AbraSilver – Updated Diablillos Mineral Resource Estimate Highlights 258 Million Silver-Equivalent Ounces Contained In The Measured And Indicated Categories

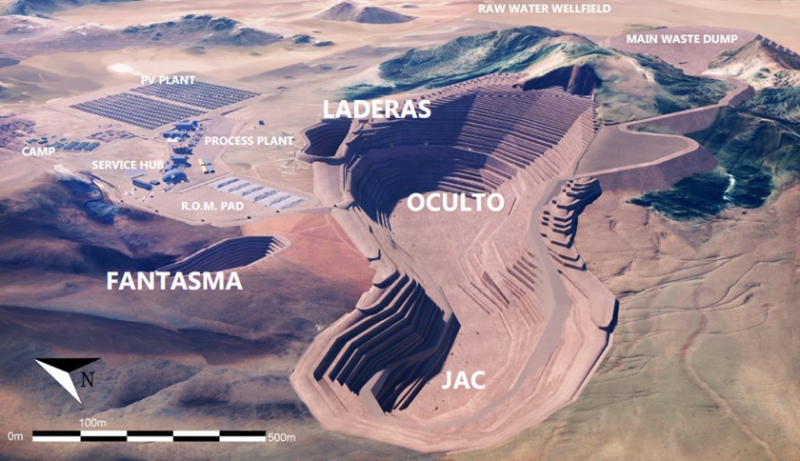

John Miniotis, President and CEO and David O’Connor, Chief Geologist of AbraSilver Resource Corp (TSX.V:ABRA – OTC:ABBRF), join me to review the substantial increase in size and overall silver grades in the updated Mineral Resource Estimate (MRE) on the Company’s wholly-owned Diablillos property in Salta Province, Argentina. The 258 million silver equivalent ounce MRE comprises an updated estimate for the Oculto deposit plus estimates for the JAC, Fantasma and Laderas deposits, all making up the overall Diablillos Project.

We start off having John break down the key takeaways from the MRE, which demonstrated a 36% increase in total contained silver in Measured & Indicated (M&I) mineral resources to 148 million ounces Ag (from 109 Moz Ag), primarily due to the recently discovered JAC deposit. There was also a 32% increase in the average silver grades in M&I Mineral Resources to 87 g/t Ag (from 66 g/t Ag), due to higher silver grades at the JAC deposit and higher equivalent cut-off grades at Oculto. There was also a significant contained gold resource totaling 1.36 Moz Au in M&I, representing a 5% increase in contained Au.

Both John and Dave noted that behind most of this growth was the debuting of the Maiden Resource Estimate for the JAC deposit of 5.3 million tonnes at 202 g/t Ag and 0.13 g/t Au, containing 34 Moz silver and 22 koz gold. However, it should also be noted that the Oculto deposit also grew in size and grade adding to the overall growth, even with a higher cutoff grade being incorporated into the Project.

Dave then breaks down some of the areas for further upside growth and focus for more drilling next year in the coming Phase 4 drill program following up on this year’s success in drilling the Alpaca, JAC North, Fantasma, and Laderas Targets. The point was made that this is clearly now a regional district, that may end up having multiple open pits feeding the overall project once it moves into development. Dave breaks down the structural trends in the mineralization, and further outlines how JAC North and Alpaca are orientated in relation to the main JAC Zone, and also points out that in a similar way, the Laderas Target, is another zone of gold and copper mineralization near the Oculto main zone, that warrants further drilling follow up.

The next key catalyst for the Company will be the Pre-Feasibility Study, due out in the first quarter of 2024, which will include the economics on this larger updated resource estimate.

If you have any follow up questions for John or Dave regarding at AbraSilver, then please email me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of AbraSilver at the time of this recording

.

Click here to visit the AbraSilver website and read over the most recent news releases.

.

You are about to enter the fifth dimension an area I call “The Twilight Zone”, I see a lot of green on the screen today, stocks are being manipulated upwards. It must be the Algorithmic trading machines, they have found out that you can make money on the way up as well as down! DT

Yeah, it was a healthy day in the PM stocks today, with Gold around $2040 and Silver around $25.

GDX was up 4.8% and GDXJ was up 4.31%. SIL up 3.19% and SILJ up 3.97%.

Lots of the gold and silver producers and larger developers getting a bid today pushing them up bigly.

Nice to see some green on the screen in this sector once again.

AbraSilver – featured in the interview above, was up 14.5% today, but they also had a very positive news catalyst with the announcement of the growth in their resource size and grade, as an accelerant.

This time I am going to absolutely kill it. My apprenticeship is over! Duddy Kravitz! DT

So you are DK now?

A Duddy Kravitz quote, ” A boy can be two, three, four potential people, but a man is only one. He murders the others.” LOL! DT

Gold Ventures @TheLastDegree – 6:21 AM · Nov 28, 2023 – X/Twitter

$ABRA.v – “Beacon analyst raises target to 0.90CAD (from 0.60), presenting 200% upside with current Metal prices.”

https://twitter.com/TheLastDegree/status/1729505880901636451