Will Gold Price Glitter Or Fizzle In 2016? (Part 1)

Here is another take on the gold price as we move in to 2016. The author John Manfreda is a former bullion broker and resource investor for 10 years. While I agree with his comments on a new low for gold in 2016 which should be the bottom. The comeback in price is what I think to be important. I tend to think it will be a slow grind back up but a number of issues could change that.

Click here to visit the Gold Eagle site where this post was published.

…

Since gold’s 2011 high of $1,920, the gold market entered a brutal bear market that has even worn out the many experienced precious metals investors. There are two questions that seem to be on the minds of investors: “Is the gold correction over?” and “When will this new bull market begin?” In this article, I will do my best to answer these questions.

I do believe that the bear market is almost over and that we have one more low, due to the Fed’s forward guidance. Thus, in my opinion, the bear market will most likely end this year.

Why Gold will probably make one more low

Earlier this month, the Federal Reserve decided to raise the Federal Funds rate for the first time since 2006 by 25 basis points. In its forward guidance, the Fed said it would raise interest rates four more times in 2016. By 2017, interest rates are estimated be roughly 1.5 percent. Moreover, by 2018 interest rates are estimated to stand at 2.4 percent. As a way of trying to keep the Fed credible, I think that the Fed won’t be done when it comes to interest rate hikes; no matter what the government economic data reveals. I do think that the Fed will try to raise interest rates 2-3 more times. This is why I say there will be one more down turn in the precious metals sector. Once the Fed follows through with another interest rate hike, the market will start pricing in more rate hikes in the future. In my opinion, this will generate more sell orders in the precious metals market. So now let’s explore were gold’s bottom could be.

Fellow Gold-Eagle analyst Christopher Aaron has given us a range of where he thinks gold is going to bottom. And I believe he is very accurate in his range estimation. This range has provided three bottom targets that every gold investor should watch closely.

My first bottom target is the $1,000 dollar level, where Gold is headed as I am writing this. I believe this to be a realistic target due to India’s famous central bank purchase made in 2009. At that time, the Central Bank of India bought over 200 metric tons of gold from the IMF. When the second largest gold consuming nation in the world makes that big of a purchase, when gold is already trading at over $1,000 an ounce for the first time in its history at that time; I think it is safe to say that they believe the days of three digit gold prices are in the past. Due to this fact, I think some pretty sophisticated substantial buyers will enter the market in the $1,000 area.

Now I want to disclose that markets can overshoot on the upside and on the downside as well. Consequently, it’s more than likely that gold prices won’t bottom at $1,000 exactly, i.e. it could go to $997 or $993, or even $1002 an ounce. Nonetheless, $1,000 range is my first target.

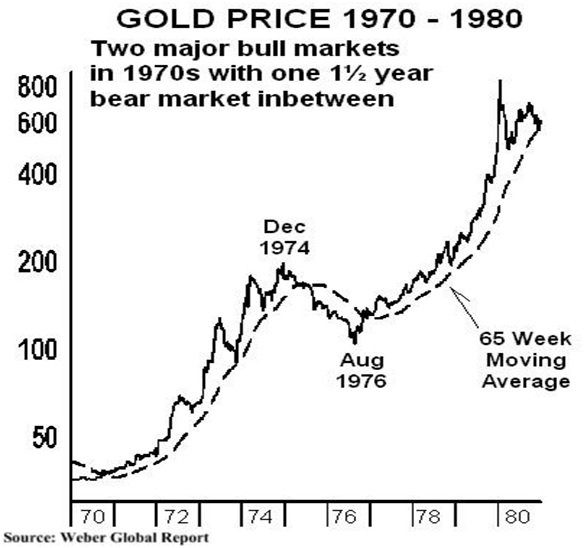

My next bottom target is the $960 range. This would complete a 50% retracement from the 2011 all-time high of $1,920. I believe this would be the most likely target for historical reasons. Looking at this chart below (provided from the Weber Global Report), you will see the price movements during the last gold bull market in the 1970s.

If you look at the middle of the price chart, you will see that from December 1974 to August 1976 there was 50 percent correction had occurred, right before Gold made new all-time highs later that decade. But it isn’t just the 1970s bull market in gold that experienced a roughly 50 percent correction. Look at this chart below

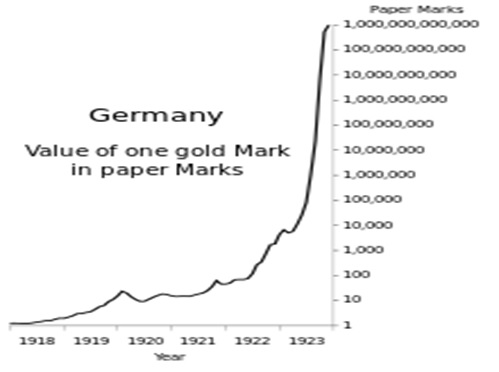

This chart provided by Wikipedia, is based on the price of gold valued by Deutsche Marks during the Weimar hyperinflation era. If you look at the 1919-1920 price movement, one can see that a strong (albeit brief) correction occurred during Germany’s hyperinflation era also.

Based on history, the $960 dollar area should be the bottom. But if gold doesn’t bottom there, my last target is the 1980 high of $850 an ounce. The reason I picked that low is because when trend traders trade markets, they look at two important points of Technical Analysis…and that is support and resistance. In any market, support can turn into resistance, and resistance can turn into support. I believe the $850 dollar area is a strong level of support due to the fact that it was an all-time high in the price of gold for over 25 years.

Those are my three targets, but please be aware that doesn’t mean I am right. My experience tells me markets are generally emotional…and can act irrational from time to time. So it is entirely possible that the Gold Price could decline further than my expected targets. If that were to happen (and I turn out to be wrong), I would watch the $700 dollar area, which is the 2008 low. I don’t believe it will go that low. However, when it comes to markets, never say never, as they can surprise all of us. Not likely, but If the $700 area is broken, then all bets are off.

Nice day in Platinum………….up $18

BYE BYE………2015………….

Frank, what are Jerry’s predictions for 2016? Ask him his predictions for these questions.

https://www.lewrockwell.com/2015/12/andrew-p-napolitano/dare-bet-judge/

So if it doesn’t stop at $1000 or $900, $800 or $700, then it could go lower. And you call this analysis. Fortunately, since I trade for a living, I’m a bit more accurate than that. Just as lower rates did not propel gold higher, higher rates do not have to depress gold. It depends on Macro. Basing a gold forecast on interest rates is foolish. Probably why Manfreda is a former broker.

I just read a fairly lengthly article by the ZEAL people on Dollar Collapse who focus on investment demand and speculators. They make the case that gold should go up substantially in 2016. Some of the thinking is that gold didn’t tank, as many thought, with the Fed rate hike, and once future traders, short-coverers, speculators etc start moving things to the upside, more and more investment demand starts to come in and up it goes. I’m at the place any more what will happen, but I appreciate the input. Everyone though is not on the same page.

Interesting…Mr. Big Al, what is your take on this? Will you be home for New Year’s? When are they letting you out of the rest home?