Vizsla Silver – Recent drill results both expanding the Napoleon Resource Area and a new high-grade discovery zone

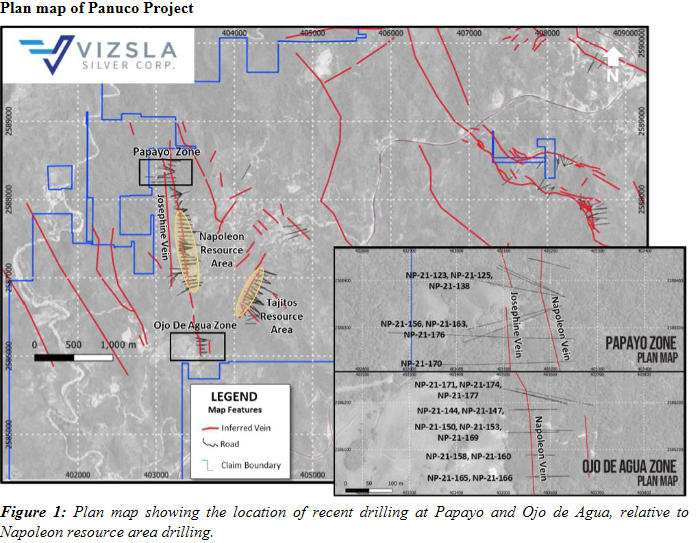

Mike Konnert, President and CEO of Vizsla Silver (TSX.V:VZLA – OTCQB:VIZSF) joins us to recap 2 recent news releases that were released over the last 2 weeks. We start with the September 2nd release highlighting drilling that expanded the Napoleon Resource Area to 1,000meters. Next is the August 26th release outlining new zones around the Napoleon vein. These include results from the new high grade vein, the Josephine Vein. See the map below for more context on the location of the new zones.

Please email us with any follow up questions you have for Mike regarding these drill results or any of the ongoing exploration. Our email addresses are Fleck@kereport.com and Shad@kereport.com.

Click here to read over the news releases we discussed.

Truly a great upside potential. Now if only gold and silver could cooperate… That cartel is not making it easy. But the young people buy bitcoins, the oldtimers who used to buy gold are sort of vanishing. Ugh, I sounded horrid there, sorry about that.

Agreed Ulf the Wolf. I remain very impressed with the consistency and grades the Vizsla team is hitting at both the Napoleon vein and at the newer Josephine vein they just uncovered through ground truthing.

There is also still so much more upside on all the other veins on their property, and they’ve got a lot of drills turning at present, which is nice to see. Lots of room to keep hitting pay-dirt and expanding resources on the land package, and now that they have the mill, a clear pathway to production in the medium term.

Slide 8 on their corporate presentation show how their vein field stacks up to other comparable district scale projects.

There are only a few companies out that are hitting high grade silver intercepts like these that Vizsla has been putting out. (Silvercrest, Silver Tiger, Impact, Alexco, and Excellon come to mind, but there aren’t many with these kinds of grades).

_______________________________________________________________________________

(VZLA) (VIZSF) Vizsla Drills 20,413 g/t AgEq Over 0.7 M Within 1,564 g/t AgEq Over 11.4 M in New Zones at Napoleon

by @newswire on 26 Aug 2021

https://vizslasilvercorp.ca/site/assets/files/7008/2021-08-26_napoleon_exploration_v10_final.pdf

speaking of Alexco… they put out another barn-burner hole from Bermingham today.

________________________________________________________________________________

(AXU) Alexco Reports Interim Results from Bermingham Drilling, Composite Assays to 1,681 g/t Ag over 20.37 meters True Width

by @newswire on 7 Sep 2021

https://ceo.ca/@newswire/alexco-reports-interim-results-from-bermingham-drilling

speaking of Silver Tiger… they had another high-grade drill intercept out today, although a bit more narrow than the ones from Vizsla or Alexco. Still, pretty encouraging results with the larger part of the intercept being over 7 meters.

_______________________________________________________________________________

(SLVR) (SLVTF) Silver Tiger Intersects 2,025.7 G/T AgEq over 1.7 Meters within a Broader Interval of 7.2 Meters Grading 870.3 G/T AgEq in Drill Hole 21-236

by @accesswire on 7 Sep 2021

https://ceo.ca/@accesswire/silver-tiger-intersects-20257-gt-ageq-over-17-meters

I used to own botth Alexco and Excellon. Even had a beer with Peter Megaw when he was with Excellon. Oh that was a long time ago…:-)

Yeah, Peter Megaw is now more focused over at Reyna Silver, but a top notch guy.

As for Excellon, we’ve had Brendan on the KE Report a few times, and I asked if he wanted to come on to unpack their recent high-grade silver results at Platosa, but he wanted to wait for some of the drilling from Silver City, Oakley, and Kilgore to come back first.

I thought this drill result 3 weeks back was still quite respectable though:

_____________________________________________________________________________

(EXN) Excellon Drills 1,828 g/t Silver Equivalent Over 5.2 Metres at Platosa

by @newswire on 18 Aug 2021

https://ceo.ca/@newswire/excellon-drills-1828-gt-silver-equivalent-over-52

Ulf the Wolf, are you by chance Norwegian? I once knew a runway Ulf…

Close. Not Norway. But Sweden. That’s why I spell so bad at times 🙂

MOST MINERS DRILL VERY NICE HOLE IN MY POCKET

It could be that you have a stack of Silver Eagles in those pockets, and they are looking for that high grade…. 🙂

Maybe tomorrow.

What’s happening tomorrow?

Most of mine were down today including the ones with good drill results. So those that were negative today will be green tomorrow.

Oh, yes, understood. Overall it was more of a red day than a green day in the PM stocks, and my account was down about 1.7%, but that’s on the back of some nice gains the end of last week in the miners. It was still a mixed bag in my portfolio with some companies up bigly like I-80 Gold, Scorpio Gold, or the Golden Valley takeover, and most of the Uranium stocks (including the big move on the Azarga Uranium takeover) were still up nicely offsetting some the weakness in the PMs.

Still, yeah, looking forward to a green day tomorrow if that is in the forecast with the alternating days you mentioned before. We’ll see how it goes…. fingers crossed.

I guess the move higher in I-80 Gold was based on acquisition news as well, but more along the lines of them increasing their projects and mills to grow, which was very well received. I had posted last week about their stellar drill hit, and that may have still played a supporting role when investors looked at the overall lay of the land.

_______________________________________________________________________________

i-80 to Acquire Lone Tree/Processing Facilities, Buffalo Mtn & Ruby Hill to Create Nevada Mining Complex

by @newswire on 7 Sep 2021

I was up about .09% but only because of Emerita. It had a good finish. Doc Jones put out a good/extensive analysis on where things stand which I think moved it. Also getting close to more confirmation drill results. I am still sitting on things waiting for a move of some kind in everything else. Still having a decent year but this sideways move kind of sliwed the excitement. Not sure I want to hold everything I have, but no way of knowing. Tried to change sliwed to slowed but it throws the cursor everywhere. Print size also changed twice. Weird

Yeah, I saw that piece out on Emerita earlier from Doc Jones. You guys have done a bang-up job in that stock this year. Congrats again to you both!

Here’s a link to the Doc Jones piece for anyone following Emerita.

Well, as Charles noted on the weekend show blog, one of the big news stories out today was more M&A in the royalty sector with Gold Royalty Corp taking over Golden Valley and Abitibi Royalties. This is right on the back of Gold Royalty Corp taking over Ely Gold.

That is the 6th takeover I’ve been in this year, and while they have not all been sexy, they’ve all still been profitable exits. Yes, some of these mergers happening at such depressed valuations do rob the future gains from the rerating many of the smaller companies would have gone through on the next upleg; but getting these takeover premiums frees up funds to rotate into other beat down companies, and is better than the continued losses in other names. I usually have mixed feelings when the takeover news hits, but nobody got hurt pulling a profit, and there are plenty of other opportunities for those funds to rotate into.

_____________________________________________________________________________

(GROY) Gold Royalty, (RZZ) Abitibi Royalties & (GZZ) Golden Valley to Combine to Create a Leading Growth and Americas-Focused Precious Metals Royalty Company

by @newsfile on 7 Sep 2021

https://ceo.ca/@newsfile/gold-royalty-abitibi-royalties-golden-valley-to-177ce

I had mentioned after the Ely Gold takeover by Gold Royalty Corp, that felt we’d still see more acquisitions and mergers in the royalty space, but was leaning towards FISH Sailfish being taken over next, and thought it would be Gold Royalty Corp on the bid for that. I’ve also mused a few times in the past that a potential back door into Abitibi would be for a larger royalty company to take over Golden Valley, and have been watching for that potential. Today’s news was a cleaner transaction though as GROY took over both GZZ and RZZ in the same motion, consolidating the Canadian Malartic royalties all under one roof, and all the other NSRs are just gravy for Gold Royalty Corp.

I sold my Golden Valley today but will give it a little while and then take another look at GROY down the road (now that they have 3 different companies assets under their umbrella – Ely, Abitibi, and Golden Valley). I was initially not very impressed with the collection of Amir’s old Gold Mining royalties when they launched the company, but they have transformed the company through these acquisitions. It is sad, as there are other royalty companies I like a lot more that missed their chance to scoop up these smaller royalty companies and their good assets, and when you snooze you lose…

Still there are plenty more royalty companies that can be consolidated to cull the herd a bit more…

Correction, this is the 7th M&A deal I’ve been in and almost missed the news about my Azarga position being acquired today by enCore Energy.

Since most of the Uranium stocks were up solidly again today, I just thought AZZ was running higher with the pack, but boom, another takeover:

____________________________________________________________________________

(EU) enCore Energy and (AZZ) Azarga Uranium To Combine To Create Leading American Uranium ISR Company

September 7, 2021

https://ceo.ca/@newswire/encore-energy-and-azarga-uranium-to-combine-to-create

Ex:

Congrats on all the M&A success. You have projected those fir some time…no luck about it. Some great investing…

Thanks David. Yes, there are a number of companies that are ripe for the takeover, but nobody knows what morning the news will break. Again, while there are mixed feelings sometimes as to whether the takeover happened at the wrong time in the cycle, one could argue that the acquiring companies are just as opportunistic as investors are, and they also want a good deal. As a result many M&A transactions happen when prices are beaten down and the valuations are more ripe (and shareholders more willing) to part with shares for a 30-50% premium.

There are some good companies with good projects that get their wings clipped too early in the cycle, stealing from their potential future valuations; but that is also exactly why the acquiring companies make their moves on that kind of valuation gap in the market.

Still, I’ll take the takeover premiums today in Golden Valley and Azarga Uranium and plow them into some of the other stocks that are beat up in the sector.

i am in ukraine right now. took one silver eagle to a coin shop. they wanted to make a hole in the coin to make sure that silver is solid, not plated.

Interesting. They must have been burnt with some fake plated coins and learned their lesson, but I’d think that would ruin the coin to make a hole in it like that.

Yep, everyone is drilling for silver. Ha!

AXU: from 2015 low of .22 cent to last July 3.50 hi…

it looks like .618 retrace and 400 dma is $1.50’ish , does anyone see that low a possibility? :/

Yes, AXU Alexco has been on an epic run since the end of the PM bear market in December of 2015 (and in the miners in January 2016), and now it has retraced back a lot of that move higher from last summer’s strength, so it is looking very attractive again recently.

A retracement to the .618 level would not surprise any technician, and would be a nice entry point. However, if the PMs can turn things around here in the month of September, then it may not quite get down to that $1.50 level. I’ve got a pretty solid position in AXU, and added some last month at $1.79, but do still want to add one more tranche to it; so if we go down lower, that may be a good general area to consider for a final buy point.

AXU has been punished on taking longer to get commercial production ramped up than originally forecasted, but they should be humming right along in Q4 with operations. I anticipate a slower ramp up most of the time on new mines, so that is just par for the course, and like buying into the selloff that usually happens during the mine commissioning phase.

Regardless, that drill hit today from Alexco was an eye-popping result, and one of the better silver drill holes of the year, and the market yawned, which just shows how poor the sentiment still is in the mining sector.

Unlike many Silver Jrs, as a new producer, Alexco can monetize a drill result like that in pretty short order, as they are looking to start bringing in ore from the Bermingham deposit over the next year or two. They’ve continued to expand Berminingham, and that new Bermingham Deep area with some of the best grades to date, beyond what they found at Flame & Moth, Lucky Queen, and the old Bellekeno resources.

.618 from that .22 low gives 1.47, but using the March 2020 low of .86 gives 1.87 — already broken. However, using .86 gives 1.42 for a .786 retracement, which is possible.

So if the recent 1.58 is broken there will likely be powerful support in the 1.42 – 1.47 zone.

(SKE) (SKREF) Skeena Initiates Exploratory Drilling Program at Eskay Creek

7 Sep 2021

https://skeenaresources.com/news/skeena-initiates-exploratory-drilling-program-at-eskay-creek/

It is no surprise that silver pulled back from the fork resistance (broken support) that it reached on Friday.

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=D&yr=1&mn=3&dy=0&id=p04191234480&a=500462915

I am sticking with my guess that this week will be “good” and that next week will be better.

I guess I am sticking with your guess also…at least that is what I was thinking.

IPT is up 30.5% versus SILJ in two weeks (3.3% today)…

https://stockcharts.com/h-sc/ui?s=IPT.V%3ASILJ&p=W&yr=5&mn=11&dy=0&id=p61410361405&a=601239737

The last similar weekly MACD buy signal for IPT vs SILJ happened about 4 years ago but this one is almost certainly better for a lot of reasons (technical, fundamental, cyclical, etc).

Jonsyl, I hope you sell/short anything and everything that I like.

I bought IPT last night and sold some puts on HL.

Im wondering why there has been no discussion on the mill that Viszla recently purchased. What is the scope of the refurbishment and when will Viszla ore begin to be processed through It?

Nathaniel C J Rothschild Says…….

Buy Physical Silver & Gold.

https://goldbroker.com/news/silver-the-raid-and-its-expected-backfire-2461