Anaconda Mining intersects 21.05 g/t over 11.5 metres and 17.41 g/t over 7.5 metres at the Goldboro Gold Project

Here are the latest drill results from Anaconda Mining at the Goldboro Project. This is another good round of drill results from Goldboro. One thing to consider is how relatively shallow these results are.

Remember the Company is still progressing with its takeover offer of Maritime Resources. If you are a shareholder or just an interested party please email me at Fleck@kereport.com with your questions. I always keep your contact info and name private unless you tell me otherwise.

Click here to listen to the most recent interview with Dustin Angelo at Anaconda Mining.

…Here’s the news…

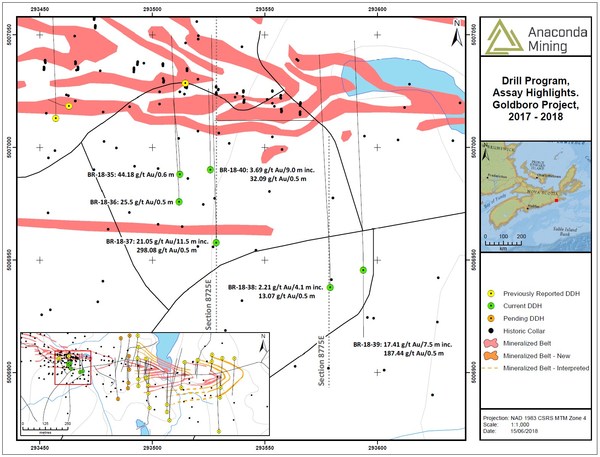

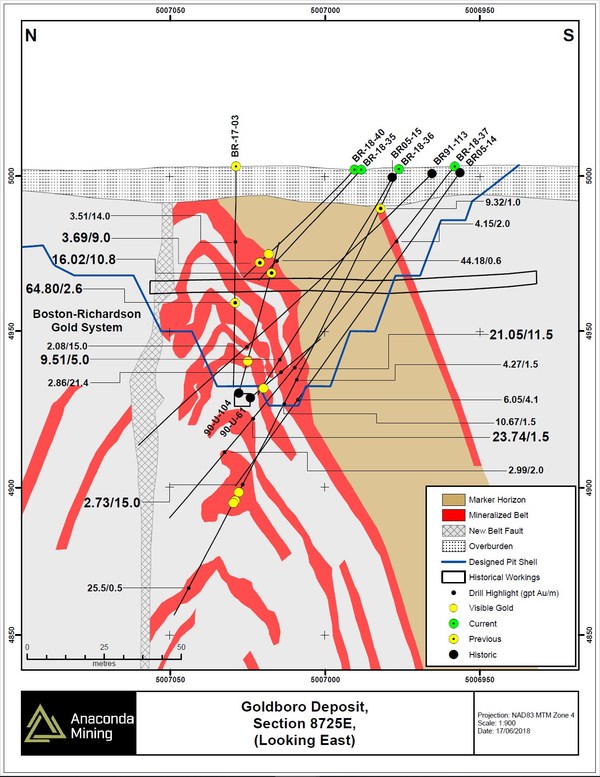

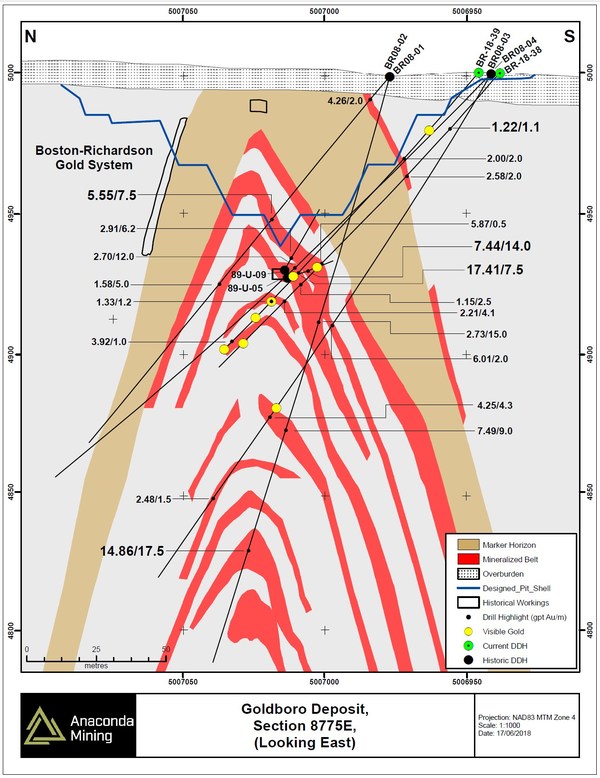

TORONTO, June 18, 2018 /CNW/ – Anaconda Mining Inc. (“Anaconda” or the “Company“) (TSX: ANX; OTCQX: ANXGF) is pleased to announce assay results from six drill holes (695 metres), as part of 11,588 metres of diamond drilling completed since October 2017 (the “Drill Program“) at the Company’s Goldboro Gold Project in Nova Scotia (“Goldboro“). The six drill holes (BR-18-35 to BR-18-40) targeted two specific areas of the Boston-Richardson Gold System (“BR Gold System“) as a potential site for a future underground bulk sample and to confirm the existing geological modelling in the area within, and adjacent to, an open pit outlined within a recent Preliminary Economic Assessment (“PEA”) filed on March 2, 2018, and available on SEDAR at www.sedar.com and on the Company’s website at www.anacondamining.com.

Highlights of the composited assays from the Drill Program on sections 8725E and 8775E include:

- 21.05 grams per tonne (“g/t”) gold over 11.5 metres (77.5 to 89.0 metres) in hole BR-18-37;

- 17.41 g/t gold over 7.5 metres (93.5 to 101.0 metres) in hole BR-18-39;

- 2.73 g/t gold over 15.0 metres (106.0 to 121.0 metres) in hole BR-18-36 including 9.3 g/t gold over 1.0 metres;

- 23.74 g/t gold over 1.5 metres (104.0 to 105.5 metres) in hole BR-18-37;

- 3.69 g/t gold over 9.0 metres (38.0 to 47.0 metres) in hole BR-18-40 including 32.09 g/t gold over 0.5 metres; and

- 64.08 g/t gold over 2.6 metres (44.4 to 47.0 metres) in hole BR-17-03 (previously reported*).

The holes were drilled from surface to intersect several previously modelled zones of mineralization adjacent to existing underground exploration drifts (“Historical Workings”), and along cross sections 8725E and 8775E (Exhibits A, B and C). Previous exploration work and results from Historical Workings indicated the presence of high-grade mineralization in these areas, though the core was no longer available to observe the mineralization or to confirm its exact location relative to the Historical Workings.

The Drill Program was successful in confirming mineralization modelled from previous drilling as well as repeating observations of the geological setting as outlined in previous exploration efforts and in Historical Workings. The drilling also intersected several broad zones of moderate to high-grade mineralization, many of which are within or immediately adjacent to the current open pit design outlined in the recent PEA. Five occurrences of visible gold were also observed.

Select highlights of composited assays from historic drilling on sections 8725E and 8775E include:

- 14.86 g/t gold over 17.5 metres (169.0 to 186.5 metres) in hole BR-08-02;

- 16.02 g/t gold over 10.8 metres (39.9 to 50.6 metres) in hole 90-U-104;

- 7.44 g/t gold over 14.0 metres (3.7 to 17.7 metres) in hole 89-U-05;

- 9.51 g/t gold over 5.0 metres (65.0 to 70.0 metres) in hole BR-05-15; and

- 5.55 g/t gold over 7.5 metres (64.0 to 71.5 metres) in hole BR-08-01.

A full table of composited assays from recent drilling is presented below as well as intervals from select historic drill holes for sections 8725E and 8775E.

“We continue to get tremendous results from our drill program at Goldboro, demonstrating the significant upside potential of what is already an attractive, profitable development project. The results of the Drill Program validate the resource model in this area of the BR Gold System and demonstrate that the mineralization has significant, double-digit grade and thickness associated with the modelled zones. Of greater consequence is the fact that the multiple, thick zones of mineralization encountered in this Drill Program fall within or near a designed open-pit outlined within the Preliminary Economic Assessment published last winter. Furthermore, the drilling adjacent to the Historic Workings provides the direct observation and information required to complete engineering designs for a future bulk sample at Goldboro, as part of ongoing work towards feasibility.”

~Dustin Angelo, President and CEO, Anaconda Mining Inc.

Table of composited assays from section 8725E

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Gold (g/t) |

Gold System |

Visible Gold |

|

|

BR-18-35 |

28.0 |

29.0 |

1.0 |

0.93 |

BR |

Current |

|

|

and |

40.0 |

40.6 |

0.6 |

44.18 |

BR |

||

|

BR-18-36 |

14.0 |

15.0 |

1.0 |

9.32 |

BR |

vg |

|

|

and |

68.5 |

69.0 |

0.5 |

0.84 |

BR |

||

|

and |

69.5 |

70.5 |

1.0 |

3.94 |

BR |

||

|

and |

72.5 |

73.5 |

1.0 |

1.65 |

BR |

||

|

and |

75.0 |

76.5 |

1.5 |

4.27 |

BR |

||

|

and |

80.5 |

82.5 |

2.0 |

2.47 |

BR |

||

|

and |

84.0 |

85.5 |

1.5 |

10.67 |

BR |

||

|

and |

93.5 |

96.0 |

2.5 |

3.24 |

BR |

||

|

and |

106.0 |

121.0 |

15.0 |

2.73 |

BR |

vg |

|

|

including |

106.5 |

107.5 |

1.0 |

9.30 |

BR |

||

|

and |

124.5 |

125.5 |

1.0 |

1.73 |

BR |

||

|

and |

143.5 |

144.5 |

1.0 |

0.56 |

BR |

||

|

and |

152.0 |

152.5 |

0.5 |

25.50 |

BR |

||

|

and |

157.0 |

158.0 |

1.0 |

0.64 |

BR |

||

|

BR-18-37 |

30.0 |

32.0 |

2.0 |

4.15 |

BR |

||

|

including |

30.0 |

30.5 |

0.5 |

12.82 |

BR |

||

|

and |

77.5 |

89.0 |

11.5 |

21.05 |

BR |

||

|

including |

79.0 |

79.5 |

0.5 |

298.08 |

BR |

||

|

and |

87.0 |

87.5 |

0.5 |

94.15 |

BR |

||

|

and |

94.5 |

97.5 |

3.0 |

1.13 |

BR |

||

|

and |

100.5 |

101.0 |

0.5 |

2.43 |

BR |

||

|

and |

104.0 |

105.5 |

1.5 |

23.74 |

BR |

||

|

including |

104.5 |

105.0 |

0.5 |

67.08 |

BR |

||

|

and |

118.0 |

120.0 |

2.0 |

2.99 |

BR |

||

|

including |

118.0 |

118.5 |

0.5 |

7.63 |

BR |

||

|

and |

129.0 |

130.0 |

1.0 |

2.00 |

BR |

||

|

BR-18-40 |

38.0 |

47.0 |

9.0 |

3.69 |

BR |

vg |

|

|

including |

42.8 |

43.3 |

0.5 |

32.09 |

BR |

vg |

|

|

and |

46.5 |

47.0 |

0.5 |

12.88 |

BR |

||

|

BR-17-03 |

17.4 |

17.9 |

0.5 |

1.15 |

BR |

Previous |

|

|

and |

23.0 |

37.0 |

14.0 |

3.51 |

BR |

||

|

including |

29.0 |

29.8 |

0.8 |

33.71 |

BR |

||

|

and |

44.4 |

47.0 |

2.6 |

64.80 |

BR |

vg |

|

|

including |

45.4 |

46.2 |

0.8 |

204.34 |

BR |

||

|

and |

50.5 |

51.6 |

1.1 |

3.51 |

BR |

||

|

and |

55.2 |

57.3 |

2.1 |

3.92 |

BR |

||

|

including |

55.2 |

55.7 |

0.5 |

10.46 |

BR |

||

|

90-U-104 |

7.2 |

13.1 |

5.9 |

1.59 |

BR |

vg |

Historic |

|

and |

15.9 |

20.4 |

4.5 |

0.77 |

BR |

||

|

and |

22.6 |

25.8 |

3.2 |

1.54 |

BR |

||

|

and |

28.8 |

32.1 |

3.3 |

9.15 |

BR |

||

|

and |

39.9 |

50.6 |

10.8 |

16.02 |

BR |

vg |

|

|

BR91-110 |

19.0 |

29.0 |

10.0 |

1.15 |

BR |

||

|

and |

34.0 |

64.0 |

30.0 |

1.40 |

BR |

||

|

and |

94.0 |

114.0 |

20.0 |

2.64 |

BR |

||

|

and |

134.0 |

144.0 |

10.0 |

1.31 |

BR |

||

|

BR05-014 |

33.0 |

35.0 |

2.0 |

2.50 |

BR |

||

|

and |

83.0 |

84.5 |

1.5 |

1.38 |

BR |

||

|

and |

85.6 |

88.5 |

3.0 |

1.84 |

BR |

||

|

and |

89.4 |

93.5 |

4.1 |

6.05 |

BR |

||

|

including |

90.3 |

91.6 |

1.3 |

12.45 |

BR |

||

|

90-U-61 |

2.7 |

24.2 |

21.4 |

2.86 |

BR |

vg |

|

|

including |

8.0 |

14.7 |

6.7 |

5.17 |

BR |

||

|

BR91-113 |

58.0 |

63.0 |

5.0 |

0.54 |

BR |

||

|

and |

73.0 |

88.0 |

15.0 |

2.08 |

BR |

||

|

and |

103.0 |

113.0 |

10.0 |

1.73 |

BR |

||

|

BR05-015 |

65.0 |

70.0 |

5.0 |

9.51 |

BR |

||

|

including |

69.0 |

70.0 |

1.0 |

41.10 |

BR |

||

|

and |

75.5 |

81.7 |

6.2 |

1.69 |

BR |

Table of composited assays from section 8775E

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Gold (g/t) |

Gold System |

Visible Gold |

|

|

BR-18-38 |

49.6 |

51.6 |

2.0 |

2.58 |

BR |

Current |

|

|

and |

94.5 |

95.0 |

0.5 |

5.87 |

BR |

||

|

and |

97.0 |

97.5 |

0.5 |

5.78 |

BR |

||

|

and |

104.0 |

106.5 |

2.5 |

1.15 |

BR |

||

|

and |

108.5 |

109.3 |

0.8 |

3.07 |

BR |

||

|

and |

111.5 |

115.6 |

4.1 |

2.21 |

BR |

||

|

including |

113.5 |

114.0 |

0.5 |

13.07 |

BR |

||

|

and |

135.0 |

136.0 |

1.0 |

0.91 |

BR |

vg |

|

|

BR-18-39 |

40.3 |

42.3 |

2.0 |

2.00 |

BR |

||

|

and |

93.5 |

101.0 |

7.5 |

17.41 |

BR |

||

|

including |

95.5 |

96.0 |

0.5 |

35.41 |

BR |

||

|

and |

97.5 |

98.0 |

0.5 |

187.44 |

BR |

||

|

and |

110.7 |

111.9 |

1.2 |

1.33 |

BR |

vg |

|

|

and |

131.0 |

132.0 |

1.0 |

3.92 |

BR |

||

|

BR08-01 |

10.0 |

12.0 |

2.0 |

4.26 |

BR |

Historic |

|

|

including |

10.0 |

10.5 |

0.5 |

10.40 |

BR |

||

|

and |

40.5 |

41.0 |

0.5 |

4.24 |

BR |

||

|

and |

50.0 |

54.5 |

4.5 |

1.03 |

BR |

||

|

including |

50.0 |

50.5 |

0.5 |

4.99 |

BR |

||

|

and |

64.0 |

71.5 |

7.5 |

5.55 |

BR |

||

|

including |

65.5 |

68.5 |

3.0 |

11.97 |

BR |

||

|

and |

73.5 |

77.0 |

3.5 |

0.97 |

BR |

||

|

and |

81.5 |

84.0 |

2.5 |

1.80 |

BR |

||

|

including |

83.5 |

84.0 |

0.5 |

4.54 |

BR |

||

|

and |

85.5 |

86.5 |

1.0 |

1.14 |

BR |

||

|

and |

87.0 |

87.5 |

0.5 |

0.91 |

BR |

||

|

and |

93.0 |

98.0 |

5.0 |

1.58 |

BR |

||

|

including |

97.0 |

97.5 |

0.5 |

5.30 |

BR |

||

|

and |

120.5 |

123.5 |

3.0 |

0.90 |

BR |

||

|

and |

127.0 |

128.5 |

1.5 |

1.10 |

BR |

||

|

BR08-02 |

75.5 |

76.5 |

1.0 |

4.43 |

BR |

||

|

and |

81.5 |

82.0 |

0.5 |

48.10 |

BR |

||

|

and |

86.0 |

101.0 |

15.0 |

2.73 |

BR |

||

|

including |

99.5 |

101.0 |

1.5 |

7.89 |

BR |

||

|

and |

128.5 |

137.5 |

9.0 |

7.49 |

BR |

||

|

including |

129.5 |

130.5 |

1.0 |

20.70 |

BR |

||

|

and |

137.0 |

137.5 |

0.5 |

84.60 |

BR |

||

|

and |

146.0 |

148.5 |

2.5 |

0.74 |

BR |

||

|

and |

161.0 |

163.5 |

2.5 |

2.05 |

BR |

||

|

and |

169.0 |

186.5 |

17.5 |

14.86 |

BR |

||

|

including |

170.0 |

170.5 |

0.5 |

425.00 |

BR |

||

|

and |

173.0 |

175.0 |

2.0 |

7.51 |

BR |

||

|

and |

181.5 |

182.0 |

0.5 |

19.90 |

BR |

||

|

BR08-03 |

105.0 |

107.0 |

2.0 |

6.01 |

BR |

||

|

and |

110.5 |

116.0 |

5.5 |

1.82 |

BR |

||

|

and |

122.5 |

123.0 |

0.5 |

50.80 |

BR |

||

|

and |

143.8 |

148.0 |

4.3 |

4.25 |

BR |

||

|

including |

143.8 |

145.5 |

1.8 |

8.24 |

BR |

||

|

and |

165.5 |

167.5 |

2.0 |

1.08 |

BR |

||

|

and |

183.5 |

185.0 |

1.5 |

2.48 |

BR |

||

|

and |

190.5 |

192.0 |

1.5 |

1.22 |

BR |

||

|

BR08-04 |

99.0 |

111.0 |

12.0 |

2.70 |

BR |

||

|

including |

99.0 |

99.5 |

0.5 |

9.25 |

BR |

||

|

including |

108.5 |

109.0 |

0.5 |

13.90 |

BR |

||

|

and |

162.5 |

163.0 |

0.5 |

3.12 |

BR |

||

|

89-U-05 |

3.7 |

17.7 |

14.0 |

7.44 |

BR |

vg |

|

|

including |

8.9 |

13.1 |

4.2 |

21.77 |

BR |

||

|

89-U-09 |

0.0 |

6.2 |

6.2 |

2.91 |

BR |

||

|

and |

10.3 |

12.6 |

2.3 |

1.47 |

BR |

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a “Qualified Person”, under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

All samples and the resultant composites referred to in this release are collected using QA/QC protocols including the regular insertion of standards and blanks within the sample batch for analysis and check assays of select samples. All samples quoted in this release were analyzed at Eastern Analytical Ltd.(“Eastern”) in Springdale, NL, for Au by fire assay (30 g) with an AA finish.

Samples analyzing greater than 0.5 g/t Au via 30 g fire assay were re-analyzed at Eastern via total pulp metallic. For the total pulp metallic analysis, the entire sample is crushed to -10mesh and pulverized to 95% -150mesh. The total sample is then weighed and screened to 150mesh. The +150mesh fraction is fire assayed for Au, and a 30 g subsample of the -150mesh fraction analyzed via fire assay. A weighted average gold grade is calculated for the final reportable gold grade. Anaconda considers total pulp metallic analysis to be more representative than 30 g fire assay in coarse gold systems such as the Goldboro Deposit.

Reported mineralized intervals are measured from core lengths. Intervals are estimated to be approximately 80-100% of true widths of the mineralized zones, with the exception of some intervals reported from historical drill holes where the drill trace crosses to the northern limb of the host fold structure near the bottom of the hole. In these areas reported intervals may be less than 50% of true width.

*Hole BR-17-03 was previously reported in a press release on July 27, 2017. The reported results were based on fire assay alone. Since then the same sample pulps were reprocessed using total pulp metallic analysis and it is these values that are reported in this press release to be consistent with all other gold analysis conducted by the Company since October of 2017.

A version of this press release will be available in French on Anaconda’s website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA MINING INC.

Anaconda is a TSX-listed gold mining, development, and exploration company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The Company operates the Point Rousse Project located in the Baie Verte Mining District in Newfoundland, comprised of the Stog’er Tight Mine, the Pine Cove open pit mine, the Argyle Mineral Resource, the fully-permitted Pine Cove Mill and tailings facility, and approximately 5,800 hectares of prospective gold-bearing property. Anaconda is also developing the Goldboro Project in Nova Scotia, a high-grade Mineral Resource, with the potential to leverage existing infrastructure at the Company’s Point Rousse Project.

The Company also has a pipeline of organic growth opportunities, including the Great Northern Project on the Northern Peninsula of Newfoundland and the Tilt Cove Property on the Baie Verte Peninsula, also in Newfoundland.

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of applicable Canadian and United States securities legislation. Forward-looking information includes, but is not limited to, the Company’s future exploration, development and operational plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects”, or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “does not anticipate”, or “believes” or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”. Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda’s annual information form for the seven-month period ended December 31, 2017, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE Anaconda Mining Inc.

The mobs don’t like gold stocks but if you made every I phone with gold on the casing we would instantly see a bust out in the precious metals markets. Boy do I love a “Bust Out”. DT

🙂

This thing has to blow soon. They need to get the acquisition uncertainty behind them so folks can start focusing more on their stellar drill results.

Agree Charles. It is odd to see good results shrugged off by the marketplace, but the takeover is looming and most are likely waiting on the sidelines to see how things work out. I’m fine with either outcome and like Anaconda already before they made the offer.

It is still a coin toss on whether ANX the acquisition for MAE is going to go through or not but I tendered my Maritime shares, and already have had a position in ANX since last summer.

If the deal falls through Anaconda can always just buy (RCG) Resource Capital Gold Corp and then the Maritime shareholders will wish they could get a redo….. 😉

Bob M. summed it up well in this prior piece and I concur that their merger would be nice:

“Having been to Nova Scotia in the past and seeing the Dufferin and now knowing about Goldboro, I have fantasies about the two companies either merging or one buying the other out. With Goldboro going into production, Anaconda has 60,000 to 80,000 ounce a year gold potential when the mill is complete. But there is an existing mill at Dufferin. Anaconda could save probably $50 million in capital cost by buying Resource Capital Group (RCG-V) that only has a $13 million dollar total market cap today.”

“Resource Capital had a real dingbat as CEO who just either got fired or at least shoved out the door. He was the same guy that destroyed Palladon Ventures. That was one of the greatest projects I ever saw and it would take someone working 24/7 to have killed it. But kill it he did. I suppose he put in a lot of overtime. In any case, right now RCG needs management and ANX has it in spades. I’d love to see a deal between them on any terms.”

“Anaconda has a lot of valuable pieces. They have a producing mill in Newfoundland with lots of potential feed. Management is young and first class. Goldboro is an unsung opera just waiting to be heard. While total gold production isn’t much now, I believe the 80,000 ounce potential is not far off. If ANX and RCG got together, it would be a company to be reckoned with. It’s a case where the whole is greater than the sum of its parts.”

Yes I bought some after reading Roberts initial write up on the company. Bob sure can make a convincing case. I really respect his opinion.

Agreed. I was positioned in ANX before Bob’s write up based on research and coverage from my buddy Peter @Newton Bell and @Leni, but was thrilled to see Bob weigh in on the merits of the company and their various projects (in particular Goldboro).

Here are some old articles from Peter @Newton Bell that may be of interest:

Sorry, that link went into the ANX room but I’m not sure what happened.

Here is the link to @Newton’s earlier Anaconda research:

Thanks Ex. for the additional information. I wish I new how to navigate the CEO site better. I don’t have a subscription which I think is somewhat limiting.

I really like the ANX story. Great management that is shareholder friendly, cash flowing operations to support exploration, considerable growth potential of oz. in the ground, own their own mill with capacity to make acquisitions. I wish I had others in my portfolio as good as this story.

Yes, I agree that ANX has solid leadership, is shareholder friendly, has a tighter share structure than last year, and they’ve been doing good work on both Production and Exploration.

As for the ceo.ca site, it looks confusing but is very easy to use once you get their system down.

If you click on specific ticker in blue with the $ in front of it, then it brings you to that company room. So for Anaconda you can search for ANX or click on $ANX and then any posts tagged with that ticker will come up.

If you want a sector you search for it or click on the red links with # in front of it. So for example, #Gold #Silver #Copper #Uranium

If you want to connect to tag a person you put the @ in front of their handle and you can click on their purple link to just go to their personal room. So for me it is @Excelsior.

* Here is a link to the ANX room, and you should be able to read without subscribing, but can’t comment without subscribing. (BTW subscribing for the regular site is totally free).

Cheers!

Silver $16.28……….looking like it wants to go down under. $16……looking for a kangaroo….

It may, but honestly Silver has been stuck in a channel for over a year, oscillating between $15.60 and $17.70.

People make such a big deal about the little variations in price, but honestly it has been stable and really in no man’s land for a while now and is the definition of neutral and boring.

I would agree with your thought,…..but, I just think that $15 dollar range is depressing …but, a good opportunity to buy,….but, Phyz, is no longer a big deal at this point for me, …I think Matt and You have the best idea, and that is the stocks…..JMO

Thanks OOTB. I don’t spend much time on investing in the metals, because I see them as chaos insurance and a store of value, but not really a speculative vehicle. Once investors have metals stored away in vault or the digital GLD/SLV in their trading account, then there is little more to do with it.

The mining stocks are much more speculative trading vehicles, and they average a 3:1 leverage to the metals anyway, so if people are bullish on metals they’ll have far better returns in the miners.

Likewise, If people are bearish the metals they can have far better returns on the inverse ETFs or using options to short the larger mining companies.

I like the volatility of the resource sector for trading, but it clearly is not for everyone. It is the same kinds of opportunities provided by trading the cryptos, pot stocks, or biotech, but easier for me to get my head around, because I understand the commodities and energy sectors better than those.

Ever Upward!

Again……..thanks for putting out the news on the “newsletter” scammers (my word)….

Scum rises to the surface , eventually,….crude wording, but, truth is the truth…. 🙂

Yes, it is interesting that so many of the negative nancy newsletter writers rarely get called on their BS. Arizona Minings epic rise, despite all the haters is a prime exampe.

I traded it when it was Wildcat Silver, and caught a lot of the initial run up when it changed over to Arizona Mining and started getting multiple drill rigs hitting paydirt.

There were so many dubious claims like it was the next “mini Bre-x” or would fail due to an abundance Manganese in the concentrate, or that management was trying to hide things in press releases, or that their land was too small for a mill, or that they’d never be able to raise money or attract a suitor.

South32 (a large Mid-tier bording on a Major) bought them out yesterday for like 1.3 Billion in valuation. Investors that listened to all the haters raising red flags missed a great opportunity, and while I value short-side analysis for bringing up potential problems, the negative hot air was ridiculous on this stock and that is true of many other stocks.

It was nice to see @Engineer summarize the history of the blustering BS for all to see, and maybe next time they’ll couch their comments a bit more and take them with a grain of salt.

I doubt the negative scum bags will change…..or will even get it right the next time……best to just avoid them……get close to the ones who have proven themselves………JMO

That’s good advice OOTB. Let’s not forget most Gurus don’t even have a 50% success rate…. so people may do better just flipping a coin 😉

DITTO……. 🙂

I think this time the mining stock won’t follow silver and gold down. Stewart Thomson seems to agree.

Gold: Will Goyal Make It Royal?

Stewart Thomson

Jun 19, 2018

The dollar and the US stock market may be starting their next major legs down today. Please click here now. Double-click to enlarge this ominous US dollar versus Japanese yen chart.

Central banks around the world are ramping up their tightening. Back in 2013-2014 when I predicted quantitative tightening and relentless rate hikes were imminent, almost nobody believed me.

I promised that this tightening cycle would be like no other because of the enormous size of the QE money balls in Japan, Europe, and America. The tightening action is moving the money balls out of the deflationary government bonds asset class and into the inflationary fractional reserve banking system.

Powell just raised rates again and is poised to launch another increase in quantitative tightening. He’s also beginning to change the spread between the Fed funds rate and the excess reserves rate that banks get paid to keep money at the Fed. Going forward, I expect him to put much more pressure on banks to move money out of the Fed. This is highly inflationary action.

Please click here now. Double-click to enlarge. The US stock market looks like a technical train wreck.

For the stock market, one mainstream money manager just referred to the global tightening cycle in play as akin to a sports team losing their goalie!

It’s obvious that the stock market is doomed. Powell appears determined to push through another rate hike in either August or September. Maybe the market staggers sideways or slightly higher until then, but the US stock market train is headed towards a global central bank tightening cliff. It’s going to go right over that cliff and implode, and tariffs are just icing on the cake.

Please click here now. Double-click to enlarge this interesting T-bond chart. Stock market money managers usually buy bonds when they panic, and that’s starting to happen now.

This time they are jumping from the fire to the fry pan. They believe the Fed will blink and stop hiking. In contrast, I predict the hiking will be accelerated, with a possible half point hike coming in December as inflation continues to rise.

Because of the widening spread between the Fed funds and excess reserve rates, banks will become more aggressive about moving money out of the Fed. Ultimately, the money managers will panic-sell bonds and buy gold as they see the stock market melting but inflation getting even stronger.

The bottom line is that Powell’s tightening actions to date have not done enough damage to the bond market to kill it as a safe haven for stock market investors. That will change fairly soon.

Please click here now. Double-click to enlarge this GDX chart. Gold stocks continue to meander sideways in my important $23 to $21 accumulation zone.

Many individual miners have started to trade independently of the ETFs and mine stock indexes, and are staging fabulous rallies. There are always some outperformers in a sideways market, but the large number of them staging these rallies now is quite impressive.

Note the strong volume bar that occurred on Friday. Gold stocks are in very strong hands now at a time where some possible “game changing” news is coming for bullion.

On that note, please click here now. India and China are the biggest markets for physical gold, and price discovery on the COMEX and LBMA ultimately relates to changes in demand there versus mine and scrap supply.

When Narendra Modi got elected as India’s prime minister, he put Arun Jaitley in charge of the finance department. This was disappointing, because Jaitley’s actions and words have been very negative for gold, and the finance ministry has the power to set the gold import duty.

Jaitley has a long history of health issues, and he just had a kidney transplant. Piyush Goyal has been appointed as “interim” finance minister. He’s pro-gold and fought against the import duty. There are rumours that his appointment may become permanent.

If that happens, I think gold investors around the world are going to watch the import duty tapered to zero just like American QE was tapered to zero.

Please click here now. Double-click to enlarge this spectacular long-term gold price chart. The Indian finance ministry is the main driver of the global gold price doldrums that have been in play for the past seven years.

It’s unknown if Goyal takes charge of the finance ministry on a permanent basis, but if he does, that is likely the catalyst that launches a massive and sustained rise in Indian gold demand. That demand will be enough to drive gold in an Elliott C wave advance to at least $1650, and probably $2000!

If “Royal Goyal” has charge of India’s finance ministry at the same time as Powell is joined by the ECB and then Japan in a giant effort to roll the QE money balls into the fractional reserve banking system, gold will likely surge to $3000 – $5000 very quickly.

When gold began its “eight-bagger” advance from the $250 area in 1999, few people anticipated the upside potential. The highest price targets coming from mainstream analysts were in the $400 area. Most of them thought gold was going to stay in the doldrums for decades, while the stock market would never decline in a material way. They had no clue what was coming!

Please click here now. Double-click to enlarge. I believe the potential for another eight-bagger is much stronger now than it was in 1998. This quarterly bar chart shows gold making an epic bull wedge breakout.

All that’s technically in play right now is a pullback from the breakout zone and that’s very healthy. Note the rise in volume from 1998-2002. That came ahead of the runaway action in the price. The exact same thing is happening now. Gold and silver investors should have absolute confidence in their holdings… and look to eagerly accumulate more!

More solid hits for the Anaconda team. ANX has delivered on production and exploration results on press release after press release for the last year and 1/2 and it is amazing that they don’t get more visibility in the Gold mining community.

Keep of the great work Dustin and the ANX team!