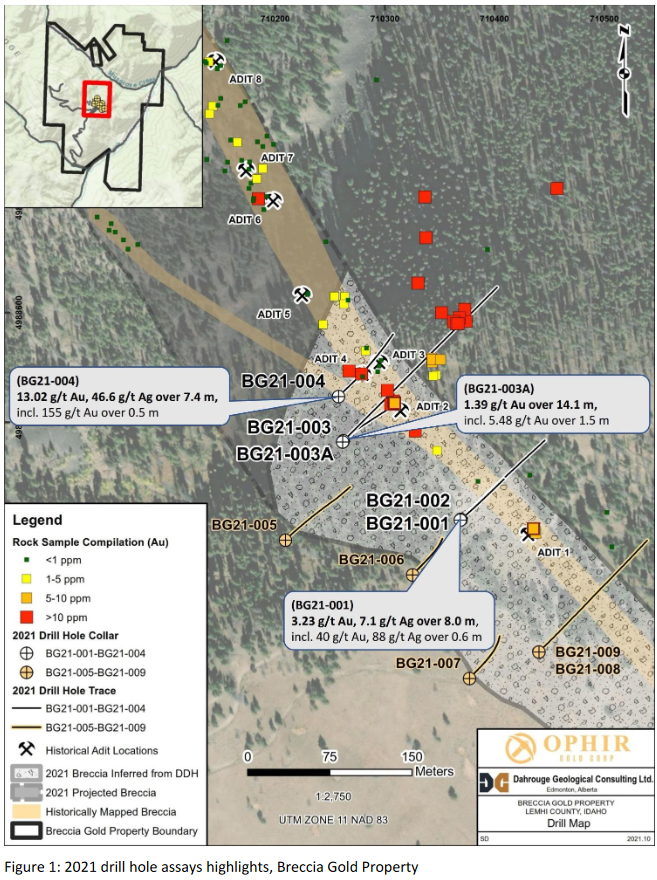

Ophir Gold – Follow Up On The Initial Drill Results Yielding 13.02 g/t Gold and 46.6 g/t Silver over 7.4 m at the Breccia Gold Property, Idaho

Shawn Westcott, President and CEO of Ophir Gold (TSX.V:OPHR – OTCQB:KPZIF) and Darren Smith, VP Exploration and Director at Ophir join me to discuss the initial drill results from the Breccia Gold Property, in Idaho. The first 4 holes of the program were released on December 1st with hole 4 yielding the best result, 13.02g/t gold and 46.6g/t silver over 7.4 meters.

I have Shawn and Darren outline the overall strategy of this year’s drill program and recap these results. We also focus on the plans moving into next year to follow up on the initial results.

If you have any follow up questions for Shawn and Darren regarding these results please email me at Fleck@kereport.com.

Click here to read over the drill results news release.

Thanks for sharing those thoughts on Ophir Marksteel, and nice to see you posting here at the KE Report. Cheers!

Thanks for the interview. When Sadie’s the next drilling season start?

Goldupdate!

We are at that moment or quite frankly nobody wants to put the reputation on the line because quite frankly nobody knows which direction gold or the miners are headed in at this moment.

Glen has a reputation for sticking his neck out on the day-to-day operations of the miners and gold. Right or wrong I will continue to do that for the ones who follow me.

Let me commence with Iamgold which is my biggest holding, has been a leader in the pack in the move up from the bottom. Again I took heat from one or two pundants who trashed Iamgold and here we are with clarity as I speak and could not be more delighted.

It seems from the charts many believe that the direction is lower I would like to think we are in day five or six of the daily cycle low in gold which can take us up to day 28 or 35.

I still hold firmly that we are going to have a good December as the majority of the population and investors believes Gold is going to crash more specifically the miners.

I am invested heavily and still remain with 3.2% cash on the side and for the record my latest purchase was compass gold which in the last 2 to 3 days I added to my position. I would have to think I’m a top 10 shareholder in compass gold as I speak.

I will continue to purchase what I believe to be the low in specific miners and I will take a position as I have being a Contrarian and that we are headed up if that makes any of the bulls happier then I’m glad. This is not investment advice by my experience in the last 15 to 20 years of investments.

Hang on strong don’t let the hedge funds and bankers steal your shares we are headed higher.

Glen

Hey Glennie, thanks for checking in and sharing your insights. I didn’t know you had stepped in to Compass. Welcome. Maybe you had mentioned it earlier and I had missed it.

I’ve been less active in my purchases since laying down a tranche two months ago. I figure I’ll wait it out a bit more till I see a convincing change signaling a greater commitment in direction or, if I feel prices are just too darn low.

I appreciate your comments saying you’ve gone whole hog, whereas I always find it interesting when others say they nibbled here and there, with little commitment, but were somehow always able to have gotten out prior to any price drops.

Thanks for your openness.

Much appreciated.

Doc sure claims to have sold a lot of tops despite having never called a top or a bottom here on KER. It seems to me he would do more buying than nibbling if he were so capable.

Thank you canucksi. Hope your doing well and glad to know we both own compass 🙂

Glen, why do you make yourself and your greatness the focus of every post? Why not just share what you think and leave it at that? I can’t remember you ever just putting up a chart without calling everyone out.

You’re wrong to say that “frankly nobody wants to put the reputation on the line.” You don’t know that but you’re happy to assume it.

The bounce that began last Friday has been weak so far with low to very low volume in most miners and the metals themselves. In addition, silver has been very unimpressive relative to gold and looks like it wants to retest its September low versus gold and possibly the dollar. Last Friday still might have been the low for the miners but they are vulnerable until we see some strength backed by volume.

I’m not worried either way and remain very heavily invested (and added to a couple of positions yesterday).

Notice the falling volume since Friday:

https://stockcharts.com/h-sc/ui?s=GDX&p=D&yr=1&mn=6&dy=0&id=p91408178297&a=1075655023

It should be noted that silver could fall versus gold even if the two continue higher versus the dollar. If that happens, silver’s relative weakness could easily result in the miners not acting quite right until silver bottoms versus gold.

https://stockcharts.com/h-sc/ui?s=%24SILVER%3A%24GOLD&p=D&yr=0&mn=9&dy=22&id=p82499386720&a=1077666344

Thanks for the charts Matthew as they are appreciated. Yes, Silver does look precariously perched relative to gold, and it may still have a little more work to do relative to gold to get out of the technical pricing funk it has been in.

.

On the other editorial posted this afternoon, Jordan R.B. is still expecting more weakness in silver and the commodities, for the short to medium term; however, he outlines why he feels the Fed rate hikes next spring/summer will be more bullish for Silver than for Gold. I would expect Silver will, in fact, outperform Gold in the 2nd half of 2022 (post rate hikes) and for most of 2023. That’s not that long to wait if Jordan is correct for some really fantastic gains in Silver and the silver mining stocks for next year.

Thanks. Assuming I’m understanding you correctly, I think Jordan is making a mistake lumping silver in with commodities. It moves with gold and the two typically move differently than commodities. Silver has been moving opposite commodities for many months and underperforming commodities for over a year. What it does share with commodities is that it underperforms gold significantly when the entire commodities complex is out of favor/in a bear market but that’s here nor there for our purposes.

Commodities have been in a strong and clear uptrend versus silver (and gold) for well over a year and I think that trend has weeks to go at best. Then, the monetary metals will be in a new uptrend versus commodities and most other sectors. So, I share JRB’s negative medium term outlook for commodities but not for silver.

CRB vs Silver:

https://stockcharts.com/h-sc/ui?s=%24CRB%3A%24SILVER&p=D&yr=1&mn=5&dy=15&id=p38654724836&a=1077774311

A new high for CRB vs Silver is very likely to be a false breakout “designed” to suck in bag holders.

https://stockcharts.com/h-sc/ui?s=%24CRB%3A%24SILVER&p=W&yr=5&mn=0&dy=0&id=p09025327716&a=1077794175

Matthew, I appreciate your approach/commentary.

Thank you Terry.

Glen……….. has many great thoughts and is willing to share those with what I believe to be some great expertise … for FREE…. …….. JMO…………..

I agree with many of this thoughts……….. and always appreciate him sharing…. for FREE….

I am on a FREE kick…… lol………..

I am trying to get some sponsorships going forward……. lol

I have a special going on with my new COVID KIT FOR DUMMIES….. lol

Thanks Jerry for your support and kind words as always. It is greatly appreciated. 💪🤠

Yes sharing is caring and we all have different characters and ways of sharing the should be respected. To each there own

Gold is stuck just below speed line resistance. If it can finish the week decisively above it, we could get the volume that we’ve been missing across the sector. Something over 1795 would probably do it.

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=W&yr=1&mn=11&dy=0&id=p01756702501&a=1073808830

Here’s a timely opinion, not advice: Sell Harmony Gold Mining (HMY)

https://stockcharts.com/h-sc/ui?s=HMY&p=D&yr=0&mn=11&dy=0&id=p72887803868&a=1038069350

Thanks for a great interview. Looking forward to much more.

I really like this team. The management is key.

Collectively, the Ophir team shares the right mix of success, honesty, and the hunger to build on

their previous successes to do it again and make Ophir a winner for shareholders. It as an

experienced management team with technical and capital markets strengths.

Shawn Westcott was part of NioCorp, Excelsior Mining, and Queen’s Road Capital. All 3

companies he started with when they had less than $10 million market cap, and on leaving, had

higher than quarter $Billion in market caps.

Darren Smith – VP Exploration has numerous successes, including development of Commerce

Resources Ashram Rare Earth project.

Garry Clark – Director was heavily involved in Idaho and the major success of US Cobalt to First

Cobalt Corporation.

Jon Bey – Chairman is one of the hardest working passionate mining executives, as witnessed by

his Standard Uranium, aggressively drilling in the Athabasca basin for Uranium.

Management is key to an exploration project. Their collective history is in my book a blue stamp for

one competent management, that will be able to create value for its shareholders.

The project is intriguing as well.

Before the recent news release I thought the system was big, and now, by only drilling 4 holes they extended the system zone by 3 (three) times in width. That’s a huge win. The magnitude of the breccia is really quite intriguing, as it indicates a massive explosive event.

I am looking forward to seeing the next deeper holes as well as the csamt scan!

Stock is trading far under fair value in my honest opinion according to peers.

Elaborating on the story more in this (3 months old) write up if anyone interested: https://drive.google.com/file/d/1AaC_IWuBIQ56vs4SVZ_2wxdn8WWBAbcY/view

/Mark