Japan’s recovery is being held back by a shortage of skilled labour, a leading minister has claimed, after the world’s third-largest economy entered its fourth technical recession in five years.

Economics minister Akira Amari said a lack of workers available for public works projects worth billions of pounds restricted the government’s ability to bolster the economy.

Amari urged Japanese firms to use their record cash holdings to raise wages and increase capital spending to generate sustainable growth led by the private sector, instead of relying on government to always take the lead. He added that Tokyo was not considering a fresh stimulus.

The plea for big business to support the recovery came as official data on Monday showed Japan’s economy shrank by an annualised 0.8% in July to September after a deeper than previously estimated 0.7% contraction in the previous three months, providing the two consecutive quarters of declines needed to mark a recession.

Analysts said labour shortages were a significant feature of an ageing population in a country that had put severe restrictions on immigration.

But the government maintained its cautiously upbeat outlook, saying that despite a downturn in national income during the summer and autumn, an improved outlook for jobs and wages would mean a return to growth later in the year.

“While there are risks such as overseas developments, we expect the economy to head toward a moderate recovery thanks to the effect of the various [stimulus] steps taken so far,” Amari said.

He blamed a big reduction in stock levels for the dip in the third quarter and excluding this effect, said the economy expanded by an annualised 1.4%.

Structural reform to support business investment is the third arrow in the country’s recovery plan, dubbed Abenomics after the prime minister, Shinzō Abe.

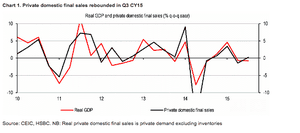

Izumi Devalier, an economist at HSBC, was also upbeat about the prospects for the economy, saying there were “positive trends that reflect the economy’s continued progress in exiting deflation”.

“Private consumption rebounded strongly on the back of improved real labour income. Meanwhile, nominal GDP continues to rise on the back of firm domestic price pressures and a better terms of trade,” she added. “The bad news is that corporates are not yet convinced that the reflationary trend is here to stay, keeping capital expenditure weak. But this issue cannot be addressed through short-term stimulus alone.”

Japan has been stuck in a deflationary economic slump since a property and banking crash in the early 1990s. Under Abe’s reforms, the government has increased its spending to regularly run a budget deficit of about 10%. This has been matched by aggressive action by the Bank of Japan to drive down borrowing costs to business and households with extra quantitative easing. But structural reforms have proved more difficult to implement and business investment has lagged.

The Reuters Tankan sentiment index for manufacturers fell in November to its lowest reading since April 2013. The service sector index fell in October to its lowest since March, dragged down by wholesalers and retailers.

Hiroshi Shiraishi, senior economist at BNP Paribas Securities: “Abenomics’ first two arrows of monetary and fiscal stimulus were meant to buy time, but Japan failed to make progress with painful reforms needed to boost its growth potential. Without reform [the ‘third arrow’], the economy’s growth potential remains low, making it vulnerable to shocks and to suffering recessions more often.”

Private consumption, which accounts for about 60% of Japan’s GDP, rose 0.5% from the previous quarter. But capital expenditure fell 1.3%, more than the 0.4% decrease expected by economists.

Japans economy falls into recession again !!!!!! What I was not aware they came out of the last one.