Jordan Roy-Byrne – The Gold Secular Bull Market Will Begin When US Equities Begin A Secular Bear Market

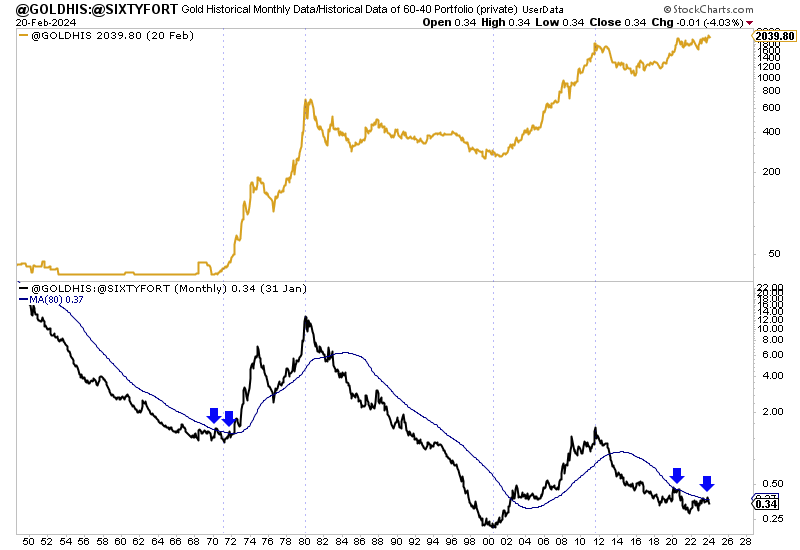

Jordan Roy-Byrne, Founder and Editor of The Daily Gold, joins me to discuss the historical precedent that for gold and the precious metals sector to begin a true secular bull market, that will require that US equities are in a true secular bear market. Jordan dispels the notion that even with the gold price doubling from the December 2015 low at $1045 to the multiple pops to $2080 the last few years that this meant it was necessarily in a bull market. He outlines that this was more technical noise and an attempt for the yellow metal to break out, but not a true precious metals bull market. He points to the outperformance of US equities during the same time period, and the weak action in both silver and the PM mining stocks that did not confirm the type of action that we’ll see in a real bull market.

Jordan also addresses the longer-term cup & handle pattern on the gold chart, and whether it has broken down, or is still relevant. His larger point is that regardless of the specifics of that pattern, that it has all been a large consolidation for the last 13 years, and when it breaks out, it will be a longer bull market and go to higher levels than most realize; again dependent upon the US equities truly entering into a secular bear market.

.

Click here to follow along with Jordan at The Daily Gold.

.

Look at a chart on ELI LILLY…….. 🙂

Like Jordan said….. Gold against the stock market…..

weekly GDX…..Looks like this cycle should bottom time wise by 3/15/24…..So….for my way of trading…I need to take a stab on the long side in the next few weeks….or just wait for 2 closes over the OUL at 28.17….This ‘could’ be big once it launches….really hard one to interpret….

https://tos.mx/yLG8FZM