then I’ll repurchase it at lower levels…

If silver and the silver stocks keep running then I have 19 other silver stocks for exposure to the sector.

I’ve got big position in Defiance & have lightened up a little on the way up, so far. I’m surprised at how quickly it’s moved, but then it’s typically an early mover, so glad I didn’t punt too early. (Also, last time it tanked, I rode it down hard, not unlike so many other silver juniors).

Well, looks like I dodged a bullet on Defiance Silver’s retracement of the move by selling out for the gain, but now that it has retraced, I’ll likely add the position right back again.

Nice move. Getting down to where I can start adding back another 10,000 shares.

Jordan’s Gold vs 60/40 chart is extremely interesting.

As for Gold vs CPI, I’ve been watching it for years and the wait is finally over…

https://stockcharts.com/h-sc/ui?s=%24GOLD%3A%24%24CPI&p=Q&yr=50&mn=11&dy=0&id=t5152168459c&a=851796789&r=1715837056439&cmd=print

Thanks as always Matthew. Being of more limited in funds I have to pick and choose a bit more so I’m leaning towards impact for more accumulation near term as I think I have time to accumulate more Brixton. At least that’s the hope. Lol

Left out that I also prefer impact at this stage cuz I’m bullish zinc as well

Wolfster, I agree with you and would still agree even if Impact’s technical action since February wasn’t so bullish.

https://stockcharts.com/h-sc/ui?s=IPT.V&p=D&yr=0&mn=9&dy=0&id=p52236414364&a=1654079986

https://www.youtube.com/@TheDailyGold/videos

Note JRB’s latest two (long AGQ).

AGQ: AB (1:1) CD = 49.14

XY (1:1.272) Z = 43.48

{BackBox Target}

https://tinyurl.com/bddmb9wj

Added Silver Streaker

Nixed SP4X

SIVR (Silver) Triple Breakout

Noon Today : 29.47

Short Term : April 2024 (28.50)

Intermediate : May 2023 (25.00)

Long Term : August 2020 (28.44)

Similar (today) for GDX.

Yeah…. Silver has been ripping higher today. Very nice to see it above $31 to close up the week!

Copper