Steve Penny Reviews The Technical Outlook On Gold, Silver, and Platinum

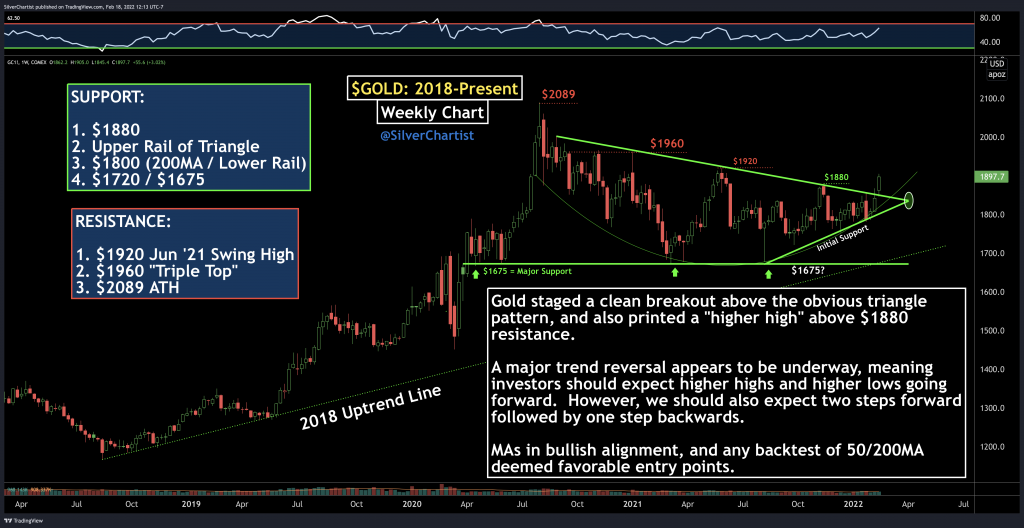

Steve Penny, Publisher of the SilverChartist Report, joins us to share a number of key charts on Gold, Gold versus the Dow, Silver, Platinum, and Platinum versus Silver. (all posted below so you can follow along). We weave in some fundamental macro insights on the precious metals throughout the discussion, and get some cogent advise from Steve on trading strategies and how he manages risk and probabilistic setups within his portfolio. Steve outlines why medium-term, he see the technical and fundamental pieces coming together for a big move in the mentals to the upside.

Click here to visit the SilverChartist website and sign up for Steve’s free email list. That is the best way to get a handle on Steve’s research.

This pop in gold could be due to the Russian and Ukraine possible invasion. If it doesn’t happen gold could fall hard. Like to know your views on this possibility??

I asked that question to both Craig Hemke and Brien Lundin yesterday, and they both noted that gold has already been trending higher in the mid $1800s before the recent Ukraine/Russia tensions flared, and so there may be about $50 of war premium factored in. They go into more detail on both those interviews yesterday.

Keep in mind that geopolitical factors are always fleeting, but the prime movers for Gold are going to be the Fed policy (tapering completion this month, rate hikes starting next month, plans to remove market liquidity by reducing their balance sheet), inflation trends, the reaction in bonds/interest rates/yield curve, the reaction in currencies, and the hedge against general market turmoil. This move in Gold was setting up regardless of the geopolitical drivers, so while it is a contributing factor it is merely the appetizer, not the main meal. If there is peace declared, there may be a bit of PM weakness, but all the other economic factors will be ongoing.

Mike Larson also addressed what would happen to the gold price in today’s editorial if Putin and Ukraine made up to be good friends, and he didn’t think it would be that huge of selldown although he agreed it would take a temporary hit.

Cover stories always manage to appear and that’s all the Russia-Ukraine story is, a cover for gold doing what it was going to do anyway. Yes, gold can and will correct and the headlines will surely point to some reason but there is little good reason to suspect that this breakout will fail or that new lows are coming for any part of the sector.

Gold just had its best weekly close since May, back-up by its RSI, and has been in an uptrend since the mid August low putting in two higher lows and two higher highs of intermediate term, weekly chart, scale.

Those who’d give the bears the benefit of the doubt don’t know what they are doing.

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=W&yr=3&mn=11&dy=0&id=p37475530405&a=1115075683

Yep. Gold was already advancing out of the end of year draw down in December, and already set up technically for the Q1 Run in January and February, and there are plenty of macroeconomic drivers putting wind in Gold’s sails from the Fed policy (finishing up removing accommodative bond purchases this month by wrapping up “tapering,” getting ready to start rate hiking cycle in March, and announcing they want to remove more liquidity by reducing their balance sheet and letting assets rolling over expire), and the reality that Fed can only get so far with all this before needing to reverse course again.

In addition we are seeing 40 year record high levels of inflation with CPI at 7.5% and PPI over 9%, and more generalists are waking up to the reality that negative real rates will continue to be in place for some time, it makes no sense to hold 10 year treasuries in the face of such high levels of inflation so there will be a rotation out of bonds and we’ve been seeing that, and the weakness seen in the general equities over the last few months is a further boon for the PMs.

The whole Ukraine/Russia geopolitical theater has been given more importance as the driver of Gold price than warranted, and is simply a convenient cover story at the moment. Again, as Craig, Brien, and Mike mentioned in their editorials the last few days, it played a part in boosting the precious metal as a safe haven, but maybe only by $50 which is miniscule in the overall big picture. If the war drums are muted, then sure Gold may take a $50 hit, but it will be as temporary and fleeting as geopolitical news always is. The main drivers for the yellow metal remain the place it has against financial malfeasance and monetary chaos, and that hasn’t changed and is still very much in gold’s favor.

Ditto as well Ex! Docs idles of March will possibly be no more then a Backtest of the breakout if that. I see miners and gold/silver gradually climbing the steps into year end obviously with some corrections.

Equities look pretty bad imo and look to possibly bottom in March. Much lower from these prices.

Ditto Matthew!

This breakout is the real deal imo and the beginning of better times to come ahead.

Gold: Break-Out or Fake-Out?

Michael Ballanger – Streetwise Reports (2/15/22)

“As the chart at the start of this missive reveals, gold prices have punched out through no few than five major downtrend lines since the beginning of 2020 only to have four of them turn out to be fake-outs, with prices reversing back down and hitting new lows well below the break-out levels shortly thereafter. The fifth such break-out happened on Friday and while the jury is out, the reason for the sudden panic into oil and gold was all “event-driven” and in my forty-five-odd years of trading, the vast majority of event-driven moves turn out to be failures.”

The Twitterverse must have had no fewer than fifty tweets light up with a near-ecclesiastic chorus of celebration highlighting this wondrous event and given that I am seriously long gold and copper with a certain Canadian gold developer as my largest holding, one might suppose that I would join the Kumbaya-line and pay homage to the precious metals gods that have finally seen the light. However, that would not be the case because the gray hairs predominating my chin are growing with annoying frequency each and every time the ”breakout buyers” get summarily pummelled. Ergo, I absolutely refuse to a) buy the breakout nor b) respond to anything “event-driven.”

“Could the move in gold and oil have been the machinations of a large group of traders looking for an excuse to have commodities grab the mantle of popularity from the tech and meme names? Could it have been the beginning of the Millennial and GenXer migration away from crypto and tech and into commodities? The answer is “YES” to both with the word ‘possibly’ added for caveat-emptor flavoring.”

https://www.streetwisereports.com/article/2022/02/15/gold-break-out-or-fake-out.htm

Crescat Gets Activist on Gold & Silver #65 – Updates Day! (Pt. 1)

Crescat Capital – Streamed live 5 hours ago

“This video contains position updates on Eskay Mining ($ESK.V), Goliath Resources ($GOT.V), Newfound Gold ($NFG.V), Labrador Gold ($LAB.V), Eloro Resources ($ELO.V), Pacific Ridge Exploration ($PEX.V), Bell Copper ($BCU.V), BCM Resources ($B.V), Snowline Gold ($SGD), Core Assets ($CC), Nevada King Resources ($NKG.V), Lion One Metals ($LIO.V), and Gold Mountain Mining ($GMTN.V). ”

To those who think silver’s non-confirmation of gold so far is cause for concern, I say nonsense. Gold’s 2020 top came 26 weeks before silver’s and gold’s bottom last March came 29 weeks before silver’s September low (40 weeks if you use silver’s December low which was identical to its September low).

The two metals are simply traveling different paths but of course remain directionally well correlated.

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=W&yr=3&mn=0&dy=0&id=p37561690845&a=1115079509

I’d agree Matthew, and wish we had recorded the conversation with Steve Penny that we had before we got on mic, as I had pointed out that people have these same concerns about Silver almost every time there is a big rally in the PMs. People were so negative on Silver back in late 2015, but then when the worm turned in Gold first and it started to rally, Silver and the mining stocks more than caught up and outperformed in 2016. We saw in late 2018 and 2019, before Silver and the mining stocks outperformed once again. We also saw it in the pandemic crash when Silver fell out of bed down to $13 and people thought it was over, but then it kicked in the afterburners and greatly outperformed gold once again, and the silver stocks outperformed the gold stocks… like we see almost every time.

I had quipped pre-call that Silver is the “ultimate dark horse that comes from behind and wins the race when people have given up on it.” Steve Penny agreed and mentioned that we could have been discussing the same concerns back in 2019, and I laughed and said “We were discussing this same thing on our blog back in 2019, because people never change”. Haha! At least he partially referenced that point in one of his answers to Cory about the market concerns of Silver’s underperformance relative to Gold. Steve get’s it and is bullish on Silver catching up to Gold, as am I, because I agree with him that “this time isn’t different.”

I asked about what would happen if Silver was to break below that $21.41 just to take the other side of the equation in the interview to be balanced and consider the bearish case, but I agree with Steve that it is far more likely that Silver and the mining stocks will play catchup to Gold movement, and that will be bullish for the whole sector… like it has been over and over again in the past.

No need to explain why you asked Penny certain questions. Your listeners are varied in their views so your questions probably should reflect that to some extent. Plus, all of my comments and charts here were posted before listening so if any seem prompted by the interview it’s pure coincidence.

Fork marks the spot again…

The HUI had its best close since June and has been in an uptrend since September.

https://stockcharts.com/h-sc/ui?s=%24HUI&p=D&yr=1&mn=4&dy=0&id=p04156174553&a=1115085819

This week contributed plenty to the bullish picture…

https://stockcharts.com/h-sc/ui?s=%24HUI&p=W&yr=2&mn=11&dy=0&id=p91390395962&a=1115033700

The gold miners bottomed 4 months before the silver miners so it should be no mystery why they are technically further along.

https://stockcharts.com/h-sc/ui?s=SILJ&p=W&yr=3&mn=7&dy=0&id=p98464936531&a=1075727223

Silver made progress at resistance today while its bullish Accumulation/Distribution line made another high.

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=D&yr=1&mn=1&dy=0&id=p52472668829&a=1113164086

GDX ran into the same fork resistance that halted its rise in November.

https://stockcharts.com/h-sc/ui?s=GDX&p=W&yr=3&mn=9&dy=0&id=p56999897727&a=940285795

DIA vs GLD finished at MA support today…

https://stockcharts.com/h-sc/ui?s=DIA%3AGLD&p=D&yr=1&mn=3&dy=0&id=p13257840345&a=1038000474

GDX looks great vs GLD:

https://stockcharts.com/h-sc/ui?s=DIA%3AGLD&p=D&yr=1&mn=3&dy=0&id=p13257840345&a=1038000474

GDX is at the anchored VWAP based on its 2020 high. I bet we’ll see volume rise materially next week.

https://schrts.co/riAzZMue

Barrick for comparison:

https://schrts.co/wvKpcxNU

Newmont has been in a league of its own.

https://schrts.co/QZfJeywi

Things are about to get worse for the stock market.

https://schrts.co/sThNDNTS

Thanks for the charts Matthew! The setup is across the board and even more so in the monthly. Xau/hui/gdx all in w formation and its going way higher again faster then many will believe. I think the move coming is going to be progressive/Relentless with miner corrections into end of year.

Cad vs usd

Eur vs usd

Hui vs wtic

Hui vs spy

Gdxj vs wtic

Every single one is lined up on the monthly. Going to be epic once it really gets going

Oops, I posted the wrong chart above where I said that GDX looks great vs GLD.

https://stockcharts.com/h-sc/ui?s=GDX%3AGLD&p=W&yr=3&mn=9&dy=0&id=p85698354303&a=1115087447

Haha Matthew

Still a great gld vs dow

Sandstorm Gold Ltd. (SAND) (SSL) CEO Nolan Watson on Q4 2021 Results – Earnings Call Transcript

Feb. 18, 2022 – Seeking Alpha

https://seekingalpha.com/article/4488480-sandstorm-gold-ltd-sand-ceo-nolan-watson-on-q4-2021-results-earnings-call-transcript