Junior Miners ; Big loss presents opporunity

I recently had Chris Kimble on the show because I think he is very good at presenting charts in a straight forward manner. The post below is another example of Chris’s work and in this post he is focused on the GDX.

We have been talking about the sell off in metals and the metals stocks and how the charts are now in oversold territory. We are due for a bounce and Chis is on the same page. Have a read of his post below and click the link to visit his website. Just signing up for his free emails is worth your time. Chris will not clog up your inbox everyday which is nice.

Click here to visit Chris’s website.

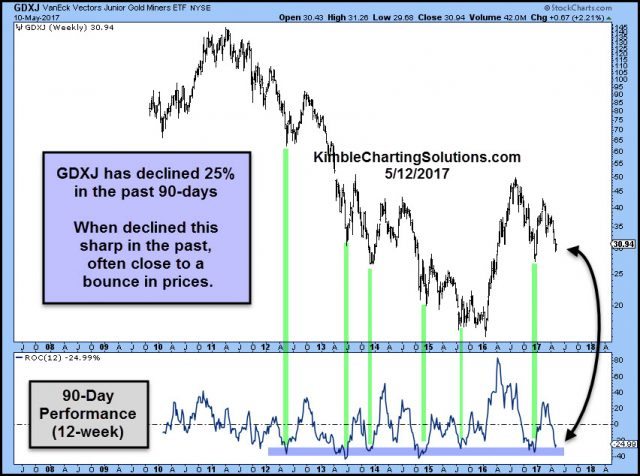

Junior Miner ETF has had a rough go of it the past 90- days. Could that large decline, present an opportunity? Below looks at the performance of GDXJ over 90-day windows since inception.

CLICK ON CHART TO ENLARGE

GDXJ has fallen nearly 25% over the past 90-days. When GDXJ has been down this hard in a 90-day window, in during a bear market, it was closer to a short-term low than a high. Below looks at the chart pattern of GDXJ and the GDXJ/GDX ratio.

CLICK ON CHART TO ENLARGE

Joe Friday Just The Facts- The large decline and the two charts directly above reflect that GDXJ was presenting a entry point, where a really should take place.

Both of these charts were shared on Wednesday with Premium and Metals members. We would be honored to have you as a member, if these type of patterns are of interest to you.

needs that much just to sell to the 1%

Off topic but for those still mulling over crypto-currencies Marin Katusa’s post is useful.

The dumb comments under Katusa’s post make me want to short BC.

Matthew. I sent you PM. Check the Bat Phone….

Ex, same bat phone same bat channel, make sure the boy wonder gets it right. LOL! DT

🙂

So are you saying Bix Weir’s got it right Matthew?

RANSONWare attacks 57,000 companies…….ask for $300 in Bitcoin……..zerohedge….

BITCOIN GOING UP JUST ON INSURANCE plan………

Make that 57,000 USERS………attacked ………

I am no fan of Katusa but in this case he is 100% right. Those bitcoin guys have really drunk the koolaid. A lot of them seem to be confusing blockchain technology with money. I am very bullish on new uses of blockchain technology but when it comes to money I would rather have gold. One of the posters in the comment section actually thinks that gold is only traded in a few exchanges and thinks that bitcoin is more liquid than gold. This is ridiculous. I can go to almost any city in the world and sell a gold coin in a few minutes. I live in NZ and bitcoin is very difficult with relatively high commissions and delays with the exchanges. I would have to travel more than 4 hours to Wellington to do a large transaction in person. If I want to avoid high commissions and go still go peer to peer, it ends up being back alley deals with much risk.

https://www.youtube.com/watch?v=IvGdJvxCWqg

covers ethereum in depth

BC…..chart looks parabolic to me……….

Ethereum up 1000%…………..$9 to 90……….

Geez a person could make alot of coin making a crypto.

Make it and market it.

All comes down to marketing.

Get a government to accept it for taxes and youd be wealthy beyond imagination.

Microsoft is looking to create their own crypto currency…….

Gates and Buffitt together could start their own crypto……cutting the jewish bankers out..lol

I hadnt heard that.

The bankers would have to get their cut.

But they do or dont Gates and Buffet have the power to make whatever they come up with dominant.

Thats one of the things about cryptos, people can create them endlessly.

Think of all the corporations each one of these guys owns , or is on the board of…..

Not sure if Marin Katusa…….is thinking outside the box on this one…..

He needs to read the silver stealers .net……….not everything is as it appears.

Introduction to blockchain technology:

interesting………….

It’s Platinum Week, Weaker, Weakest as Miners Meet in London

by Eddie Van Der Walt and Kevin Crowley

May 11, 2017,

platinum as you know I like………but, it is worse than watching paint dry

Fine by me OOTB. I’ve just started to get my interest more piqued again some of the unloved and forgotten PGM miners.

do not get me wrong……..I still own platinum for the long haul……and I believe it is undervalued…….JUBILEE PLATINUM is a winning name……. 🙂

Agreed on both points sir. Platinum is very undervalued at present, and Jubilee Platinum is a winning name. Cheers mate!

$FWZ Fireweed Zinc Ltd. (Brandon Macdonald)

#MIF – Metals Investor Forum – May 2017: #CorporatePresentation #Zinc

(VTT) (VDTAF) Vendetta Mining Corp. (Michael Williams) #ZINC #LEAD #COPPER

Metals Investor Forum [MIF]May 2017 – Beneath The Surface

Michael Williams, President, CEO & Director of Vendetta Mining Corp. gives a presentation at the May 5-6 2017 Metals Investor Forum.

https://www.youtube.com/watch?v=wIj3c_VVSNw&feature=youtu.be&list=PL7A77857F371F9F47

JUNIOR MINERS ; BIG LOSS PRESENTS OPPORUNITY

Always a good time to buy.

Excelsior:

Since I wrote this, the spread has gone $40 better for platinum. I love hearing how the hedge funds are going short for the first time.

http://www.theaureport.com/pub/na/compared-to-silver-and-platinum-gold-is-getting-really-expensive

Platinum is the place to be.

Agreed Bob M. The Platinum/Gold spread is getting very intriguing indeed. If the hedgies are going short, and the price falls further, I’ll be getting more and more serious to buy while it is unloved. BTW – I posted your article a few times and liked the points you raised about Silver and Platinum relative to Gold. Good stuff!

Ironically, I was just talking to CEO and CFO of (PTM) Platinum Group Metals a few minutes ago on a conference call, but it was focused on their Gold development project in Nevada – (WKM) West Kirkland Mining. [They’re sandwiched between Scorpio Gold and Corvus Gold and have a very interesting story] R Michael Jones did mention the current Platinum situation in passing, and they are in the thick of things in S. Africa.

My favorite Platinum company the last few months has been Jubilee Platinum (JLP.L) as they have a profitable Platinum Tailings project, and a second Chrome/Platinum project they they are going to use to fund their 2 larger PGM development projects. Hardly anyone is watching some of these Platinum miners.

Jubilee Platinum……..now that is the best name yet….

+1

Here’s an interesting shareholder video call they did. It is long, and it takes them a while to get into some of the goods, but they really did a good job laying out the climate in Platinum and Chrome mining and their strategy to capitalize and thrive in these depressed metals prices.

http://webcasting.brrmedia.co.uk/broadcast/583bfef07b884957387e792a

Left you a note above…………. 🙂

…. and I wrote you back a “Dear Jerry” letter….. 😉

Better than a ..Dear Frank…….. 🙂

Much better than getting a Dear John letter……

ditto 🙂

Interesting on the chrome and platinum mining…….thanks for the video

Yes, they have an interesting pipeline of projects in Platinum, Chrome, and Nickel:

$JLP.L $JUBPF Jubilee Platinum Plc – Market Update

09 May 2017

> HERNIC

• First commercial platinum concentrate production in March 2017 with production ramp-up continuing

• Platinum concentrate achieving 100g/t 4E PGMs (platinum, palladium, rhodium and gold)- 20% above contractual grade

• Targeting steady state production of 1100 tonnes of platinum concentrate per month

• Full design throughput expected to be reached during June 2017 on completion of the hydraulic-mining process to reclaim the feed material from the surface platinum stocks

>> DILOKONG CHROME MINE

• Earnings attributable to Jubilee for Q1 2017 from chromite concentrate production up 10.87% to GBP 0.408 million (ZAR 6.66 million) compared with Q4 2016

• Chromite concentrate production reached 14 973 tonnes and production rates have been restored to previous levels following successful expansion of the new tailings facility…”

Since it is on my mind at present, here is the more recent Corporate Presentation for

(WKM) (WKLDF) West Kirkland Mining

http://cdn.ceo.ca/1chc40k-2017-03-03-WKM-Corporate-Presentation.pdf

> Look at their projected NPV if gold stays in the $1200 – $1300 region.

> Check out their IRR of 43% at $1275 Gold !!

Their peer comparisons show just how undervalued and unloved this company is.

This recent trade of their exploration TUG property to Newmont for control back of 1.1% of their NSR was a nice transaction that almost nobody was paying attention to and shrugged it off. The markets are very inefficient at times, and I plan on exploiting that situation.

________________________________________________________________________

WEST KIRKLAND MINING BUYS 1.1% NSR ROYALTY AT HASBROUCK IN EXCHANGE FOR TUG PROJECT INTERESTS

May 9, 2017 – West Kirkland Mining Inc. (WKM)

E:

I know Michael Jones well and I’m a shareholder in WKM. Platinum Group Metals is my favorite platinum story. I am not a fan of South Africa but they will be mechanized and should do well over the long term. Management is excellent.

Michael was very enthusiastic and was kind to let me ask him 3 rapid fire questions on the WKM call. 🙂

I’m a shareholder of both companies and have started nibbling at both the last few weeks.

Silver Mine Production Drops For First Time In 14 Years – Study

Daniela Cambone – Thursday May 11, 2017

“Global silver mine production declined by 0.6 percent in 2016 to a total of 885.8 Moz. A large proportion of the drop was attributable to the lead/zinc and gold sectors, where production dipped by a combined 15.9 Moz,” the institute study said

$300 in BItcoin Ransom requested…..from 57,000 users……..Largest attack ever……zerohedge……..

NEW …………..BITCOIN DEMAND……………….. 🙂 🙂 🙂

What is their guidance on “Ransom Demand” through year’s end?

there will be a parabolic move brought on by paramania…………

Ten Rick Rule-isms Every Resource Investor Must Know

MiningStockEducation

May 12, 2017

“Rick Rule is the president and CEO of Sprott US Holdings and has four decades of success investing in the natural resource sector. A Rule-ism is one of Rick’s sayings or investing proverbs frequently repeated in one of the many interviews and speeches he conducts. This video presents ten of Rick’s best and most-frequently quoted Rule-isms.”

I like this one, from Rick Rule,

“The most important factor to note is that people’s expectation of the future is set by their experience in the immediate past, and if all of your experience in the immediate past is negative, the expectation you have for the future is that you’re going to get spanked again.”

+1

Pete, where ya been hiding out man?

Excelsior,just too much to do lately 🙂

Understood. Life is busy, busy, busy…..

The Bearish Gold Bull

by @TheDailyGold (Jordan Roy-Byrne) on May 12, 2017

“The Bearish Gold Bull was the title of my presentation last weekend at the Metals Investor Forum in Vancouver, British Columbia. While the title could be ascribed to me personally for my recent tendency towards conservative and cautious views, it more importantly describes the current dichotomy in the gold sector. The mining sector saw its fundamentals hit rock bottom in 2014-2015 and became “bombed out” at the end of 2015. However, while parts of the industry have performed well, as a whole it has been unable to push higher after a torrid recovery in early 2016. A big reason is the outlook for metals prices suggests lower prices before any large advance. Until metals prices are ready to rise, the miners may find themselves in a bearish bull.”

“The mining stocks have fallen below their 50 and 200-day moving averages and are even struggling around their 400-day moving averages (which provided support in December 2016) but this does not threaten the epic 2015-2016 bottom. There are a plethora of valuation metrics from January 2016 that are unlikely to be seen again. That time marked the worst 5 and 10-year rolling performance for gold stocks in 90 years. Gold stocks relative to the S&P 500 hit an all-time low and Gold stocks relative to Gold hit a 90 year low. Gold stocks price to book and price to cash flow valuations were the lowest in 40 years. (The data does not go back farther than that). Finally, January 2016 marked the end of the worst bear market ever. Remember this chart?”

Here’s a larger version of that Gold stocks Bear markets analog chart from Jordan:

https://s3-us-west-2.amazonaws.com/cdn.ceo.ca/1chccbe-BGMIbears2016end.png

Gold is just muddling along here. The longer it does this, the more likely it falls towards Docs mid-term range of $1160 I believe. Cant help a passing comment on bitcoin considering its all the rage at the moment. A daily price range of $170 must be a rollercoaster feeling but its the nature of the beast I suppose.

I have been looking at 1150 for a long time and much lower targets in the longer term. The stock market is just dead now with no volatility so too tough to do easy trades. I cashed out at 2400 and will wait for that Vix to spike to 20 to 30+ which it will eventually do.

It would be most bullish if coming out of the summer consolidation if Gold could take out the 2016 high of ($1377.50) and make a “higher high”. This may be most likely in the Fall rally from August – late October.

* Here’s a #Gold chart that shows the 2015 Dec low of ($1045.40) and the 2016 peak at ($1377.50).

http://www.stockcharts.com/h-sc/ui?s=%24GOLD&p=D&yr=2&mn=0&dy=0&id=p52467914321

– Notice also that since the December 2016 lows, that Gold made 3 “higher lows” at ($1124.30), ($1194.50), and then recently ($1214.30).

– Also there have been 2 “higher highs” since the end of last year at ($1264.90) and ($1297.40).

** If Gold could just take out that recent peak @ ($1297.40) decisively on a closing basis; (and preferably above psychological resistance at the $1300 century mark), then that would still be a bullish set up for 2017 and moving into 2018.

Excelsior that would be most bullish, unfortunately I cant see that price eventuating in the next few months. Hope im wrong. Regarding your price target of the $1370 range, that has become an area of increasing resistence for gold over the last 3-4 years. So a weekly close above that area would be the minimum objective for the bulls I wouldve thought. See how it pans out in the coming months.

Good thoughts Ozibatla. Yes, over the next few months, May/June/July we may have some rips, dips, and pips…. but I’d expect the seasonally strong Aug/Sept/Oct to be were we see any “fireworks” for the year. As you say, we’ll see how it all pans out.

Ever Upward.

were = where

Ever upward indeed Excelsior. Hopefully gold hears that sentiment

The Gold Forecast – Weekend Review #Video

Gary Wagner – May 12, 2017 – 7:21pm

#TechnicalAnalysis #Gold #Silver #DOW #SPX #Nasdaq #Dollar #Chart

https://thegoldforecast.com/video/north-korea-once-again-threatens-nuclear-war

Good stuff, Ex.

+1

Matthew,(and Doc)

Thanks again for the analysis on ANF,i sold before the plunge 🙂

Tiffany stocking up on gold….buys 700 kilos.