Excelsior Prosperity – Last Week in Review And The Week Ahead – Part 8A – Macro Market Movers

[This last week and heading into this week has been so chock full of macroeconomic news and takeaways in the commodities that I’ve decided to break this Part 8 into two sections (A) Macro Market Movers and (B) Commodities. Stay tuned, because I’ll post the second part on the resource sector in the next day or so]

The last week of January was a very busy one for investors, with a flurry of macroeconomic data points popping up and then popping back down like a large game of financial whack-a-mole. The next big data point quickly became passe and stale-dated a day or so later, to then shine a light on the next shiny data point. All-in-all, it was really hard for investors and the financial media to know exactly what to really focus on and what actually mattered.

We had all kinds of earnings reports coming in from the mega-cap tech companies and consumer staple companies, then the mid-week FOMC Minutes with one narrative, but then the Powell press conference with different market takeaways, then the jobs report headline number being a huge beat on the surface, and all of this being paired with the constantly changing Fed fund futures speculations about rate cuts. This added up to a whole lot of volatility, and traders trying to place quick trades on one financial narrative before it ducked out of view and was replaced by a new data point popping its head up.

- The main point for investors and economists even digesting all this financial news and data flow is to ascertain the health of the US economy and most importantly, what the central bank may do with their monetary policy as a result.

The end game on each new data point that gets paraded out to the financial media is to play 4-D chess and try and calculate when and by how much the Fed will start cutting rates. This economic war-gaming is simply wild speculation, and so far it’s been a fool’s errand. Since back in mid 2022, we’ve seen Fed fund futures as a constantly moving target for almost 2 years now, and projections have been all over the map, but consistently too optimistic that rate cuts were right around the corner. We heard from many about past historical evidence, that the Fed will typically cut 60-90 days after pausing rate hikes, but so far we are well past that time period and still not a rate cut on the table for the next few months. Maybe this time is different… (don’t you just hate that phrase?)

The point is that no news seems to have much sticking power these days as we roll from month to month and quarter to quarter, and the goal posts for first cuts have consistently moved from early 2023, to now all the way back to mid to late 2024. People that have tried to trade interest rate sensitive markets based on reading the tea leaves on the macroeconomic news conversion into central bank monetary policy have been consistently wrong-footed.

To a degree, most of the macro news from last week has, once again, already been superseded by a widely watched and panned “60 Minutes” interview with Federal Reserve Chair Jerome Powell that aired on Sunday night.

In this interview, Powell rehashed the blowout January jobs, people’s concerns about the commercial real estate sector, the potential collateral damage to the regional banking sector, the prospects of when the rate cuts would start, clarifying comments on the Fed’s 2% inflation target, and concerns about a growing US fiscal deficit.

.

It was a slightly confusing interview considering how the stances on many charged topics have transmogrified from the mouth of the Fed head, (as is par for the course in revisionary Fedspeak). Many of the talking points Powell made stood in stark contrast to statements issued by a whole host of fed officials for the last few months of 2023. One area many market observers noted that was especially concerning was the admission of the challenges in commercial real estate and the prospects of more smaller regional bank failures. (Remember when we were assured had seen a line in the sand drawn after Silicon Valley Bank and those concerns were now in the rear-view mirror? Oh really?….)

.

From the 60 minutes interview transcript:

.

>Scott Pelley: The value of commercial office all across the country is dropping as people work from home. Those buildings support the balance sheets of banks all across the country. What is the likelihood of another real estate-led banking crisis?

.

»Jerome Powell: I don’t think… I don’t think that’s likely. We’ve looked at the larger banks’ balance sheets, and it appears to be a manageable problem. There’re some smaller and regional banks that have concentrated exposures in these areas that are challenged. And, you know, we’re working with them.

.

>Scott Pelley: You believe it’s a manageable problem? (Powell: I think it appears to be) We’re not gonna see bank failures across the country as we did in 2008?

.

»Jerome Powell: I don’t think there’s much risk of a repeat of 2008. Certainly, there will be some banks that have to be closed or merged out of existence because of this. That’ll be smaller banks, I suspect, for the most part. You know, these are losses. It’s a secular change in the use of downtown real estate. And the result will be losses for the owners and for the lenders, but it should be manageable.

.

>Scott Pelley: You seem confident in the banks, and yet the Silicon Valley Bank, second largest failure in U.S. history. Did the Fed miss that?

.

>Jerome Powell: So, yes, we did. and we forthrightly– saw that we needed to do better.

.

So the question for any rationale person should be – Are they going to do better?

.

If the Fed was surprised that inflation wasn’t transitory, surprised they’d have to wrap up their tapering months faster than anticipated, surprised they’d have to hike faster and more aggressively a whole year earlier than anticipated, and they were surprised by the regional bank crisis last spring in 2023 where there were 2 of the largest bank failures in history… Then what really gives anyone any confidence that the Fed has any grip on the severity of the potential problems facing the regional banking sector here and now?

.

Ø If bonds keep selling off, and rates keep popping higher again, then what does that do to the bond assets that regional banks are holding onto? That was the whole problem a year ago, and it doesn’t seem those mid-sized to smaller banks are out of the woods yet.

.

Ø With the Fed’s emergency overnight repo Bank Term Funding Program (BTFP) set to wind down in March, then what will these smaller to mid-size banks do to shore up losses held on their books that will eventually be daylighted? Those trillions of dollars in liquidity back-stopping the banks has been the only thing holding back more carnage since the banking crisis last spring. It will be interesting to see how long many of these smaller banks can keep peddling their bikes, without the Fed training wheels supporting them and keeping them upright.

.

To illustrate this very point we just witnessed more timely news: New York Community Bancorp (NYCB) is a $116 billion commercial real estate lender that, once again, blindsided the Fed and Wall Street last week by slashing it’s dividend due to a “surprise” quarterly loss, and importantly millions of dollars in future losses on it’s books. Again, this is primarily related to it’s commercial real estate holdings. People have been scoffed at by financial media talking heads and Fed sycophants for pointing to this potential commercial bank issue most of last year. It is more than clear that there are still a number of skeletons in the closet for a lot of regional banks. What will be the next shoe to drop?

Look, (NYCB) fell by 38% on Wednesday, then another 11% on Thursday, dragging the rest of the regional banking sector down with it (as evidenced by the KRE EFT). It recovered a small amount in Friday’s trading session, but then New York Community Bancorp closed down another 10.76% today on Monday. At this point it has essentially had it’s valuation chopped in half in less than a week. That’s not a good look, and the question remains, how many more banks may go through something similar?

One can see how the SPDR S&P Regional Banking ETF (KRE) was hit hard by this last week, and flies in the face of the many generalist that have been very constructive on the financial sector for this year in 2024. Sure, there was a solid recovery off the October lows of 2023, rallying in sympathy with most other markets and spiked by the December Powell “Pivot Party.” However, looking at the recent chart damage, on fairly high trading volume, the pricing is now decisively down below the 21-day and 50-day exponential moving averages (EMA), and testing the 200-day EMA. So far that has held as support, but if that breaks then Katie bar the door for the regional banks…

OK, so there’s this commercial real estate / regional banking concern that was aired out in the 60 minute interview with Jerome Powel. When those revelations are paired with his comments about not having a March rate cut as a “base case,” then the markets pulled back to kick off this week. There may have also been profit-taking after a pretty solid rally into the end of last week, on the continued pattern of better-than-expected job numbers. However, there was a silver lining to Powell’s comments in yesterday’s interview, in that he has now conceded publicly that they are not planning on waiting for inflation to get down to 2% and stay there for reasonable amount of time. That’s different than Fed messaging for almost a year now.

Even at last week’s press conference after the FOMC meeting, the Fed messaging mid-week was still that in relation to taming inflation and switching back to monetary loosening and rate cuts; that there was a “danger of moving too soon is the job’s not quite done.” Powell had gone on to say mid-week that “We’re not declaring victory at all. I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting. It’s a highly consequential decision to start the process of dialing back on restriction and we want to get that right.”

Then on Sunday evening’s 60 Minutes interview, Powell seemed to have shifted the narrative once again.

Scott Pelley: Are you committed to getting all the way to 2.0% [inflation] before you cut the rates?

Jerome Powell: No, no. That’s not what we say at all, no. We’re committed to returning inflation to 2% over time. I’ve said that we wouldn’t wait to get to 2% to cut rates.

(So now you central bankers are not going to wait until inflation gets to 2%. Oh really…?)

You would think this would have been good news to the markets, because they are now signaling that they are going to move on cutting rates prior to seeing a consistent 2% inflation reading, but it appears the comments brushing aside a March rate hike, and making the May FOMC more dubious, were just too much for both the equity markets and bond markets as they digested all of this at the main takeaway to kick off this week. According the CME Fedwatch tool, the odds of a March 20th FOMC rate cut are now down to 16%, after this was all but a certainty just in December of last year.

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

As a result the market sold off bonds and we saw another pop higher in interest rates, with the 10-year bond yield popping back over 4% to 4.16% (today) on Monday. As evidence on the TNX CBOE 10-year US Treasury Yield index, the 41.6 level shot right back up above the 200-day and 50-day EMAs. Higher rates thus further pressured US stocks and gold to kick off this week.

As has been noted here a few times now, we are in a strange place where even after the recent pop in bond yields they are still quite a bit below the Fed funds rate of 5.25-5.5%, and more importantly that rate is markedly higher than where inflation readings are coming in (closer to 3% year-over-year, and 2% on a 3-6 month rolling average). That means that “real” inflation-adjusted interest rates are still in the positive, and this generally doesn’t persist too long before shifting to a monetary loosening policy. When those rate cuts do finally get initiated later this year, it is quite possible that is what marks a top to the rally in the general US stock markets, and starts the next bull market rally in interest rate sensitive sectors like gold.

Before we move on from the macro into more individual sectors, we should also address the BLS jobs report from last Friday, from a headline standpoint, and then dive under the hood at just how insane these adjustments and revisions are becoming.

On the surface, January’s jobs number of 353,000 blew away almost all economists’ expectations. Additionally, wages jumped up by 4.5%, and unemployment remained low at 3.7%. It was a glowing report, and as a result, financial outlets immediately heaped on the praise for the robust labor markets, and gushed that the jobs market was so resilient that it was accelerating despite the “higher for longer” interest rate environment.

- Last Friday, over at the KE Report, we had a solid interview with Marc Chandler, Managing Partner at Bannockburn Global ForEx and Editor of the Marc To Market website, where he recapped the strong BLS jobs data released, and weighed in on the Fed meeting and press conference from a main-stream generalist perspective. He did a good job of encapsulated what factors and key data that the equities, bonds, and currencies markets were trading off of to close up last week.

However, if one actually looks at how these jobs numbers are calculated (or one could say engineered) it can really make one’s head hurt. The reality is that most people don’t want to look at how the sausage is made. All the adjustments and how part-time vs full-time jobs are calculated and conveniently ignoring that there are actually more people giving up on looking for jobs and less people looking are not being counted does make this whole exercise a bit of a farce.

- My buddy, Craig Hemke, that runs TF Metals report, has often quipped that they should be called the BLS (BS) jobs report, for these very reasons. He really gets fired up about how these jobs reports are calculated in an interview we had with him on the KE Report last Thursday, and I’ve put in a hot link here that should jump listeners to that section of the interview at the 10 minute : 16 second mark.

Craig Hemke – Fedspectations Shift Post Powell Presser – All Eyes On The Jobs Number

There have been a lot of pundits that have pointed out how many of these economic reports that are pushed out to the markets from inflation, manufacturing, to GDP, consumer confidence, and yes the jobs numbers are massaged. However, this weekend there was a very eye-opening article published on Saturday titled:

“Inside The Most Ridiculous Jobs Report In Recent History.”

https://www.zerohedge.com/economics/inside-most-ridiculous-jobs-report-recent-history

This deep dive into the jobs data really shreds the prevailing main-stream narrative about how strong the labor market is… or possibly isn’t by simply analyzing the data inside the report. I don’t have time here to get into some of the nuances around how unemployment is calculated and reported, or how payroll numbers get tweaked and massaged, but I will post one of the more telling passages, from that article linked above, that really caught my attention with regards to just the number of jobs created and reported as the headline number.

“Which would be great, if only it wasn’t almost entirely due to the BLS’s latest choice of seasonal adjustments, which have gone from merely laughable to full clown-show, as the following comparison between the revised BLS Payrolls number and the ADP payrolls show: the trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is actually far more accurate), shows an accelerating slowdown.

“And speaking of seasonal adjustments, the January print was all seasonals, because while the seasonally adjusted payrolls was up 353K, the unadjusted was down 2.635 million, a 3 million jobs delta. In other words, just a 10% error rate in the seasonal adjustment (roughly where it falls) would wipe out the entire gain and make January increase a decline. Then again, this is the case with every January jobs report, because as shown below, the actual change in jobs in the first month of the year is down anywhere between 2.5 million and 3 million!”

For most people, living in the real world, I think we all know of family, friends, and colleagues that have lost their jobs over the last year, and we’ve all seen the string of large corporations laying off significant amounts of workers in the headlines.

Remember near the holidays where the toy company Hasbro laid of 1,100 employees in December, after already having made 800 other layoffs earlier last year prior to that announcement. Or how about UPS laying off 12,000 workers announced just last Wednesday on January 31st, or Microsoft announcing last month that it was laying off 1,900 workers. Here are just a few of the announcements we’ve seen in the last week:

-

February 1, 2024 – Deutsche Bank to layoff 3,500 jobs and reward shareholders.

-

January 31, 2024 – UPS will cut 12,000 jobs as part of a bid to save US$1 billion in costs.

-

January 30, 2024 – American Airlines to lay off 656 workers as it consolidates customer support.

-

January 29, 2024 – iRobot, vacuum maker to lay off 350 employees.

-

January 27, 2024 – Levi Strauss will lay off 10%-15% of corporate workers.

Here is a great resource for tracking the downsizing and rightsizing in corporate America.

- Companies That Announced Major Layoffs and Hiring Freezes

- February 1st, 2024 – Intellizence

https://intellizence.com/insights/layoff-downsizing/major-companies-that-announced-mass-layoffs/

Bottom line on the health of the labor markets: It is hard to square all these layoffs and the actual unadjusted job loss of 2.635 million jobs, versus the headline seasonally adjusted jobs number being up as a 353,000 jobs gain. That is a huge gulf between unadjusted job losses and adjusted job gains, and there is definitely some gamesmanship going on with how these numbers are being adjusted and reported. Regardless, few market participants or even “professional” financial news outlets are interested in that again, as it would interfere with the prevailing soft landing narrative.

- We had a poignant interview today with John Rubino, with regards to some of the macroeconomic data points and jobs report news where he dives into some of these same themes, and encourages investors to dig further into these reports and question the prevailing narratives bandied about in the mainstream financial markets media.

John Rubino – The Issue Of Rising Interest Rates, The Truth Behind The Strong Jobs Data

US Dollar:

Compared to other currencies, the US dollar has really been garnering the bid lately, as “the cleanest shirt in the dirty laundry bin.” This American exceptionalism makes sense because compared to Europe, Great Brittain, Japan, or China, the US economy is on more sound footing, and the greenback remains the world’s reserve currency.

It is surprising to see the buck truck higher, consistently breaking a number of shorter-term technical resistance levels, when so many came into 2024 bearish on the US dollar. A range of technical analysts agreed that the congestion zones at 102.50 and then again at 103.50 would act as strong resistance to deflect the greenback back lower again. There were even sharp analysts pointing to the psychological 104 area or the recent peak at 104.26 as technical level of resistance that would be challenging for the dollar to get through and lines in the sand. Well, on the back of all this positive US macroeconomic news, negative global growth news, and a push higher in interest rates, we saw the USD cash settle price close up to 104.45 here on Monday’s trading session to kick of this week. It is clearly above all those prior resistance levels, and just put in the highest close since November, closing decisively above both its 50-day and 200-day EMAs.

US Equity Markets:

Despite the economic machinations seen in the bond markets, currency markets, and fed fund futures markets pushing back rate cuts, none of this seemed to matter to the US equity indexes towards the end of last week. US stock indexes surged up near all-time highs again on Friday. I read several financial editorials remarking that the narrative had shifted from bad news is good news, to the good news is now good news. Convenient eh? Apparently, Powell isn’t the only one that has pivoted then.

It should be noted though, that other than the brief Pivot Party hangover the very end of December through the first 2 weeks of January, that the larger general equities have just been plowing higher and higher for the last few months. The 3 main stock indexes, the Dow, Nasdaq, and S&P 500 have all vaulted to new all time highs in the last 2 months, and so for investors positioned in the weighted index funds, this has been one hell of a ride.

Dow Jones Industrial Average INDU chart to all-time highs:

Nasdaq Triple Q’s chart to all-time highs:

S&P 500 Large Cap Index SPX to all-time highs:

However, kicking off this week and with bond yields moving higher again today on Monday, general equities are retracing some of that surge higher and possibly reconsidering the implications of a higher for longer narrative.

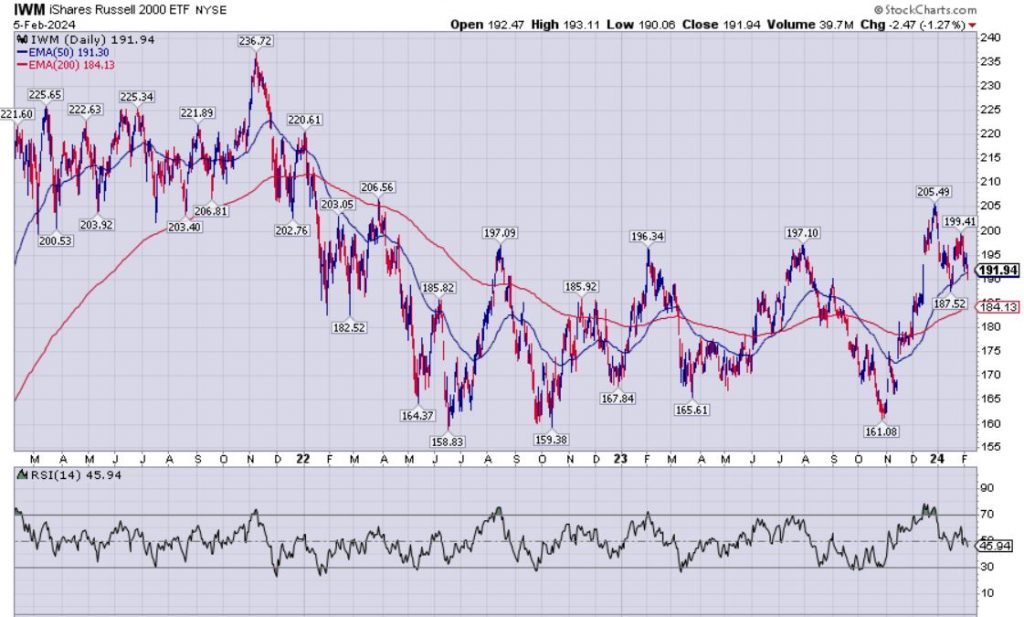

Another comment we’ve been hearing a lot about is that the breadth in the markets is starting to narrow once again, and when looking at the Russell 2000 (IWN) as it has not been able to break out to new all-time highs, and has been under pressure since the calendar year turned over.

For that matter, neither have many of the equal-weighted indexes. Here’s a chart of the (SPXEW) S&P 500 Equal Weighted Index, and it absolutely rallied from October along with other markets, but has not been able to eclipse the November 2021 highs to date.

We’ll keep following along with the progress of the general US equity markets, as investors are now fixated on the remaining quarterly earnings estimates in the week ahead, and after big beats in some of the mega-cap tech stocks last week. Never a dull moment.

For now we’ll wrap it up, because we are out of room in this article here on Substack. Part 8B will be a bigger review of the commodities sector and related resource stocks, to give it the time and attention it deserves.

If you haven’t subscribed to my substack channel yet, it is free to do so here:

https://excelsiorprosperity.substack.com/

Thanks for reading and may your trading be prosperous. Ever Upward!

– Shad

Even with Ex helping us out investing is a tough racket, if you make money someone else is losing! LOL! DT

Hi DT. Yes, investing by being an active stock picker is a tough racket in most sectors, but especially the smaller cap speculative “high risk/high reward” sectors. There are always winners and losers whether, it’s gold/silver/lithium/uranium/oil & gas, or if it’s cryptos, cannabis, solar, wind, biotech, meme stocks, or growth tech. Best to make hay while the sun is shining on that sector, and then look for the next sector setting up to get it’s moment in the sun.

OK EX…I began to study this thesis at 4:30 AM……I already see you are hitting on all my concerns….I am only 2 paragraphs in and already require a break in order to slam open a new pack of cigarettes followed by a fresh brew…I had serious flashbcks to prior cram sessions in my first quarter at Ohio State…..I am better now….and will just continue slogging through this informational expression so dense that maybe it is a cosmic black hole further trapping me in my state of indecision and paralysis?…..I am already sort of there without this additional gravitational collapse ….lmao

I should have taken more writing courses when I could have….sorry

That was a great post Larry and made me smile. Yes, sorry for the information density, but happy that you were cramming for the exam. Haha! (I started college in Cincinnati and used to drive up to visit folks on the Ohio State campus… that’s a huge and at times wild university)

Great idea IrishT. We just need to go back in time to buy silver and platinum coins at a discount, and bring them into the present to sell them. If you figure out the time machine idea, I want in as a seed investor. Haha!

Ex: Great analysis. Top Shelf!

Could it be that the truly ‘big money’ (credit) has yet to be unleashed; that those precincts should be focused upon for evidence of the first such stirrings? Is this the meaning of ‘deflation’ sometimes mentioned? – BDC

Thanks BDC and good question.

I’d submit that some “big money” has definitely already been unleashed for many many years now, by creating it out of nothing into something… (which leads to inflation first… but when all the monetary policies to deal with crimp the economy, and slow growth, it can lead to a deflationary spiral).

The reality is that the cycle will continue where even “bigger money” is created like magic to deal with that problem, and it shifts back to even more inflation…and thus the cycle perpetuates itself until a whole system collapse.

New-wave reactor technology could kick-start a nuclear renaissance — and the US is banking on it

By Angela Dewan, Ella Nilsen and Lou Robinson, CNN – Thu February 1, 2024

“Off the Siberian coast, not far from Alaska, a Russian ship has been docked at port for four years. The Akademik Lomonosov, the world’s first floating nuclear power plant, sends energy to around 200,000 people on land using next-wave nuclear technology: small modular reactors.”

“This technology is also being used below sea level. Dozens of US submarines lurking in the depths of the world’s oceans are propelled by SMRs, as the compact reactors are known.”

“SMRs — which are smaller and less costly to build than traditional, large-scale reactors — are fast becoming the next great hope for a nuclear renaissance as the world scrambles to cut fossil fuels. And the US, Russia and China are battling for dominance to build and sell them…”

Historic & Massive Silver Upside Overshoot On The Way With Sentiment At Rock Bottom, Plus A Look At Gold

February 01, 2024

Layoffs Surged 136% In January To Second-highest Level On Record

US job cuts skyrocket at beginning of 2024

By Megan Henney

The pace of job cuts by U.S. employers accelerated at the start of 2024, a sign the labor market is starting to deteriorate in the face of ongoing inflation and high interest rates.

That is according to a new report published by Challenger, Gray & Christmas, which found that companies planned 82,307 job cuts in January, a substantial 136% increase from the previous month. However, that is down about 20% from the same time one year ago. It marked the second-highest layoff total for the month of January in data going back to 2009.

“Waves of layoff announcements hit U.S.-based companies in January after a quiet fourth quarter,” said Andy Challenger, senior vice president of Challenger, Gray & Christmas. The cuts were “driven by broader economic trends and a strategic shift towards increased automation and AI adoption in various sectors, though in most cases, companies point to cost-cutting as the main driver for layoffs.”

“Financial companies bore the brunt of the job losses in January, with the industry shedding 23,238 employees. That is the highest monthly layoff total for the financial sector since September 2018, when it announced 27,343 job cuts.”

“The technology sector followed with 15,806 layoffs, the most since May 2023 and a stunning 254% increase from just one month prior.”

“The impact of rapidly advancing artificial intelligence adoption is beginning to be felt from a jobs perspective, particularly in media and tech, but truly across sectors,” Challenger said. “That said, companies are not outright blaming AI for many layoff decisions.”

https://www.foxbusiness.com/economy/layoffs-surged-january-second-highest-level-record

So, I had a direct message exchange with another PM investor recently, where he expressed his concerns and disappointment with the gold and silver stocks, and that he regretted having ever gotten involved in 2020 and then watched the last 3.5 years play out as they have in bear market action. It was a long and sincere and emotional response he sent over, so I took a long time to respond back because it hit me at the right time, where I had the bandwidth to respond. Honestly, it’s a really long response back, but was also helpful personally to write some of it out to unpack my own thesis again.

>> My thinking here is what the heck, I’ll just repost it on this thread in case the points and lessons and stories in it resonate with anyone else.

————————————————————————————————

Thanks for being candid and unpacking your experience. Trust me, I do understand how sentiment in bear market action can feel like it will never end, causing self-doubt about the decisions one has made, and it is psychologically and emotionally draining. I get it, and am living it right now in the PM stocks as well.

Now, if there is any consolation, then it is that commodities are always cyclical in nature, and the resource stocks come in waves. This is not like investing in general DOW or S&P 500 equities, that gradually ramp up over time. The resource stocks in a given commodity can go to sleep for many years before stirring once again. Just when it seems they’ll never wake up, there will be a large and outsized gain period that can be so transformative.

This will likely turn into a larger response back, but I want to share a few examples in some other recent commodities runs with you to consider, that are a good analog for what seems increasingly likely to also play out in gold and silver stocks:

I was investing in Lithium stocks back in 2010-2012 in a prior cycle, got overconfident in the narrative, and then failed to take evasive action as the stocks dove down and the sector fell apart for many years and most investors exited in disgust. Luckily for me, I didn’t have a huge amount invested at that time, but it was a sizable enough amount to really hurt me and leave a lasting impression. It hurt even worse that in 2011-2015 that gold/silver and uranium stocks also cratered, so it was a crappy time to be a resource speculator, but provided many humbling lessons on investing.

However, after reviewing and learning more about the fundamentals for the sector, I started getting more serious with Lithium stocks again in 2016 & 2017 and kept accumulating straight through 2019 (trading some small rallies here and there, but mostly just being frustrated with the obvious supply/demand set up and confused as to why the Li stocks were not getting more market love). It seemed obvious the lithium markets would eventually run, but that maybe my time horizon was way off. Clearly I was in too early, but most of my cost basis positions were still manageable, and I had gotten in the companies that had gone from exploration, to development, and that I believed would be the next batch of producers. Well 4 of them did make it into production, 2 became large development projects in strategic partnerships that are still being developed to move into production, one failed at the pilot plant stage, and one just whipsawed all over the place.

When the 2020 pandemic crash happened, all sectors took a nosedive at the same time. I decided to take whatever capital I had left and pepper it around some areas that seemed destined to eventually recover – gold, silver, uranium, lithium, copper, and PGMs. Obviously buying when some people thought it was the end of the world was risky, but the valuations were so silly that it didn’t really seem too risky to me, as everything was already priced for Armageddon.

So in this example, when Lithium stocks took off later in 2020 – 2021, I had about 8 stocks, then boiled it down to 6 stocks, then only the 4 best stocks, and then no stocks as they ramped up 5x, 8x, 10x+ on increasingly smaller positions as I faded out of the sector in late 2021. Those were amazing gains, and more than compensated for the arduous period of 2016 through the 2020 pandemic crash, in just over a year and half after that period. Basically, even considering the opportunity cost of being in Lithium stocks versus US tech stocks became totally worth it in a relatively short period. (again, this is the kind of setup I’m anticipating in the gold and silver stocks over the next 1-2 years, and why I’m sharing this example).

It was exactly the same experience in Uranium stocks. I bought in 2016 & 2017 when Uranium hit $17 a pound, and thought it was just ridiculous, and I kept trading Uranium stocks for a few years on small rallies. During the 2020 pandemic, I averaged down in U-stock positions as they dove down to silly valuations, and then watched those positions go up 5x-10x from those March 2020 lows to November of 2021. At that point I liquidated 85% of my uranium positions, and had made such great returns that it made the long wait and bearish periods over 4-5 years totally worth it all in about a year and a half. (almost the same pattern as Lithium).

Then in 2022 & 2023 I averaged back into positions in the Uranium stocks as they corrected and consolidated, and just caught the recent wave higher from mid 2023 into 2024 all over again, but have been starting to scale out of positions by about 20%-25%, and if we see even higher levels I’ll likely sell things down to just 50%-60% of my initial position (trimming off 40%-50% of the positions since initiating them in 2022-2023). I share this Uranium example, again, to offer a bit of encouragement to a sector that has run, then retreated, then run higher, then retreated, then run even higher. Again, this is what I expect to see as the next leg higher in the PMs should be more exciting than the last few rallies.

Then consider Oil & Gas stocks. They’d literally been kicked while they were down for almost a decade, with some nice rallies for 3-6 months to upwards of a year here and there, but it was most a sideways to down slog in many energy stocks. When the oil futures finally went negative, it just seemed ludicrous, and so I started acquiring more oil and gas stocks in the months and year that followed.

It took until late 2021 into early 2022 for the energy stocks to really break out and provide multi-fold gains, and it was again a long time coming. When the Ukraine war conflict really spiked up the energy prices in a bigger way, I exited some positions with the thesis that the conflict would get resolved and we’d some of the hot air come out of the sector. I was wrong about the Ukraine conflict being resolved (as it is still ongoing) but was right to harvest some gains into those overbought conditions. Now, that they’ve rolled over a for a fair bit of time, I’m reinvesting in the oil and nat gas stocks, and may roll more uranium profits into them over time, especially if they are staggered in their runs (a more ideal situation, versus every sector running at the exact same time).

Now let’s tie all of this into the gold and silver stocks. Personally, I’ve been investing in the precious metals sector since the 2008 Great Financial Crisis, and was engaged with the bull market from 2009-2011 in physical metals trading first, and then eventually mining stocks in 2010 and 2011. Of course, that was my first foray into mining stocks, so I overstayed the welcome initially and then suffered through the bear market from Sept 2011 through December 2015. I still did OK in 2012 all things considered, but 2013 really cleaned my clock. So I started focusing more on learning technical analysis to trade counter-trend rallies in a bear market, and it served me well later in 2013 – 2015.

However, then I experienced the first wave of the current secular bull market in 2016 (the baby bull) and those were explosive gains in just 8 months from January through August of that year. Many PM stocks I was in went up 5x-8x+ and it reminded me of why it was worth it getting beat up for prior years. Then there was the sideways consolidation for 2017 and most of 2018, where I tolerated it, after having more than recouped all investments from prior years in just the first 2/3rds of the prior year in 2016. However, many investors had entered or beefed up positions in late 2016, buying into the frenzy too late, and then they became the next round of bagholders. As a result, they were very disappointed in 2017 and 2018 and many left the sector, and said the PMs would never recover.

Well, that kind of uber bearishness is usually when the worm turns once again, and sure enough the next wave of the bull market took off in Oct 2018 and ran through Aug 2020 (with a few silver stocks peaking in Feb 2021). With the caveat that, of course that rally was also interrupted in the middle of it by the pandemic crash from late Feb – April of 2020. As previously mentioned, along with scooping up more Lithium and Uranium, I had also bought and added to a lot of gold and silver positions in March and April of 2020, and that gave me even more torque on the positions that had been initiated years prior.

In the summer of 2020, by July, the sentiment and breadth indicator the BPGDM was buried at 100 for several weeks, so I started lightening up on positions knowing it was way too frothy. Granted, it would have been wise to just completely exit the whole sector then, but I left about 70%-80% of positions in place and only pulled out 20%-30% of my PM positions. I also added back to those as the stocks as they corrected (sometimes way too early), and have been swing trading the sector, using a bear market playbook the last few years.

It has been really tough to carve out some winning swing-trades and position-trades, but conversely it has been easy to get wrong-footed. However, trading the sector rallies in a lot of the more heavily weighted positions I have in producers and royalties has kept me in the game to live to fight another day, and it kept me from experiencing as severe of corrections as people that just bought Jr explorers only, and then worse just sat in them and took no evasive action as they dropped 70%-90%. It’s not much of a consolation prize to celebrate “losing less” than others, but from an overall investing standpoint, it limiting losses and booking some winning trades does add up. A number of the profitable trades were able to wash out the stinker trades, and it was a good time to take wins that could be offset by losing trades without the tax ramifications.

I was actually a little disappointed though in the rally in the summer of 2020 (and with silver Feb of 2021), considering how high gold and silver moved off their lows. I felt at the time that the mining stocks were not really keeping paces with their normal outperformance to the metals price moves, but hey, they were at least making a nice run higher up multiple-fold. Still, something seemed off, and even in the good times before everyone used “rising costs” as the boogeyman to explain the disconnect, there was already a disconnect on the way up that was underwhelming. It was hard to put a finger on why that was the case (too many other distractions in other sectors like cannabis, crypto, meme stocks, tech stocks, or maybe a smaller investing audience as so many had been ground up and spit out in prior years, or maybe too many competing PM trading vehicles.

Since that time, there has been a bear market in the equities the last 3 years, while gold keeps testing a larger breakout to all-time highs. There have been about 5 really good tradable rallies in the bear market over the last 3 years, where gains were available, but mostly in the producers and royalty companies, more so than the developers and explorers as an overall general comment. (Yes, there are exceptions in each category to the contrary, but in general, the producers have been the best for position-trading these rallies).

This has been a really weird and frustrating period and the most disconnected I’ve ever seen the valuations in the mining stocks to the price of the metal. I don’t buy the narrative that it is just because of higher costs or capex either. Sure, that is a factor, but there is too big of disconnect in valuations and ounces in the ground to be explained away by a drop fo $200-$300 in margins from $800 average margin in 2020, to $500-$600 average margin in 2024. Yes, there has also been dilution, but there has also been expansion of projects, acquired projects, new mines built, resources expanded, economic studies completed, and value created. No, something else is going on here.

This is even crazier than late 2015 to early January of 2016 bottoming period, and at that time gold was almost down to $1000 and Silver was in the low teens, so it was more understandable. Whatever has been the case, I do believe the pendulum is going to swing in the other direction in the next 2 years from undervalued to more overvalued. That is the move I want to personally capitalize on.

So yes, this is a very disappointing PM mining stock sector indeed, and if the last few years were my very first experience in this space, as you eluded to, then yes it would be pretty disappointing. Hell, it has been disappointing for all people in this space the last few years… no doubt about that. However, those that have experienced this cyclicality in other commodities, or just within the PM sector over other cycles, do understand that this will all turn around at one point. It isn’t just cliché, and we’ll absolutely see those multi-bagger gains in the gold and silver stocks once again. My best guess, based on the fundamental and technical set up, is that it starts in earnest in 2024 and peaks in 2025.

As Rick Rule likes to say…. “If you’ve stayed around for all the pain, make sure to stay around for the gains.” It’s a great point. If you are going to exit a given sector (and there’s nothing wrong with that BTW) then with commodities you want to do it during a strong bull market upleg rally.

Nobody knows if we’ll see one or not, but I’ve got the most concentrated bet on the gold and silver equities in my trading account than I’ve ever had, because it does seem imminent to me. Maybe that thesis is wrong though. Maybe it never happens. Who knows? My bet is that we will see a big rip higher in many stocks in the sector, but some will still disappoint to the downside even in a bull market.

Again, maybe that is a bad call on my part. I’ve made plenty of bad calls and poorly timed trades… that is for sure… but that is how one learns. After spending over a dozen years and insane amounts of time learning this sector, my performance has gotten better over the years, and there has been a pattern for years of more wins than losses, which is the key to making money longer term. I still have big disappointments down 20%, 30%, 40%, 50%, but there are also still a lot of positions only down 5%-10% or up 30%-100%+ by effectively trading around core positions, adding on dips and lightening up on rips.

I’m not sure if this long-winded answer is helpful or not, but the intent was to use the moves in Lithium, Uranium, Oil/Nat Gas, and prior moves in the Gold/Silver stocks to illustrate the point that often after years of pain, there are, in fact, stellar portfolio changing gains. I’m pretty discouraged lately, which is why I feel so confident in plowing even some recent uranium profits back into more gold/silver positions to average down in them, and I’m peppering a little bit back into the oil/nat gas stocks.

This is way longer than initially intended, but I guess it was therapeutic to write this out for me too… as it has been such a brutal bear market the last few years in the PM stocks. This too shall pass, but when that happens is anybody’s guess. My guess and my bets are that it is 2024-2025, but we’ll see how it goes.