Steve Penny – Technical Analysis for S&P 500, 10 Yield Treasuries and Bonds, Gold, Silver, Platinum, Uranium, and Uranium Miners

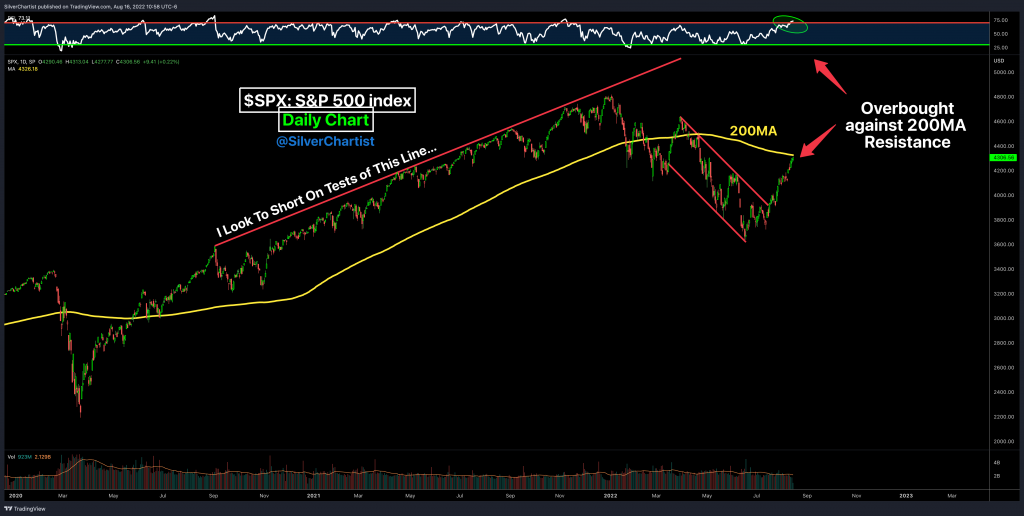

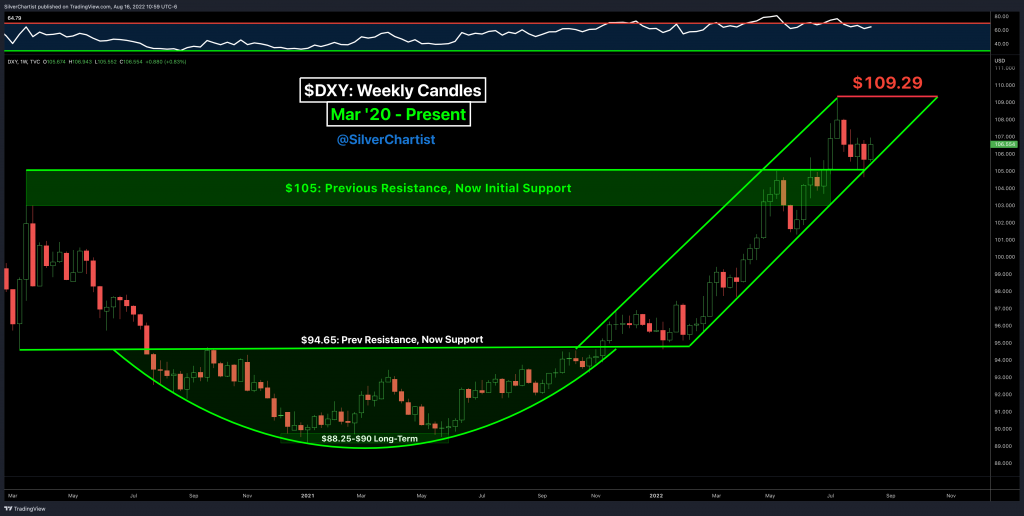

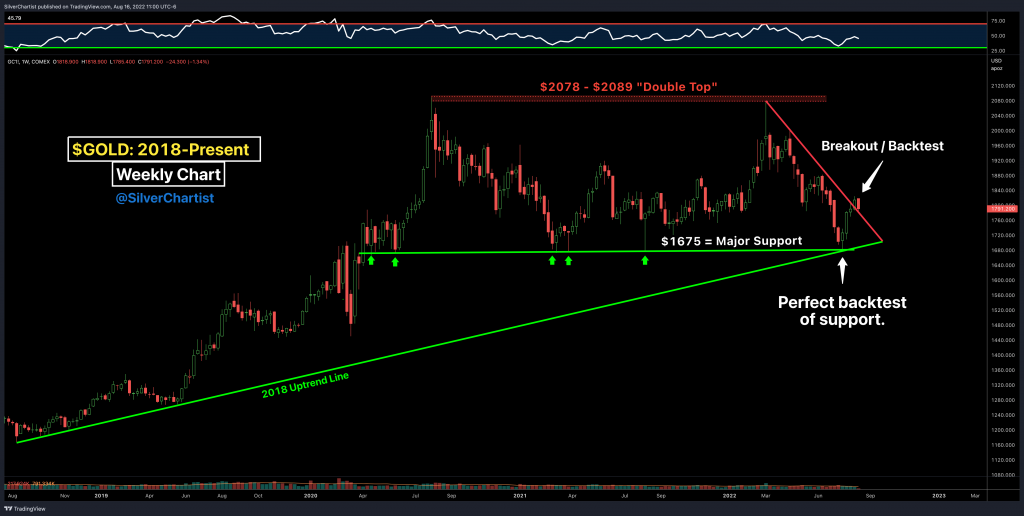

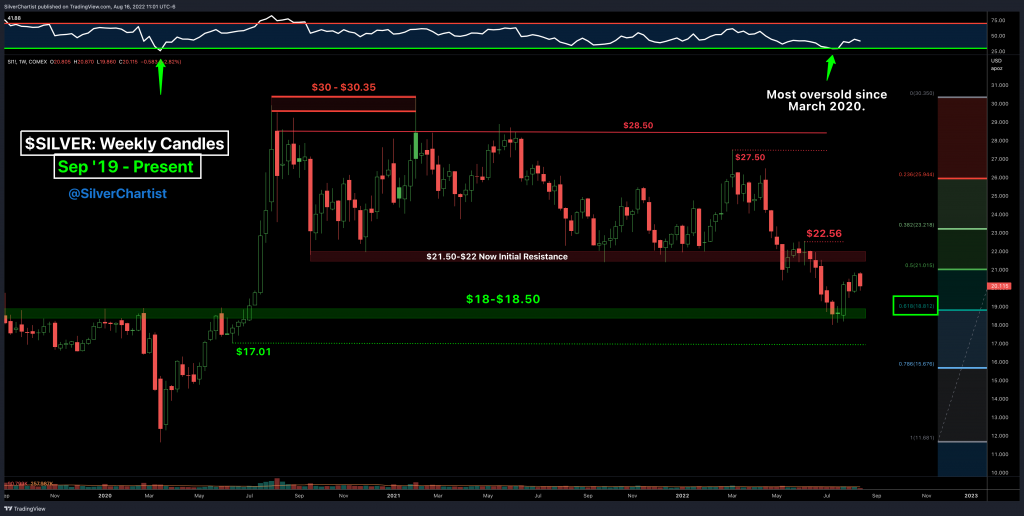

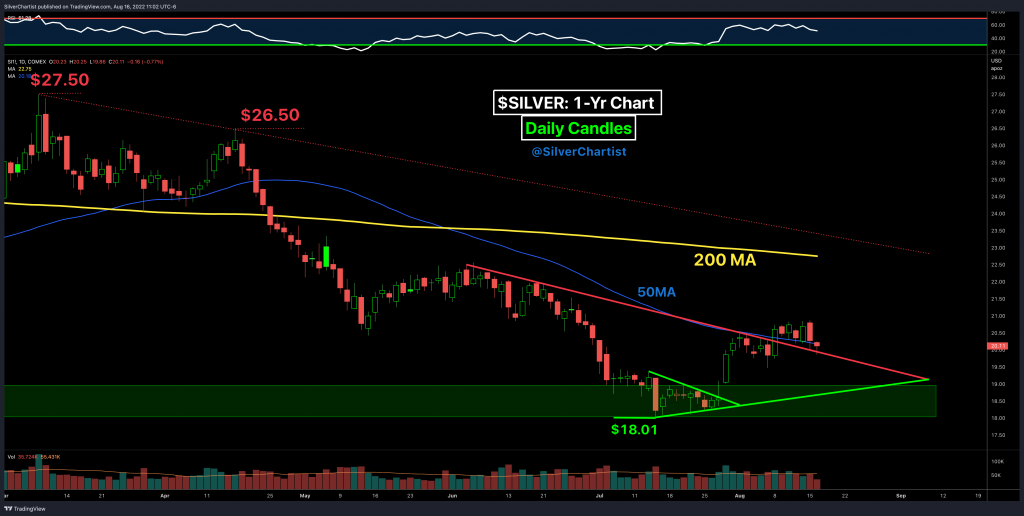

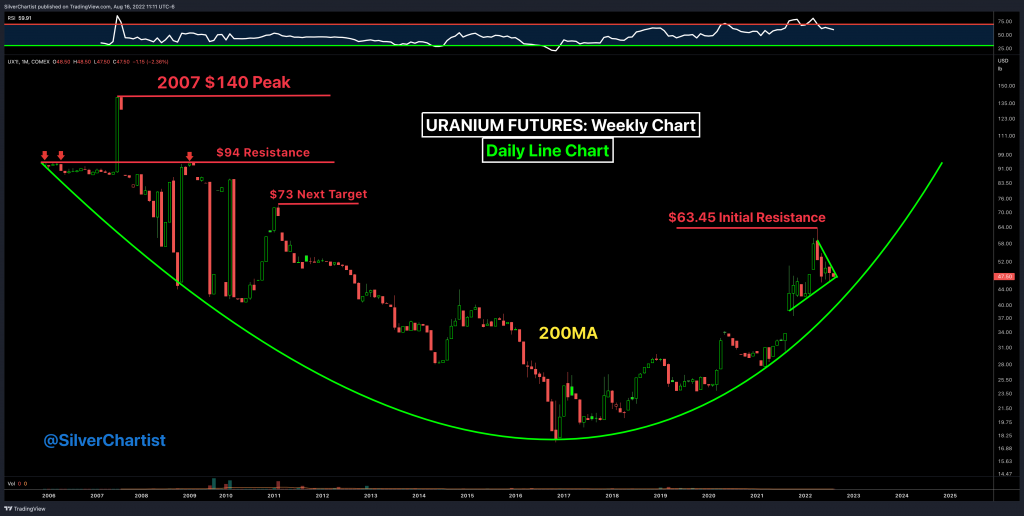

Steve Penny, Publisher of The SilverChartist Report, joins us to share a number of key charts on the S&P 500, (TNX) for 10 year US treasury yields, (TLT) reflecting long-dated bonds, (DXY) US Dollar Index, Gold weekly and daily, Silver weekly and daily, Platinum weekly, Uranium, a URNM:Uranium ratio chart, and a month chart of (URNM) Sprott Uranium Miners ETF. {all charts are posted below so you can follow along}

We intermix some macro fundamental discussion in around these various markets to get an overall take on where the drivers of each sector will come from, in relation to price movements.

.

Click here to visit the SilverChartist website

.

Lake, Headwater Gold looks good, all their projects are in The US and they have a solid management, I have owned them in the past but with the way this market is sitting, not much is moving. I’m not interested in most resource stocks until such time as the screw turns. I’m a trader not an owner. Headwater is on my radar and I saw that news release this morning. DT

The Newcrest optional expenditures are possibly in the millions which caught my eye. Doesn’t much matter until bankers are ready to work the other side of the trades. But thanks for the comments as it is a new purchase for me.

Government inbreeding… from Craig Hemke

Need to get rid of Citizens United and end the buying of politicians. They work for who pays them. It would be such a simple solution to limit contributions and who they can come from (actual voters) and you would begin seeing Politicians start figuring out we have laws and a Constitution that they are sworn to uphold. Can’t do it when money interests are allowed to buy the Federal Government. No wonder half the Congress wants to be Fascists. That is who pays them.

big cap gold miners like NEM holding up nicely….Looks like low volume retrace so far…..1750ish is the gap retest on/GC…..that point has volume and would/could constitute a valid retest of the breakout…will it happen after hours w a miners pop in the AM….no idea but plausible…

daily /GC…

https://tos.mx/vlZEvPu

SILJ strongly outperformed GDX over the last month and is now taking a normal/natural break. It looks like SILJ:GDX is going a bit lower from here but probably not much.

https://stockcharts.com/h-sc/ui?s=SILJ%3AGDX&p=D&yr=1&mn=8&dy=11&id=p82991593010&a=1230657507

Does anyone have any technical thoughts on the many charts Steve Penny shared up above?

Sometimes we get comments that people want to hear more TA from guests, and then we bring on a technician like Steve that provided a number of charts on general equities, bonds, gold, silver, platinum, uranium, and uranium miners, and there are hardly any comments on the points he raised.

Just curious if people agree, disagree, or have different outlooks on the technicals for the sectors he covered?

I did listen to him and like his charts, on further inspection almost every one is forming an inverse head and shoulders pattern IMHO. We need patience and I sense that patience is wearing thin, myself included… haha!;-)

Good points Dan – on the inverse H&S patterns, and on having the patience to let things unfold. Cheers!

Hi Ex, as you are aware these are the dog days of summer, not much going on! WOOF! WOOF! DT🛴

AWSOME!…I would let him trade for me anytime if I was not afflicted w the bug myself….

I’ve been following Steve Penny’s trading through his service for 2 years and he does a pretty good job of most of his short to medium term trade set ups, but makes mistakes like we all do. Still, he’s a very savvy technician, and has a good sense of the background macro drivers to boot. It’s great we can get quality folks like Steve on the KE Report to invest their time with our audience.

oops ,,,my rush…AWESOME!

my intraday view…is we put in a C today of an AB=CD up in miners etf’s!…do not trade off this speculation…or just use stops…glta

Today has been the best buying opportunity since the lows last month.

https://stockcharts.com/h-sc/ui?s=GDXJ&p=D&yr=0&mn=11&dy=0&id=p45679234209&a=1230685676

GDXJ gave real clear signals …i was surprised …got in jnug when gdxj was 32.14…thanks to you guys i am going into junior miners…i would never have done that until recently…thank you

That’s an encouraging point Matthew. Thanks for sharing your technical outlook with us.

The way everything finished makes me think that a gap lower could easily happen tomorrow but the odds of a subsequent bullish reversal would be good.

K92 bounced 3.5% after the Fed minutes but then went to a new low for the day and closed near it. GDX/J, SIL/J did not make new lows but look like they probably will tomorrow.

https://stockcharts.com/h-sc/ui?s=KNT.TO&p=D&yr=0&mn=11&dy=0&id=p09673067554&a=894594506

Thanks for that additional feedback on K92 and the mining ETFs action and closing post Fed and lately.

If we do see a big move down in PMs tomorrow, then I may deploy a bit more of the dry powder I raised in trimming some positions in the recent rally over the last month.

BC is ready to resume its fall.

https://stockcharts.com/h-sc/ui?s=%24BTCUSD&p=D&yr=1&mn=5&dy=0&id=p68447623405&a=1013900351

/GC has to be given possibility of 1750 tonight….but also a gap up is equally possible in miners due to gold strengthening….

i just heard that the back end of the FED paper release was gloomy…so they may call it quits on the interest rate front soon….is that the pivot …i guess…

worth mentioning…if this does end up being the C point in /GC…It portends strength on the move up…Because sellers could not even sell it off to a .382 retracement….That would have been 1768 and we hit 1773…..exciting for gold prospectors…glta

Good point Larry. Much appreciated.

DXY intraday is showing divergences on indicators of a possible top…no guarantees please….but it is puking fast now….UUP volume may be increasing in today’s pullback…a tell…

already stopped out of jnug…made a few bucks…..it should not have hit my stop if the run was real…imho…oh well

Picked up some Headwater Gold based on an option agreement with Newcrest. Eric Coffin mentioned on his site.